Revving up your savings: Exploring the advantages of electric cars for Benefit In Kind (BIK)

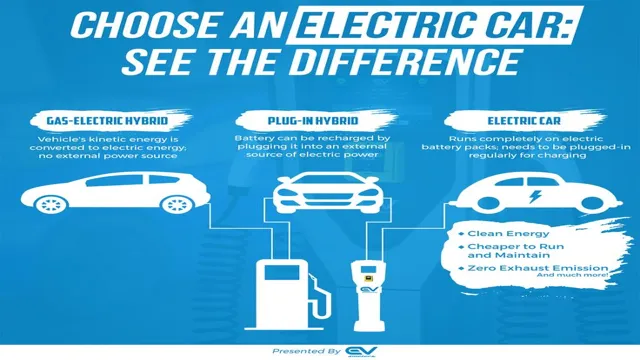

Electric cars have gained considerable attention in recent years due to their many advantages. Not only are they an eco-friendly option as they run on electricity, but they also offer significant financial benefits. One such benefit is the reduced Benefit in Kind (BIK) tax rate applicable to employees who receive them as company cars.

This incentive seeks to encourage employees to opt for electric vehicles, as they are a more sustainable mode of transportation compared to traditional petrol and diesel cars. In this blog, we’ll explore the specifics of the BIK tax relief for electric cars and how it can impact both individuals and businesses.

What is Benefit in Kind?

Electric cars have become increasingly popular in recent years due to environmental concerns and incentives for companies and individuals to reduce their carbon footprint. However, one aspect that often gets overlooked is the Benefit in Kind (BIK) tax. Put simply, BIK is a tax paid by employees who receive non-cash benefits from their employers, such as company cars or private healthcare.

With the rise of electric cars, the UK government has introduced incentives to encourage their adoption and reduce emissions, including reduced BIK rates for electric vehicles. This means that employees who receive an electric company car as a benefit will pay significantly less in tax than those with traditional petrol or diesel cars. In fact, for the 2020/2021 tax year, electric cars have a BIK rate of 0%, compared to rates of up to 37% for petrol and diesel cars.

This makes electric company cars an increasingly attractive option for both employers and employees looking to save money on taxes while also contributing to a cleaner environment.

Explanation of Benefit in Kind for Company Cars

As an employee, getting a company car may seem like a great perk, but it also comes with a Benefit in Kind (BIK) tax that you should be aware of. So, what exactly is a Benefit in Kind? Put simply, it’s a tax paid on any perks that employees receive from their employers, such as company cars. In the case of company cars, the BIK tax is calculated based on factors such as the car’s CO2 emissions, list price, and fuel type.

The higher the emissions and list price, the higher your BIK tax will be. It’s important to note that if you also use your company car for personal use, this will also be subject to BIK tax. So, while a company car may seem like a great benefit at first, it’s important to factor in any BIK tax that may apply to avoid any unexpected expenses down the line.

Benefit in Kind for Electric Cars

Electric cars benefit in kind refers to the tax liabilities a company and its employees incur when they use an electric company car or receive one as a perk. The UK government has introduced incentives to encourage more people to switch to electric vehicles and Benefit in Kind is one of these incentives. Companies are incentivized to provide electric cars to employees by charging lower rates of tax on those cars.

Currently, electric cars are charged at a rate of 1% for electric cars compared to much higher rates for petrol or diesel-run vehicles. Employees who get electric company cars also benefit greatly as it reduces their personal tax liabilities, making it easier for them to afford these vehicles and to drive more sustainably. This incentive can help change people’s attitudes towards electric cars and contribute to the success of their adoption.

Lower taxes for electric cars as Benefit in Kind

As electric cars become increasingly popular, more and more people are considering switching to them. One of the benefits of owning an electric car is the significantly lower taxes for Benefit in Kind (BIK). BIK is a tax that employees have to pay on any perks or benefits they receive from their employer, such as a company car.

However, the rate for electric cars is much lower than for traditional petrol or diesel cars. This is because the government wants to encourage people to switch to more environmentally friendly vehicles. By offering incentives such as lower BIK rates, they hope to make electric cars a more attractive option for company car users.

So, if you’re thinking about getting an electric car for work, the reduced tax rate could save you a substantial amount of money over the course of a year.

Comparison of Benefit in Kind for electric and traditional cars

Benefit in Kind, electric cars, traditional cars When it comes to Benefit in Kind for cars, there has been a lot of talk about the benefits of electric cars over traditional cars. The Benefit in Kind is essentially the tax a company pays on providing an employee with a company car. Electric cars have a lower tax rate due to their environmental benefits, which is an incentive for companies to prioritize electric cars.

This also means that employees who are provided with an electric car as a company car will pay less tax on it compared to a traditional petrol or diesel car. This is because the Benefit in Kind is based on the car’s CO2 emissions and electric cars have no emissions, meaning the tax rate is significantly lower. It’s a win-win situation where companies and employees can benefit from investing in electric cars and promoting environmentally-friendly practices.

Financial Benefits of Electric Cars

One of the biggest financial benefits of choosing an electric car is the reduced benefit in kind tax liability. Benefit in kind (BIK) is a tax paid by employees for the private use of a company car. Traditionally, BIK tax is calculated based on a vehicle’s carbon dioxide (CO2) emissions, with higher-emitting cars incurring a higher tax obligation.

