Reaping the Benefits in Kind: Why Electric Cars are the Future of Driving

Looking for ways to reduce your company car tax? Switching to electric cars could be the solution you’ve been looking for. Electric cars are becoming increasingly popular among business owners due to their numerous benefits. From lower tax rates to cost savings and environmental advantages, electric cars offer a host of advantages over traditional gas-powered vehicles.

In this blog post, we’ll explore the benefits of electric cars for company car tax and how they can help businesses save money while promoting sustainability and corporate responsibility. So, let’s dive in!

Zero emission vehicle benefits

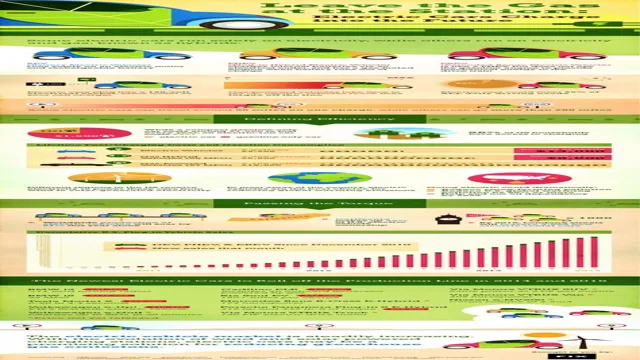

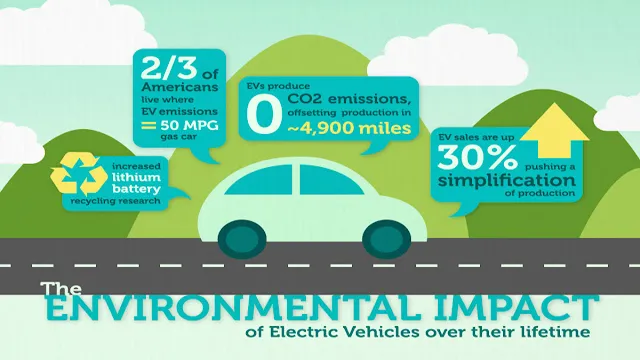

One of the biggest advantages of electric cars (benefits in kind) is their zero-emission feature, which greatly benefits the environment. Unlike traditional vehicles that release harmful gases into the air, electric cars run on electricity, which does not produce any emissions. This means that they help to improve air quality, reduce carbon dioxide emissions, and minimize the effects of climate change.

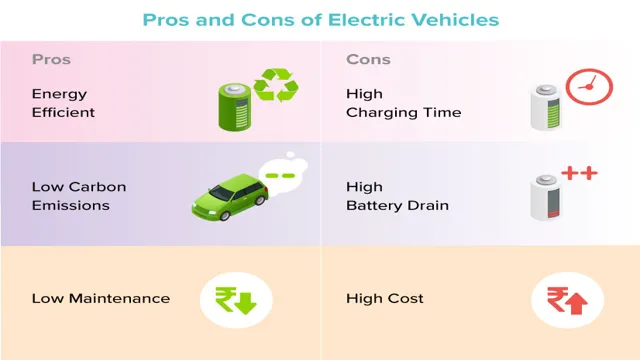

In addition, electric cars are more energy-efficient than gas-powered vehicles, which means that they use less energy to travel the same distance. This can result in significant cost savings for drivers, especially as more charging stations become available. Plus, with their quiet engines, electric cars provide a peaceful and comfortable driving experience without the noise pollution that we’ve come to expect from traditional vehicles.

All in all, electric cars are not only better for the environment but also offer a more efficient and convenient mode of transportation.

Zero company car tax and reduced fuel cost

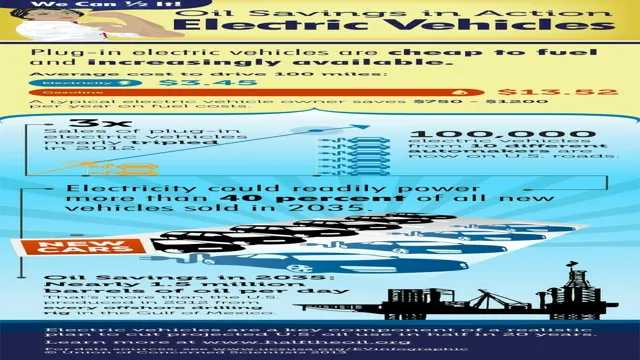

Zero emission vehicles offer a wide range of benefits for drivers. One of the most notable advantages is zero company car tax. This means that drivers who opt for electric vehicles or other low-emission cars can save on their tax bill and enjoy significant savings over time.

