Revving Up Your Investment Portfolio: 10 Electric Car Technology Stocks to Watch in 2021

Looking to invest in the future? Consider electric car stocks. As the world moves closer and closer to a carbon-neutral future, electric cars are becoming more and more popular. This means that investing in electric car companies could be a smart move for your portfolio.

But which electric car stocks should you invest in? With the industry rapidly growing, there are plenty of options to choose from. Some popular choices include Tesla, NIO, and General Motors. As you consider investing in these companies, it’s important to remember that there is always a level of risk involved in any investment.

However, many experts believe that the electric car industry is set to boom in the coming years, which could lead to significant returns for investors. In addition to the potential financial benefits of investing in electric car stocks, there is also a sense of satisfaction that comes with investing in a more sustainable future. By supporting companies that are working to reduce carbon emissions and promote clean energy, you can feel good about your investment choices.

So, whether you’re a seasoned investor or just starting out, consider electric car stocks as a smart investment choice for the future. With the industry on the rise and a growing demand for sustainable solutions, now could be the perfect time to get in on the action.

Why Invest in Electric Car Technology?

Electric car technology stocks are rapidly gaining popularity among investors due to the increasing demand for clean energy and sustainable transport. One of the primary reasons to invest in electric car technology is the global shift towards reducing carbon emissions to combat climate change. The adoption of electric cars is expected to increase in the coming years, leading to massive growth opportunities for companies producing electric vehicles, batteries, and charging infrastructure.

Moreover, electric cars are becoming more affordable and efficient, making them a practical choice for consumers. As a result, electric car technology stocks have the potential to provide high returns for investors who are conscious of sustainability and looking to join in the green energy revolution. Whether you’re a seasoned investor or just starting, electric car technology stocks can be an excellent addition to your portfolio.

Rising Demand for Electric Vehicles

Investing in electric car technology has become more necessary than ever before due to the rising demand for electric vehicles. People understand that gasoline-powered cars contribute to air pollution and climate change, which is why many are opting for environmentally friendly electric cars. The automobile industry has taken notice of this shift in consumer behavior and is heavily investing in electric car technology to meet the new demands.

With these investments, electric car technology is improving rapidly as companies compete to produce the best electric car. Switching to electric cars has many advantages, including reduced carbon emissions, lower fuel costs, and decreased maintenance fees. Investing in electric car technology now can help companies stay ahead of the curve and secure their place in the future automobile market.

Government Support and Incentives

Investing in electric car technology is a wise decision as it not only supports the global shift towards sustainable transportation, but also guarantees a promising financial return. Governments worldwide are providing support and incentives to encourage people to switch to electric vehicles (EVs). This includes tax credits, subsidies, and exemptions from taxes and other charges.

For instance, in the US, EV buyers can receive federal tax credits worth up to $7,500, while in Norway, EV owners enjoy incentives such as tax exemptions, free public charging, and reduced tolls. By investing in the development of EV technology, automakers can benefit from these supportive policies, and also gain a competitive advantage in the market by providing customers with eco-friendly options. Moreover, as the demand for EVs increases, the costs of production are expected to decrease, further enhancing the attractiveness of these vehicles.

In summary, investing in electric car technology is not just an ethical choice, but also a smart business move that promises long-term growth and profitability.

Growing Concerns over Climate Change

With growing concerns over climate change, investing in electric car technology is becoming more important than ever. As we learn more about the devastating effects of traditional gasoline-powered vehicles on the environment, many people are turning to electric cars as a more sustainable alternative. By investing in electric car technology, we can help reduce global carbon emissions and lessen our impact on the planet.

Not only is this important for the environment, but it’s also a smart financial choice. As technology advances and electric cars become more popular, investing in this field has the potential to yield high returns. Whether you’re an environmentally conscious consumer or a savvy investor, electric car technology is definitely worth considering.

Top Electric Car Technology Stocks to Watch

If you’re interested in investing in the electric car industry, then electric car technology stocks are a great place to start. There are several companies that are leading the charge (pun intended) in the development of electric car technology, and investing in them could prove to be profitable in the long run. One such company is Tesla, which is a clear leader in the electric car industry and has made significant advancements in battery technology.

Another company to keep an eye on is NIO, which is a Chinese electric vehicle maker. NIO recently announced that it would be launching a new battery swapping service, which could be a game changer for the industry. Other companies that are worth considering include BYD Company Limited, which is a Chinese battery and electric vehicle manufacturer, and Plug Power, which provides hydrogen fuel cell solutions for electric cars.

Investing in electric car technology stocks can be a smart move for those who are interested in the future of the automotive industry and the potential of clean energy.