However, electric cars are exempt from BIK tax for the 2020/2021 tax year, and have a reduced rate in subsequent years. This makes them a highly attractive option for those looking to save money on their tax liability. Additionally, electric cars can save drivers money on fuel costs as they cost much less per mile to run than petrol or diesel cars.

With the added benefit of reduced maintenance costs and government incentives such as grants and reduction in road taxes, choosing an electric car can be a financially savvy decision.

Lower fuel and maintenance costs

Electric cars have a number of financial benefits that make them a more attractive investment than traditional gas-powered vehicles. One of the most significant advantages of electric cars is lower fuel costs. Unlike gas-powered cars, electric vehicles run on electricity, which is significantly cheaper than gasoline.

Additionally, electric cars require less maintenance than traditional cars, since they have fewer moving parts and don’t require oil changes. This means that electric car owners can save a significant amount of money over the life of their vehicle by avoiding the high maintenance costs and fuel prices associated with traditional cars. Overall, the financial benefits of electric cars are significant, and they make a compelling case for switching to electric for drivers looking to save money and reduce their environmental impact.

So, if you’re planning to purchase a car, investing in an electric one can help save you a lot of money in the long run.

Government incentives for electric cars

The financial benefits of owning an electric car are numerous and can save you a lot of money in the long run. One of the most significant incentives for electric vehicle owners is the federal tax credit. This credit was created to encourage the purchase and use of electric vehicles and can be worth up to $7,500 depending on the make and model of your car.

Furthermore, many states also offer additional incentives such as rebates, tax credits, and reduced registration fees. Not only do these incentives help offset the initial cost of purchasing an electric vehicle, but they can also provide significant savings over the life of the car, particularly in terms of fuel and maintenance costs. For example, electric cars are much cheaper to maintain and refuel than traditional gas-powered vehicles, which means you could save thousands of dollars over the life of your car.

If you’re in the market for a new car and want to save money while also reducing your carbon footprint, it’s definitely worth considering an electric vehicle.

Environmental Benefits of Electric Cars

Electric cars benefit in kind to the environment in many ways. Firstly, they emit significantly fewer greenhouse gases than traditional internal combustion engines, reducing carbon emissions and combating climate change. In fact, a study found that electric cars emit less than half the greenhouse gases compared to traditional cars.

Secondly, they reduce local air pollution, which can have significant impacts on human health, especially in urban areas. Electric cars produce no tailpipe emissions, improving air quality and reducing the risk of respiratory and cardiovascular diseases. Finally, electric cars have the potential to reduce the dependence on fossil fuels, which are finite resources and can have significant geopolitical and economic implications.

By utilizing renewable energy sources, such as wind and solar power, electric cars have the potential to create a more sustainable and secure energy future for us all.

Reduced carbon emissions

Electric cars are an excellent way to reduce carbon emissions and promote a more environmentally friendly future. With traditional vehicles, gas-powered engines burn fossil fuels, releasing harmful greenhouse gases into the atmosphere. These gases contribute to climate change and air pollution, which is harmful to human health.

Electric cars, on the other hand, are powered by rechargeable batteries, which do not produce any exhaust emissions. By driving an electric car, you can help decrease your carbon footprint and improve air quality. This is especially important in densely populated urban areas where air pollution is a major concern.

Overall, the environmental benefits of electric cars are significant, making them an attractive option for eco-conscious drivers looking to reduce their impact on the planet. So, why not consider switching to an electric vehicle and drive towards a cleaner, greener future?

Improved air quality in cities

Electric cars bring with them a host of environmental benefits, from reduced emissions to improved air quality in cities. As electric vehicles do not run on gasoline, they produce zero tailpipe emissions, reducing harmful pollutants in the air. With traditional gas-powered cars, nitrogen oxides, volatile organic compounds, and particulate matter can all contribute to poor air quality, especially in urban areas with heavy traffic.

Electric cars offer an efficient and clean alternative to conventional cars, reducing the amount of pollution in the environment. As a result, electric cars may help to improve respiratory health and reduce the risk of cardiovascular disease, particularly among vulnerable populations such as children and the elderly. In summary, electric cars provide a more environmentally-friendly option for transportation and bring significant benefits for both individuals and communities.

Conclusion

In the world of fleet management, electric cars are a clear winner when it comes to benefits in kind – they’re environmentally friendly, cost-efficient, and offer a smooth and quiet ride. With the growing demand for sustainable transportation, it’s no surprise that electric cars are gaining popularity in the corporate world. So, if you want to reduce your carbon footprint and your tax bill, it’s time to trade in your gas-guzzler for an electric car and start recharging your benefits in kind!”

FAQs

What is the benefit in kind for electric cars?

Benefit in kind refers to the tax paid by employees for using a company car for personal use. Electric cars have a lower benefit in kind tax rate compared to petrol or diesel cars.

How is the benefit in kind tax calculated for electric cars?

The benefit in kind tax rate for electric cars is determined by the car’s list price, CO2 emissions, and electric range. The lower the CO2 emissions and the higher the electric range, the lower the tax rate.

Are there any exemptions for electric cars in benefit in kind taxation?

Yes, electric cars with zero emissions and a range of at least 130 miles are exempt from benefit in kind taxation until 2025. However, this exemption will be phased out in the following years.

How can electric cars provide cost savings for employers and employees?

Electric cars have lower running costs, reduced maintenance costs, and lower benefit in kind taxes compared to traditional petrol or diesel cars. This can provide cost savings for both employers and employees. Additionally, some local governments offer incentives for EV ownership such as free parking and charging.