Additionally, zero emission vehicles have a much lower fuel cost than traditional gasoline-powered cars. This is because they can be charged at home using a regular outlet, which is often much cheaper than the cost of gasoline. Plus, by using a zero-emission vehicle, drivers are also doing their part to help reduce air pollution and combat climate change.

Overall, zero emission vehicles offer a win-win situation for drivers by providing cost savings and eco-friendly benefits. So why not consider switching to a green vehicle today?

Enhanced capital allowances

Enhanced capital allowances offer many benefits for businesses that invest in zero-emission vehicles. This is because the government incentivizes companies to become more environmentally friendly and reduce their carbon footprint by offering tax breaks. By purchasing a zero-emission vehicle, businesses can qualify for a 100% first-year allowance on the cost of the vehicle.

This means that companies can claim the full cost of the vehicle against their taxable profits in the year it was purchased, reducing their tax bill significantly. Additionally, businesses can also claim a 100% first-year allowance for charging stations and other infrastructure necessary for zero-emission vehicles. Choosing to invest in zero-emission vehicles not only benefits the environment but also provides financial incentives for companies looking to reduce their tax liability.

Lower emission vehicle benefits

If you’re considering an electric car, you may be wondering about the benefits in kind. One of the major advantages of electric cars is their lower emissions, which makes them a more eco-friendly choice. This means you can reduce your carbon footprint and contribute less to the pollution of the environment.

But the benefits don’t stop there. Electric cars are also cheaper to run than traditional petrol or diesel vehicles, as they require less maintenance and have lower fuel costs. Plus, they offer a quieter, smoother driving experience, which can be especially beneficial if you spend a lot of time on the road.

And let’s not forget about the potential tax benefits of owning an electric car. In many countries, governments offer incentives such as tax credits or grants to encourage the adoption of electric vehicles. So not only are you doing your bit for the environment, but you could also save money in the long run by choosing an electric car.

Reduced company car tax and fuel cost

Reduced company car tax and fuel cost With the emphasis on reducing carbon emissions and fostering a greener environment, many countries have implemented policies to encourage reduced car emissions. The UK remains a leader in this drive, with a particular focus on promoting lowered emission vehicles. This has led to several benefits for companies that adopt these low emission cars to their fleet.

With such vehicles, companies can enjoy reduced company car tax and lower fuel costs, which can amount to substantial savings in the long run. Not only does this help to improve a company’s bottom line, but it also demonstrates its commitment to eco-friendliness, showing that it is a responsible corporate citizen. So, whether you are looking to reduce costs for your business or do your part to conserve the environment, a fleet of low-emission cars can help you achieve both these objectives.

Lower National Insurance Contribution

Lower emission vehicles can bring benefits in multiple ways, among which is the lower national insurance contribution that drivers benefit from. As more and more people are adopting greener vehicles, the government has been incentivizing this trend by offering tax perks to drivers of low-emission cars to encourage people to make choices that are better for the planet. One such incentive is the lower National Insurance (NI) contribution, which can make a significant difference in your monthly expenses.

Companies that offer salary sacrifice schemes to employees who wish to have a low-carbon vehicle can save as much as 18% in NI contributions, as compared to traditional vehicles. Besides, individuals who have cars with C02 emissions of less than 75g/km only have to pay 1

8% on the salary sacrificed. These benefits make it an attractive option for people to switch to eco-friendlier models, with companies also opting to invest in greener fleets, to benefit from these perks. These incentives decrease the burden of the cost of low-emission vehicles, which makes them more accessible and encourages individuals to have a more sustainable lifestyle.

Improved capital allowances

Capital allowances have been improved to benefit vehicles with lower emissions. This move will promote sustainability and decrease harmful emissions, making the planet cleaner. By lowering emission vehicle benefits, businesses will be incentivized to invest in eco-friendly cars to improve their team’s mobility.

