Electric Car Leasing Tax Benefits: Maximize Savings!

Are you thinking about leasing an electric car? You may save money. There are many tax benefits for electric car leasing. Let’s explore these benefits in detail. This article will help you understand how leasing an electric car can be good for your wallet.

What is Electric Car Leasing?

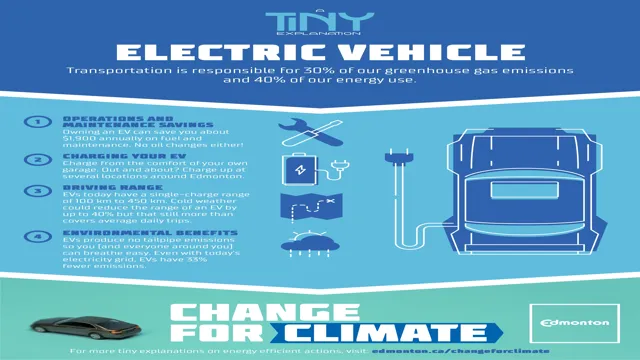

Leasing an electric car is like renting it. You pay a monthly fee. This fee is usually lower than buying a car. At the end of the lease, you return the car. You can also buy it if you want. Leasing allows you to drive a new car every few years.

Why Choose Electric Cars?

Electric cars are good for the environment. They produce no tailpipe emissions. This means they do not pollute the air. Electric cars are also quiet and smooth to drive. Many people choose electric cars for these reasons.

Tax Benefits of Leasing Electric Cars

Leasing electric cars comes with tax benefits. These benefits can save you money. Here are some key tax benefits to consider:

1. Federal Tax Credit

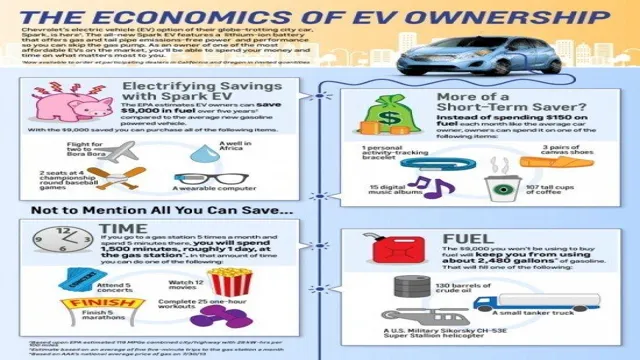

The federal government gives a tax credit for electric cars. This credit can be up to $7,500. The amount depends on the car model. If you lease the car, the dealership may apply this credit. This can lower your monthly payment.

2. State And Local Incentives

Many states offer tax credits or rebates. These can help with the cost of leasing. Some cities also have local incentives. Check your state’s rules. Some states offer special licenses or parking privileges. These benefits can make leasing cheaper.

3. Sales Tax Savings

When you lease a car, you usually pay sales tax. However, some states do not charge sales tax on electric cars. This can save you money. Make sure to find out the rules in your state.

4. Business Deductions

If you use your electric car for business, you can save more. You can deduct the lease payments on your taxes. This means you can lower your taxable income. Make sure to keep good records of your business use.

5. Lower Insurance Rates

Electric cars can have lower insurance rates. This is because they are less likely to get into accidents. Lower insurance costs mean more savings. Talk to your insurance agent to find the best rates.

How to Take Advantage of Tax Benefits

Here are some tips to make the most of the tax benefits:

- Research different electric car models.

- Look for cars that qualify for the federal tax credit.

- Check state and local incentives.

- Keep track of your business mileage.

- Consult a tax professional for advice.

Things to Consider Before Leasing

Leasing an electric car is not for everyone. Here are some things to think about:

- Leasing has mileage limits. Exceeding these limits costs extra.

- You do not own the car at the end of the lease.

- Some leases have fees for wear and tear.

- Make sure you understand the lease terms.

The Future of Electric Cars

The future looks bright for electric cars. Many companies are making more electric models. The government is also supporting electric vehicles. This means more tax benefits in the future. Electric cars will likely become more popular.

Frequently Asked Questions

What Are Tax Benefits For Electric Car Leasing?

Tax benefits for electric car leasing include deductions on state and federal taxes, reducing overall lease costs.

How Can Leasing An Electric Car Save Money?

Leasing an electric car often comes with lower monthly payments and tax incentives, making it more affordable.

Do All Electric Cars Qualify For Tax Benefits?

Not all electric cars qualify. Check if the model meets specific criteria set by tax authorities.

Can I Lease An Electric Car For Business Use?

Yes, leasing an electric car for business use can provide significant tax deductions.

Conclusion

Leasing an electric car offers many tax benefits. These benefits can help you save money. Federal tax credits, state incentives, and other savings can reduce costs. If you use the car for business, you can save even more. However, consider the limitations of leasing. Make sure you understand all terms and conditions.

In summary, electric car leasing is a smart choice. It is good for your wallet and the environment. Do your research and consult experts. This will help you make the best choice for your needs.