Maximizing Savings: Understanding the Tax Benefits of Leasing an Electric Car

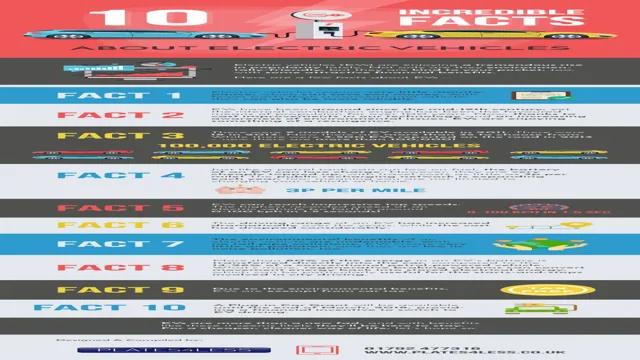

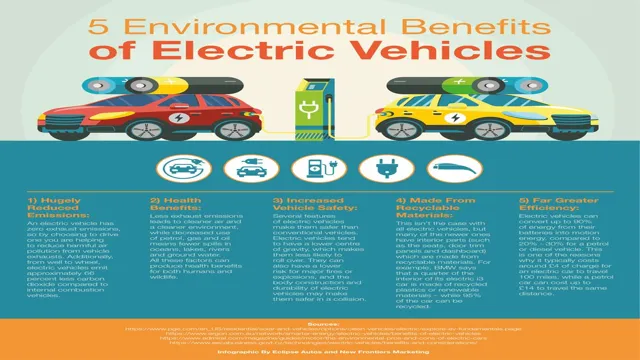

Are you considering leasing an electric car? Not only does it benefit the environment, but it can also benefit your wallet. Electric car lease tax benefits can make it even more worthwhile to switch to an eco-friendly vehicle. With federal and some state tax incentives, you can save thousands of dollars in taxes over the life of your lease.

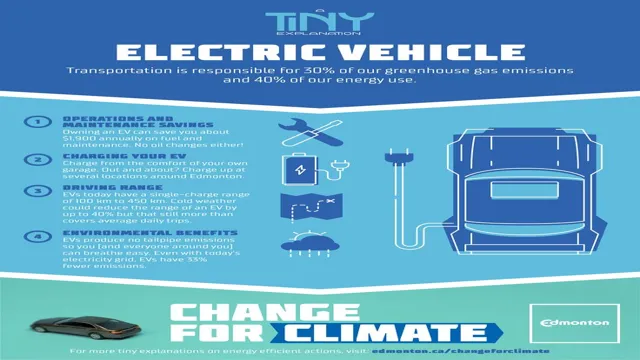

In addition to the potential tax savings, electric cars also tend to have lower maintenance and fuel costs than their traditional counterparts. Plus, they offer a quiet and smooth driving experience with no emissions. But before you sign on the dotted line, it’s important to understand the specifics of electric car lease tax benefits.

For example, the federal government offers a tax credit for electric vehicles, but it’s important to know the limitations and requirements in order to qualify. In this blog, we’ll dive into the details of electric car lease tax benefits, including federal and state incentives, eligibility requirements, and how to claim your tax credits. So, let’s get started on your journey towards a more sustainable and cost-effective ride.

Overview of Tax Benefits

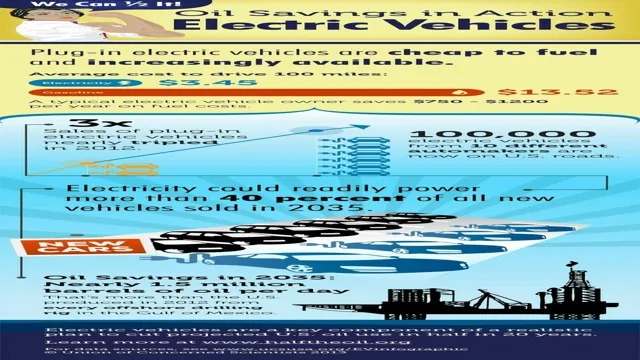

If you’re looking to lease an electric car, you’ll be happy to know that there are several tax benefits to take advantage of. First off, the federal government offers a tax credit of up to $7,500 when you lease an electric car. This is a one-time credit that can be applied to your tax bill, reducing the amount you owe or increasing your refund.

Additionally, some states offer additional incentives, such as rebates or tax credits, for leasing an electric car. Be sure to check with your state’s Department of Energy to see what incentives are available in your area. Keep in mind that these tax benefits can also be applied to plug-in hybrid cars, which use both electricity and gasoline.

Overall, leasing an electric or plug-in hybrid car can not only save you money on gas, but also on your taxes.

Federal Tax Credits

Federal tax credits are a great way to save money on your tax bill and reduce your overall tax liability. These tax benefits are designed to encourage certain behavior or actions, such as investing in renewable energy or purchasing an energy-efficient vehicle. Some of the most popular tax credits available to taxpayers today include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit (AOTC).

Each of these credits has its own eligibility requirements and maximum credit amounts, so it’s important to review the details to determine which ones you qualify for. By taking advantage of these tax credits, you can greatly reduce your tax bill and keep more of your hard-earned money in your pocket. So, if you’re looking for ways to save on your taxes, be sure to explore the various federal tax credits available to you and see how they can benefit you and your family.

State and Local Incentives

State and local governments often provide incentives in the form of tax benefits for businesses to encourage economic growth and development in the area. These incentives can include tax credits, exemptions, and deductions, which can significantly reduce a company’s tax liability. For example, a state might offer a tax credit for hiring new employees or for investing in capital equipment.

