Rev Up Your Savings: Exploring the Tax Benefits of Electric Cars in India

Electric cars have been gaining popularity lately, and for good reason! They not only have a lower environmental impact, but they also offer a range of tax benefits, making them a smart financial investment. In India specifically, with its recent push towards sustainable mobility, electric vehicles are becoming increasingly attractive, and tax incentives are a driving force behind their adoption. In this blog post, we’ll explore the tax benefits of electric cars in India, including subsidies and exemptions, and how they can make a world of difference to your wallet.

So, if you’re considering making the switch to an electric vehicle, keep reading to find out why it could be a smart move for both your wallet and the planet.

Overview

Electric cars are becoming more popular in India due to the many tax benefits they offer. Switching to electric cars can save you a lot of money in the long run, as they are exempt from road tax and carry a lower goods and services tax (GST). Additionally, the Indian government provides subsidies to electric car buyers, further increasing their affordability.

These benefits encourage individuals and companies to invest in electric vehicles, helping reduce air pollution and carbon emissions. Besides, electric cars are cost-effective as they require less maintenance and consume less fuel. It’s important to note that although electric cars may have a higher upfront cost, over time, their savings in taxes and reduced fuel expenses outweigh the initial investment.

So, if you’re looking to purchase a car in India, opting for an electric vehicle can be a smart choice financially and environmentally.

What are Electric Cars?

Electric cars are vehicles that run on electricity, rather than gasoline or diesel fuel. They are powered by motors that use electricity stored in batteries. These batteries are rechargeable, meaning that the electric car can be refueled by plugging it into a charging station.

Electric cars are becoming increasingly popular due to their environmentally friendly nature. They produce zero emissions, which means that they do not contribute to air pollution or climate change. Additionally, they are much quieter than traditional cars, making them a great option for city driving.

While electric cars have a higher upfront cost than traditional cars, they are often more cost-effective in the long run due to their low maintenance costs and lower fuel costs. As technology continues to evolve, the range of electric cars is also increasing, making them a more practical choice for long-distance driving. Overall, electric cars are an exciting and innovative option for those looking to reduce their environmental footprint and save money on fuel.

Why Electric Cars in India?

Electric Cars in India. Electric cars are a crucial step towards sustainable transportation in India. As the second-most populous country in the world and one of the fastest-growing economies, India currently faces severe challenges related to air pollution, energy security, and climate change.

Electric cars have significant potential to address these issues by providing a clean, efficient, and affordable mode of transportation. They offer environmental benefits by producing zero emissions, reducing dependency on fossil fuels, and creating a more sustainable future. Moreover, electric cars can significantly reduce India’s dependence on oil imports, thus enhancing energy security.

By promoting the development and adoption of electric cars, India can also create new opportunities for technological innovation, job creation, and economic growth. Therefore, electric cars are not only beneficial for the environment and energy security but also for the overall socio-economic development of the country.

Government Initiatives

Electric cars have been gaining popularity in India in recent years, and the government has taken several initiatives to promote their use. One significant benefit for electric car owners is tax incentives. The government has exempted electric cars from the Goods and Services Tax (GST), which is a significant savings for buyers.

Additionally, electric vehicles are eligible for a reduced rate of road tax, which varies from state to state but can be up to 50% less than that of traditional petrol or diesel vehicles. These tax benefits make electric vehicles more affordable and accessible for individuals and businesses looking to reduce their carbon footprint. The government’s push toward electric vehicles is part of a larger effort to reduce air pollution and promote sustainable transportation options.

With these tax incentives, more Indians may be motivated to switch to electric cars in the coming years.

FAME India Scheme

The FAME India scheme launched by the Indian Government is one of its biggest initiatives to promote electric mobility in the country. FAME stands for Faster Adoption and Manufacturing of Electric Vehicles. The primary objective of this scheme is to incentivize the adoption of electric vehicles by increasing affordability and availability of these vehicles.

