Unlocking Significant Tax Benefits: Make the Switch to Electric Cars in India!

Have you been considering switching to an electric car in India but worried about the expenses? Well, automotive companies and the government have come up with an incentive to encourage people to buy electric vehicles. Electric car tax benefits in India have been introduced to make it easier for consumers to switch to eco-friendly transportation while simultaneously reducing their expenses. In this blog, we’ll delve deeper into the tax benefits available for those who purchase electric cars.

From no road tax to reduced GST, we’ll highlight everything you need to know to make an informed decision about buying an electric car in India.

Introduction

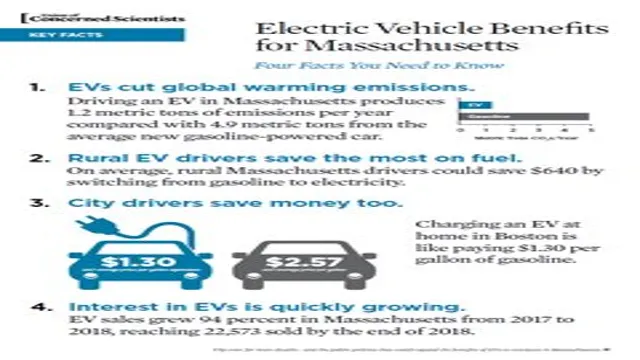

Electric car tax benefits in India are increasingly becoming popular as the country aims to reduce its carbon footprint and promote green living. The Indian government has taken several initiatives to encourage the use of electric vehicles, including income tax reductions, GST reduction, and subsidies for electric vehicle purchasers. One of the most significant benefits for electric car owners is the reduced GST rate, which is charged at a lower rate of 5% compared to the standard rate of 28% for traditional fuel cars.

In addition, electric car owners are also eligible for a tax deduction of up to 5 lakh rupees under Section 80EEB of the Income Tax Act. These benefits not only make electric cars more affordable but also help in reducing carbon emissions by encouraging eco-friendly transportation in India.

As more people switch to electric cars, the demand for them will increase, and the country will take another step towards a sustainable future.

Overview of electric car tax benefits in India

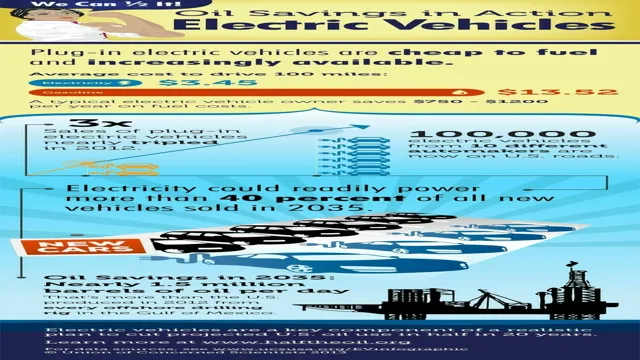

Electric car tax benefits in India. Electric cars are gaining popularity in India due to their numerous benefits such as being eco-friendly, cost-saving, and efficient. The Indian government has been encouraging the use of electric cars by offering various tax benefits to the buyers.

One of these benefits is a reduction of GST (Goods and Services Tax) from 12% to 5% for electric vehicles. The government also offers an income tax deduction of up to Rs.

5 lakh on the interest paid on the loan taken to purchase an electric vehicle. Additionally, there are state-specific benefits such as exemption from road tax and registration fees. These tax benefits have made electric cars more affordable for the average Indian and incentivized many to make the switch to electric vehicles.

Income Tax Benefits

If you’re considering buying an electric car in India, there are several income tax benefits that you can take advantage of. First of all, under Section 80EEB of the Income Tax Act, you can claim a deduction of up to Rs.

5 lakh on the interest paid on your electric vehicle loan. Additionally, if you use your electric car for business purposes, you can claim depreciation benefits under Section 32 of the Income Tax Act. This means that you can deduct a percentage of the cost of the car each year from your taxable income.

Furthermore, if you install a charging station at your home, you may be eligible for a GST refund under the Electric Vehicle Charging Infrastructure Promotion and Adoption (FAME-II) scheme. These tax benefits are designed to encourage more people to switch to electric vehicles and help reduce India’s carbon footprint. So not only will you be reducing your carbon emissions, but you’ll also be able to save on taxes by driving an electric car in India.

Overview of income tax benefits for electric car owners in India

Electric car owners in India can avail a range of income tax benefits that make owning such a vehicle much more attractive. These benefits come in the form of deductions and exemptions that can help reduce taxable income significantly. For instance, under Section 80EEB of the Income Tax Act, electric car owners can claim a deduction of up to Rs.

