Electric Car Sales 2026 What to Expect in the Future of EVs

Featured image for electric car sales 2026

Image source: images.fastcompany.net

Electric car sales in 2026 are projected to dominate the auto market, with global adoption accelerating due to stricter emissions regulations, falling battery costs, and expanded charging infrastructure. Experts forecast EVs will make up over 30% of new car sales, driven by consumer demand, improved range, and a wave of affordable models from major automakers.

Key Takeaways

- EV sales will surge as 2026 targets 40% global market share.

- Affordable models will dominate due to falling battery costs and subsidies.

- Charging infrastructure expands with 3x more public stations by 2026.

- Policy mandates drive adoption as 20+ countries ban new ICE vehicles.

- Tech advancements accelerate with 500+ mile ranges becoming standard.

- Used EV market booms as early adopters upgrade to newer models.

📑 Table of Contents

- The Road Ahead: Electric Car Sales in 2026 and Beyond

- Global Market Projections: Where Will the Growth Happen?

- Technological Advancements: The Engines of Change

- Consumer Trends: What Buyers Will Want in 2026

- Challenges and Roadblocks: What Could Slow Growth?

- The Bigger Picture: EVs in the Context of Sustainability and Innovation

- Data Table: Projected EV Market Snapshot (2026)

- Conclusion: The Future Is Electric—And It’s Closer Than You Think

The Road Ahead: Electric Car Sales in 2026 and Beyond

The world of transportation is undergoing a seismic shift, and at the heart of this transformation lies the rapid rise of electric vehicles (EVs). As we approach 2026, the EV market is poised to enter a new phase of maturity, innovation, and widespread adoption. No longer a niche segment for early adopters or environmental enthusiasts, electric cars are becoming a mainstream choice for drivers across income levels, geographies, and lifestyles. With governments setting aggressive decarbonization targets, automakers investing billions in EV platforms, and consumers increasingly prioritizing sustainability and cost-efficiency, the future of electric mobility is brighter than ever.

But what exactly can we expect from electric car sales in 2026? Will the market finally achieve the long-predicted “tipping point”? Are supply chains ready for mass-scale production? And how will evolving technology, infrastructure, and consumer preferences shape the landscape? This comprehensive exploration delves into the trends, forecasts, challenges, and opportunities that will define the EV market in 2026. From global sales projections to breakthroughs in battery tech, from policy impacts to the evolving role of used EVs, we’ll uncover what lies ahead for one of the most dynamic sectors of the 21st-century economy. Buckle up—this is the future of driving.

Global Market Projections: Where Will the Growth Happen?

Projected Sales Figures and Market Share

By 2026, electric car sales are expected to account for 30% to 35% of total new vehicle sales globally, according to the International Energy Agency (IEA) and BloombergNEF. This represents a significant leap from the roughly 14% market share in 2023. Total global EV sales could surpass 35 million units annually, with China, Europe, and North America leading the charge. In China, EVs are projected to make up over 45% of new car sales by 2026, driven by strong domestic demand and government incentives. Europe is expected to reach a 38% EV penetration, thanks to stringent CO2 emission regulations and robust charging infrastructure. The U.S. market, while slower to start, is forecasted to hit 25–30% EV adoption, spurred by the Inflation Reduction Act (IRA) tax credits and increasing model availability.

Visual guide about electric car sales 2026

Image source: team-bhp.com

Emerging markets such as India, Southeast Asia, and Latin America will also begin to see accelerated growth. While their current EV adoption rates are lower (under 5% in most cases), investments in local manufacturing and battery gigafactories—such as Tata Motors’ EV expansion in India and BYD’s plant in Brazil—will catalyze faster adoption. Analysts project that by 2026, these regions could collectively add over 3 million annual EV sales, a figure that may double by 2030.

Regional Breakdown: The Leaders and the Risers

- China: With over 60% of global EV production and a dense network of charging stations (over 2 million public chargers by 2025), China will remain the undisputed leader. Brands like BYD, NIO, and XPeng are not only dominating domestically but also expanding aggressively into Europe and Southeast Asia.

