Electric Car Tax Credit 2026 What You Need to Know Now

Featured image for electric car tax credit 2026

Image source: i.ytimg.com

The 2026 electric car tax credit offers up to $7,500 in savings, but new eligibility rules mean not all EVs qualify—act now to maximize your benefit. Starting in 2026, stricter battery and assembly requirements will limit which models qualify, so researching compliant vehicles early is crucial. Stay ahead of the changes to lock in savings before updated IRS guidelines take effect.

Key Takeaways

- Check eligibility early: Confirm if your income and vehicle qualify for the 2026 tax credit.

- New income limits apply: Adjusted gross income must fall under IRS thresholds to claim the credit.

- Verify battery requirements: Only EVs with batteries meeting 2026 sourcing rules qualify.

- Claim at purchase or filing: Decide whether to transfer credit to dealer or claim it yourself.

- Stay updated on state incentives: Combine federal credit with local rebates for maximum savings.

- Act before deadlines: Some 2026 rules phase in—timing affects credit value.

📑 Table of Contents

- The Future of Electric Car Tax Credits: What 2026 Holds

- How the Electric Car Tax Credit Works in 2026

- Eligibility Requirements: What You Must Know

- Battery and Supply Chain Requirements: The New Rules

- How to Maximize Your Credit: Smart Strategies for Buyers

- State and Local Incentives: Stacking Your Savings

- Conclusion: Act Now to Maximize Your 2026 EV Savings

The Future of Electric Car Tax Credits: What 2026 Holds

The electric vehicle (EV) revolution is accelerating at a pace few could have predicted just a decade ago. With governments worldwide pushing for carbon neutrality and automakers investing billions into EV development, the transition from gas-powered to electric cars is no longer a question of *if*—but *when*. At the heart of this transformation lies a critical financial incentive: the electric car tax credit 2026. As we approach the middle of the decade, understanding how this credit will evolve is essential for consumers, businesses, and policymakers alike.

