Electric Car Rebates Florida Save Big on Your Next EV

Featured image for electric car rebates florida

Image source: carrebate.net

Florida offers generous electric car rebates and incentives that can save you thousands on your next EV purchase. From state tax exemptions to utility company rebates and federal tax credits, residents can stack multiple savings programs to significantly reduce upfront costs and accelerate the switch to clean, efficient transportation.

Key Takeaways

- Act fast: Florida’s EV rebates are limited—apply early to secure your savings.

- Combine incentives: Stack state rebates with federal tax credits for maximum discounts.

- Check eligibility: Income and vehicle price caps apply—verify before purchasing.

- Charging perks: Some rebates include free or discounted home charger installations.

- Used EVs count: Pre-owned electric cars may qualify—expand your options.

- Dealer participation: Not all dealers offer rebates—ask before signing.

📑 Table of Contents

- Why Florida Is the Perfect Place to Buy an Electric Car

- Understanding the Federal EV Tax Credit (And How It Works in Florida)

- State and Local Electric Car Rebates in Florida

- Used EV Incentives: Yes, You Can Save on a Pre-Owned Electric Car

- Charging Incentives and Time-of-Use Savings

- How to Maximize Your Savings: A Step-by-Step Guide

- Data Table: Florida Electric Car Rebates and Incentives (2024)

- Final Thoughts: Is Now the Time to Go Electric in Florida?

Why Florida Is the Perfect Place to Buy an Electric Car

Imagine driving down the sun-kissed streets of Miami, the breeze from the ocean tickling your face, all while knowing your car isn’t adding a single puff of exhaust to the air. That’s the reality for many Floridians who’ve made the switch to electric vehicles (EVs), and it’s getting even sweeter thanks to a growing number of electric car rebates Florida programs. Whether you’re tired of gas prices that spike with every hurricane warning or just want to do your part for the planet, now might be the perfect time to go electric.

Florida may not be the first state you think of when it comes to EV incentives—California usually steals that spotlight—but the Sunshine State is quietly building a compelling case for eco-conscious drivers. From federal tax credits to local utility rebates and even state-level perks, there are real savings to be had. And with more charging stations popping up from Pensacola to Key West, range anxiety is becoming a thing of the past. The best part? You don’t need to be a policy expert or a tech whiz to take advantage. In this guide, we’ll walk you through every electric car rebate Florida option available, how to qualify, and how to stack them for maximum savings. Think of it as your friendly neighbor’s insider tips—no jargon, no hype, just honest, practical advice to help you save big on your next EV.

Understanding the Federal EV Tax Credit (And How It Works in Florida)

What Is the Federal Clean Vehicle Credit?

Let’s start with the big one: the federal EV tax credit. This is the most well-known incentive and can knock up to $7,500 off the purchase price of a new EV—if you qualify. Officially known as the Clean Vehicle Credit (formerly the Qualified Plug-in Electric Drive Motor Vehicle Credit), it’s a non-refundable tax credit, meaning it reduces the amount of federal income tax you owe. If your tax bill is less than the credit, you won’t get the difference back, but it still lowers your overall tax burden.

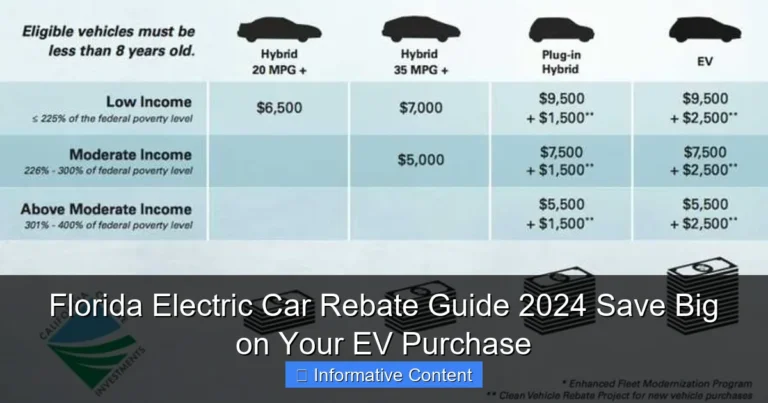

Visual guide about electric car rebates florida

Image source: carrebate.net

To qualify, your EV must meet several criteria:

- Be a new vehicle (not used or leased)

- Have a battery capacity of at least 7 kWh

- Be assembled in North America

- Be purchased after December 31, 2022, for the current rules

- Meet battery component and critical mineral sourcing requirements (phased in from 2023–2024)

Which EVs Qualify in Florida?