Tesla (TSLA)

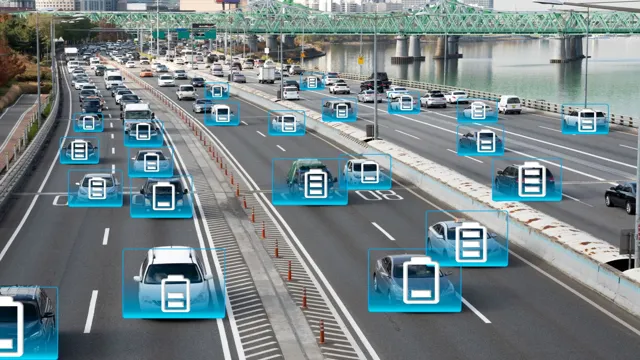

Tesla (TSLA) Are you interested in investing in electric car technology stocks? Look no further than Tesla (TSLA). Tesla has been the leader in electric car technology for years, and their technology continues to advance. Not only do their cars have impressive range, but they also have cutting-edge features like autopilot and self-driving capabilities.

Tesla’s CEO, Elon Musk, is constantly pushing the boundaries of what’s possible, and their success reflects that. Of course, investing in any stock can be risky, so it’s always important to do your research and weigh the potential risks against the potential rewards. But if you’re looking for a solid option in the electric car technology space, Tesla (TSLA) is definitely a stock to watch.

NIO Inc. (NIO)

If you’re interested in investing in electric car technology, NIO Inc. (NIO) is definitely a stock worth watching. Based in China, NIO is an electric vehicle manufacturer that specializes in premium electric SUVs.

In recent years, the company has gained a lot of attention due to its innovative technology and aggressive growth strategy. NIO’s electric vehicles come with advanced features like autonomous driving, battery-swapping technology, and intelligent connectivity solutions. This has helped the company establish a loyal customer base and attract interest from investors.

In fact, NIO’s stock has increased significantly over the past year, with some analysts predicting even more growth in the future. So if you’re looking to invest in electric car technology, NIO could be a great choice.

Ford Motor Company (F)

Ford Motor Company (F) If you’re looking to invest in electric car technology, then Ford Motor Company (F) is definitely one to watch. In recent years, Ford has made significant strides towards developing more sustainable and environmentally-friendly vehicles, with a focus on electric and hybrid technologies. Their Mustang Mach-E, for example, is a sleek and powerful electric SUV that’s been generating a lot of buzz among car enthusiasts.

Additionally, Ford has announced plans to release at least 16 fully electric vehicles by 2022, which would make them one of the biggest players in the industry. With their strong reputation and a solid commitment to innovation, it’s no wonder that investors are starting to take notice of Ford’s potential in the electric car market. So if you’re keeping an eye out for top electric car technology stocks, Ford should definitely be on your radar.

General Motors Company (GM)

General Motors Company (GM), one of the world’s leading automakers, is driving the electric car revolution with its cutting-edge electric vehicles (EVs). As consumers become increasingly environmentally conscious and governments worldwide push for lower carbon emissions, EV technology is expected to revolutionize the auto industry in the coming years. Investing in electric car technology stocks can be a wise move for those looking to capitalize on this trend.

In particular, stocks like Tesla, NIO, and General Motors are among the top electric car technology stocks to watch. These companies are at the forefront of the EV movement and are constantly pushing their technology to new heights. General Motors, in particular, has made a significant commitment to electrification and has plans to release 30 new EV models by 202

As the EV market advances, these stocks are poised for growth and could provide promising returns for investors.

BYD Company Limited (BYDDF)

BYD Company Limited (BYDDF) is one of the top electric car technology stocks to keep an eye on in the industry. With the growing concerns about the environment and the increasing demand for sustainable transportation, electric cars are gaining popularity globally. BYD is among the leading electric car manufacturers known for producing quality electric vehicles.

The company’s cutting-edge technology in battery manufacturing and energy storage solutions has set it apart from its competitors. BYD has also partnered with global corporations such as Toyota to expand its market reach. Investing in BYD is a smart move for anyone looking to capitalize on the electric vehicle market’s growth.

As BYD is poised to become one of the leading manufacturers in the industry, owning a stake in its stock could be a profitable decision down the line.

Analysis and Market Trends

Electric car technology stocks have been gaining traction in recent years due to the rise in demand for electric vehicles. As more people become aware of the environmental benefits of electric cars, the demand for electric car technology stocks has also increased. Many established car manufacturers are now investing heavily in the development of electric cars, and this trend is expected to continue in the coming years.