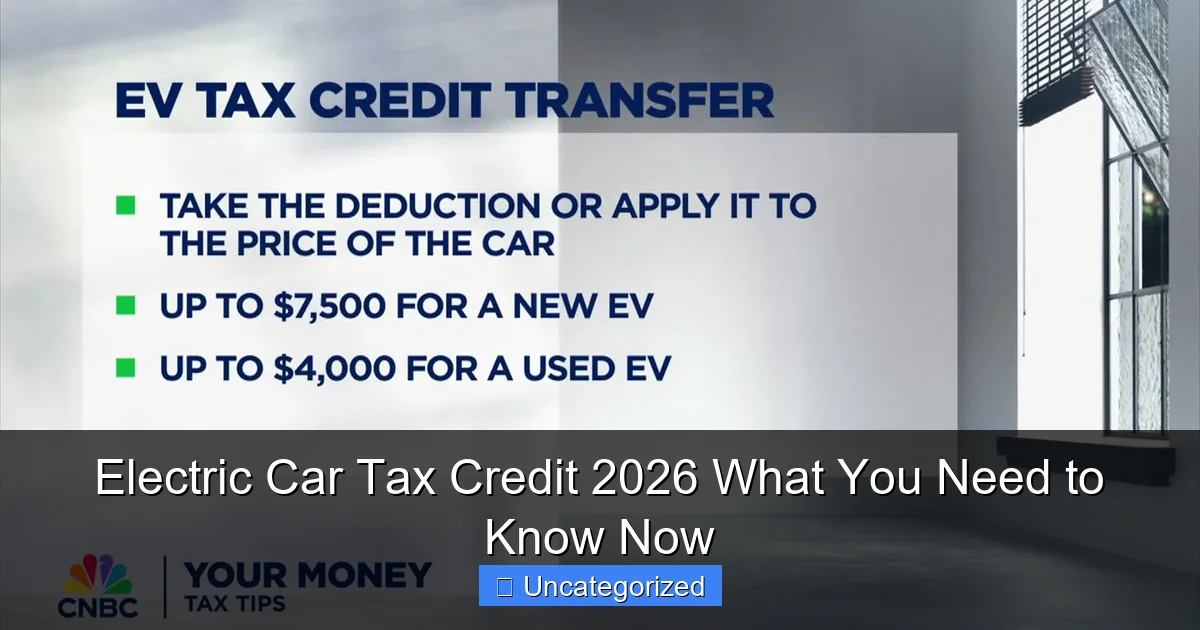

Originally introduced under the Inflation Reduction Act (IRA) of 2022, the federal EV tax credit was designed to make electric vehicles more accessible by offering up to $7,500 for new EVs and $4,000 for used EVs. But the rules are changing—drastically. By 2026, the landscape of EV incentives will look vastly different due to new eligibility requirements, sourcing mandates, and a shift toward domestic manufacturing and supply chains. Whether you’re a first-time EV buyer, a fleet operator, or simply curious about the future of sustainable transportation, knowing what to expect from the electric car tax credit 2026 can mean the difference between a smooth purchase and a costly surprise. This guide breaks down everything you need to know—now—to make informed decisions before the rules tighten.

How the Electric Car Tax Credit Works in 2026

By 2026, the federal EV tax credit will no longer be a simple, flat $7,500 rebate for qualifying new vehicles. Instead, it will operate as a two-tiered system, where the full credit depends on meeting specific criteria related to battery component sourcing and critical mineral extraction. These changes are part of the Biden administration’s broader strategy to reduce U.S. dependence on foreign supply chains and promote domestic EV manufacturing.

Visual guide about electric car tax credit 2026

Image source: image.cnbcfm.com

Two-Part Credit Structure: $3,750 Each

Starting in 2026, the maximum $7,500 credit will be split into two equal $3,750 components:

- Battery Component Credit ($3,750): Awarded if at least 50% of the value of the battery’s components (e.g., cells, casings, separators) are manufactured or assembled in North America.

- Critical Minerals Credit ($3,750): Awarded if at least 40% of the value of the battery’s critical minerals (like lithium, cobalt, nickel, and graphite) are extracted or processed in the U.S. or a country with which the U.S. has a free trade agreement (FTA).

Crucially, both conditions must be met to receive the full $7,500. If only one is satisfied, the buyer receives just $3,750. If neither is met, the credit is $0.

Used EV Tax Credit: $4,000 with Income Limits

The used EV tax credit remains at $4,000, but with stricter rules by 2026:

- The vehicle must be at least two years old.

- The purchase price cannot exceed $25,000.

- The buyer must meet income thresholds: $75,000 (single), $112,500 (head of household), or $150,000 (joint filers).

- The credit is non-refundable and can only be claimed once per vehicle.

Example: A buyer purchasing a 2023 Tesla Model 3 for $24,000 in 2026 could claim the $4,000 credit if their income is below the limit. However, if the same car was sold for $26,000, the credit would be ineligible—even if all other conditions are met.

Lease Credit: New Option for Renters and Fleets

A significant change in 2026 is the introduction of a lease tax credit. Businesses and consumers leasing qualifying EVs can now transfer the full $7,500 credit to the leasing company, which then passes the savings to the lessee via lower monthly payments. This is a game-changer for those who don’t have sufficient tax liability to claim the credit directly.

Tip: When leasing an EV in 2026, ask the dealer or leasing company whether the vehicle qualifies for the credit and how the savings will be applied. Not all leased EVs will meet the battery or mineral sourcing requirements.

Eligibility Requirements: What You Must Know

While the core concept of the EV tax credit remains, the eligibility criteria have become far more complex by 2026. Gone are the days of simply checking a vehicle’s EPA range or MSRP. Now, buyers must scrutinize battery origin, automaker compliance, and their own tax situation.

Vehicle Eligibility: MSRP and Battery Sourcing

To qualify for the credit, new EVs must meet both price and sourcing benchmarks:

- MSRP Caps: $55,000 for sedans, $80,000 for SUVs, trucks, and vans.

- Final Assembly: The vehicle must be assembled in North America.

- Battery Component Threshold: 50% North American-made components by value (increasing to 60% in 2027).

- Critical Minerals Threshold: 40% from U.S. or FTA countries (rising to 50% in 2027, 60% in 2028).

Example: The 2026 Ford F-150 Lightning (assembled in Michigan) may qualify if its battery pack contains at least 50% North American components and 40% critical minerals from the U.S. or allies. However, a similarly priced EV from a foreign automaker with batteries sourced from China may not qualify—even if it’s assembled in the U.S.

