Electric Car Rebate Florida How to Save Big on Your Purchase

Featured image for electric car rebate florida

Image source: i0.wp.com

Discover how to save thousands with the electric car rebate Florida offers—up to $2,000 in state incentives plus federal tax credits! This guide breaks down eligibility, application steps, and top deals to help you maximize savings on your EV purchase. Don’t miss out on limited-time rebates that make driving electric more affordable than ever.

Key Takeaways

- Check eligibility: Verify income and vehicle requirements for Florida’s rebate program.

- Act fast: Rebates are limited and awarded on a first-come, first-served basis.

- Combine incentives: Stack federal tax credits with state rebates for maximum savings.

- Buy new: Only new electric car purchases qualify, not used vehicles.

- Submit paperwork: File all documents within 90 days of purchase to claim rebates.

- Research models: Ensure your chosen EV meets program efficiency standards.

📑 Table of Contents

- Electric Car Rebate Florida: How to Save Big on Your Purchase

- Understanding the Basics: What Are Electric Car Rebates?

- Florida-Specific Incentives: What’s Available Now?

- How to Stack Rebates for Maximum Savings

- Common Pitfalls and How to Avoid Them

- Future Outlook: What’s Coming for Florida EV Buyers?

- Real-Life Example: How One Family Saved $12,000

- Final Thoughts: Is It Worth It?

Electric Car Rebate Florida: How to Save Big on Your Purchase

So, you’ve been thinking about making the switch to an electric car. Maybe you’re tired of the gas station shuffle, or perhaps you’ve been inspired by the sleek designs and quiet hum of electric vehicles (EVs) zooming past you on the highway. Either way, you’re not alone. Florida, with its sunny skies and sprawling cities, is a fantastic place to go electric. But let’s be real—EVs can be pricey upfront, and that sticker shock can be a real bummer. That’s where electric car rebate Florida programs come in. They’re like a financial high-five from the state, helping you save big on your purchase while doing your part for the planet.

Now, before you start dreaming about cruising down I-95 in your shiny new Tesla, let’s get real. Navigating rebates, tax credits, and incentives can feel like trying to decode a secret government document. But don’t worry—I’ve been there, done that, and I’m here to break it all down for you. Whether you’re a first-time EV buyer or a seasoned pro, this guide will walk you through everything you need to know about electric car rebates in Florida, from federal tax credits to state-specific incentives, and even how to stack them for maximum savings. Let’s dive in!

Understanding the Basics: What Are Electric Car Rebates?

Before we get into the nitty-gritty of Florida’s incentives, let’s start with the basics. What exactly are electric car rebates, and why do they exist? Simply put, rebates and tax credits are financial incentives designed to encourage people to buy electric vehicles. They’re offered by federal, state, and even local governments (and sometimes utilities) to help offset the higher upfront cost of EVs. Think of them as a thank-you for choosing a cleaner, greener mode of transportation.

Visual guide about electric car rebate florida

Image source: i0.wp.com

Federal Tax Credits: The Big Kahuna

First up, the federal tax credit. This is the biggie—a one-time credit of up to $7,500 for new EV purchases, depending on the vehicle and your tax liability. But here’s the catch: not all EVs qualify. The credit phases out once an automaker sells 200,000 qualifying vehicles, which is why brands like Tesla and General Motors no longer offer it. As of 2023, eligible vehicles include:

- Ford Mustang Mach-E

- Chevy Bolt EV and EUV

- Hyundai Ioniq 5 and Kona Electric

- Toyota bZ4X

- And more (check the IRS website for the full list).

Pro tip: This credit is non-refundable, meaning you can only claim it if you owe taxes. If your tax bill is less than the credit, you won’t get the difference back. But don’t worry—there’s a workaround. Starting in 2024, buyers can transfer the credit to the dealer at the point of sale, effectively reducing the purchase price upfront.

