Electric Car Tax Benefits 2024: Maximize Your Savings!

Are you thinking about buying an electric car? You are not alone. More people are choosing electric cars. They are good for the environment. Plus, they save money on gas. But did you know they also come with tax benefits? In this article, we will talk about the electric car tax benefits in 2024. This can help you save money when you buy an electric car.

What are Tax Benefits?

Tax benefits are special rules that help you pay less tax. They can help you save money. The government gives these benefits to encourage people to buy electric cars. This is because electric cars are better for our planet.

Federal Tax Credit for Electric Cars

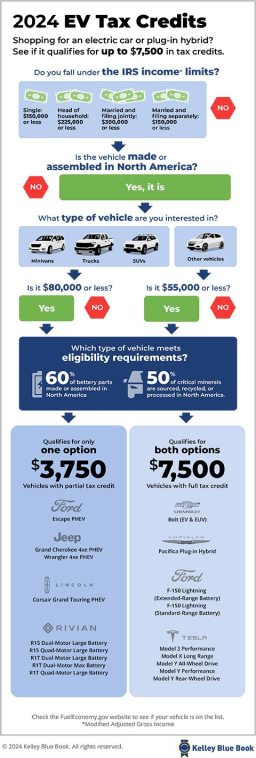

One of the most important tax benefits is the federal tax credit. This credit can help you save money when you buy an electric car. In 2024, the federal tax credit can be up to $7,500. This means if you buy a new electric car, you can reduce your tax bill by this amount.

Eligibility For The Federal Tax Credit

Not everyone can get the full $7,500. To qualify, you must meet certain rules:

- You must buy a new electric car.

- The car must be made by a qualifying manufacturer.

- Your income must be below a certain level.

Each car company has a limit on how many cars can qualify. After they sell a certain number, the credit goes down. Check if your car still qualifies before you buy.

State Tax Benefits

Many states also offer tax benefits. These can vary a lot from state to state. Some states give you a state tax credit. This can be a few hundred to a few thousand dollars. Others may offer rebates. A rebate gives you money back after you buy the car.

Example State Benefits

| State | Type of Benefit | Amount |

|---|---|---|

| California | Rebate | $2,000 |

| New York | Tax Credit | $2,000 |

| Texas | Rebate | $2,500 |

Check your state’s website for details. They have the most up-to-date information.

Local Benefits

Some cities and towns also have benefits for electric car owners. These can include free parking. Others may offer discounts on registration fees. Some places give away charging stations for free.

Example Local Benefits

- Free charging stations in certain areas.

- No parking fees for electric cars.

- Discounted registration fees for electric vehicles.

Always check with your local government. They can tell you what benefits are available.

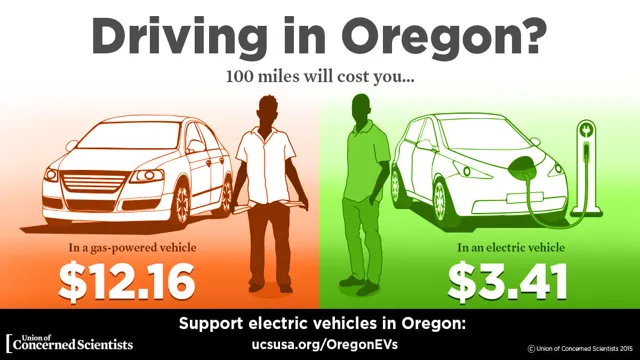

Lower Fuel Costs

Electric cars cost less to fuel. Charging your car is cheaper than buying gas. On average, charging an electric car can cost about $0.13 per kilowatt-hour. This is much less than the cost of gas.

Cost Comparison

Here is a quick comparison of costs:

| Fuel Type | Cost per Mile |

|---|---|

| Gasoline | $0.12 |

| Electricity | $0.04 |

As you can see, electric cars are cheaper to run.

Maintenance Costs

Electric cars often cost less to maintain. They have fewer moving parts. This means fewer repairs. For example, electric cars don’t need oil changes. This can save you time and money.

Common Maintenance Needs

- Tire rotations

- Brake checks

- Battery checks

These services are usually less expensive for electric cars.

Charging Station Incentives

Some states and cities also help you install a charging station at home. They may give you money back or help with the cost. This can make it easier to charge your car.

Benefits Of Home Charging

- Convenient charging at home.

- Lower electricity rates at night.

- Increased home value.

Having a home charging station can make owning an electric car easier.

Environmental Benefits

Electric cars help the planet. They produce less pollution than gas cars. This is good for our air and health. By driving electric, you help reduce greenhouse gases.

Why It Matters

Cleaner air is better for everyone. It can lead to fewer health problems. It also helps fight climate change. By choosing an electric car, you make a positive impact.

Frequently Asked Questions

What Are The Tax Benefits For Electric Cars In 2024?

The tax benefits for electric cars in 2024 include federal tax credits, state incentives, and reduced registration fees.

How Much Is The Federal Tax Credit For Electric Cars?

The federal tax credit can be up to $7,500, depending on the vehicle’s battery capacity.

Do All Electric Cars Qualify For Tax Credits?

Not all electric cars qualify. Check the IRS website for eligible models.

Are There State Tax Benefits For Electric Cars?

Yes, many states offer tax credits, rebates, or grants for electric vehicle buyers.

Conclusion

Buying an electric car has many benefits. The tax benefits in 2024 can save you a lot of money. You can get a federal tax credit, state incentives, and local rebates. Plus, electric cars cost less to fuel and maintain.

Think about all the good things. You help the planet, save money, and enjoy a great car. If you are thinking about buying an electric car, now is a great time. Check all the benefits available to you. Make the smart choice for your wallet and the earth.