10 Tax Benefits of Owning an Electric Car in the UK: What You Need to Know!

As more and more people turn to electric cars to reduce their carbon footprint, there’s never been a better time to invest in one. However, the cost of an electric car can sometimes be a deterrent to potential buyers. Luckily, if you’re in the UK, there are a range of tax benefits that can help make an electric car a more affordable option.

These benefits include lower vehicle tax rates, exemptions from some congestion charges, and even grants to install charging points at home. In this blog, we’ll dive deeper into these tax benefits to help you understand how much you could save by going electric. So sit tight, grab a cuppa and get ready to learn all about electric car tax benefits in the UK.

Overview of Electric Car Tax Benefits

If you are considering purchasing an electric car in the UK, it may be worth taking note of the various tax benefits that come with owning one. Previously, road tax was completely free for all electric vehicles, but this has since changed for newer models. For vehicles with zero emissions (such as pure electric cars), the annual rate is now £0, while hybrid models will still have to pay a small fee.

Additionally, electric vehicle owners can take advantage of a government grant towards the installation of a charging point at their home. This grant normally covers around 75% of the total cost, up to a maximum of £350. Another benefit is that electric vehicles are exempt from the London Congestion Charge, which can save owners up to £15 per day.

While these benefits may not seem significant initially, they can add up over time and make a real difference to an electric vehicle owner’s finances. So if you’re considering making the switch to an eco-friendly mode of transport, be sure to keep these tax benefits in mind.

Government Grants and Rebates

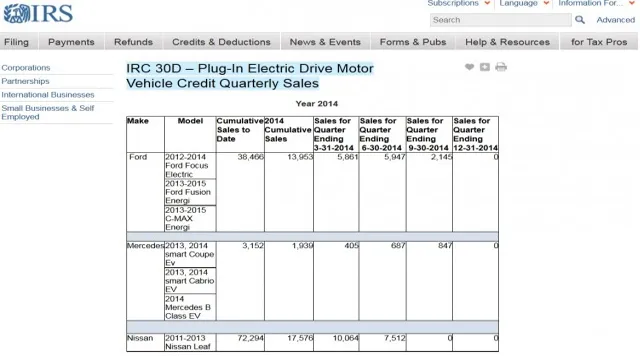

If you’re considering purchasing an electric vehicle, there are several government grants and tax benefits you may be eligible for. These incentives were put in place to encourage individuals to adopt more sustainable transportation options and reduce their carbon footprint. One of the most common tax benefits is a federal tax credit, which can be up to $7,500 depending on the make and model of your electric car.

However, it’s important to note that this credit is only available for a certain number of electric cars sold by each manufacturer, so it’s best to do your research and make sure the car you’re interested in qualifies. Additionally, some states also offer their own tax credits and rebates for electric vehicles, which can further reduce the cost of purchasing and owning an electric car. Overall, taking advantage of these incentives can make electric vehicles a more affordable and appealing option for eco-conscious drivers.

Lower Company Car Tax Rates

When it comes to buying an electric car, there are a host of tax benefits that can help reduce costs. One of the most significant advantages is the lower company car tax rates. The UK government has implemented an ambitious target of reaching net-zero carbon emissions by 2050, and in order to achieve this, they have provided tax incentives for companies and individuals to switch to electric vehicles.

This has resulted in lower company car tax rates for electric cars compared to their petrol or diesel counterparts. Such tax benefits make owning an electric car a cost-effective option and can save companies a significant amount of money. So, if you’re considering buying an electric vehicle, it’s worth exploring the available tax benefits to maximize your savings.

Exemption from Road Tax

Electric cars provide numerous benefits to their owners, one of which is the exemption from road tax. As an incentive to switch to electric vehicles, many governments around the world are offering tax benefits to encourage people to make the switch. Road tax is one such benefit that electric car owners can enjoy.

With electric vehicles, owners do not have to pay annual vehicle tax, which typically applies to petrol and diesel cars. The exemption from road tax is aimed at encouraging people to move away from fossil fuel-powered vehicles and towards cleaner, more sustainable options. In addition to road tax exemption, electric cars offer numerous benefits, such as lower fuel costs, reduced carbon emissions, and a quieter ride.

With these benefits, it’s easy to see why electric vehicles are becoming increasingly popular among eco-conscious drivers.

Financial Benefits of Owning an Electric Car

Electric car UK tax benefits are an attractive perk of owning an electric vehicle. In the UK, electric cars can save you a lot of money, as you can benefit from tax breaks such as the zero-emission vehicle (ZEV) allowances. This means that you don’t have to pay any car tax or congestion charges if you drive an electric car.

Additionally, new electric cars have the added bonus of being exempt from the expensive fuel duty, which means you can save even more money on your everyday commute. Not only that, electric cars are also more cost-efficient, as they require less maintenance than traditional cars, with fewer oil changes, brake replacements and exhaust repairs needed. As electric vehicles continue to rise in popularity, owning an electric car can not only save you money but also reduce your carbon footprint, making it a smart investment for both your wallet and the environment.