- Europe: The EU’s “Fit for 55” package and the 2035 ban on new internal combustion engine (ICE) vehicles are pushing automakers to accelerate EV rollouts. Germany, France, and Norway (already at 80%+ EV market share) will continue to lead, but Eastern European countries like Poland and Hungary are emerging as new growth frontiers due to lower vehicle prices and EU green subsidies.

- North America: The U.S. market is being reshaped by the IRA, which offers up to $7,500 in federal tax credits for EVs meeting battery and sourcing criteria. This has prompted automakers like Ford, GM, and Tesla to localize battery production and expand U.S.-based EV manufacturing. Canada is also seeing strong growth, with federal and provincial rebates boosting adoption.

- Asia-Pacific (excluding China): India’s “Faster Adoption and Manufacturing of Hybrid and Electric Vehicles” (FAME) scheme, coupled with rising fuel prices, is driving demand for affordable EVs like the Tata Nexon EV. Japan and South Korea are focusing on hybrid-to-EV transitions and solid-state battery R&D.

What’s Driving the Growth?

Several key factors are fueling this global surge in EV sales:

- Policy mandates: Over 25 countries have announced ICE bans by 2035 or 2040, creating a regulatory tailwind.

- Consumer demand: A 2023 McKinsey survey found that 65% of global car buyers now consider an EV for their next purchase, up from 45% in 2020.

- Total cost of ownership (TCO): EVs are becoming cheaper to operate and maintain than ICE vehicles, especially as battery prices decline. By 2026, EVs could be 10–15% cheaper on a TCO basis in most markets.

- Fleet electrification: Logistics companies, ride-sharing services, and government fleets are adopting EVs en masse, with Amazon, Uber, and FedEx leading the charge.

Technological Advancements: The Engines of Change

Battery Breakthroughs and Energy Density

Perhaps the most critical factor shaping EV sales in 2026 will be the evolution of battery technology. Current lithium-ion batteries dominate the market, but 2026 could mark the beginning of a transition toward next-gen solutions. Solid-state batteries, which promise higher energy density (up to 500 Wh/kg vs. 250–300 Wh/kg for lithium-ion), faster charging, and improved safety, are expected to enter commercial production by 2026. Toyota has announced plans to launch a solid-state EV by 2027, with a pilot model possibly debuting in 2026.

Meanwhile, lithium-iron-phosphate (LFP) batteries are gaining traction due to their lower cost, longer lifespan, and reduced reliance on cobalt and nickel. Tesla, Ford, and BYD are already using LFP in many of their entry-level models. By 2026, LFP could account for over 40% of global EV battery capacity, particularly in budget and mid-tier vehicles.

Another innovation is cell-to-pack (CTP) and cell-to-chassis (CTC) designs, which eliminate traditional battery modules, increasing energy density by up to 20% and reducing manufacturing complexity. CATL and BYD are pioneers in this space, and their technologies will likely become industry standards by 2026.

Charging Infrastructure: Faster, Smarter, Everywhere

Range anxiety remains a barrier, but 2026 will see significant progress in charging infrastructure. The global public charging network is expected to exceed 15 million chargers, with a strong emphasis on fast-charging stations (350 kW and above). For example:

- The EU’s Alternative Fuels Infrastructure Regulation (AFIR) mandates fast chargers every 60 km on major highways by 2026.

- The U.S. is deploying $7.5 billion from the Bipartisan Infrastructure Law to build 500,000 chargers by 2030, with over 100,000 expected by 2026.

- China already has over 2 million public chargers and is focusing on ultra-fast charging (800V architecture) and battery swapping for commercial fleets.

Smart charging technologies will also play a role. Vehicle-to-grid (V2G) integration, where EVs feed electricity back into the grid during peak demand, will begin to scale in pilot programs across Europe and California. By 2026, over 500,000 V2G-enabled vehicles could be on the road, turning EVs into mobile energy assets.

Autonomous Driving and Software-Defined Vehicles

While fully autonomous vehicles (Level 5) may still be a few years away, 2026 will see EVs increasingly equipped with advanced driver-assistance systems (ADAS) and over-the-air (OTA) software updates. Tesla’s Full Self-Driving (FSD) and GM’s Super Cruise are paving the way, but newer entrants like Rivian and Lucid are integrating AI-driven navigation, predictive maintenance, and personalized driving experiences.