State and Local Rebates: Florida’s Role

Now, let’s talk about Florida. Unlike some states (looking at you, California), Florida doesn’t have a statewide electric car rebate program—yet. But that doesn’t mean there’s nothing to take advantage of. The Sunshine State offers a few key incentives, and there are also local programs and utility-specific rebates that can save you hundreds or even thousands. We’ll cover those in detail later.

Here’s the good news: Florida’s lack of a statewide rebate is balanced by its lack of sales tax on EVs. That’s right—no sales tax on new or used electric vehicles, which can save you thousands depending on the car’s price. For example, on a $50,000 EV, you’d save $3,000 (based on Florida’s 6% sales tax). Not too shabby, right?

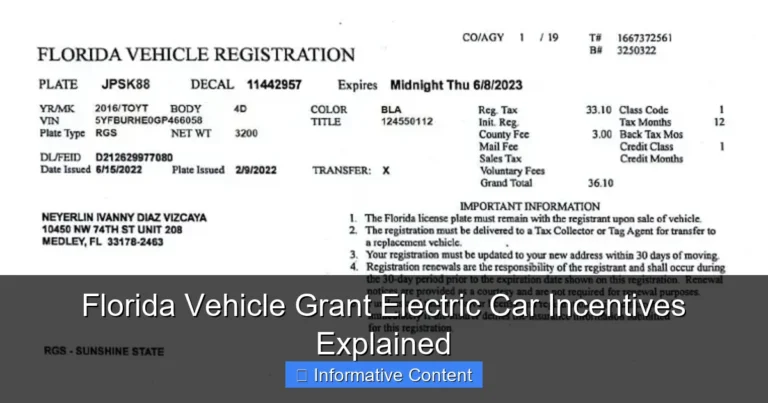

Florida-Specific Incentives: What’s Available Now?

Alright, let’s get into the meat of it: what electric car rebates in Florida are actually available today? While the state doesn’t have a traditional rebate program, there are several ways to save—some of which might surprise you.

1. No Sales Tax on EVs

As mentioned earlier, Florida doesn’t charge sales tax on electric vehicles. This applies to both new and used EVs, making it one of the most generous incentives in the state. To qualify, the vehicle must be:

- Fully electric (no hybrids or plug-in hybrids)

- Registered in Florida

- Used primarily for personal transportation (not commercial use).

Example: A friend of mine, Sarah, bought a used Tesla Model 3 for $35,000. Thanks to the no-sales-tax policy, she saved $2,100—enough to cover her first year of insurance!

2. HOV Lane Access (Even with One Person)

Florida allows single-occupancy electric vehicles to use High Occupancy Vehicle (HOV) lanes on highways, even if you’re driving solo. This is a huge perk for commuters in cities like Miami, Orlando, or Tampa, where HOV lanes can cut your drive time in half. To qualify, you’ll need a special EV decal from the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). The application is free, but there’s a one-time $10 fee for the decal.

Pro tip: The decal is valid for four years, so if you plan to sell your EV, the next owner can transfer it (with a $10 transfer fee). This can be a nice selling point when you’re ready to upgrade.

3. Local and Utility Rebates

While Florida doesn’t have a statewide rebate, many cities and utility companies offer their own incentives. These are often overlooked but can be incredibly valuable. Here are a few examples:

- Orlando Utilities Commission (OUC): Offers a $1,000 rebate for new EV purchases and up to $500 for used EVs. They also provide discounts on home charging stations.

- Jacksonville Electric Authority (JEA): Gives $500 for new EVs and $250 for used EVs, plus free EV charging for the first year.

- Florida Power & Light (FPL): Offers a $250 rebate for home charging equipment and a “Charge at Night” program with lower electricity rates for overnight charging.

- City of Tallahassee: Provides $1,000 for new EVs and $500 for used EVs, plus free public charging.

How to find these: Check your local utility’s website or call their customer service. Many of these programs have limited funding, so apply as soon as you buy your EV—they’re first-come, first-served!

