Revolutionizing Commutes: Understanding the Benefits of Electric Company Cars as a Tax-Efficient Benefit in Kind

Driving an electric car is a trendy move to make, and it’s not just environmentally friendly, but it also offers tax benefits. Have you ever thought about obtaining an electric company car benefit in kind? The UK government is pushing for more companies to embrace company cars and the use of electric vehicles, which means employees now have a wider choice of electric cars. The benefit-in-kind (BIK) tax rates for electric cars are lower than for petrol and diesel vehicles.

Therefore, the adoption of company electric cars in large numbers would be incredibly impactful environmentally, and the employees would enjoy substantial tax benefits. In this blog post, we will explore what a company car benefit-in-kind is, the benefits of electric company cars, and how to ensure your vehicle stays compliant with tax laws. So, let’s dive into the world of electric cars and company benefits.

What is Benefit in Kind?

If you are considering an electric company car, it’s essential to understand the concept of Benefit in Kind (BIK). BIK is a tax on any benefits that an employee receives, such as company cars, health insurance, or gym memberships. In the case of electric company cars, the BIK rate is much lower than that of petrol or diesel cars.

This is because electric cars emit less CO2 and are more environmentally friendly. Essentially, the BIK rate is calculated using the car’s list price, CO2 emissions, and fuel type. The lower the CO2 emissions and the higher the car’s value, the higher the BIK rate will be.

However, choosing an electric car with zero CO2 emissions means you will pay the lowest possible BIK rate. This is a significant benefit of choosing an electric company car, as it can help reduce your tax liability and provide you with a cost-effective vehicle. So, if you’re considering an electric company car, don’t forget to factor in the BIK rate when calculating your overall costs.

Explanation of Benefit in Kind for Electric Company Cars

Benefit in Kind As an electric car driver, you may have heard the term “Benefit in Kind” (BIK) being thrown around. But what exactly does it mean? Essentially, BIK is the extra financial value that an employee receives from their employer in addition to their salary or wages, specifically for things like company cars. For electric company cars, the BIK is calculated based on the car’s CO2 emissions and its list price.

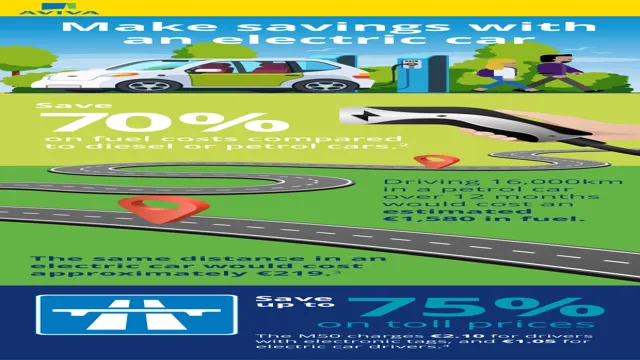

Since electric cars have zero emissions, they have a much lower BIK rate than traditional cars, making them an attractive option for both the employee and the employer. This means that not only will you be saving money on fuel costs, but you will also be benefiting from the potential tax savings from having an electric company car. So, if your employer offers the option of an electric company car, it may be worth considering as it can be a financially savvy choice for both parties involved.

Why choose an Electric Company Car?

Choosing an electric company car can be a smart move, especially when considering the benefits in kind. One of the primary advantages is the lower tax cost for the driver. Electric vehicles have lower carbon emissions, which means lower rates of CO2-based Benefit in Kind (BIK) tax.

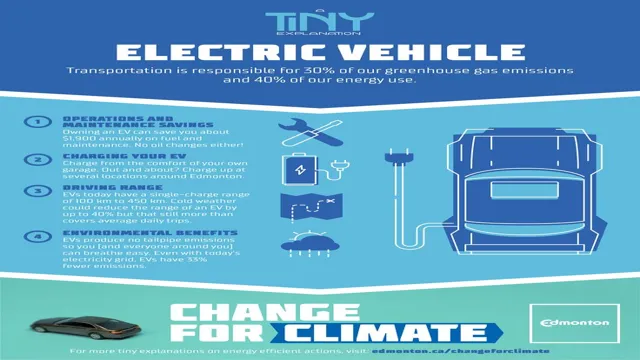

This saving can mean that electric cars are more cost-effective for employees than traditional internal combustion engine vehicles. Additionally, electric cars require less maintenance and fuel, leading to further savings and environmental benefits. Companies that choose electric cars also demonstrate their commitment to sustainability, which can positively impact their brand image and reputation.

