Going Green and Saving Cash: A Guide to Electric Cars with Tax Benefits

Electric cars with tax benefits have become an increasingly popular choice in recent years, both for their eco-friendly perks and the financial advantages that come with them. If you’re in the market for a new vehicle and considering making the switch to electric, you may be wondering what exactly those tax benefits are and how they can benefit you. Luckily, there are a variety of credits and deductions available for electric car owners, from federal tax credits to state-specific incentives.

These can make purchasing and owning an electric car more affordable and accessible for a wider range of budgets. In this blog post, we’ll take a closer look at some of the specific tax benefits available for electric car owners, so you can make an informed decision and take full advantage of everything electric cars have to offer.

Benefits of Electric Cars

Electric cars are becoming increasingly popular, not least because they have numerous benefits compared to traditional gasoline-powered vehicles. One of the most significant advantages is the tax benefit that comes with driving an electric car. Governments around the world are offering financial incentives to encourage people to switch to zero-emission vehicles.

For example, in the United States, there is a federal tax credit of up to $7,500 available for the purchase of an electric car. Additionally, many states offer additional incentives, such as tax rebates, free parking, and access to high-occupancy vehicle lanes. These incentives can significantly reduce the cost of owning an electric car and make it a more attractive option for many consumers.

Consequently, more and more people are considering electric cars as a practical and affordable alternative to gasoline-powered vehicles.

Lower Fuel Costs

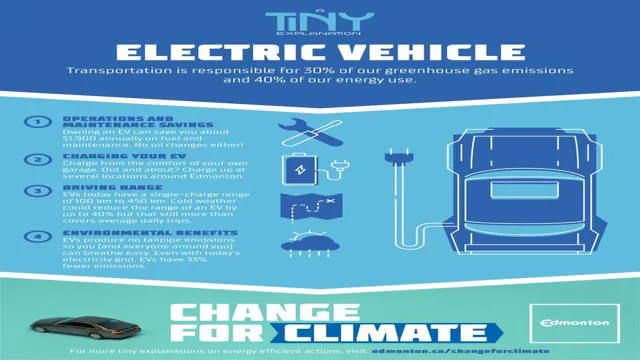

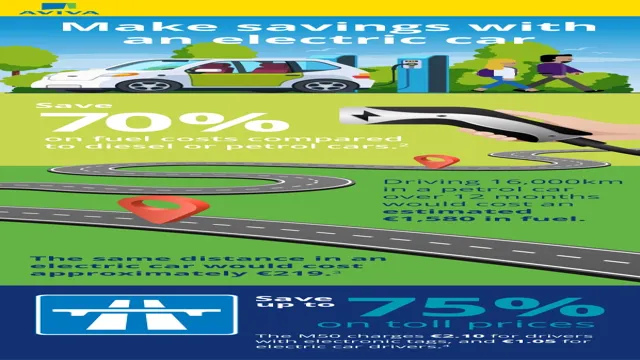

One of the biggest benefits of electric cars is that they can help lower fuel costs. Unlike gasoline-powered cars, which require regular fill-ups at the gas station, electric cars can be charged at home or at charging stations. This means that owners don’t have to worry about fluctuating gas prices or spending a lot of money to keep their car on the road.

In fact, studies have shown that electric cars can save drivers thousands of dollars in fuel costs over the course of their lifespan. And with more and more charging stations popping up across the country, it’s easier than ever to keep your electric car fully charged and ready to go. So if you’re looking to save money on fuel costs and reduce your carbon footprint at the same time, switching to an electric car could be a great choice.

Reduced Maintenance Costs

When it comes to owning a vehicle, one of the biggest expenses is often maintenance costs. However, electric cars have the potential to significantly reduce these costs. This is because electric cars have fewer moving parts than traditional gasoline-powered vehicles, which means there is less wear and tear on the vehicle overall.

Not only that, but electric vehicles do not require oil changes or other typical maintenance tasks that are necessary for combustion engine cars. All of these factors result in lower maintenance costs for electric car owners. Plus, with the growing popularity of electric cars, there are more options available for finding affordable and reliable mechanics who specialize in electric cars.

So not only are electric cars better for the environment, but they can also save you money in the long run. It’s a win-win situation!

Environmental Benefits

When it comes to the environment, electric cars come with a whole host of benefits. One of the most significant benefits is the mitigation of air pollution. Traditional gasoline-powered cars release a plethora of harmful pollutants, including carbon dioxide, nitrogen oxides, and particulate matter, which can cause numerous respiratory diseases.

However, electric cars emit zero emissions while driving, making them an eco-friendly transportation option. Additionally, electric cars help reduce greenhouse gas emissions since their batteries are charged through renewable energy sources. This results in a lower carbon footprint and a greener world.

So, by choosing electric cars, you can play a significant role in preserving our planet’s environment.

Federal Tax Credits for Electric Cars

If you’re considering buying an electric car, it’s worth taking advantage of the federal tax credits that are available to help offset the cost. To qualify for these tax benefits, the electric car that you purchase must meet certain criteria. First, the vehicle must have a battery capacity of at least 4 kWh.

Second, the car must be used primarily in the United States. The amount of the tax credit varies depending on the vehicle’s battery capacity, but it could be as much as $7,500. It’s important to keep in mind, however, that the tax credit is subject to certain limitations.

For example, it can only be used to offset your federal income tax liability, so if you don’t owe any tax, you won’t be able to benefit from it. Nonetheless, electric cars with tax benefits are a great choice for environmentally-conscious drivers who want to save both money and resources.

Amount of Tax Credit

If you’re looking to buy an electric vehicle (EV), one perk worth considering is the federal tax credit. This credit can help offset the higher price tag of many EVs and make them a more affordable option. The amount of the credit varies based on the make and model of the car and the battery size.

