Unlocking the Benefits of Electric Cars: Understanding the P11D Benefit

If you’re considering purchasing an electric car, you may be wondering about the financial implications. Specifically, how will the P11D benefit impact your taxes? Put simply, the P11D benefit is the value attributed to any non-cash benefits that employees receive from their employer, such as a company car. For electric cars, the P11D benefit is lower than for traditional petrol or diesel vehicles.

This means that not only can you enjoy the environmental benefits of driving an electric car, but you’ll also pay less tax. In this blog post, we’ll explore the P11D benefit in more detail and how it can impact your finances when driving an electric car. So buckle up and let’s dive in!

Understanding the P11D Benefit for Electric Cars

Are you considering switching to an electric car? If so, it’s important to understand the P11D benefit that comes with it. The P11D form is used by employers to report taxable benefits and expenses provided to employees, including company cars. With electric cars, there are several benefits on the P11D form, including a reduced benefit-in-kind rate of 1% for the tax year 2021-22 and zero taxable emissions.

This means you could potentially save money on your tax bill by driving an electric car. It’s important to note that the P11D benefit can differ depending on the make and model of the electric car, so it’s worth doing some research before making a decision. Overall, switching to an electric car not only benefits the environment but can also benefit your wallet.

Definition of P11D Benefit

As an employee, understanding the P11D benefit for electric cars can give you a significant financial advantage. In simpler terms, a P11D benefit is a taxable benefit an employee receives from their employer for using a company car for personal use. Electric cars, being the more eco-friendly option, come with lower emissions and are entitled to a lower P11D value than traditional petrol or diesel cars.

This means that the amount you are taxed for using an electric company car for personal use is lower than that of a petrol or diesel car. This not only benefits you financially, but it also helps reduce the harmful emissions produced by petrol and diesel engines. So, if you’re an employee considering a company car, opting for an electric one can be a wise choice for both your pocket and the environment.

Why Electric Cars are More Beneficial

Electric cars have numerous benefits, ranging from environmental sustainability to lower running costs. Electric vehicles also offer an attractive P11D benefit for businesses and company car drivers. The P11D is a form used to detail employees’ taxable expenses and benefits, and it applies to company cars.

Electric cars have a lower P11D value, generally 50% lower than their petrol or diesel equivalents. This means employees pay less tax on the benefit of having a company car. This reduction can provide businesses and employees with significant savings.

Additionally, companies can take advantage of exemptions from company car tax if they use electric vehicles for business purposes. Overall, the P11D benefit is a compelling reason for companies and employees to consider electric vehicles as their primary mode of transportation. Not only does it reduce costs, but it also helps companies fulfill their environmental commitments.

Calculating Your P11D Benefit for Electric Cars

If you’re considering purchasing an electric car, it’s essential to understand the P11D Benefit that comes with it. The P11D Benefit is the amount paid by an employee for the use of their car and other expenses, which are not reimbursed by the employer. For electric cars, the P11D Benefit is calculated based on the car’s list price, including any extras, minus any contribution towards its cost made by the employee.

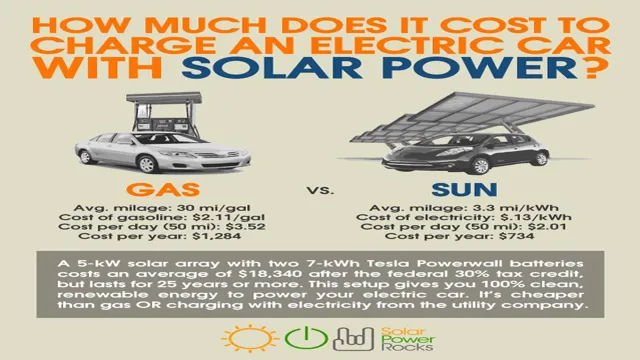

The P11D Benefit is then multiplied by the appropriate tax band rate (typically 20%, 40%, or 45%), and the resulting figure is subject to income tax. This means that the higher the list price of the electric car, the greater the P11D Benefit, and the higher the tax liability. However, electric cars typically have lower running costs than their petrol and diesel counterparts, and they’re exempt from some taxes, such as London Congestion Charge and Vehicle Excise Duty, which may offset the higher P11D Benefit and result in savings for the employee.

Factors that Affect the P11D Value

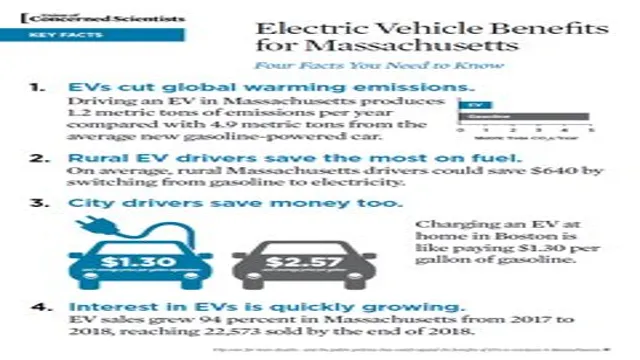

When it comes to calculating your P11D benefit for electric cars, there are several factors that come into play. The P11D value represents the taxable benefit you receive from your employer for driving a company car. Factors that affect the P11D value include the car’s list price, CO2 emissions, and fuel type.

Electric cars are a popular option for those looking to lower their tax liability. This is because they have zero CO2 emissions and are often exempt from road tax and congestion charges. As a result, their P11D value can be significantly lower than that of petrol or diesel cars.