Overall, choosing an electric company car not only helps to reduce carbon emissions but also brings financial and environmental benefits.

Lower Emissions and Tax Benefits

Electric company cars are becoming increasingly popular due to their lower emissions and tax benefits. By switching to electric cars for business use, companies can reduce their carbon footprint and contribute to a greener future. Electric cars emit zero exhaust emissions, reducing a company’s overall carbon footprint and the negative impact on the environment.

In addition, electric cars have several tax benefits, including lower company car tax, fuel tax, and reduced national insurance contributions. These tax breaks can save companies a considerable amount of money, making electric company cars not only environmentally friendly but also a sound financial decision. By choosing electric company cars, businesses can actively reduce their environmental impact while also benefiting from tax savings.

Financial Savings and Employee Perception

Electric Company Car Choosing an electric company car may be a smart financial decision for employers and can also positively impact employee perception. By offering electric vehicles, companies can save on fuel and maintenance costs, which can ultimately result in lower expenses for the business. Additionally, employees may see the company’s embrace of electric cars as a responsible and forward-thinking move, potentially improving their overall view of the organization.

Importantly, electric cars also reduce emissions and may qualify for government incentives, further incentivizing employers to make the switch. Ultimately, offering electric company cars can be a win-win for both companies and employees, as it can be both cost-effective and eco-friendly. So, why not consider an electric company car?

How is Benefit in Kind Calculated?

When it comes to calculating the benefit in kind for an electric company car, there are a few factors to consider. Firstly, the list price of the vehicle needs to be established. From there, any optional extras or discounts need to be factored in.

Next, the CO2 emissions of the car need to be determined. For electric company cars, this will usually be zero, which means the car falls into the lowest benefit in kind band. However, it’s worth noting that if the car has a range-extender, this can impact the CO2 emissions and therefore the benefit in kind.

It’s also worth keeping in mind that the benefit in kind will typically be a percentage of the vehicle’s list price, but this can vary depending on the employee’s income tax bracket. Overall, the calculation can be quite complex, so it’s important to seek professional advice if you’re unsure about anything. By carefully considering the relevant factors, however, it’s possible to work out an accurate and fair benefit in kind for an electric company car.

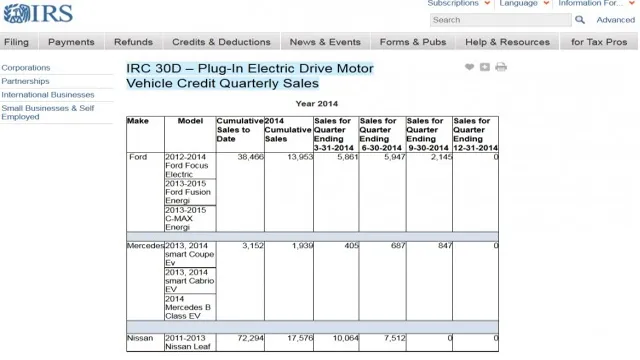

Calculation based on CO2 emissions and car price

Benefit in Kind or BIK is calculated based on a combination of factors, including the car’s carbon dioxide (CO2) emissions and its price. The lower the CO2 emissions of the car, the lower the BIK rate will be. In essence, the idea behind the calculation is to reward drivers who use environmentally friendly cars that emit lower amounts of greenhouse gases.

On the other hand, the higher the purchase price of the car, the higher the BIK rate will be. This is because the government assumes that more expensive cars are typically driven by higher earners who can afford to pay higher taxes. It’s important to note that BIK applies to company car drivers and is included as part of their taxable income.

The higher the BIK rate, the more income tax the driver will have to pay. That’s why it’s important to factor in the BIK rate when calculating whether to lease or purchase a car. Ultimately, choosing a car with lower emissions can significantly reduce your tax liability and save you money in the long run.