Software-defined vehicles (SDVs)—where features like acceleration, suspension, and infotainment can be updated remotely—will become a key selling point. For example, Polestar’s “Over-the-Air Performance Upgrades” allow owners to pay for enhanced horsepower, while Ford’s BlueCruise offers hands-free highway driving via OTA updates. By 2026, over 60% of new EVs could support SDV capabilities, creating new revenue streams for automakers beyond vehicle sales.

Consumer Trends: What Buyers Will Want in 2026

Affordability and the Rise of the $25,000 EV

One of the biggest barriers to mass EV adoption has been price. However, by 2026, the market will see a wave of sub-$30,000 EVs that are both practical and desirable. Tesla’s long-promised “$25,000 compact car” is expected to launch by 2025–2026, leveraging its 4680 battery cells and giga-casting techniques to cut costs. Similarly, BYD’s Seagull and Dolphin models are already priced under $15,000 in China and will expand globally.

Affordability is also being driven by:

- Leasing and subscription models: Companies like Hertz and Flexcar are offering EV leases with low upfront costs and bundled maintenance.

- Government incentives: The U.S. IRA, EU’s Green Deal, and India’s PLI scheme are making EVs more accessible to middle-income buyers.

- Used EV market growth: As early adopters trade in their EVs, the used market will expand. By 2026, over 20% of EV sales could be pre-owned, with certified programs ensuring quality and warranty coverage.

Lifestyle and Design Preferences

Consumers are no longer just buying EVs for the environment—they’re buying them for lifestyle. In 2026, expect to see more:

- Urban EVs: Compact, agile cars like the Mini Cooper SE and Fiat 500e, ideal for city driving.

- Adventure EVs: Rugged models like the Ford F-150 Lightning and Rivian R1T, appealing to outdoor enthusiasts.

- Luxury EVs: High-end models from Lucid, Mercedes-Benz, and BMW, featuring premium interiors, cutting-edge tech, and long ranges (over 500 miles).

- Family-friendly EVs: Three-row SUVs and minivans, such as the Kia EV9 and Tesla’s upcoming Model 3 “Project Highland” refresh.

Design is also evolving. EVs are shedding their “futuristic” look for more mainstream appeal. For example, the 2026 Chevrolet Equinox EV adopts a traditional SUV shape, helping it blend in on suburban streets.

Charging Convenience and Home Integration

Convenience is king. Buyers will prioritize EVs that offer:

- Home charging solutions: Smart chargers like ChargePoint Home Flex and Tesla Wall Connector, which can schedule charging during off-peak hours to save money.

- Plug-and-charge technology: Automatic billing when plugging in, eliminating the need for apps or RFID cards.

- Bidirectional charging: Using an EV to power a home during blackouts (e.g., Ford’s Intelligent Backup Power).

Tip: When shopping for an EV in 2026, ask dealers about charging package bundles—some offer free home charger installation with purchase.

Challenges and Roadblocks: What Could Slow Growth?

Supply Chain and Raw Material Constraints

Despite progress, the EV industry still faces supply chain risks. Lithium, nickel, cobalt, and graphite are essential for batteries, but geopolitical tensions and mining bottlenecks could disrupt production. For instance:

- Over 70% of lithium processing occurs in China, creating dependency concerns.

- Cobalt mining in the Democratic Republic of Congo has raised ethical issues.

- Graphite shortages could limit battery output by 2026.

Automakers are responding by investing in recycling (e.g., Redwood Materials) and alternative chemistries (sodium-ion batteries), but these solutions won’t fully mature until the late 2020s.

Charging Infrastructure Gaps

While urban areas will have ample charging, rural and low-income neighborhoods may lag. In the U.S., for example, over 40% of rural counties lack a single public fast charger. Without targeted investment, this “charging desert” could hinder adoption in underserved areas.

