Electric Car Market Share 2026 Tesla Toyota Battle for Dominance

Featured image for how to electric car market share tesla toyota

Image source: global-uploads.webflow.com

Tesla and Toyota are locked in a fierce battle for electric car market share dominance by 2026, with Tesla leveraging its tech-forward EVs and charging infrastructure while Toyota bets on hybrids and upcoming solid-state batteries. The race hinges on innovation, affordability, and global supply chain agility, as both automakers vie to outpace rivals and capture the rapidly expanding EV market.

How to Electric Car Market Share 2026 Tesla Toyota Battle for Dominance

Key Takeaways

- Tesla leads in innovation: Pioneering tech keeps it ahead in premium EV segments.

- Toyota scales affordability: Mass-market hybrids and EVs target broader global adoption.

- Market share hinges on pricing: Competitive entry-level EVs will reshape dominance by 2026.

- Supply chains decide growth: Battery sourcing and production capacity are critical differentiators.

- Regional strategies vary: Tesla excels in West; Toyota dominates Asia’s emerging markets.

Why This Matters / Understanding the Problem

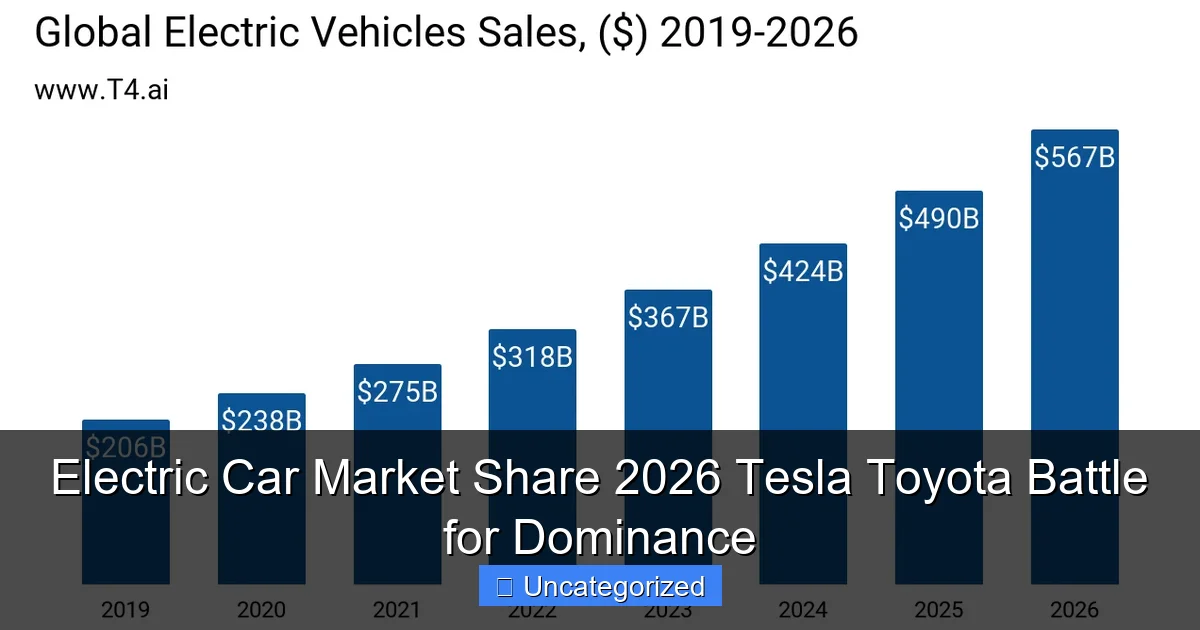

The race for the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance isn’t just about cars—it’s about the future of transportation, energy, and global manufacturing power. In 2023, electric vehicles (EVs) made up about 18% of new car sales worldwide. By 2026, that number is expected to climb to over 30%, with Tesla and Toyota leading the charge in very different ways.

You might be wondering: why does this matter to you? Whether you’re an investor, a car buyer, a policy maker, or just curious, understanding how these two giants are shaping the EV landscape gives you a front-row seat to one of the biggest industrial shifts of the 21st century.

Tesla, the Silicon Valley disruptor, built its empire on battery-powered innovation and software-first thinking. Toyota, the Japanese manufacturing titan, has long championed hybrids and is now pivoting to EVs—but with a cautious, supply-chain-smart strategy. The Electric Car Market Share 2026 Tesla Toyota Battle for Dominance will determine who controls the technology, the consumer trust, and the global infrastructure that powers the next generation of vehicles.