5 lakh on the interest paid on the loan taken to purchase the vehicle. Additionally, the government also offers a GST reduction on the purchase of electric cars, which can make them significantly cheaper than their fossil fuel counterparts.

Furthermore, electric car owners can also avail of exemptions on road tax and registration fees, which can further bring down the total cost of ownership. Overall, the income tax benefits available to electric car owners in India make it a highly viable option for those looking to make the switch to a more sustainable mode of transportation.

Deductions available under Section 80EEB

Section 80EEB of the Income Tax Act, 1961, provides deductions to taxpayers who have taken a loan to purchase an electric vehicle. The government introduced this section in the 2019 budget to encourage the adoption of electric cars. Under this section, taxpayers can claim a deduction of up to Rs.

5 lakh on the interest paid on the loan. However, the maximum loan amount eligible for deduction is Rs.

25 lakh, and the loan must have been sanctioned between 1st April 2019 and 31st March 202 Additionally, the vehicle purchased must be registered and used for personal use only. The deduction is available for both salaried and self-employed taxpayers and can be claimed over and above the deduction available under Section 80C.

By availing of this deduction, taxpayers can reduce their taxable income and save on their tax liability. Not only is this a win-win situation for the taxpayers, but it also supports the government’s efforts to promote eco-friendly vehicles.

Examples of how income tax benefits can save money

Income tax benefits are a great way to save money. Many people overlook the opportunities provided by the tax code, but these benefits can add up quickly and have a significant impact on your bottom line. For example, if you’re a homeowner, you can deduct mortgage interest and property taxes from your taxable income.

This can save you hundreds, if not thousands, of dollars each year. Contributions to a 401(k) or other retirement plan are also tax-deductible, which not only helps your future finances but also reduces your current tax burden. For those with children, the child tax credit and dependent care credit provide additional relief on your tax bill.

These are just a few examples of the income tax benefits available to individuals. By taking advantage of these opportunities, you can save money and keep more of your hard-earned income in your pocket.

GST Benefits

If you’re considering purchasing an electric car in India, you may be interested in knowing about the various tax benefits that come along with it. Thanks to the implementation of the Goods and Services Tax (GST), electric cars are taxed at a much lower rate than their petrol and diesel counterparts. In fact, electric cars are taxed at only 5%, as opposed to the previous tax rate of 1

5%. This significant reduction in tax has made electric cars much more affordable and accessible for the average Indian consumer. Moreover, the Indian government is offering additional incentives, such as a waiver of road tax and registration fees, to promote the adoption of electric vehicles across the country.

With these tax benefits in place, there has never been a better time to switch to an electric car and experience the many advantages it has to offer, both for your bank account and for the planet.

Overview of GST benefits for electric cars in India

Electric cars in India have been given GST benefits under the government’s aim to promote sustainable modes of transportation. The GST on electric vehicles has been reduced to 5% from the previous 12%, making it more affordable and accessible for people. Apart from this, there are also tax rebates offered on loans taken for buying electric cars.

The government has also waived road tax and registration fees for electric vehicles, making them even more cost-effective compared to their petrol or diesel counterparts. The reduction in GST for electric cars has also led to an increase in demand for these vehicles, which is a positive step towards reducing carbon emissions and air pollution. Overall, the GST benefits for electric cars in India are a significant move towards a cleaner, greener future.

Comparison of GST rates for electric and fuel-powered cars

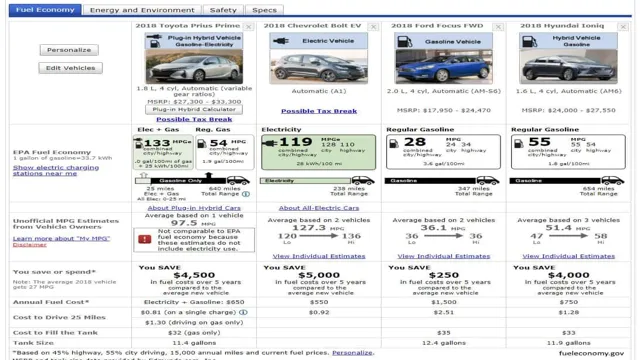

The introduction of Goods and Service Tax (GST) in India has been a game-changer for the automobile industry. Electric cars, which were once considered a luxury, are now becoming more accessible to Indian citizens, thanks to the lower GST rates as compared to fuel-powered cars. The government has offered a benefit of 5% GST on electric cars, while fuel-powered cars are taxed at a standard rate of 28%.

This significant reduction in GST rates has made the electric cars more affordable and is expected to stimulate the growth of the electric vehicle (EV) market in India. Furthermore, the government has also reduced the GST rates on the EV charging stations to 5%. The lower GST rates are not only a boon for the environment but are also expected to reduce the cost of owning an electric vehicle while saving on petrol or diesel costs.