With the new capital allowance, businesses can now recover their initial investment in electric vehicles much quicker. This is great news for eco-friendly entrepreneurs looking to improve their operations as it will not only promote sustainability but also help investors save money. The government has taken a great step towards sustainable practices, and we can only hope that this will encourage more businesses to adopt greener infrastructure.

Together, we can make the planet cleaner, if only we take the right steps towards achieving these long-term goals.

Employee benefits

Electric cars benefits in kind can provide a great incentive for employees who are environmentally conscious and looking to reduce their carbon footprint. These benefits are becoming increasingly popular among companies that want to demonstrate their commitment to sustainability while also offering practical benefits to their staff. Electric cars are a great way to reduce emissions and save on fuel costs, and they also offer tax advantages that can make them an attractive option for many employees.

By offering these types of benefits, companies can attract and retain talented employees who are looking for a sustainable, forward-thinking workplace. Additionally, by promoting the use of electric cars, companies can show their customers and stakeholders that they are committed to reducing their environmental impact and contributing to a more sustainable future.

Reduced personal tax on company cars

When it comes to employee benefits, a company car can be a desirable perk. However, with this perk typically comes added personal tax on the employee. The good news is that there are ways to reduce this burden.

By choosing a low-emission company car, employees can take advantage of reduced personal tax rates, which in turn can save them money. It’s important for both employers and employees to understand the tax implications of company cars and how to make the most of tax reductions. While a company car may seem like a luxury, taking advantage of reduced personal tax rates can make it a more financially sound decision.

So, if you’re considering offering a company car as an employee benefit or about to take one, don’t overlook the tax savings that can come with a low-emission vehicle.

Wellbeing and health benefits

Employee benefits can have a positive impact on both the physical and mental wellbeing of employees, which ultimately leads to increased job satisfaction and productivity. Employers can offer a range of health and wellness benefits, such as gym memberships, mental health resources, and healthy meal options. These benefits can help employees maintain a healthy lifestyle, while also reducing stress and improving overall happiness.

Additionally, offering health insurance and paid time off can ensure that employees have access to necessary medical care and can take time off to prioritize their mental and physical health. By investing in employee benefits that promote wellbeing and health, employers demonstrate their commitment to their employees’ overall quality of life. This leads to increased loyalty and retention, as employees feel valued and supported in both their personal and professional lives.

Environmental benefits

Electric cars have numerous benefits, particularly when it comes to the environment. Compared to gas-powered vehicles, electric cars emit significantly less greenhouse gases and air pollutants, which means they produce less harmful effects on the environment. In addition, electric cars also help to reduce noise pollution, which can be a major issue in busy cities.

These benefits are significant, both in terms of fighting climate change and improving overall air quality. For those who are looking to reduce their environmental impact, electric cars are a great choice. Plus, with the benefits in kind offered by the government on electric vehicles, such as lower tax rates and charging station installations, making the switch can be even more financially feasible.

All in all, electric cars are an environmentally friendly option that can help to make a positive impact on our planet.

Conclusion

In conclusion, electric cars not only provide a more sustainable and eco-friendly alternative to traditional gasoline vehicles, but they also come with some pretty sweet benefits in kind. From tax incentives to reduced maintenance costs, driving an electric car is not just good for the environment, it’s good for your wallet too. So if you’re looking for a fun, efficient, and financially savvy way to commute, why not consider “plugging in” to the electric car revolution? As they say, the future is electric, and the perks that come with it are certainly electrifying!”

FAQs

What is a benefit in kind for electric cars?

A benefit in kind is a non-cash form of payment provided by an employer to the employee, such as the use of an electric car for personal use.

How are benefit in kind taxes calculated for electric cars?

Benefit in kind taxes are calculated based on the CO2 emissions and the list price of the electric car. However, electric cars have a lower rate of benefit in kind tax compared to petrol or diesel cars.

What are the other benefits of electric cars apart from benefit in kind tax savings?

Electric cars have lower running costs, reduced emissions, quieter driving experience, and potential access to low emission zones and tax exemptions.

Can all electric cars be used as company cars for benefit in kind?

Not all electric cars are eligible for benefit in kind as it depends on their CO2 emissions and list prices. However, most pure electric cars are eligible for a lower rate of benefit in kind tax.