This isn’t just about who sells more cars. It’s about who sets the standards for batteries, charging networks, AI-driven driving, and affordable EVs. And with governments worldwide pushing for net-zero emissions, the stakes couldn’t be higher.

What You Need

To truly understand and analyze the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance, you don’t need a PhD in engineering or a Wall Street trading account. You just need the right tools and mindset. Here’s what you’ll need to follow along:

Visual guide about how to electric car market share tesla toyota

Image source: cdn.motor1.com

- Reliable data sources: Industry reports from BloombergNEF, Statista, IEA, and company investor relations pages (Tesla’s “Shareholder Deck” and Toyota’s “Sustainability Report” are gold mines).

- EV sales dashboards: Platforms like EV Volumes, InsideEVs, or CleanTechnica track global EV deliveries by brand and region.

- Financial tracking tools: Yahoo Finance, Google Finance, or Bloomberg for monitoring Tesla (TSLA) and Toyota (TM) stock performance and earnings.

- Geopolitical awareness: Keep an eye on trade policies, battery mineral sourcing (like lithium and cobalt), and government incentives (like the U.S. Inflation Reduction Act).

- Basic understanding of supply chains: Knowing how batteries are made, where raw materials come from, and how factories scale helps you see the full picture.

- Critical thinking skills: Don’t just accept headlines—dig into the data behind the hype.

Bonus: A notepad or spreadsheet to track key metrics like quarterly deliveries, R&D spending, and market penetration by region. This helps you form your own conclusions about who’s winning the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance.

Step-by-Step Guide to Electric Car Market Share 2026 Tesla Toyota Battle for Dominance

Step 1: Map Out the Current Market Landscape (2023–2024)

Before you can predict 2026, you need to understand where we stand today. Start by gathering the latest global EV sales data from sources like EV Volumes or Statista.

In 2023, Tesla delivered about 1.8 million EVs, making it the top-selling pure EV brand globally. Toyota, while selling over 10 million vehicles total, sold just over 100,000 battery-electric vehicles (BEVs). That’s a massive gap—but Toyota’s hybrid sales (over 3 million) give it a strong foothold in electrified mobility.