Buyer Eligibility: Income and Tax Liability

Even if the vehicle qualifies, the buyer must meet income and tax requirements:

- Income Limits (New EVs): $150,000 (single), $225,000 (head of household), $300,000 (joint filers).

- Tax Liability: The credit is non-refundable. If your tax bill is $5,000, you can only claim up to $5,000—even if you’re entitled to $7,500. Unused credits do not roll over to future years.

Tip: If you’re close to the income limit, consider timing your purchase. For example, if you expect a lower income year in 2026 due to retirement or reduced work hours, that may be the ideal time to buy an EV.

Automaker Compliance: The Role of Manufacturers

Automakers must submit detailed reports to the IRS certifying their vehicles’ compliance with sourcing rules. The IRS publishes a list of eligible vehicles annually. As of early 2026, only about 30% of new EVs on the market meet both battery and mineral thresholds.

Action Step: Always check the IRS official list before purchasing. Don’t rely solely on dealership claims—some may not be up to date.

Battery and Supply Chain Requirements: The New Rules

The most transformative aspect of the electric car tax credit 2026 is its focus on supply chain transparency. The U.S. government is using the tax credit as a lever to reshape global EV production, pushing automakers to build domestic battery ecosystems.

Critical Minerals: From Extraction to Processing

To earn the $3,750 critical minerals credit, at least 40% of the battery’s mineral value must come from:

- The U.S.

- Countries with a U.S. free trade agreement (e.g., Canada, Mexico, South Korea, Australia).

- Recycled materials sourced from North America.

This means automakers must track the origin of every kilogram of lithium, cobalt, nickel, and manganese. For example, lithium extracted in Nevada and processed in Texas qualifies. But lithium mined in Chile and processed in China—even if shipped to the U.S.—does not.

Battery Components: Manufacturing and Assembly

The $3,750 battery component credit requires 50% of the battery’s value to be made in North America. This includes:

- Cathodes and anodes

- Electrolytes

- Battery cells and modules

- Pack assembly

Example: General Motors’ Ultium battery platform, with cell production in Ohio and Tennessee, is well-positioned to meet the 2026 standards. In contrast, some foreign brands relying on imported cells from China may struggle to qualify.

Phase-In Schedule: A Gradual Tightening

The thresholds are not static. They will increase over time:

- 2026: 50% components, 40% minerals

- 2027: 60% components, 50% minerals

- 2028: 60% components, 60% minerals

- 2029: 70% components, 70% minerals

This phase-in gives automakers time to adapt but also means that vehicles eligible in 2026 may not qualify in 2027 unless they upgrade their supply chains.

How to Maximize Your Credit: Smart Strategies for Buyers

Navigating the electric car tax credit 2026 requires planning. With so many moving parts—vehicle eligibility, income limits, tax liability, and sourcing rules—buyers who act strategically can save thousands.

1. Buy Early in the Year (If Possible)

The IRS updates the list of eligible vehicles quarterly. If a model is added in Q1 2026, buying it early ensures you lock in the credit before any rule changes or supply chain disruptions. Additionally, automakers may offer additional incentives (e.g., $1,000 rebate) for buyers who claim the federal credit, so timing matters.

2. Consider a Used EV or Lease

For buyers with low tax liability or high incomes, the used EV credit or lease credit may be more practical:

- Used EV: $4,000 off a $25,000 car = 16% discount. Ideal for budget-conscious buyers.

- Lease: Transfer the $7,500 credit to the leasing company. Monthly payments could drop by $100–$200.

Example: A family leasing a 2026 Chevrolet Equinox EV for $450/month might see payments reduced to $350/month if the credit is transferred.

3. Coordinate with Your Tax Advisor

Since the credit is non-refundable, work with a CPA or tax professional to:

- Estimate your 2026 tax liability.

- Determine if you can claim the full $7,500 or only a portion.

- Explore strategies like tax-loss harvesting or retirement contributions to increase tax liability.

4. Research Battery Origin Before Buying

Ask the dealer: “Where was the battery pack assembled? What percentage of the critical minerals come from the U.S. or FTA countries?” Reputable dealers should provide a Vehicle Eligibility Statement from the manufacturer.

Tip: Use third-party tools like PlugStar or Energy.gov’s credit checker to verify eligibility.