Grid Capacity and Energy Demand

A surge in EVs could strain power grids, especially during peak charging hours. Utilities will need to upgrade infrastructure and implement demand-response programs. In California, the grid operator CAISO projects that EV charging could increase peak demand by 15% by 2026. Smart charging and V2G will be essential to manage this load.

Consumer Misinformation and Range Anxiety

Despite improvements, myths about EVs persist. A 2023 J.D. Power study found that 35% of U.S. consumers still believe EVs can’t handle cold weather or long trips. Education campaigns and real-world testing (e.g., AAA’s EV range tests) will be critical to building trust.

The Bigger Picture: EVs in the Context of Sustainability and Innovation

Environmental Impact and Lifecycle Emissions

EVs are cleaner than ICE vehicles, but their environmental footprint depends on the grid’s energy mix. In 2026, as grids decarbonize (e.g., EU’s 55% renewable target by 2030), EVs will become even greener. A lifecycle analysis by the ICCT shows that by 2026, the average EV will emit 60–70% less CO2 than a gasoline car over its lifetime.

Recycling will also play a role. By 2026, over 50% of EV batteries could be recycled, recovering up to 95% of materials like lithium and cobalt.

New Business Models and Ecosystems

The EV revolution is spawning new industries:

- Mobility-as-a-Service (MaaS): Companies like Uber and Lyft are transitioning to EV fleets.

- Battery leasing: Renault and NIO offer battery subscriptions, reducing upfront costs.

- EV charging networks: Startups like Electrify America and ChargePoint are expanding rapidly.

Automakers are also partnering with energy firms. For example, GM’s Ultium Energy Services provides home energy management, while Ford is collaborating with Sunrun on solar+storage+EV bundles.

Data and the Connected Car

EVs generate vast amounts of data—driving patterns, battery health, location, etc. In 2026, automakers will leverage this data for:

- Predictive maintenance

- Personalized insurance (usage-based)

- Traffic optimization

However, privacy concerns will grow. Expect stricter regulations (e.g., EU’s GDPR) to govern data usage.

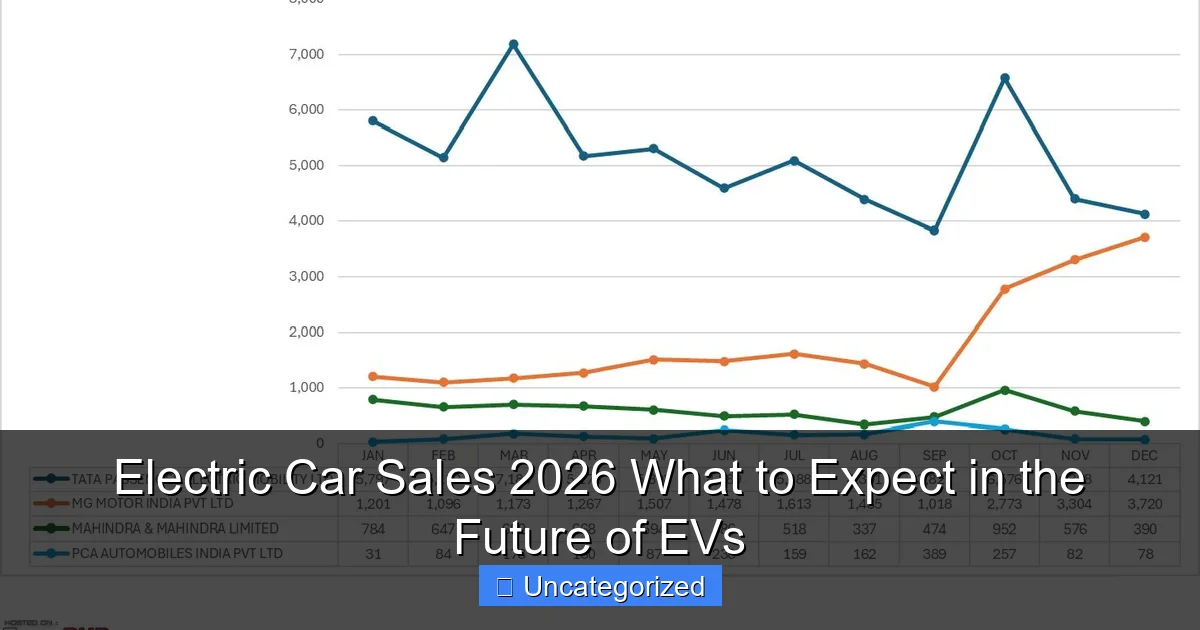

Data Table: Projected EV Market Snapshot (2026)