Example of Benefit in Kind Calculation for Electric Car

When it comes to calculating the Benefit in Kind (BIK) for electric cars, there are a few things that need to be considered. First, the list price of the car is taken into account, including any optional extras that may have been added. This figure is then adjusted to take into account any government incentives or grants that may have been applied.

Once the final figure has been calculated, it’s multiplied by a percentage to determine the BIK. For electric cars, this percentage is currently set at 0%. This means that if an electric car has a list price of £30,000 and no government grants or incentives have been applied, the BIK will be £0.

This is a huge benefit for those who opt for an electric car as their company vehicle, as it can result in significant savings compared to those driving petrol or diesel vehicles.

Tips for Maximizing Benefit in Kind for Electric Company Cars

Owning an electric company car can be a significant benefit to employees due to the reduced costs and minimal carbon footprints. However, it is essential to maximize the electric company car benefit in kind, which can be done by following some tips. Firstly, it is crucial to ensure that the car is eligible for the electric car benefit in kind, which requires the vehicle to have zero emissions and meet certain criteria.

Secondly, it is beneficial to choose a car with a lower list price and avoid purchasing unnecessary extras that can increase the taxable amount. Thirdly, it is advisable to choose a car with a longer range to minimize the need for charging, which can impact on the benefit. Additionally, it is essential to keep accurate records of personal and business use to avoid any errors in the taxable amount.

By following these tips, employees can maximize their electric company car benefit in kind, while also contributing to a greener and more sustainable environment.

Investing in Efficient Charging Infrastructure

Investing in efficient charging infrastructure is crucial for businesses looking to transition their fleet to electric cars. To maximize the benefit in kind for electric company cars, companies can implement smart charging systems and provide employees with access to charging stations at the workplace and at home. This not only reduces stress for employees who don’t need to worry about running out of charge during the day, but it also allows for a more efficient use of energy.

Businesses can also consider utilizing renewable energy sources to power their charging stations, further reducing their carbon footprint. By investing in the right charging infrastructure, companies can not only save money in the long run, but also contribute to a cleaner and greener future.

Promoting the use of Electric Company Cars among Employees

Maximizing Benefit in Kind for Electric Company Cars Electric cars are becoming more popular among companies as they are both environmentally friendly and cost-effective. As an employee who is benefiting from an electric company car, there are ways to maximize the Benefit in Kind (BIK) tax relief that you can take advantage of. First, ensure that your car has the lowest possible carbon dioxide (CO2) emission level, as the tax relief is based on the level of CO2 emissions.

Secondly, choose a car with a low list price, as this reduces the taxable value of the car. You can also consider selecting a car with desirable features for your personal use, such as a satellite navigation system or heated seats, as these increase the taxable value of the car and therefore increase the amount of tax relief. Lastly, take good care of your electric car as the value is based on the car’s list price, and any enhancements or damage will affect the taxable value of the car.

By following these tips, you can maximize the BIK tax relief and enjoy the benefits of an electric company car.

Conclusion

In the world of electric cars and tax incentives, the benefit in kind is the juicy cherry on top of an already delicious eco-friendly cake. While some may view it as a mere perk for company cars, it is in fact a powerful tool that can drive employees towards a cleaner, greener future. By reducing the tax liability on electric cars, the benefit in kind becomes a no-brainer for anyone looking to make a positive impact on the environment.

So, let’s charge ahead and embrace the electric revolution, one benefit in kind at a time!”

FAQs

What is the benefit in kind for an electric company car?

The benefit in kind for an electric company car is currently 1% for tax year 2021/2022.

How is the benefit in kind for an electric company car calculated?

The benefit in kind for an electric company car is calculated based on the car’s list price, the percentage of its CO2 emissions, and its fuel type.

Are there any exemptions to paying benefit in kind for an electric company car?

Yes, if the electric car has zero emissions and is charged using only off-grid electricity, it is exempt from benefit in kind tax.

Can I claim back the VAT on an electric company car?

If your company is VAT registered, you can claim back the VAT on an electric company car, as with any other company expense.