5. Look Beyond the Federal Credit

Many states offer additional EV incentives. For example:

- California: Up to $7,500 Clean Vehicle Rebate (CVR)

- New York: $2,000 Drive Clean Rebate

- Colorado: $5,000 tax credit for new EVs

Stacking state and federal credits can reduce the effective price of an EV by $10,000 or more.

State and Local Incentives: Stacking Your Savings

While the electric car tax credit 2026 is federal, state and local programs can dramatically increase your savings. These incentives vary widely, so researching your region is essential.

State-Level Tax Credits and Rebates

As of 2026, over 20 states offer direct EV incentives. Here’s a snapshot of the most generous:

| State | Incentive Type | Amount | Eligibility Notes |

|---|---|---|---|

| California | Rebate (CVR) | $7,500 (new), $2,000 (used) | Income limits apply. Must be registered in CA. |

| New York | Rebate (Drive Clean) | $2,000 | No income limits. Applies to new EVs only. |

| Colorado | Tax Credit | $5,000 (new), $2,500 (used) | Non-refundable. Must be claimed on state return. |

| Massachusetts | Rebate (MOR-EV) | $3,500 | MSRP cap of $55,000. Income limits for full rebate. |

| Maryland | Tax Credit | $3,000 | Must be purchased or leased in MD. |

Local Incentives: Charging and HOV Access

Beyond cash rebates, many cities and counties offer:

- Free or discounted charging: Some utilities offer $500–$1,000 toward home charger installation.

- HOV lane access: In states like California and Washington, EVs can use carpool lanes regardless of occupancy.

- Reduced registration fees: Oregon waives registration fees for EVs.

Utility Programs: Hidden Savings

Many electric utilities partner with automakers to offer additional incentives. For example:

- Pacific Gas & Electric (PG&E): $1,000 rebate for new EV purchases.

- Con Edison (NYC): $250–$500 for home charger installation.

Pro Tip: Contact your local utility provider before buying. These programs are often underutilized but can add up.

Conclusion: Act Now to Maximize Your 2026 EV Savings

The electric car tax credit 2026 is more than just a financial incentive—it’s a catalyst for a cleaner, more self-reliant transportation future. But it’s also more complex than ever. With split credits, strict sourcing rules, income limits, and a non-refundable structure, success requires preparation, research, and timing.

To recap, here’s what you need to do now:

- Check vehicle eligibility using the IRS list and third-party tools.

- Assess your tax liability and income to determine credit usability.

- Explore leasing or used EVs if you can’t claim the full credit.

- Stack federal, state, and local incentives for maximum savings.

- Consult a tax professional to optimize your strategy.

The EV revolution is here, and the financial landscape is shifting rapidly. By understanding the electric car tax credit 2026 and acting proactively, you can drive into the future with confidence—and keep more money in your pocket. Don’t wait until the last minute. The best deals and the most qualifying vehicles may disappear as automakers adjust to the new rules. The time to plan is now.

Frequently Asked Questions

What is the Electric Car Tax Credit 2026 amount?

The 2026 electric car tax credit offers up to $7,500 for new EV purchases and $4,000 for used EVs, depending on income and vehicle eligibility. These amounts may phase out based on manufacturer sales caps or changes in federal policy.

How do I qualify for the electric car tax credit in 2026?

To qualify, your modified adjusted gross income (AGI) must fall below IRS limits, and the EV must meet battery and assembly requirements under the Inflation Reduction Act. Always verify the specific model’s eligibility with the IRS or a tax professional.

Can I claim the 2026 EV tax credit if I lease a car?

No, leasing doesn’t qualify for the personal electric car tax credit, but the leasing company may pass on savings through lower monthly payments. The credit applies only to purchases or financed vehicles.

Does the electric car tax credit 2026 apply to plug-in hybrids?

Yes, if the plug-in hybrid meets the battery capacity (≥7 kWh) and final assembly requirements set by the IRS for 2026. Check the vehicle’s certification before purchasing.

What if I buy an EV in late 2025—can I claim the 2026 credit?

No, the tax credit applies only to vehicles purchased and placed in service during the 2026 tax year. Purchases in 2025 follow the 2025 rules, even if delivery occurs in early 2026.

How does the 2026 EV tax credit affect state incentives?

The federal electric car tax credit is separate from state or local rebates, so you may qualify for both. Some states stack incentives, but others adjust eligibility based on federal credit receipt.