How to Stack Rebates for Maximum Savings

Here’s where things get fun. You don’t have to choose between rebates—you can often stack them to save even more. Think of it like a discount sandwich: federal tax credit + state incentives + local rebates + utility perks = one sweet deal.

Step 1: Start with the Federal Tax Credit

If your EV qualifies, claim the federal tax credit first. As mentioned, you can now transfer it to the dealer at purchase (starting 2024), which means the savings are immediate. For example, if you buy a $40,000 Chevy Bolt EUV, the $7,500 credit brings your effective price down to $32,500.

Step 2: Apply for Local and Utility Rebates

Once you’ve secured the federal credit, go after local and utility rebates. These are usually one-time cash payments, so they’re straightforward. Let’s say you live in Orlando and buy the same Bolt EUV:

- Federal tax credit: $7,500

- OUC rebate: $1,000

- No sales tax (6% on $32,500): $1,950

- Total savings: $10,450

Your final price? Just $29,550—a 26% discount off the original sticker price. Not bad, right?

Step 3: Add Home Charging Incentives

Many utility companies offer rebates for home charging stations. For example, FPL’s $250 rebate covers a big chunk of a Level 2 charger, which can charge your EV 2-3 times faster than a standard outlet. Some programs even include free installation or discounted electricity rates for overnight charging.

Pro tip: Install your charger before applying for the rebate. Most programs require proof of purchase and installation, so keep your receipts and photos of the setup.

Step 4: Don’t Forget About Used EVs

If you’re buying a used EV, you’re still eligible for many incentives. The federal tax credit for used EVs is $4,000 (or 30% of the purchase price, whichever is less), and several Florida utilities offer rebates specifically for used EVs. Plus, you’ll still save on sales tax.

Common Pitfalls and How to Avoid Them

Even with all these incentives, there are a few traps to watch out for. Let’s talk about the most common mistakes and how to sidestep them.

1. Missing Deadlines

Many rebates are time-sensitive. For example, OUC’s program requires you to apply within 90 days of purchase. Miss that window, and you lose the cash. Set a reminder on your phone or calendar to apply as soon as you drive off the lot.

2. Overlooking Eligibility Requirements

Not all EVs qualify for every rebate. For example, the federal tax credit excludes vehicles with MSRPs over $80,000 (for trucks/SUVs) or $55,000 (for cars). Some local rebates also have income limits or require the EV to be registered in the utility’s service area. Always read the fine print.

3. Confusing Rebates with Tax Credits

Rebates are cash payments you receive after purchase (like a check or direct deposit). Tax credits are claimed on your annual tax return. Don’t assume a “credit” is the same as a “rebate”—they’re processed differently and have different rules.

4. Not Checking for Updates

Electric vehicle incentives change fast. A program that existed last year might be gone this year (or vice versa). Bookmark the U.S. Department of Energy’s Alternative Fuels Data Center and check it monthly for updates.

5. Forgetting About Charging Costs

While EV incentives save you money upfront, don’t forget about long-term costs. Charging at public stations can be expensive, and some utilities charge higher rates during peak hours. Consider switching to a time-of-use (TOU) plan, which offers lower rates at night.

Future Outlook: What’s Coming for Florida EV Buyers?

So, what’s next for electric car rebates in Florida? The state is slowly catching up to the EV revolution, and there are a few promising developments on the horizon.

1. Proposed Statewide Rebate

In 2023, Florida lawmakers introduced a bill to create a statewide EV rebate program, offering up to $2,500 for new EVs and $1,500 for used ones. While it didn’t pass, the fact that it was proposed signals growing support for EV incentives. Watch for similar bills in the future.

2. More Utility Partnerships

As EV adoption grows, utilities are likely to expand their rebate programs. For example, FPL recently announced plans to install 500 new public charging stations by 2025. More infrastructure could lead to more incentives for drivers.