For example, a fully electric vehicle like the Tesla Model S can qualify for a credit of up to $7,500, while a plug-in hybrid like the Toyota Prius Prime can qualify for a smaller credit of around $4,500. It’s important to note that the credit is not a rebate, but rather a reduction in your taxable income. Therefore, it only applies if you owe federal taxes.

Additionally, the credit is subject to phase-out once a manufacturer has sold 200,000 eligible vehicles, so it’s important to check the current status of any EV you’re considering purchasing. Overall, the federal tax credit for electric cars can be a significant benefit to those looking to make the switch to a more environmentally friendly vehicle.

Qualifying Requirements

Federal Tax Credits for Electric Cars have specific qualifying requirements that buyers must meet in order to receive the tax credit. The most important thing to note is that the vehicle must be new and purchased or leased after December 31, 200 The other major requirement is that the car must be powered by an electric motor that draws its power from a battery with at least 4 kWh and the battery must be charged from an external power source.

There are also certain weight and speed requirements that must be met, but most electric cars on the market today meet these criteria. Additionally, the tax credit amount varies based on the vehicle’s battery capacity and overall efficiency. The maximum credit amount is $7,500, but not all electric cars will qualify for the full amount.

Nonetheless, these credits can help make electric cars more affordable and accessible for buyers who are looking to purchase a clean energy vehicle.

Examples of Eligible Electric Cars

Federal tax credits are available for those who purchase eligible electric cars. Some examples of electric cars that qualify for the credit include the Tesla Model S and X, the Nissan Leaf, the Chevrolet Volt and Bolt, the BMW i3, and the Ford Focus Electric. These credits can amount to thousands of dollars and serve as a significant incentive for individuals to switch to more sustainable modes of transportation.

It’s important to note that the amount of the credit varies depending on the make and model of the car and the individual’s tax situation. Additionally, the credits are only available for a limited time, so it’s best to take advantage of this opportunity sooner rather than later. Not only do electric cars help reduce carbon emissions, but they also offer long-term cost savings due to lower fuel and maintenance costs.

By choosing to purchase an eligible electric car and take advantage of the federal tax credits, individuals can not only help the environment but also save money in the process.

State Incentives for Electric Cars

For those in the market for a new car, electric cars with tax benefits may be a great option to consider. Many states offer incentives to encourage the use of electric cars, including tax credits for buyers. These incentives can vary by state, so it’s important to research what might be available in your area.

In addition to potential tax benefits, electric cars also offer long-term savings through reduced fuel costs and maintenance expenses. Many also come equipped with advanced features like regenerative braking and smart phone integration. While the sticker price may be higher than a traditional gasoline-powered car, the long-term benefits and added incentives make electric cars a compelling option for those looking for a clean, high-tech, and cost-effective choice for transportation.

So why not do your part for the environment and your wallet and consider an electric car with tax benefits today?

State Tax Credits

State tax credits can be a great incentive to purchase an electric car. These credits vary by state and can range from a few hundred dollars to several thousand dollars. In California, for example, the state offers up to $2,500 in tax credits for electric and plug-in hybrid vehicles.

Other states, such as Colorado and Massachusetts, offer similar tax credits. It’s important to do your research and see what incentives are available in your state before making a purchase. These tax credits not only make electric cars more affordable, but they also encourage more people to switch to cleaner transportation options.

So, if you’re thinking about purchasing an electric car, check to see what state incentives are available and take advantage of them.

State Rebates

State incentives for electric cars are becoming increasingly popular in the United States. As more people switch to electric vehicles (EVs), states are offering rebates and tax credits to those who purchase them. The amount of these incentives varies depending on the state, but some can be quite substantial.

One example is Colorado, which offers a tax credit of up to $5,000 for the purchase of an EV. California is another state with a generous rebate program, offering up to $7,000 for qualifying buyers. These incentives not only help make EVs more affordable for consumers, but they also help to reduce emissions and improve air quality.

So if you’re in the market for a new car, be sure to check out the incentives available in your state for electric vehicles to see if you can save some money while doing your part for the environment.

Conclusion

In conclusion, electric cars with tax benefits are the ultimate combination of practicality, sustainability, and frugality. Not only do they offer a way to reduce your carbon footprint, but they also come with significant financial incentives that will have you driving in style without breaking the bank. So if you want to make a smart investment in both your future and the planet’s, it’s time to charge up and get behind the wheel of an electric car with tax benefits.

Who knows, you just might shock yourself with how much you save!”

FAQs

What is the tax benefit for electric cars?

The tax benefit for electric cars varies depending on the country and region. However, in many cases, electric car owners can receive tax credits or incentives from their government for adopting a sustainable transport option.

How much can I save on taxes with an electric car?

The amount of tax savings from owning an electric car can range from a few hundred to a few thousand dollars. It depends on the specific tax credit or incentive scheme available in your region.

Are there any restrictions on the type of electric cars that qualify for tax benefits?

In some cases, tax benefits may only be available for electric cars that meet certain criteria, such as battery size or range. It’s important to check the eligibility requirements of your chosen scheme before making a purchase.

Can I get a tax benefit for charging my electric car at home?

In some regions, there are tax benefits available for the installation of home charging stations for electric cars. This may include a tax credit or a deduction on your income tax return. Check with your local tax authority for more information.

Is the tax benefit for electric cars the same for businesses and individuals?

The tax benefit for electric cars can differ depending on whether they are purchased by an individual or a business. In some cases, businesses may be able to receive more significant tax savings for adopting electric vehicles as part of their fleet.