The government aims to reduce the dependency on fossil fuels and minimize pollution levels by promoting sustainable transportation. The FAME India scheme offers incentives for the purchase of electric vehicles and provides support for the establishment of charging infrastructure. This includes up to ₹15,000 for electric two-wheelers, up to ₹

5 lakh for electric cars, and even up to 50% of the cost for setting up charging stations. The program also includes financial assistance for research and development, skill development, and public awareness campaigns to encourage the uptake of electric vehicles. Through FAME India, the government has taken a significant step in the direction of eco-friendly transportation.

Not only does it help in reducing environmental damage, but it also creates opportunities for the development of domestic manufacturing and employment. The scheme aims to save around 6 million tonnes of oil equivalent per year and ultimately contribute towards energy security and self-sufficiency.

In conclusion, the FAME India scheme is an excellent initiative that promotes sustainable transportation, reduces pollution levels, and creates opportunities for domestic manufacturing. It provides substantial incentives for electric vehicle purchase and establishment of charging infrastructure, ensuring that these vehicles become a viable alternative to traditional vehicles. By incentivizing the adoption of electric vehicles, the government is helping to secure India’s energy future while leading the country towards a cleaner, greener tomorrow.

GST Reduction

In a significant initiative, the Indian government has slashed the GST (Goods and Services Tax) rates on a wide range of items. The government cut GST rates on residential properties, cinema tickets, and other items, aiming to provide relief to middle-class taxpayers. The GST reduction will cost the government approximately $

4 billion in lost revenue, but it is expected to boost consumer demand and spur economic growth. This move will also benefit the real estate industry, which has been struggling with rising inventories and stagnant prices. The GST reduction is a positive step towards making housing more affordable for the middle class and providing a much-needed push to the Indian economy.

Tax Benefits for buyers

Electric cars have received a lot of attention lately, and one of the reasons is the tax benefits they offer to buyers in India. These tax benefits are provided by the government to promote the use of electric vehicles and reduce air pollution in the country. The benefits include a lower Goods and Services Tax (GST) rate of 5% compared to the standard rate of 28%, a reduction or exemption in road tax, and incentives for using electric vehicles.

Some states also offer additional benefits such as waived toll fees, free parking, and subsidies for installing charging stations. These tax benefits have made electric cars more affordable and attractive for buyers, especially those who are environmentally conscious. By choosing an electric car, buyers can not only save money on taxes but also contribute to a cleaner and healthier environment.

With the increasing awareness and popularity of electric cars, it’s a great time to consider making the switch and taking advantage of the tax benefits provided by the government.

Income Tax Deduction

Are you looking to buy a new home? Did you know that you may be eligible for some tax benefits? Yes, that’s true! Income tax deduction is a significant advantage available to the homebuyers. You can reduce your taxable income by up to Rs.

5 lakh per annum under section 80C of the Income Tax Act. This section includes contributions to Public Provident Fund (PPF), Equity-Linked Savings Scheme (ELSS), home loan principal payment, and National Savings Certificate (NSC), among others. Additionally, if you have taken a home loan, you can claim an income tax exemption of up to Rs.

2 lakh per annum on interest payment under section 24B of the Income Tax Act. So, for instance, if you take a home loan of Rs. 70 Lakhs at an interest rate of 7% per annum for a term of 20 years, the total interest payable will be approximately Rs.

56 Lakhs. Therefore, as per the tax exemption norms, you can claim a tax deduction of up to Rs. 2 lakhs on this interest payment component, reducing your taxable income by this amount.

This can lead to significant savings on your tax liability. So, make sure you keep track of the tax benefits available to you as a homebuyer and maximize them for optimal savings.

State-specific Benefits

When it comes to buying a home, tax benefits can greatly reduce the overall cost. Different states may offer specific tax benefits to homebuyers, making it easier for them to afford their dream home. For example, in California, first-time homebuyers may be eligible for a tax credit of up to $10,000.

Additionally, there are state-specific deductions for property taxes, mortgage interest, and even energy-efficient home upgrades. It’s important to research the tax benefits in your state to take advantage of any potential savings. By getting familiar with these benefits, you can ensure that you’re making the most of your investment and keeping more money in your pocket.

So don’t forget to explore your state’s tax benefits if you’re in the market for a new home!