Not every EV on the market today qualifies for the full $7,500 credit. As of 2024, the IRS maintains a list of eligible vehicles, and it’s updated regularly. For example, models like the Chevrolet Bolt EV/EUV, Ford F-150 Lightning, Tesla Model 3 (with specific trims), and Volkswagen ID.4 (built in Tennessee) often qualify—especially if purchased through a dealership that transfers the credit at point of sale.

Here’s a pro tip: starting in 2024, you can choose to have the tax credit applied at the time of purchase instead of waiting until tax season. That means if you buy a qualifying EV for $40,000, the dealer can reduce the price by $7,500 immediately—so you pay $32,500 out of pocket. This is a game-changer, especially for middle-income buyers who might not owe $7,500 in taxes. It’s like getting an instant electric car rebate Florida shoppers can use right away.

Important Limitations and Phase-Outs

One thing to keep in mind: the federal credit has income caps. For single filers, your modified adjusted gross income (MAGI) must be under $150,000. For joint filers, it’s $300,000, and for heads of household, $225,000. If you exceed these limits, you’re out of luck.

Also, some popular EVs—like certain Tesla and GM models—have already gone through the phase-out process. For example, Tesla reached the 200,000-vehicle threshold years ago, but thanks to the Inflation Reduction Act (IRA), many Tesla models are now eligible again under the new rules. Always check the fueleconomy.gov website for the most up-to-date list of eligible vehicles and credit amounts.

State and Local Electric Car Rebates in Florida

Does Florida Offer Its Own EV Incentives?

Here’s the short answer: not directly. Unlike states like California, Colorado, or New York, Florida does not currently offer a statewide rebate program for purchasing electric cars. That might sound disappointing—but don’t close the browser just yet.

While the state government hasn’t launched a direct electric car rebate Florida program, it has taken steps to support EV adoption. For example, Florida’s Department of Environmental Protection (DEP) has allocated millions from the Volkswagen Environmental Mitigation Trust to fund EV charging infrastructure, particularly along major highways like I-75, I-95, and I-4. This makes long-distance EV travel far more feasible.

Additionally, Florida law allows for HOV lane access for EVs, even with a single driver—a perk that can save you time and stress during rush hour. You’ll need to apply for a special decal, but it’s free and renewable annually. This isn’t a cash rebate, but the time and fuel savings can add up over a year.

Local Utility Rebates: The Hidden Gem

This is where things get exciting. While the state may not offer rebates, many local electric utilities in Florida are stepping up with their own incentive programs. These are often overlooked but can save you hundreds—or even thousands—of dollars.

For example:

- Florida Power & Light (FPL): Offers a $1,000 rebate for installing a Level 2 home charging station. You must use an FPL-approved contractor, but the process is straightforward. Bonus: FPL also has a Smart Charging Program that pays you to charge during off-peak hours (like overnight).

- Orlando Utilities Commission (OUC): Provides a $500 rebate for home EV charger installation and a $100 gift card for signing up for time-of-use rates.

- Tampa Electric (TECO): Offers a $750 rebate for Level 2 chargers and a $250 credit for enrolling in their EV charging program.

- JEA (Jacksonville): Gives a $500 rebate for charger installation and a $100 bill credit for EV owners.

These rebates are stackable with the federal tax credit, meaning you could save $7,500 (federal) + $1,000 (FPL) + $100 (time-of-use) = $8,600+ in total savings on a new EV and home charger. Not bad for a state with no direct rebate!

City and County Programs

Some municipalities are also getting creative. For instance, the City of St. Petersburg has offered grants for EV charging stations in public spaces and has explored partnerships with dealerships for local discounts. While not widespread, it’s worth checking your city or county’s sustainability office website for any pilot programs or upcoming initiatives.

Used EV Incentives: Yes, You Can Save on a Pre-Owned Electric Car

The New Federal Used EV Credit

Here’s a surprise for many: the federal government now offers a tax credit for used electric cars too. This is huge news for budget-conscious buyers. The Used Clean Vehicle Credit allows you to claim up to $4,000 or 30% of the purchase price, whichever is less—whichever is lower.