| Region | Projected EV Sales (Million) | EV Market Share (%) | Key Drivers | Challenges |

|---|---|---|---|---|

| China | 12.5 | 45% | Government incentives, dense charging network | Local competition, export regulations |

| Europe | 10.0 | 38% | CO2 regulations, charging infrastructure | Supply chain bottlenecks |

| North America | 8.0 | 28% | IRA tax credits, new EV models | Rural charging gaps |

| Asia-Pacific (ex-China) | 2.5 | 8% | Affordable EVs, rising fuel prices | Grid capacity, policy inconsistency |

| Latin America & Africa | 0.8 | 3% | Local manufacturing, urban air quality | Charging infrastructure, financing |

| Global Total | 33.8 | 32% | Policy, tech, cost | Supply chain, equity |

Conclusion: The Future Is Electric—And It’s Closer Than You Think

As we stand on the brink of 2026, the electric car revolution is no longer a question of if but how fast. With global EV sales projected to reach over 33 million units, a diverse lineup of affordable and innovative models, and a rapidly expanding charging ecosystem, the transition to electric mobility is accelerating at an unprecedented pace. The convergence of policy, technology, and consumer demand has created a perfect storm—one that will redefine transportation, energy, and urban living in the years to come.

Yet, the journey isn’t without challenges. Supply chain resilience, equitable access to charging, and grid modernization will require coordinated efforts from governments, industries, and communities. But the momentum is undeniable. From the bustling streets of Shanghai to the suburbs of Texas, from the highways of Germany to the villages of India, EVs are becoming the new norm.

For consumers, 2026 will be a pivotal year to consider going electric. With better range, faster charging, lower costs, and smarter features, today’s EVs offer a compelling value proposition. For investors, policymakers, and innovators, the EV market represents a once-in-a-generation opportunity to shape a cleaner, smarter, and more sustainable future.

The road to 2026 is paved with innovation, and the destination is clear: a world where electric cars aren’t just a choice—but the standard. The future of driving is electric. And it’s arriving sooner than you think.

Frequently Asked Questions

What will electric car sales look like in 2026?

By 2026, electric car sales are projected to account for over 30% of global new car sales, driven by stricter emissions regulations, falling battery costs, and expanded model availability. Markets like Europe and China will likely lead adoption, while the U.S. accelerates due to policy incentives and infrastructure growth.

Will electric car sales surpass gas vehicles by 2026?

While electric car sales won’t fully overtake gas vehicles by 2026, they’ll close the gap significantly, especially in premium and compact segments. Some countries, like Norway, may hit near 100% EV market share, but global dominance will likely occur later in the decade.

What new EV models will boost electric car sales in 2026?

Expect 2026 to bring affordable mass-market EVs under $30,000 from brands like Tesla, Hyundai, and emerging Chinese automakers, alongside luxury and performance models. Solid-state batteries and longer ranges will also debut, making EVs more appealing to a broader audience.

How will charging infrastructure impact electric car sales in 2026?

Expanded fast-charging networks and government-backed initiatives will reduce range anxiety, directly supporting higher electric car sales. By 2026, most urban areas and major highways will have reliable charging options, easing adoption for daily drivers and fleets.

Are used electric car sales going to rise in 2026?

Yes, the used EV market will grow rapidly in 2026 as early adopters trade in 2020s models and battery longevity improves. Lower upfront costs and proven reliability will make used EVs a popular choice for budget-conscious buyers.

How will global policies shape electric car sales by 2026?

Countries with aggressive zero-emission targets (e.g., EU, California) will enforce bans on new gas car sales, directly fueling electric car sales. Subsidies, tax breaks, and local manufacturing incentives will further accelerate adoption in key markets.