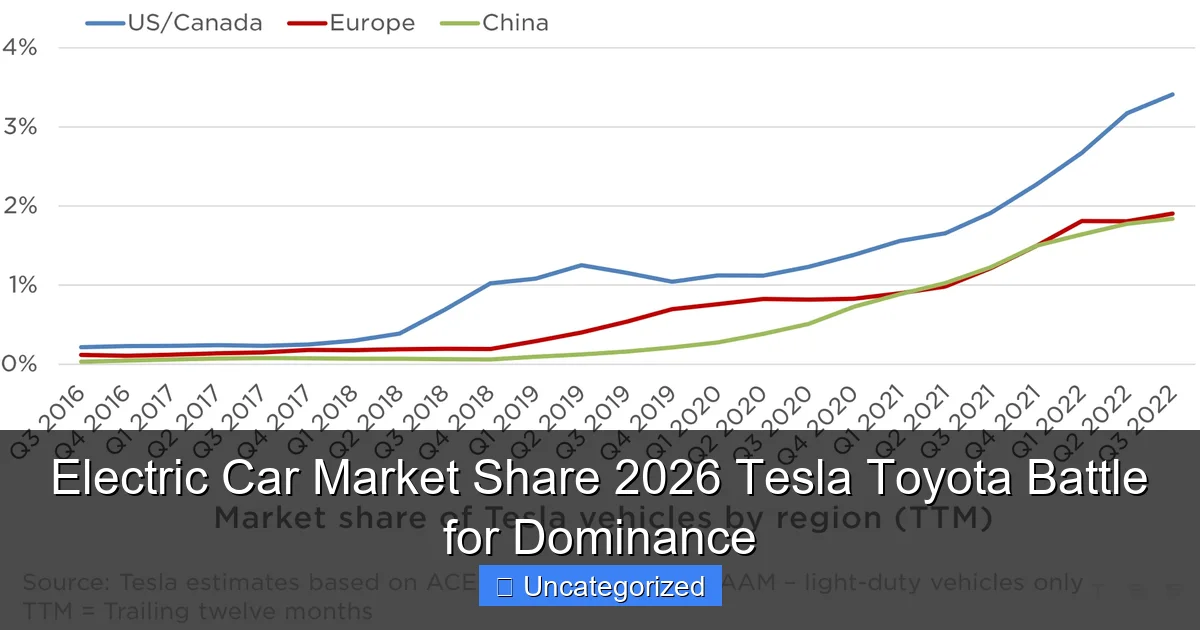

Look at regional breakdowns. Tesla dominates in North America and Europe, but struggles in price-sensitive markets like India and Southeast Asia. Toyota, on the other hand, has a strong presence in Asia and Latin America, where affordability and fuel efficiency matter more than range or tech features.

Pro Tip: Don’t just look at total sales—calculate market share by region. For example, Tesla has over 20% of the U.S. EV market, but less than 5% in Japan. That regional insight is key to predicting future dominance.

Step 2: Analyze Each Company’s EV Strategy

Now, dive into the core strategies of Tesla and Toyota. This is where the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance really begins.

Tesla’s Approach: Tesla is all about vertical integration and first-mover advantage. They design their own batteries (4680 cells), build their own chips (FSD), and own their own charging network (Superchargers). This gives them control over costs, innovation, and customer experience.

They’re also expanding fast. The Gigafactory in Texas, Berlin, and soon Mexico are scaling production. Tesla’s Model Y became the world’s best-selling car in 2023—yes, not just EV, but all cars—beating the Toyota Corolla.

Toyota’s Approach: Toyota is taking a multi-pathway strategy. They’re not putting all their eggs in the BEV basket. Instead, they’re investing in BEVs, hybrids (HEVs), plug-in hybrids (PHEVs), hydrogen fuel cells (FCEVs), and even synthetic fuels.

This “wait-and-see” approach has been criticized, but it’s rooted in real-world pragmatism. Toyota knows that charging infrastructure, battery costs, and consumer trust are still hurdles in many markets. Their new BEV platform (developed with Subaru and Mazda) and plans for solid-state batteries (targeted for 2027–2028) show they’re serious—but playing the long game.

Warning: Don’t assume Toyota is “behind.” They’re building a global supply chain for batteries, including partnerships in Indonesia (nickel) and Canada (lithium). Their strategy may pay off when battery prices drop and charging networks expand.

Step 3: Track Battery Technology and Cost Trends

Battery technology is the linchpin of the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance. Whoever masters cheaper, safer, longer-lasting batteries will win the mass market.

Tesla is pushing its 4680 battery cells, which promise 16% more range, 5x more energy density, and lower production costs. But as of 2024, production is still ramping up slowly. Meanwhile, they still rely on Panasonic and CATL for most of their cells.

Toyota is betting big on solid-state batteries. These promise 2x the range, 3x faster charging, and no risk of fire. Toyota has over 1,000 patents in this space and plans to launch a BEV with solid-state batteries by 2027. If they pull it off, it could leapfrog Tesla’s current tech.

But here’s the catch: solid-state batteries are still in the lab phase. Scaling them is a massive engineering challenge. Tesla’s advantage is execution—they’re already building cars, not just prototypes.

Also, watch battery costs. In 2020, average battery pack prices were $139/kWh. By 2023, they dropped to $132/kWh (BloombergNEF). By 2026, analysts predict $100/kWh—a key threshold for EVs to match gas cars on price.

Pro Tip: Monitor battery raw material prices (lithium, cobalt, nickel). A spike in lithium prices in 2022 delayed many EV plans. If Toyota secures long-term supply deals, they could undercut Tesla on cost.

Step 4: Evaluate Charging Infrastructure and Network Access

You can’t sell EVs without charging. Tesla’s Supercharger network is the most extensive in North America and Europe, with over 50,000 stalls. It’s a major selling point—Tesla owners rarely worry about “range anxiety.”

In 2024, Tesla opened its network to other brands (Ford, GM, Rivian), which could boost adoption but also dilute Tesla’s competitive edge. Still, their network is reliable, fast, and user-friendly.

Toyota, by contrast, doesn’t own a charging network. They rely on third-party providers like Electrify America, ChargePoint, and regional utilities. This is a weakness—but they’re forming partnerships. Toyota is investing in charging startups and co-developing fast-charging standards in Asia.