The government’s push towards electric mobility is encouraging to see and is a step towards a greener future.

State-level Benefits

Electric car tax benefits in India vary from state to state, with some states offering more incentives than others. For example, the government of Maharashtra provides a waiver of road tax and registration fees for all new electric vehicles purchased or registered between April 1, 2021, and March 31, 202 In Delhi, electric car owners are exempt from paying road tax, and they also get a subsidy of up to Rs

5 lakh for purchasing an electric car under the Delhi Electric Vehicle Policy. Other states like Telangana, Punjab, and Gujarat also offer incentives such as reduced rates of road tax and electricity tariffs. These tax benefits are aimed at encouraging more people to switch to electric vehicles, thereby reducing the dependency on fossil fuels and lowering carbon emissions.

If you are considering buying an electric car, it is worth checking the incentives available in your state to make an informed decision.

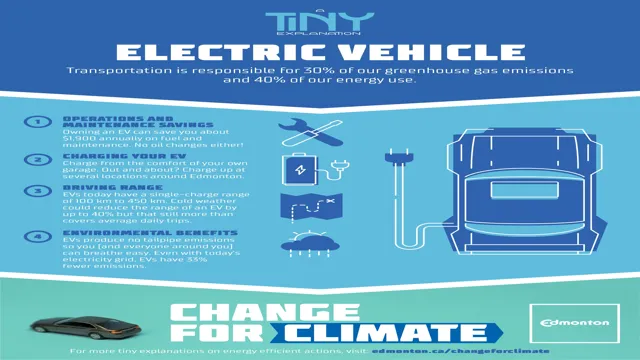

Overview of state-level benefits for electric car owners in India

If you’re thinking about purchasing an electric car in India, you’ll be happy to know that several state governments offer benefits for electric car owners. For instance, in Delhi, electric cars are exempt from road tax, and the government provides a subsidy of up to Rs.

5 lakh for the purchase of an electric car. Other states like Maharashtra and Karnataka also offer similar incentives, including reduced toll charges and free parking for electric cars. Additionally, some cities also offer charging stations for electric cars at public locations.

Despite these benefits, the adoption of electric cars in India has been sluggish due to a lack of charging infrastructure and high initial costs. However, with growing concerns over air pollution and rising fuel prices, many experts believe that electric cars could become a viable transportation option in the coming years.

Examples of state-level benefits in different states of India

State-level benefits are important for improving the lives of citizens in different states of India. For instance, in Assam, the Chief Minister Samagra Gramya Unnayan Yojana provides funds for developing rural areas, while in Bihar, the Chief Minister’s Kanya Utthan Yojana aims to empower girls by providing financial assistance. Similarly, in Gujarat, the Kisan Suryodaya Yojana facilitates farmers with the use of solar energy for irrigation, while in Karnataka, the Sakala Scheme ensures timely delivery of government services to citizens.

In Maharashtra, the Mazi Kanya Bhagyashree scheme provides financial aid to girls for higher education. Moreover, in Rajasthan, the Mukhyamantri Saksham Balika Yojana promotes education for girls belonging to economically weaker sections. Thus, each state has its own set of state-level benefits to cater to the diverse needs of the citizens.

These benefits play a crucial role in uplifting marginalized communities and creating a more equitable society.

Conclusion

In conclusion, the Indian Government’s electric car tax benefits are a brilliant move towards a cleaner, greener future. These tax incentives not only lighten the load on our wallets, but also on the environment. Investing in electric cars is not only financially savvy, but also ethically responsible.

So let’s charge up our batteries, hit the road and make a positive impact on the planet, one kilometer at a time.”

FAQs

What are the tax benefits of owning an electric car in India?

Owners of electric cars can avail tax benefits such as lower GST rate of 5%, exemption from road tax and registration fee, and income tax deductions under Section 80EEB up to Rs. 1.5 lakhs.

Are there any subsidies available for purchasing an electric car in India?

Yes, the Indian government offers subsidies under the FAME-II scheme to encourage the adoption of electric vehicles. The subsidy amount varies depending on the type of vehicle and battery capacity.

Can individuals claim tax benefits for installing electric vehicle charging stations at their home?

Yes, individuals can claim income tax deductions up to Rs. 1.5 lakhs for installing electric vehicle charging stations at their home or workplace under Section 80EEB.

What are the other benefits of owning an electric car in India besides tax incentives?

Other benefits of owning an electric car in India include lower running costs, reduced carbon footprint, and access to priority lanes and free parking in some cities.