To qualify, the used EV must:

- Be purchased after December 31, 2022

- Be at least 2 years old

- Have a sale price of $25,000 or less

- Be sold by a licensed dealer (private sales don’t qualify)

- Be the first transfer of ownership since the credit became available

For example, if you buy a 2022 Nissan Leaf for $20,000, you could claim 30% of $20,000 = $6,000, but the cap is $4,000—so you get $4,000 back at tax time. That brings your effective cost down to $16,000 for a car with 30,000 miles and a decent battery. Not bad at all.

Why Used EVs Are a Smart Choice in Florida

Used EVs are especially appealing in Florida for a few reasons:

- Lower upfront cost: A used EV can cost half as much as a new one, making it easier to qualify for the federal credit.

- Lower insurance: Older models often have lower premiums.

- Less depreciation hit: The first owner already took the biggest depreciation loss.

- Still qualifies for utility rebates: FPL and others don’t care if your EV is new or used—they’ll still give you $1,000 for a home charger.

And here’s a local tip: Florida’s mild climate means EVs don’t suffer the same battery degradation as in colder states. A used EV with 50,000 miles in Florida might have better battery health than a similar car from Michigan.

Where to Find Used EVs with Rebate Eligibility

Stick to dealerships that report to the IRS. Many certified pre-owned (CPO) programs now advertise “federal used EV credit eligible” on their websites. Look for brands like Nissan, Chevrolet, and Tesla (via Tesla’s CPO program). Avoid private sales—even if the car qualifies, you can’t claim the credit.

Charging Incentives and Time-of-Use Savings

Home Charging Rebates: More Than Just a Convenience

Installing a Level 2 home charger (240V) typically costs $500–$1,000, including labor. But thanks to utility rebates, that cost can drop to just $200–$500 in many areas. As we mentioned earlier, FPL, TECO, OUC, and JEA all offer rebates—and some even cover the full cost if you use an approved installer.

Beyond the rebate, consider this: a Level 2 charger can add 25–30 miles of range per hour. That means you can go from 20% to 100% overnight (6–8 hours), versus 3–5 days with a standard outlet. For a daily commute of 40 miles, that’s a huge convenience.

Time-of-Use (TOU) Rates: Charge Smart, Save More

Many Florida utilities offer time-of-use (TOU) electric rates, which charge less for electricity during off-peak hours (usually 10 p.m. to 6 a.m.). If you charge your EV overnight, you could pay as little as 8–10 cents per kWh instead of 15–20 cents during peak hours.

For example, charging a 75 kWh battery (like in a Tesla Model Y) at 9 cents/kWh costs $6.75. At 18 cents, it’s $13.50. That’s a $6.75 savings per charge. Over a year (300 charges), that’s over $2,000 in savings. And some utilities, like FPL, will even pay you a small bonus just for enrolling in a smart charging program.

Public Charging Incentives

While public charging is generally pay-per-use, some Florida cities and businesses offer free or discounted charging. For example:

- Walmart and Target in Florida often have free Level 2 chargers in their parking lots.

- SunRail stations in Central Florida provide free EV charging for riders.

- Some shopping malls and hotels offer free charging as a customer perk.

Also, Florida is part of the National Electric Highway Coalition, a group of 60+ utilities working to build fast-charging networks along major interstates. By 2025, you should be able to drive from Miami to Tallahassee with minimal charging stops.

How to Maximize Your Savings: A Step-by-Step Guide

Step 1: Check Vehicle Eligibility

Before you even visit a dealership, visit fueleconomy.gov and search for your desired EV. Look for the “Federal Tax Credit” badge. Confirm the credit amount and whether the vehicle is eligible for the point-of-sale transfer.

Step 2: Confirm Your Income Qualification

Use the IRS income limits (mentioned earlier) to ensure you’re eligible for the federal credit. If you’re close to the cap, consider timing your purchase or adjusting your withholdings.

Step 3: Research Local Utility Rebates

Visit your utility’s website (FPL, TECO, OUC, etc.) and search for “EV rebate” or “EV charger rebate.” Download the application form and note any deadlines or requirements (e.g., using a certified installer).