Lower Fuel Costs and Maintenance Expenses

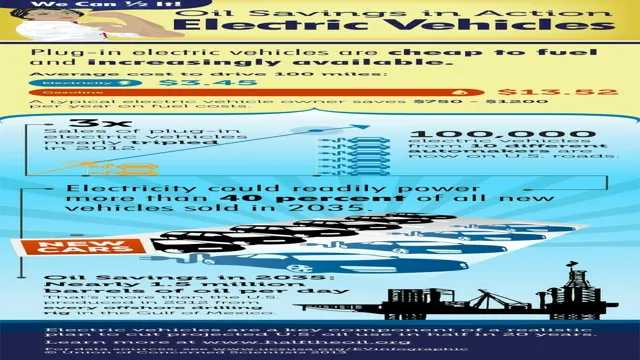

Electric car ownership is a wise financial decision due to its lower fuel costs and maintenance expenses. Unlike traditional gas-powered vehicles, electric cars don’t require gasoline to operate, which translates to huge savings in gas expenses. With the average American spending thousands of dollars a year on gas, owning an electric car can help you cut down on this expense significantly.

Additionally, electric cars are much cheaper to maintain than conventional cars, as they have fewer moving parts, do not require frequent oil changes, and have regenerative braking systems that reduce wear and tear on brake pads. You can save a lot of money on tires too, as most electric cars have energy-efficient tires that last longer than traditional tires. Additionally, owning an electric car qualifies you for tax credits, rebates, and other incentives, which can further reduce the overall cost of owning an electric car.

Overall, going electric offers incredible financial benefits that can save you a significant amount of money in the long run.

Increased Resale Value

One of the often-overlooked financial benefits of owning an electric car is the increased resale value. Compared to their gasoline-powered counterparts, electric cars tend to hold their value much better. In fact, electric cars depreciate at a slower rate, meaning you can sell your EV for a higher price after a few years of ownership.

This is because of the lower maintenance and charging costs associated with electric cars, as well as the ever-increasing demand for environmentally-friendly vehicles. Additionally, many states offer tax credits and financial incentives for owning an electric car, which can further reduce your ownership costs. So, not only will you save money on fuel and maintenance, but you’ll also enjoy a more valuable asset when it comes time to sell.

It’s a win-win situation!

Environmental Benefits of Driving an Electric Car

When it comes to driving an electric car in the UK, there are a range of tax benefits that make it an attractive option for environmentally-conscious drivers. Electric cars are zero-emission vehicles, meaning they produce no harmful pollutants or greenhouse gases. This is a significant advantage for those concerned about the environment and air quality, particularly in urban areas where air pollution can have a major impact on public health.

Additionally, electric cars are exempt from certain taxes imposed on traditional vehicles, including the congestion charge in London and certain road taxes. The UK government also offers a grant of up to £2,500 for purchasing a new electric car, further incentivizing drivers to make the switch. Overall, driving an electric car not only has a positive impact on the environment, but also provides tax benefits and financial incentives for those making the switch to a more sustainable mode of transportation.

Reduced Carbon Emissions

One of the biggest environmental benefits of driving an electric car is the reduction in carbon emissions. Traditional gasoline-powered cars emit large amounts of carbon dioxide and other harmful pollutants into the atmosphere, contributing to climate change and poor air quality. Electric cars, on the other hand, produce zero emissions while driving.

Even when accounting for the emissions generated during the production and transportation of electricity used to power electric cars, they still emit significantly less carbon than gasoline cars. Additionally, electric cars can help to reduce overall carbon emissions when charged using renewable energy sources such as solar or wind. By driving an electric car, individuals and communities can make a positive impact on the environment and help to mitigate climate change.

Improved Air Quality

One of the biggest environmental benefits of driving an electric car is improved air quality. With traditional gas-powered cars, harmful pollutants such as carbon monoxide, nitrogen oxides, and particulate matter are released into the air, contributing to smog and air pollution. However, electric cars produce zero emissions and don’t rely on fossil fuels, which means they don’t contribute to air pollution.

This is especially important for people who live in heavily populated urban areas, where air pollution can have serious health implications. By choosing to drive an electric car, you can help improve the air quality in your community and contribute to a healthier planet.

Conclusion

In conclusion, owning an electric car in the UK is more than just a smart environmental choice – it’s also a savvy financial decision. With numerous tax benefits and incentives, such as reduced road tax and company car tax, electric car owners can enjoy a little extra cash in their pockets while reducing their carbon footprint. So, not only will you be driving around in a sleek and stylish ride, but you’ll also be doing your part to help the planet and your wallet.

Talk about an electrifying win-win situation!”

FAQs

What are the tax benefits of owning an electric car in the UK?

Electric cars in the UK are exempt from paying Vehicle Excise Duty (VED), which can save drivers up to £1,000 per year. They are also eligible for a Plug-in Car Grant, which can provide a discount of up to £3,000 on the purchase price of the vehicle.

Are there any other tax benefits for electric car owners in the UK?

Yes, electric cars also benefit from lower Company Car Tax rates, which can result in significant savings for businesses that provide them to employees. Additionally, electric cars are exempt from paying the London Congestion Charge.

How can I claim the Plug-in Car Grant for my electric car in the UK?

The Plug-in Car Grant is automatically deducted from the purchase price of the vehicle by the dealership or manufacturer. You do not need to apply for it separately.

Can I claim any tax credits for installing a home charging station for my electric car in the UK?

Yes, homeowners in the UK can claim a grant of up to 75% of the cost of installing a home charging station, up to a maximum of £350. The grant is administered by the Office for Low Emission Vehicles (OLEV), and you can apply for it on their website.