Saving Green While Going Green: Understanding Electric Car Tax Benefits in Ireland

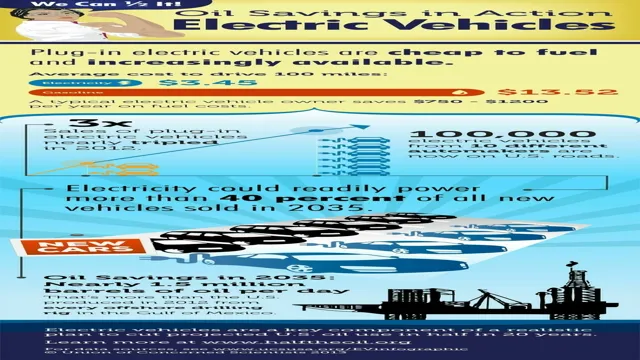

Electric cars have gained increasing popularity in recent years, as people become increasingly aware of their impact on the environment. There are many reasons why people are making the switch to electric cars, from lower emissions to reduced fuel costs. In addition to these benefits, there are also tax incentives in place for those who drive electric cars in Ireland.

This article will explore the specifics of these incentives and how they can help you save money on your electric car purchase. Whether you’re already driving an electric car or considering making the switch, read on to learn more about the tax benefits available to you.

Overview of Electric Car Tax Benefits

Electric car tax benefits in Ireland can provide a number of financial incentives for those thinking about purchasing an electric vehicle. These incentives include VRT relief of up to €5,000, reduced annual road tax, and grants of up to €5,000 for purchases of new electric cars. The government has also introduced the Accelerated Capital Allowance scheme, which allows businesses to claim tax relief on the full cost of an electric vehicle in the first year of ownership.

This can result in a significant reduction in corporate tax bills. Additionally, electric car owners in Ireland are exempt from paying tolls on certain routes and can avail of free parking in some cities. Taking advantage of these tax incentives not only saves money for car owners, but it also supports Ireland’s goal to reduce carbon emissions and move towards a more sustainable future.

Lower VRT and Motor Tax

Electric car tax benefits Electric cars offer a range of tax benefits that make them increasingly popular among environmentally-conscious drivers. These benefits include lower Vehicle Registration Tax (VRT) and Motor Tax costs. VRT on Electric Vehicles is based on their CO2 emissions, which, in the case of electric cars, are significantly lower than their gasoline-powered counterparts.

This means that EV owners receive a substantial reduction in VRT costs and further savings on Motor Tax. In addition to these direct financial savings, electric cars are also exempt from toll road fees and enjoy free parking in many cities. This makes owning an electric car an attractive option for both your wallet and the planet!

SEAI Grants for EVs

Electric Car Tax Benefits If you’re considering buying an electric vehicle (EV), there are several tax benefits that you should be aware of. One of the most significant benefits is the SEAI grant, which can provide up to €5,000 towards the cost of a new EV. This grant is available to both individuals and businesses, and it can be a significant incentive to switch to an electric car.

Additionally, electric vehicles are exempt from Vehicle Registration Tax (VRT), which can save you thousands of euros. Moreover, electric cars are also eligible for reduced motor tax rates, which can lead to substantial savings over the lifetime of the vehicle. Overall, these tax benefits can make an electric car much more affordable than you might think, and they are a significant motivator for people considering making the switch from petrol or diesel vehicles.

Business Electric Car Tax Benefits

If you’re a business owner in Ireland, investing in an electric car comes with many tax benefits. For one, businesses can claim 100% of the cost of an electric car against their profits in the year of purchase through the Accelerated Capital Allowance Scheme. Additionally, electric cars are exempt from Vehicle Registration Tax and motor tax, which can save businesses thousands of euros each year.

Finally, businesses that provide electric cars for their employees to use for work purposes can do so tax-free, as the cars are considered a benefit-in-kind. This not only benefits the environment but also helps lower costs for businesses. So, if you’re considering an electric car for your business, take advantage of these tax benefits and make the switch today.

Accelerated Capital Allowance

If you are a business owner, you may want to consider investing in electric cars. Apart from being environmentally friendly, electric cars come with tax benefits. One of the greatest tax benefits for businesses is the Accelerated Capital Allowance (ACA), which is a tax incentive given to businesses that invest in energy-efficient equipment.

By purchasing an electric car, you can qualify for ACA, which allows you to write off the full value of the car against your taxable profits in one tax year. This can help to reduce your tax bill and make your business more profitable in the long run. In addition, electric cars also have lower maintenance costs and can help your business to reduce its carbon footprint.

So, if you want to save money on taxes and help the environment, investing in an electric car might be a smart move for your business.