Environmental Benefits of Electric Cars

Electric cars have become increasingly popular in recent years due to their numerous environmental benefits. In India, purchasing an electric car can lead to tax benefits such as exemption from registration fees and a reduced GST rate. But the benefits extend far beyond financial incentives.

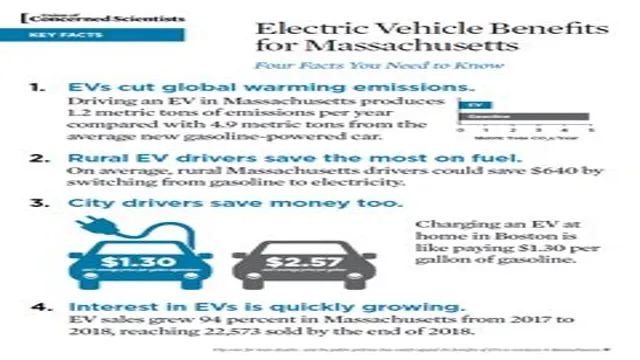

One of the most significant benefits of an electric car is the reduction in greenhouse gas emissions. Unlike traditional cars that rely on fossil fuels, electric cars are powered by rechargeable batteries and emit significantly less CO2 and other harmful pollutants. Additionally, electric cars are much quieter than gas-powered cars, reducing noise pollution.

Plus, as the country transitions to renewable energy sources, electric cars will only become more environmentally friendly. By reducing our carbon footprint and contributing to the global fight against climate change, electric cars are an excellent option for those looking to make a positive impact on the environment.

Reduced Air Pollution

One of the greatest environmental benefits of switching to electric cars is the reduction in air pollution. Traditional vehicles emit harmful pollutants into the air, such as carbon monoxide, nitrogen oxides, and particulate matter, which can have serious negative impacts on human health and the environment. Electric cars, on the other hand, produce no tailpipe emissions and have a significantly lower carbon footprint throughout their lifespan.

By reducing the amount of air pollution caused by transportation, electric cars can help improve air quality and reduce the risk of respiratory diseases like asthma and lung cancer. Additionally, by reducing our reliance on fossil fuels, we can help reduce our overall greenhouse gas emissions and mitigate the effects of climate change. Overall, the adoption of electric cars is a crucial step towards a cleaner, healthier, and sustainable future.

Energy Efficiency and Savings

Electric cars have become increasingly popular in recent years due to their potential to reduce harmful emissions and improve environmental sustainability. They function using energy that comes from a battery powered by electricity, making them much cleaner than traditional gasoline-powered cars. In fact, electric cars emit significantly fewer greenhouse gases and pollutants than their gas-powered counterparts.

This makes them a great choice for individuals who are looking to reduce their carbon footprint and support a cleaner future. Not only do electric cars help to reduce air pollution, but they can also save drivers money on fuel costs in the long run. Charging an electric car can be much less expensive than buying gasoline, making it a great choice for individuals who want to save money and reduce their impact on the environment.

Overall, electric cars offer a range of environmental benefits that make them a great choice for eco-conscious drivers who want to reduce their carbon footprint and help make the world a cleaner place.

Conclusion

In conclusion, the tax benefits for electric cars in India are a smart and practical move towards a sustainable future. Not only do they stimulate the growth of the electric vehicle market, but they also help reduce carbon emissions and promote cleaner air. And let’s not forget – no more pesky gas station stops! It’s time to rev up your engines.

.. quietly.

“

FAQs

What are the tax benefits available for electric cars in India?

The government of India provides a subsidy of up to Rs. 1.5 lakh on the purchase of electric cars. Additionally, electric cars are exempt from road tax and registration fees in many states.

Can businesses claim tax benefits on electric cars in India?

Yes, businesses are eligible for tax benefits on the purchase of electric cars in India. They can claim the subsidy provided by the government and also avail of accelerated depreciation.

Are there any restrictions on the type of electric cars that are eligible for tax benefits in India?

To be eligible for tax benefits, electric cars must meet certain criteria such as having a minimum range of 80 km per charge and meeting certain safety and performance standards.

Is there a limit to the number of electric cars eligible for tax benefits in India?

The government of India has not specified any limit on the number of electric cars eligible for tax benefits. However, these benefits are subject to change and may be revised from time to time.