Also, consider home charging. In Europe and North America, most EV owners charge at home. But in cities like Tokyo or Mumbai, apartment dwellers need public or shared charging. Toyota’s hybrid-heavy lineup (which can run on gas) is a workaround here.

By 2026, the winner may not just be the brand with the best cars—but the one with the most seamless charging experience.

Step 5: Assess Regional Market Dynamics

The Electric Car Market Share 2026 Tesla Toyota Battle for Dominance won’t be won globally at once. It will be won region by region.

North America: Tesla has a strong lead. The Model Y is a bestseller, and the Cybertruck (2024 launch) could boost sales. But Ford, GM, and Rivian are catching up. Toyota’s new BEV, the bZ4X, has had reliability issues (recalls in 2022), hurting its reputation.

Europe: Tesla’s Berlin Gigafactory gives it a local production advantage. But European brands like Volkswagen, BMW, and Renault are aggressive. Toyota’s hybrid dominance helps, but BEV sales are growing. The EU’s 2035 ICE ban will force Toyota to accelerate.

China: This is the biggest EV market—over 35% of global sales. Tesla has a Shanghai Gigafactory, but faces fierce competition from BYD, NIO, and XPeng. Toyota is a minor player here, with less than 1% market share. To compete, Toyota is partnering with Chinese battery firms and launching cheaper BEVs.

Asia-Pacific (ex-China): In India, Indonesia, and Thailand, affordability and fuel efficiency rule. Toyota’s hybrids (like the Prius and Corolla Cross Hybrid) are top sellers. Tesla has no presence here yet. By 2026, Toyota could dominate this region with budget BEVs.

Pro Tip: Watch for local partnerships. Toyota’s joint ventures with local automakers (e.g., in India with Suzuki) give it a distribution advantage. Tesla’s direct-sales model doesn’t work in many Asian markets.

Step 6: Monitor Financial Health and R&D Investment

Money talks. Tesla’s 2023 revenue was $96.8 billion, with a net profit margin of 15%. They spend heavily on R&D—over $3 billion in 2023—mostly on AI, batteries, and manufacturing tech.

Toyota’s revenue was $280 billion, but their EV R&D budget is less clear. They’ve committed $70 billion to electrification by 2030, including $35 billion for BEVs. That’s a huge bet—but spread over 7 years, it’s less per year than Tesla’s spending.

Also, consider debt and cash flow. Tesla has strong cash reserves ($26 billion in 2023), but high R&D costs eat into profits. Toyota has lower margins but more stable cash flow from its massive global operations.

By 2026, the company with better financial agility—able to scale fast while staying profitable—will have the edge.

Step 7: Watch for Policy and Regulatory Shifts

Government policies can make or break EV adoption. The Electric Car Market Share 2026 Tesla Toyota Battle for Dominance is deeply influenced by regulation.

The U.S. Inflation Reduction Act (IRA) offers up to $7,500 tax credits—but only for EVs made in North America with batteries from approved sources. Tesla benefits; Toyota’s early BEVs may not qualify until they build U.S. battery plants.

The EU’s “Fit for 55” plan bans new ICE cars by 2035. China’s “Dual Credit” system forces automakers to produce EVs or buy credits. These policies push Toyota to accelerate BEV plans.

Also, watch for battery recycling laws and carbon footprint regulations. Toyota’s circular economy approach (recycling batteries, using renewable energy in factories) could give it a sustainability edge.

Step 8: Predict 2026 Market Share Using Data Trends

Now, put it all together. Use the data to project 2026 market share.

- Global EV Market (2026 estimate): 45–50 million units (up from ~14 million in 2023).

- Tesla: Could reach 4–5 million annual BEV sales, with 8–10% global EV market share. Strong in North America, Europe, and Australia. Weak in Asia outside China.

- Toyota: Could reach 2–3 million BEV sales, but with 5–7 million total electrified vehicles (BEV + PHEV + HEV). Their hybrid base gives them a “stealth” market share. In Asia, they could dominate with affordable BEVs.

- Other players: BYD, Volkswagen, and Hyundai-Kia will also grow. But the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance will be the headline race.

By 2026, Tesla may still lead in pure BEV sales. But Toyota could have a larger total electrified footprint, especially if hybrids remain popular and BEV adoption is slower than expected in developing markets.

