Electric Car Tax Benefits: A Comprehensive Guide to Incentives and Savings

Have you ever considered driving an electric car? Not only are these vehicles eco-friendly, but they also offer enticing tax benefits. The Electric Car Tax Benefit In Kind policy is a way to incentivize the purchase of electric cars by reducing the amount of taxes individuals need to pay. This policy is gaining popularity and has led to an increase in the number of individuals who are looking into purchasing electric cars.

However, understanding the policy can be confusing, leading to many questions. What is the policy, and how does it work? In this blog post, we will delve into the details of this policy and help you understand its intricacies so that you can make an informed decision when it comes to your vehicle purchases.

Definition and Eligibility Criteria

If you’re considering purchasing an electric car, it’s important to know about the tax benefit in kind. Essentially, this is a way for employees to receive a tax break on the value of their company car. To be eligible for the electric car tax benefit in kind, the vehicle must meet certain criteria.

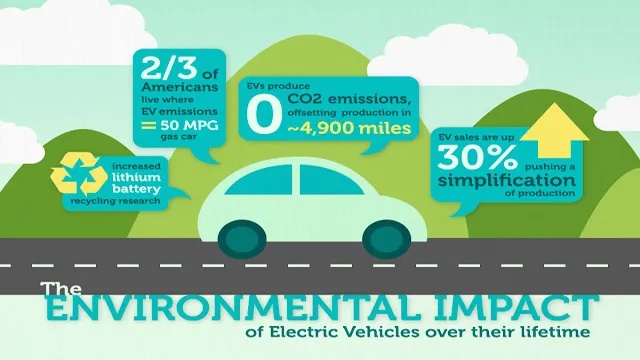

First and foremost, it must be a pure electric car – hybrids and plug-in hybrids do not qualify. Additionally, the car must have CO2 emissions of 0g/km and a minimum all-electric range of 130 miles. If you meet these requirements, you can enjoy a significantly reduced tax bill.

This makes electric cars an attractive option for company car drivers, as well as individuals looking to purchase a new car. Make sure to do research and consult with your HR department to see if you’re eligible for the electric car tax benefit in kind.

What Is The Benefit In Kind?

Benefit in kind is a term used to describe non-cash benefits provided by an employer to an employee, in addition to their regular salary or wages. These benefits are generally provided as a perk and can vary from company to company. Examples include company cars, health insurance, housing allowances, and gym memberships.

Eligibility criteria for receiving a benefit in kind will depend on the employer’s policies and the employee’s job role. Typically, the more senior the job position, the greater the likelihood of receiving additional benefits. Employees who earn above a certain income threshold may also be eligible for benefits in kind.

Ultimately, the aim of providing a benefit in kind is to incentivize and reward employees, and to retain talent within the company. It’s important for both employers and employees to understand the value and tax implications of these benefits to ensure compliance with legal obligations and to make informed decisions.

Who Qualifies For The Benefit In Kind?

If you’re a business owner providing certain benefits to your employees, such as a company car or health insurance, you may be subject to the Benefit In Kind (BIK) tax. This tax is essentially a tax on non-cash earnings and is calculated based on the value of the benefit provided. The eligibility criteria for BIK can vary depending on the type of benefit, but generally, employees must be in a certain position or role to qualify for these benefits.

For example, a company car may only be provided to employees who require it for their job, such as salespeople who need to travel frequently. Similarly, health insurance may only be provided to employees who meet certain criteria, such as being full-time and working a certain number of hours per week. It’s important to understand the eligibility criteria for BIK benefits to avoid any surprises come tax season.

How Does It Work?

If you’re thinking about purchasing an electric car, you may be curious about the tax benefits in kind. Essentially, this is a benefit that allows employees who are provided with a company car to pay a lower amount of tax for the personal use of that car. In the case of electric cars, this benefit can be significant, as they are typically associated with lower CO2 emissions and lower fuel consumption.

This means that the tax liability associated with them is often lower than it would be for a traditional vehicle. Additionally, there are a range of other incentives and benefits available for those who choose to go electric, such as lower road tax and exemption from the London congestion charge. All of these factors can help to make electric cars an attractive option for both individuals and businesses alike.

So, if you’re looking to reduce your environmental impact and save some money at the same time, it may be worth considering an electric car – and the tax benefits in kind that come with it.

Calculation of The Benefit In Kind

Calculating the Benefit In Kind can seem complicated, but it’s actually quite straightforward once you understand how it works. Essentially, the Benefit In Kind is the value of any benefits an employee receives from their employer, on top of their salary. This can include things like company cars, health insurance, and even gym memberships.

To calculate the Benefit In Kind, you need to add up the total value of all the benefits an employee has received in the tax year, and then work out how much tax they need to pay on that amount. The tax rate depends on the value of the benefit, but it’s typically between 20% and 45%. It’s worth noting that some benefits are exempt from tax, such as work-related training courses or low-value items like Christmas hampers.

Overall, the Benefit In Kind is an important consideration for employers and employees alike, as it can have a significant impact on net income, tax liabilities, and overall take-home pay. By understanding how it works, you can better navigate the complexities of the UK tax system and ensure that you are managing your finances effectively.