These tax benefits can be a significant factor for businesses when considering where to locate and invest. However, it’s essential to note that the eligibility requirements and benefits vary widely depending on the state, city, or county. Thus, it’s crucial to research and understand the available incentives and consult with a tax professional before making a decision.

Overall, taking advantage of state and local tax incentives can be an effective way for businesses to reduce costs and maximize profitability while also supporting local economic development efforts.

Qualifying for Tax Benefits

If you’re thinking about leasing an electric car, you may be eligible for tax benefits. To qualify, the leased vehicle must meet certain criteria, including being a new vehicle, having a battery capacity of at least 4 kWh, and being used for personal purposes. The amount of the tax credit will depend on the battery capacity of the vehicle, with a maximum credit of $7,500 available for vehicles with a battery capacity of 16 kWh or greater.

Additionally, some states offer additional incentives for electric car leases, so be sure to check with your state’s Department of Revenue. Overall, taking advantage of electric car lease tax benefits can be a great way to reduce the overall cost of leasing an environmentally friendly vehicle.

Vehicle Eligibility Requirements

To qualify for tax benefits when it comes to owning a vehicle, there are certain eligibility requirements that you need to meet. The first thing you need to keep in mind is that the tax benefits vary depending on the type of vehicle you own. For instance, if you own a hybrid or electric car, you may qualify for certain tax credits.

Another eligibility requirement that you need to consider is the vehicle’s emissions levels. If your car exceeds a certain emissions level, you may not qualify for any tax benefits. Additionally, the year and make of your car also play a role in determining your eligibility.

Some tax benefits are only available for new cars, while others may extend to used cars that meet certain specifications. To ensure you qualify for the available tax benefits, it’s important to talk to a tax professional who can guide you through the various eligibility requirements and help you take advantage of any tax credits you may qualify for.

Income and Credit Requirements

When it comes to qualifying for tax benefits, income and credit requirements play a significant role. Depending on your income level, you may be eligible for certain tax credits, such as the Earned Income Tax Credit or Child Tax Credit. These credits can provide valuable financial support for individuals and families who are struggling to make ends meet.

However, it’s important to note that eligibility for these credits is based on income thresholds and other criteria, so not everyone will qualify. Additionally, your credit score can also impact your ability to claim certain tax benefits. For example, if you have a low credit score, you may not be able to claim a mortgage interest deduction or other tax deductions that are tied to your creditworthiness.

To ensure that you are maximizing your tax benefits, it’s important to understand the income and credit requirements for each credit or deduction that you are eligible for. By working with a qualified tax professional, you can ensure that you are claiming all of the tax benefits that you are entitled to based on your individual financial situation.

Calculating Tax Savings

If you’re considering leasing an electric car, it’s essential to understand the tax benefits that come with it. The government offers tax credits to incentivize people to purchase or lease electric vehicles. The amount of the tax credit depends on the car’s battery capacity and the manufacturer’s phase-out schedule, which means that the tax credit amount will eventually decrease as more people buy electric cars.

However, currently, leasing an electric car can result in significant tax savings. Unlike buying an electric car, leasing means that the dealership or leasing company owns the car, which makes you ineligible for the federal tax credit. However, leasing companies can pass on a portion of the tax credit savings to the lessee, which can significantly reduce the monthly lease payments.

This savings can make leasing an electric car more affordable, particularly for those wanting to switch to an electric vehicle but are deterred by the high upfront costs. Ultimately, calculating the tax savings when leasing an electric car depends on the vehicle’s battery capacity and the leasing company’s policies, so it’s important to research and speak with leasing companies to determine the best options for you.

Examples of Tax Savings

Tax Savings When it comes to tax savings, there are many strategies you can employ to reduce your tax bill. One effective method is to contribute to tax advantaged retirement accounts, such as a 401(k) or IRA, which can lower your taxable income and provide a valuable cushion for your future. You can also consider itemizing deductions, which allows you to deduct certain expenses such as mortgage interest, charitable donations, and medical expenses.

Another strategy is to take advantage of tax credits, which are dollar-for-dollar deductions from your tax bill. For example, the Earned Income Tax Credit is a popular credit for low to moderate income families, and can result in significant tax savings. By taking advantage of these various methods, you can maximize your tax savings and keep more money in your pocket come tax time.

Conclusion

In conclusion, leasing an electric car not only benefits the environment, but also your bank account thanks to numerous tax benefits. You’ll be cruising down the road with a clear conscience knowing you are reducing your carbon footprint while also reducing your tax bill. Now you can have your EV cake and eat it too, all while saving money and looking good doing it.

So, what are you waiting for? Get charged up and hit the open road!”

FAQs

What are the tax benefits for leasing an electric car?

Leasing an electric car can provide substantial tax benefits, including federal tax credits, state incentives, and lower overall taxes on the lease payments.

How much tax credit can you get for leasing an electric car?

The federal government offers a tax credit of up to $7,500 for qualifying electric vehicles, including leased vehicles. State incentives may also provide additional tax credits.

Do electric car lease payments qualify for tax deductions?

Yes, lease payments for electric cars can be tax deductible in certain circumstances, such as if the car is used for business purposes.

Can you claim a tax credit for leasing an electric car if you don’t have enough tax liability?

No, the federal tax credit for electric vehicles can only be used to lower your tax liability, so if you don’t have enough tax liability, you may not be able to claim the full amount of the credit. However, some states offer incentives that can be used regardless of your tax liability.