Electric Car Tax Benefits India: Maximize Your Savings!

Electric cars are becoming more popular in India. They are good for the environment. They help reduce air pollution. Many people want to know about electric car tax benefits. This article will explain those benefits.

What Are Electric Cars?

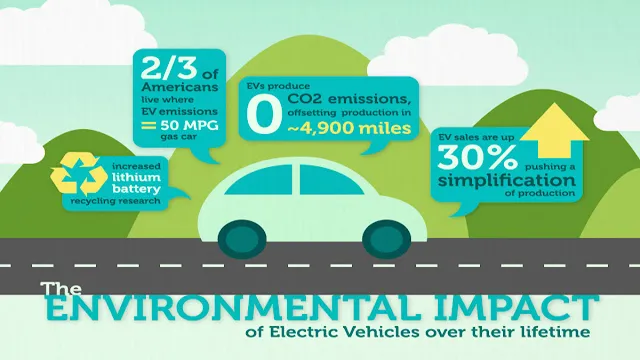

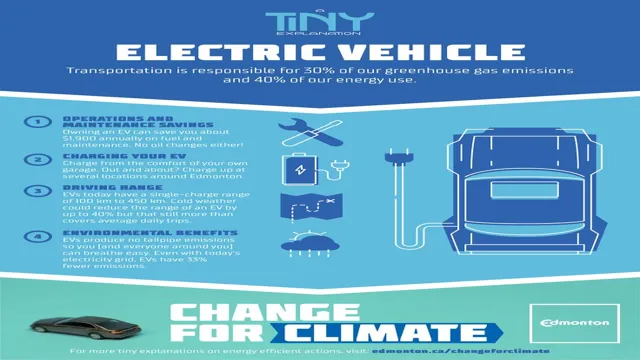

Electric cars use electricity as fuel. They run on batteries. They do not use petrol or diesel. This means they do not produce harmful gases. Electric cars are quiet and smooth to drive. They also have fewer moving parts. This means less maintenance is needed.

Why Choose Electric Cars?

There are many reasons to choose electric cars.

- They are better for the environment.

- They save money on fuel costs.

- They have low maintenance costs.

- They offer a quiet driving experience.

Many people are switching to electric cars. The Indian government supports this change. They want to reduce pollution in cities. They also want to save energy.

Tax Benefits for Electric Cars

The Indian government provides tax benefits for electric cars. These benefits help people buy electric vehicles. Let’s look at some of these tax benefits.

1. Income Tax Benefits

People can claim tax deductions. This is for buying electric vehicles. Under Section 80EEB of the Income Tax Act, you can claim up to ₹1.5 lakh. This is for interest paid on loans taken to buy electric cars. This is a big help for many buyers.

2. Gst Reduction

The Goods and Services Tax (GST) for electric cars is lower. It is set at 5%. This is lower than the tax on petrol and diesel cars. Lower GST makes electric cars more affordable. This encourages more people to buy them.

3. State-level Incentives

Many states in India offer additional benefits. These can include:

- Subsidies on electric vehicle purchases.

- Tax exemptions.

- Free parking in some areas.

Each state has its own rules. It is important to check your state’s policies. This can help you save more money.

How to Avail of Tax Benefits

Here are some steps to avail of tax benefits for electric cars:

- Buy an electric vehicle from a registered dealer.

- Take a loan if needed. Keep the loan documents safe.

- Claim deductions while filing your income tax return.

- Check your state’s incentives. Apply for subsidies if available.

Following these steps can help you save money.

Additional Benefits of Electric Cars

Besides tax benefits, there are other advantages. These include:

- Less noise pollution.

- Better air quality.

- Government incentives for charging stations.

These benefits make electric cars a good choice for many people.

Challenges of Electric Cars

Though electric cars have many benefits, there are challenges. Some of these challenges include:

- Limited charging stations in some areas.

- Higher upfront costs compared to petrol cars.

- Range anxiety. This means worrying about battery life.

However, the government is working to solve these issues. More charging stations are being built. This will make owning an electric car easier.

Frequently Asked Questions

What Are The Tax Benefits For Electric Cars In India?

Electric cars in India enjoy various tax benefits, including reduced GST rates and exemptions on road tax.

How Much Gst Do Electric Vehicles Attract In India?

Electric vehicles attract a GST rate of 5%, which is lower than that for conventional cars.

Can I Get A Subsidy For Buying An Electric Car?

Yes, the Indian government offers subsidies under the FAME India scheme for electric vehicle purchases.

What Is The Fame India Scheme?

FAME stands for Faster Adoption and Manufacturing of Electric Vehicles. It supports electric vehicle buyers with financial incentives.

Conclusion

In conclusion, electric cars provide many benefits in India. The tax benefits make them more affordable. They help reduce pollution and save money. As more people buy electric cars, the environment will improve. It is a smart choice for the future.

Remember to check the latest rules. Tax benefits may change over time. Always stay updated to take advantage of these benefits.

Choosing an electric car is not just a choice. It is a step towards a cleaner and greener future.