Employer Incentives

As an employer, you may be wondering how you can take advantage of the many incentives out there for using electric cars in your business operations. One significant benefit is through tax credits, which can help reduce your overall tax burden while promoting environmentally-friendly practices. Depending on the type of electric vehicle you purchase, you may be eligible for a credit of up to $7,500 through the federal government’s EV tax credit program.

Some states may also offer their own tax credits, which can further lower your costs and save you more money in the long run. Additionally, by using electric vehicles, you can also attract environmentally-conscious customers and improve your brand image, which can lead to increased revenues and long-term success. So why not make the switch to electric cars today and take advantage of these fantastic benefits?

Motor Tax Exemption for Business Use

As businesses increasingly try to reduce their environmental impact, electric cars are becoming more popular. Using an electric car for business use can come with a range of benefits, including motor tax exemption. Switching to an electric car can result in significant savings on motor tax, and the difference can be quite substantial over time, especially if you have a few cars in your company fleet.

This exemption applies not just to electric cars, but also hybrids and plug-in hybrids with low CO2 emissions. Apart from lower tax rates, electric cars can also help your business save a lot of money in fuel costs and maintenance expenses. With increasing government incentives and tax breaks, it’s becoming easier for businesses to switch to electric vehicles.

So, why not consider it as a way to reduce your carbon footprint and save money at the same time?

Individual Electric Car Tax Benefits

If you’re considering purchasing an electric car in Ireland, you may be glad to know that there are some great tax benefits available to you. One of the main benefits is the Vehicle Registration Tax (VRT) relief, which sees electric car buyers receive up to €5,000 in relief. This is a significant saving that can help to offset the higher initial cost of purchasing an electric vehicle.

There are also annual tax savings to be made, as electric cars emit zero or lower levels of harmful emissions compared to traditional combustion engines. Plus, electric car owners can enjoy a lower rate of motor tax and are often exempt from toll charges and parking fees. These incentives are designed to encourage more people to switch to electric cars and help reduce Ireland’s carbon footprint.

Overall, the tax benefits available for electric car buyers make the switch to electric very attractive and more accessible.

Home Charging Installation Grant

If you’ve recently purchased an electric car, congratulations! You’re not only helping the environment, but you can also take advantage of several tax benefits. One such benefit is the Home Charging Installation Grant, which provides up to 75% of the cost of installing a home charging point, up to a maximum of £350. This grant can help make owning an electric car more affordable, as charging at home is typically cheaper than charging at public charging stations.

Additionally, there are no gas taxes to pay for electric cars, and you may be eligible for a federal tax credit of up to $7,500 depending on the make and model of your electric car. It’s important to consult with a tax professional to see which benefits you may qualify for and how to properly claim them. Overall, owning an electric car not only helps the environment but can also provide tax benefits that make them a financially savvy choice for eco-conscious drivers.

Electric Vehicle Toll Incentive

If you’re driving an electric car, you might be eligible for some tax benefits that make using your vehicle on toll roads much cheaper. These benefits differ depending on the state you’re in, but typically they involve either reduced toll fees or entirely free access to certain toll roads. For example, in California, electric vehicle drivers are eligible for discounts on state toll roads and bridges.

In Florida, electric vehicles can be registered to receive discounts of up to 50% on certain toll roads. Additionally, many states offer tax credits for the purchase or lease of an electric vehicle. These benefits can save drivers a significant amount of money, which can help offset the overall higher cost of electric vehicles compared to gas-powered cars.

So, if you’re considering buying an electric car, be sure to look into the potential tax benefits in your state to see if they can help make your decision easier.

Conclusion

In conclusion, opting for an electric car in Ireland not only helps the environment but also provides some amazing tax benefits. You know what they say: “Drive electric, save electric (money that is). So, why not upgrade your ride and save some cash while doing your part for the planet?”

FAQs

What are the tax benefits of owning an electric car in Ireland?

The Irish government provides various tax incentives for owning an electric car, including exemption from Vehicle Registration Tax (VRT) and the Reduced Motor Tax rate of €120 per year.

Is there a limit to the amount of tax relief I can claim for purchasing an electric car in Ireland?

Yes, the maximum amount of tax relief you can claim for purchasing a new electric car in Ireland is €5,000.

Are there any grants available for installing EV charging points at my home or workplace in Ireland?

Yes, the Electric Vehicle Home Charger Grant and the Electric Vehicle Workplace Charger Grant offer financial assistance to support the installation of EV charging points.

Can I claim the SEAI grant and the electric car tax incentives simultaneously in Ireland?

Yes, you can claim the SEAI grant and the electric car tax incentives simultaneously in Ireland, as they are two separate schemes that have different requirements and applications.