In addition to tax savings, electric cars also offer lower fuel and maintenance costs, making them a smart choice for both your wallet and the environment. So if you’re in the market for a company car, be sure to consider the benefits of an electric vehicle.

Example Calculation for Electric Cars

So, you’ve decided to switch to driving an electric car- congratulations! Not only are you doing your part for the environment, but you’re also eligible for some financial benefits. One of these benefits is the P11D value, which is the calculation of the value of an employee’s taxable benefits from their employment. When it comes to electric cars, this calculation can get a bit tricky, as there are many factors to consider such as the car’s range, its battery size, and the available tax credits.

For example, if you have a Nissan Leaf with a P11D value of £30,000 and an annual income of £45,000, your taxable benefit would be calculated as the P11D value multiplied by the percentage of the car’s CO2 emissions. In this case, the percentage would be 16%, resulting in a taxable benefit of £4,800. However, it’s worth noting that electric cars currently have a 0% benefit in kind (BIK) tax rate for both 2021-2022 and 2022-2023, making them a financially smart choice for employees and employers alike.

So, while calculating your P11D value for electric cars may seem overwhelming at first, there are plenty of resources available to help you understand and take advantage of the benefits of driving an electric vehicle.

Comparison with Petrol/Diesel Counterparts

Calculating your P11D benefit for electric cars is an important step when considering the benefits of switching from a petrol or diesel vehicle. The P11D benefit is the value of any benefit an employee receives from their employer, including the use of a company car. For electric vehicles, the P11D benefit is calculated based on the list price of the vehicle and its CO2 emissions.

The benefit-in-kind (BIK) percentage for electric vehicles is currently set at a lower rate than their petrol or diesel counterparts, making them a more tax-efficient choice. In addition to the tax benefits, electric vehicles have lower running costs and emit fewer greenhouse gases, making them an environmentally friendly option. When comparing the costs of electric vs.

petrol or diesel vehicles, it’s essential to take into account the P11D benefit to see the full picture. By switching to an electric vehicle, not only will you save money in the long run, but you will also be contributing towards a greener future for our planet.

Maximizing Your P11D Benefit for Electric Cars

If you’re looking to maximize your P11D benefit for electric cars, there are a few things you should keep in mind. First, it’s important to understand what the P11D benefit actually is. Essentially, it’s the amount that an employee is taxed for any perks or benefits they receive as part of their job, such as a company car.

For electric cars, this benefit is based on the vehicle’s list price and CO2 emissions, so it’s important to choose a model with a low list price and emissions rating to minimize your tax liability. Additionally, it’s worth considering other incentives and benefits, such as the government’s plug-in car grant or reduced rates for electric vehicle charging. By taking advantage of these options, you can not only reduce your tax liability, but also save money on the overall cost of owning an electric car.

So if you’re considering an electric car for your company car, be sure to do your research and take advantage of all the available benefits to maximize your P11D benefit.

Tax Incentives for Employer and Employees

If you’re an employer looking to make the switch to electric cars, you may want to consider the tax incentives available to you. Not only will you be doing your part for the environment, but you can also save money through the P11D benefit. This benefit allows employers to offset the cost of providing electric company cars to their employees by reducing their taxable income.

It’s important to note that the P11D benefit only applies to cars emitting 75g/km of CO2 or less and that the vehicle must be used solely for business purposes. By taking advantage of this tax incentive, you can not only reduce your carbon footprint but also save money in the long run. So, why not make the switch to electric and enjoy the benefits for both your business and the planet?

Other Options to Reduce Tax Liability

If you’re looking to reduce your tax liability, you should consider maximizing your P11D benefit for electric cars. This is because electric cars offer several benefits, such as low emissions, low tax rates, and reduced fuel costs. By choosing an electric car for your business, you can take advantage of tax incentives and reduce your taxable income.

In addition, electric cars are becoming more popular among consumers, which means that they have a good resale value. Therefore, you can claim a higher P11D benefit by choosing an electric car over traditional petrol or diesel vehicles. Ultimately, maximizing your P11D benefit for electric cars is a smart way to reduce your tax liability while making a positive impact on the environment.

Conclusion: Going Electric Could Save You Money

In the world of company cars, the electric vehicle reigns supreme when it comes to P11D benefit. Not only are they kind to the planet, they’re kind to your wallet too. So if you’re looking for a way to reduce costs and make a positive impact on the environment, why not give electric a whirl? After all, nothing says “cool, calm and collected” quite like cruising around in a battery-powered motor.

It’s time to join the revolution and embrace the electric future!”

FAQs

What exactly is a P11D benefit for an electric car?

A P11D benefit is the taxable benefit an employee receives from their employer for the use of an electric car, which is calculated based on the list price of the vehicle and its CO2 emissions.

Are there any tax incentives for using electric cars as company cars?

Yes, there are tax incentives for using electric cars as company cars, including lower rates of company car tax, exemption from fuel benefit charge, and exemption from van benefit charge.

What is the maximum value of an electric car that can be included in P11D benefit calculations?

As of 2021/22 tax year, the maximum value of an electric car that can be included in P11D benefit calculations is £50,000.

Is there any difference in P11D benefit between electric cars and hybrid cars?

Yes, there is a difference in P11D benefit between electric cars and hybrid cars as the latter still emit CO2 and their benefit is calculated accordingly. However, plug-in hybrids may still qualify for certain tax incentives.