3. Federal Incentives for Used EVs

The federal tax credit for used EVs (up to $4,000) is a game-changer for budget-conscious buyers. Expect more states to follow suit with their own used EV incentives.

4. Charging Infrastructure Expansion

The federal government’s $5 billion National Electric Vehicle Infrastructure (NEVI) program is funding charging stations along highways nationwide. Florida is a major recipient, with over 50 new stations planned by 2025. More charging options mean fewer “range anxiety” concerns for new buyers.

5. Potential HOV Lane Expansion

Currently, EV HOV access is limited to certain highways. But as more Floridians go electric, we could see expanded access to more lanes—or even toll-free driving for EVs.

Real-Life Example: How One Family Saved $12,000

Let’s bring this to life with a real-world example. Meet the Garcias, a family in Jacksonville who bought a used Tesla Model Y for $45,000 in 2023. Here’s how they maximized their savings:

- Federal tax credit: $4,000 (30% of purchase price)

- JEA rebate: $250

- No sales tax: $2,700 (6% on $45,000)

- JEA free charging: $300 (estimated value for one year)

- HOV lane decal: $10 (one-time fee, but saved them 30 minutes per day on their commute)

- Total savings: $7,260

But wait—there’s more! They also installed a Level 2 charger at home using a $500 rebate from JEA and switched to a TOU electricity plan, saving an extra $500 per year on charging costs. Their total first-year savings? Over $12,000!

The takeaway? Incentives work best when you combine them. The Garcias didn’t just rely on one rebate—they stacked every opportunity they found.

Final Thoughts: Is It Worth It?

So, are electric car rebates in Florida worth the effort? Absolutely—if you know where to look. While the state doesn’t have a one-size-fits-all program, the combination of federal tax credits, local rebates, and utility perks can save you thousands. And with no sales tax on EVs, Florida is already one of the most EV-friendly states in the country.

But here’s the real kicker: the savings don’t stop at the purchase price. EVs cost less to maintain (no oil changes, fewer moving parts), and charging at home is often cheaper than gas. Over time, the total cost of ownership can be significantly lower than a traditional car.

So, what’s your next step? Start by researching which incentives apply to your situation. Check your utility’s website, talk to your dealer, and don’t forget to claim the federal tax credit. And if you’re on the fence, take a test drive—once you experience the smooth, quiet ride of an EV, you might not want to go back.

Remember, every dollar you save on your EV is a dollar you can spend on something else—like a beach vacation, a new bike, or even a second EV for the family. The road to savings starts now. Happy driving!

Frequently Asked Questions

What is the electric car rebate Florida program?

The electric car rebate Florida program offers financial incentives to residents who purchase or lease new electric vehicles (EVs). These rebates help reduce the upfront cost of EVs, making them more affordable while promoting eco-friendly transportation.

How much can I save with an electric car rebate in Florida?

Rebate amounts vary depending on the program and vehicle eligibility, but Florida residents can save up to $2,000–$4,000 on qualifying EV purchases. Check with state or local agencies for current offers and income-based incentives.

Who qualifies for the electric car rebate in Florida?

Florida residents who buy or lease a new, qualifying EV may be eligible for the electric car rebate. Some programs have income limits or require the vehicle to be registered in-state. Always verify requirements before purchasing.

Are used electric cars eligible for the Florida rebate?

Most Florida rebate programs only apply to new EVs, not used ones. However, federal tax credits may cover used EVs—check both state and federal guidelines to maximize your savings.

How do I apply for the electric car rebate in Florida?

Applications are typically submitted online through the Florida Department of Environmental Protection or a participating local program. You’ll need proof of purchase, residency, and vehicle registration to complete the process.

Does Florida offer additional incentives beyond the EV rebate?

Yes! Florida provides perks like HOV lane access, reduced registration fees, and charging station incentives alongside the electric car rebate. Some utilities also offer rebates for home charger installations.