Pro Tip: Use a weighted scoring model. Rate each company on: battery tech (20%), charging network (15%), regional presence (20%), financial health (15%), policy alignment (10%), and brand trust (20%). Update it quarterly.

Pro Tips & Common Mistakes to Avoid

When analyzing the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance, it’s easy to fall into traps. Here’s how to stay sharp:

Pro Tip 1: Don’t conflate total car sales with EV market share. Toyota sells more cars, but most aren’t BEVs. Focus on battery-electric vehicles for this battle.

Pro Tip 2: Look beyond quarterly earnings. A bad quarter for Tesla (like a Cybertruck delay) doesn’t mean they’re losing. Toyota’s long-term battery deals may not show up on the balance sheet—but they matter.

Pro Tip 3: Watch consumer sentiment. Tesla has a cult-like following, but reliability complaints are rising. Toyota has high trust, but is seen as “slow” in tech. Surveys (like J.D. Power) reveal hidden trends.

Warning: Don’t assume Tesla will keep innovating. They’ve been criticized for “feature bloat” (e.g., FSD still not fully autonomous). Toyota’s disciplined approach could win in the long run.

Warning: Ignore the supply chain at your peril. A battery mineral shortage or factory shutdown can derail even the best plans. Tesla’s Gigafactories are vulnerable to local regulations; Toyota’s diversified sourcing is a strength.

Pro Tip 4: Follow the software. Tesla’s OTA updates, AI navigation, and app integration are key differentiators. Toyota is catching up, but their infotainment systems are still clunky.

FAQs About Electric Car Market Share 2026 Tesla Toyota Battle for Dominance

Q1: Will Tesla still be the top EV seller in 2026?

A1: Likely yes—in pure BEV sales. Tesla’s brand, tech, and charging network give them an edge in North America and Europe. But Toyota could surpass them in total electrified vehicle sales, especially if hybrids remain popular.

Q2: Is Toyota too slow with EVs?

A2: Not necessarily. Toyota’s hybrid dominance gives them a bridge to full electrification. Their focus on solid-state batteries and affordable BEVs could pay off after 2025. They’re not behind—they’re pacing differently.

Q3: Can Toyota beat Tesla in the U.S.?

A3: Unlikely in the short term. Tesla has a strong lead in brand loyalty, charging access, and software. But if Toyota launches a $30,000 BEV with solid-state tech by 2026, they could gain ground—especially in price-sensitive states.

Q4: What role will China play in this battle?

A4: Huge. China is the world’s largest EV market. Tesla’s Shanghai factory gives them a local presence, but BYD and others dominate. Toyota’s joint ventures in China could help them catch up, but they’re starting late.

Q5: How do government policies affect the race?

A5: Deeply. Incentives (like U.S. tax credits) favor local production and battery sourcing. Bans on ICE cars (like in the EU) force Toyota to accelerate. The Electric Car Market Share 2026 Tesla Toyota Battle for Dominance is as much a policy fight as a tech one.

Q6: Should investors bet on Tesla or Toyota?

A6: It depends on your risk profile. Tesla is volatile but high-reward. Toyota is stable but slower growth. A balanced portfolio might include both—Tesla for innovation, Toyota for resilience.

Q7: What if battery tech doesn’t improve as expected?

A7: That’s a real risk. If solid-state batteries are delayed, Tesla’s current tech could dominate longer. But Toyota’s multi-pathway strategy (including hybrids and hydrogen) makes them more adaptable if BEVs stall.

Final Thoughts

The Electric Car Market Share 2026 Tesla Toyota Battle for Dominance isn’t just a numbers game—it’s a clash of philosophies. Tesla is the disruptor, betting on speed, software, and scale. Toyota is the pragmatist, betting on stability, supply chains, and long-term trust.

By 2026, we won’t have a single winner. Tesla may lead in pure BEV sales, especially in tech-forward markets. Toyota could dominate in regions where affordability, reliability, and hybrid compatibility matter most.

So what should you do? Stay informed. Track quarterly deliveries, battery news, policy changes, and consumer trends. Use the steps in this guide to form your own analysis. Whether you’re buying a car, investing, or just curious, understanding this battle gives you a smarter, more strategic perspective.

The future of mobility is being written now. And in the Electric Car Market Share 2026 Tesla Toyota Battle for Dominance, every move counts.