Examples of Saving Money on Electric Cars

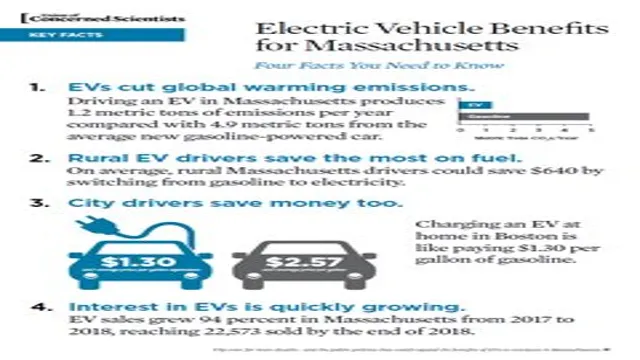

Electric cars may seem like an expensive investment at first, but there are various ways to save money on them in the long run. One way to do this is through the federal tax credit for electric vehicles, which can reach up to $7,500 depending on the make and model of the car. Additionally, electric cars have lower fuel and maintenance costs compared to traditional gasoline-powered cars.

The cost of charging an electric car is around half the price of refueling a gas car, and electric cars require fewer services and repairs due to their simpler mechanics. Furthermore, some states offer rebates and incentives for electric vehicle purchases, such as California’s Clean Vehicle Rebate Project. While the upfront cost of an electric car may be higher, the savings on fuel and maintenance costs, as well as potential tax incentives, make them a viable and cost-effective option in the long run.

Tax Savings vs. Electric Car Price

Electric car buyers often face sticker shock when they see the prices of electric vehicles. However, purchasing an electric car also comes with significant tax savings. The federal government offers a tax credit of up to $7,500 for the purchase of electric cars.

Additionally, some states also offer tax incentives, such as rebates or exemptions from sales tax. These tax savings can significantly reduce the out-of-pocket cost of buying an electric car and make it a more affordable option in the long-run. For example, if someone buys an electric car for $40,000, they can receive a federal tax credit of $7,500, bringing the net cost down to $32,500.

Furthermore, they may qualify for additional state tax credits or incentives, further reducing the cost. So, while upfront costs may seem high, the tax savings can make buying an electric car a smart, financially-savvy choice that benefits both the environment and the wallet.

Benefits of Owning an Electric Car

When it comes to owning an electric car, one major benefit that many people may overlook is the tax benefit in kind. This essentially means that if you use your electric car for work purposes, you may be eligible for a tax break. In the UK, for example, the tax benefit in kind for electric cars is much lower than for petrol or diesel cars, which can offer significant savings for businesses.

Not only does this benefit help promote the use of electric cars, but it also incentivizes companies to transition to more sustainable and eco-friendly transportation options. However, it’s important to note that tax laws may vary depending on your location, so it’s always a good idea to consult with a tax professional for specific information. Overall, taking advantage of tax benefits for electric cars can greatly reduce the cost of ownership and contribute to a more sustainable future.

Ecological Footprint and Sustainability

As we become more aware of our ecological footprint and the importance of sustainability, owning an electric car can have many benefits. Not only do electric cars produce significantly less emissions than traditional gas-powered cars, they can also save you money in the long run. The cost of charging an electric car is typically much lower than the cost of filling up a gas tank, and maintenance costs for electric cars are often lower as well.

Plus, many electric cars now have a range that can match or even exceed that of a traditional car, making them just as practical for day-to-day use. Despite the initial cost, owning an electric car can be a wise investment both for your wallet and the environment.

Savings on Fuel and Maintenance Costs

Electric car ownership can provide numerous benefits, with one of the most significant being savings on fuel and maintenance costs. Unlike conventional automobiles that require gas or diesel to operate, electric cars are powered by electricity that can be sourced from an outlet at home or a public charging station. As a result, electric cars are far cheaper to fuel and can save owners hundreds or even thousands of dollars in fuel costs annually.

Additionally, electric cars require minimal maintenance, as they have fewer moving parts and don’t require oil changes, spark plugs, or any other regular maintenance that traditional cars need. The savings on maintenance costs can also add up, making electric cars a financially savvy choice for drivers in the long run. Overall, owning an electric car means lower costs and environmental benefits, making it an ideal choice for conscious and budget-savvy consumers.

Conclusion: Is an Electric Car Right for You?

In summary, the electric car tax benefit in kind is a shockingly good incentive for both employees and employers to make the switch to cleaner, more efficient vehicles. Not only does it reduce carbon emissions and improve air quality, but it also provides a juicy tax break that can save thousands of pounds. So, if you’re looking to make a positive impact on the environment while also saving a little cash, it’s time to give electric cars a charge!”

FAQs

What is the current tax benefit in kind rate for electric cars?

The current tax benefit in kind rate for electric cars is 1%.

How long will the current tax benefit in kind rate for electric cars be in effect?

The current tax benefit in kind rate for electric cars is set to stay in effect until at least 2025.

Are there any specific requirements for an electric car to qualify for tax benefit in kind?

Yes, to qualify for tax benefit in kind, an electric car must have CO2 emissions of 50g/km or less and a minimum electric range of 130 miles.

Is there a limit on the value of an electric car to qualify for tax benefit in kind?

Yes, there is a limit on the value of an electric car to qualify for tax benefit in kind. As of 2021, the limit is £50,000.