As such, investors looking to invest in the electric car technology sector could see significant growth in the future. However, like with any stock, it is important to do your research and carefully consider your investment goals and risk tolerance before investing in electric car technology stocks. With proper research, investors can position themselves to benefit from the growth potential of this exciting sector.

Battery Technology Advancements

Battery technology has come a long way in recent years, with new advancements and innovations constantly being developed. These advancements have allowed for longer battery life, faster charging times, and greater energy density, which are all significant improvements for users. Market trends are showing a growing demand for batteries that are more efficient, sustainable and cost-effective.

This demand has led to a surge in research and development in the battery technology industry, with companies competing to find new and better solutions. One of the latest trends is the use of solid-state batteries, which promise increased energy density and improved safety. With battery-powered electric vehicles becoming more popular and the demand for mobile devices continuing to grow, it’s clear that battery technology will remain a vital part of our lives for the foreseeable future.

As a result, the companies that can provide the most efficient and effective batteries will be leaders in the industry.

Charging Infrastructure Investments

Charging infrastructure investments have been rapidly increasing as electric vehicles (EVs) become more prevalent on our roads. With the shift towards a greener future, it’s essential to have adequate charging stations that offer EV owners the convenience and accessibility they need to travel long distances. The investment in charging infrastructure is also essential for EV manufacturers looking to increase their market share.

Tesla, for example, has invested heavily in their Supercharger network to attract consumers to their brand. Other car manufacturers have also started implementing their charging solutions to gain a competitive advantage. This investment in charging infrastructure has resulted in a wide range of charging options for consumers, including home charging, workplace charging, and public charging stations.

However, there is still a long way to go to meet the increasing demand for charging stations, both in urban and rural areas. As the market for EVs grows, we can expect to see continued investment in charging infrastructure, which will help to drive adoption and make EVs more accessible to everyone.

Competition from Traditional Automakers

As the world is undergoing a mobility revolution, it’s no surprise that traditional automakers are starting to compete with electric vehicle (EV) start-ups. However, the competition is not limited to just electric vehicles. The mainstream automakers have recognized the potential in the EV market, which has skyrocketed in the past few years due to increased awareness for cleaner transportation.

Several established automakers have already announced their plans to release new electric models, posing a threat to EV start-ups. For example, Ford has announced that it plans to release an electric version of one of its most successful models, the F-150. Similarly, General Motors plans to release several electric models over the next few years.

This increased competition not only signifies a shift in the automotive market but also shows how established automakers need to adapt to new market trends to stay relevant. However, it’s not just automakers that are feeling the heat of this new competition – the lithium-ion battery and charging infrastructure markets have also begun to see new competition from traditional automakers. Nevertheless, as the mobility market grows, the playing field is open for all contenders, and only time will tell how things will eventually play out.

Final Thoughts: Investing in Electric Car Technology

Investing in electric car technology stocks can be a wise decision for those looking to diversify their portfolio in an exciting new industry. As more and more people make the switch to electric vehicles, the demand for the technology that powers them will only increase. Companies like Tesla have become household names, but they are far from the only players in the market.

By investing in various electric car technology stocks, investors can gain exposure to different aspects of the industry, such as battery technology, charging infrastructure, and autonomous driving. As with any investment, it’s important to do your research and understand the risks involved. However, it’s hard to deny that electric car technology stocks have the potential for significant growth in the years to come.

Conclusion

In the world of investments and emerging technologies, electric car technology stocks are a charge towards the future. As the world increasingly prioritizes sustainability and environmentally-friendly practices, investing in electric car technology is not only a smart choice but a conscientious one. Whether it’s companies leading the way in battery technology, EVs, charging infrastructure, or other aspects of the industry, the opportunities for growth and innovation are endless.

So, for investors looking to spark up their portfolio with the hottest trends in the market, electric car technology stocks may just be the shock they need to achieve their financial goals.”

FAQs

What are some examples of electric car technology stocks?

Some examples of electric car technology stocks include Tesla (TSLA), NIO (NIO), and BYD Company (BYDDF).

How has the electric car industry impacted the stock market?

The electric car industry has significantly impacted the stock market, with stocks such as Tesla and other electric car technology companies experiencing considerable growth in recent years.

What factors should investors consider when investing in electric car technology stocks?

Factors to consider when investing in electric car technology stocks may include the company’s financial stability, management team, market demand for electric cars, and research and development efforts.

Is it a good time to invest in electric car technology stocks?

This is subjective and depends on an individual’s investment strategy and risk tolerance. However, with the continued growth and development of the electric car industry, many believe that investing in electric car technology stocks may provide long-term growth potential.