Step 4: Stack Incentives

Here’s a real-life example of how to stack savings in Florida:

- Buy a new Ford Mustang Mach-E (qualifies for $7,500 federal credit)

- Use point-of-sale transfer: $7,500 discount at dealership

- Install a home charger with FPL: $1,000 rebate

- Enroll in FPL’s smart charging program: $100 annual bonus

- Use TOU rates: Save ~$1,500/year in charging costs

Total first-year savings: $10,100

Step 5: Apply for the HOV Lane Decal

Visit the Florida Highway Safety and Motor Vehicles website, fill out the HOV decal application, and pay the small fee (around $25). You’ll get a decal that gives you solo-driver access to HOV lanes—saving you time and stress.

Step 6: Keep Records

Save all receipts, rebate applications, and tax forms. You’ll need them for your tax return and any utility audits. A simple folder (digital or physical) will do.

Data Table: Florida Electric Car Rebates and Incentives (2024)

| Program | Amount | Eligibility | Deadline |

|---|---|---|---|

| Federal Clean Vehicle Credit (New EV) | Up to $7,500 | New EV, North American assembly, income limits apply | Ongoing |

| Federal Used Clean Vehicle Credit | Up to $4,000 (30% of price, max $25k) | Used EV, 2+ years old, dealer sale only | Ongoing |

| FPL EV Charger Rebate | $1,000 | FPL customer, Level 2 charger, approved installer | Rolling (funds may expire) |

| TECO EV Charger Rebate | $750 | TECO customer, Level 2 charger | Rolling |

| OUC EV Charger Rebate | $500 + $100 gift card | OUC customer, Level 2 charger, TOU enrollment | Rolling |

| JEA EV Charger Rebate | $500 + $100 bill credit | JEA customer, Level 2 charger | Rolling |

| Florida HOV Lane Decal | Free (time savings) | EV owner, Florida registered | Annual renewal |

Final Thoughts: Is Now the Time to Go Electric in Florida?

Absolutely—especially if you’re ready to take advantage of every electric car rebate Florida has to offer. While the state doesn’t have a flashy, headline-grabbing rebate program, the combination of federal tax credits, local utility incentives, and smart charging savings creates a powerful financial case for switching to an EV.

Think of it this way: you’re not just buying a car. You’re investing in lower fuel costs, reduced maintenance (no oil changes!), cleaner air, and the peace of mind that comes with knowing you’re part of a growing movement. And with Florida’s expanding charging network and supportive utilities, the transition is easier than ever.

So go ahead—take that test drive. Talk to your utility. Stack those rebates. And when you’re cruising down the Gulf Coast with the AC blasting and the sunroof open, you’ll know: going electric was one of the smartest moves you’ve made. And hey, you might even save enough to cover a weekend getaway in the Keys. Now that’s a bright future.

Frequently Asked Questions

What electric car rebates are available in Florida?

Florida offers several incentives for electric vehicle (EV) buyers, including a state sales tax exemption on new EV purchases and potential federal tax credits up to $7,500. Local utilities may also provide additional rebates for charging equipment or EV purchases.

How can I qualify for electric car rebates in Florida?

To qualify for Florida’s EV incentives, you must purchase or lease a new electric vehicle and register it in the state. Federal tax credits require meeting income and vehicle eligibility criteria, such as battery size and manufacturing requirements.

Does Florida offer a tax credit or rebate for EV charging stations?

While Florida doesn’t have a statewide rebate for home chargers, many local utility companies offer incentives covering 50-100% of installation costs. Check with your provider for specific programs related to electric car rebates in Florida.

Are used electric cars eligible for rebates in Florida?

No, Florida’s sales tax exemption only applies to new electric vehicles. However, used EVs may qualify for the federal tax credit of up to $4,000 under the Inflation Reduction Act if they meet specific conditions.

How much can I save with Florida’s EV incentives?

Combining state and federal incentives, you could save over $10,000 on your EV purchase. The exact amount depends on the vehicle model, local utility rebates, and your tax liability for claiming federal credits.

Where can I find a list of EVs eligible for rebates in Florida?

The U.S. Department of Energy’s Alternative Fuels Data Center lists all vehicles eligible for federal tax credits. For Florida-specific electric car rebates, consult the state’s Department of Agriculture and Consumer Services or local utility websites.