The Ultimate Guide to Federal Tax Benefits for Electric Cars: Save Big on Your EV Energy Transition

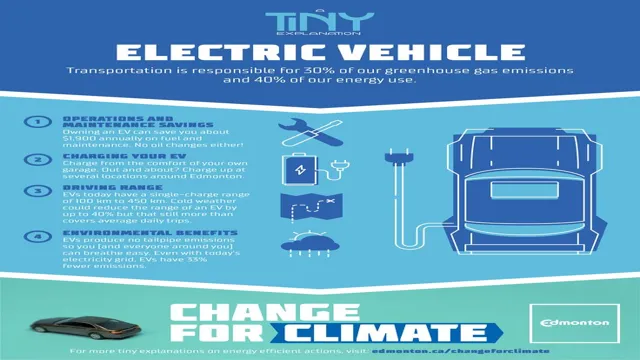

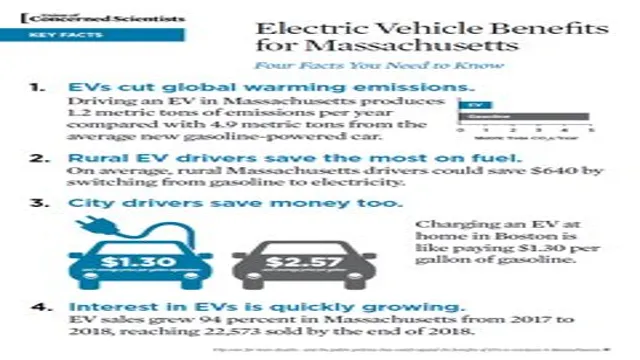

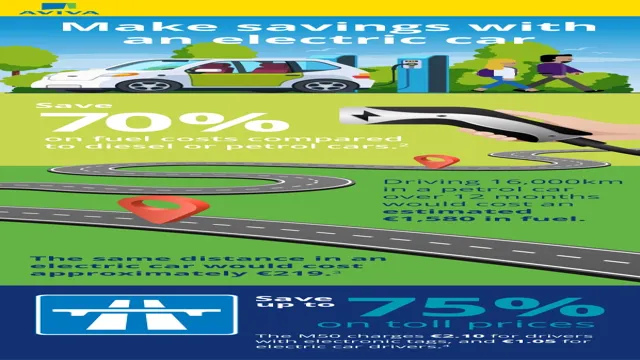

Are you in the market for a new car that’s eco-friendly and energy efficient? Have you considered an electric car? Not only can you feel good about reducing your carbon footprint, but you can also take advantage of some great federal tax benefits. The government is making it easier for consumers to switch to electric cars by offering incentives to help offset the cost. But what exactly are these federal tax benefits? For starters, you can receive a federal tax credit of up to $7,500 when you purchase an electric car.

This credit can be applied to both new and used electric vehicles, making it an attractive option for those looking to save money. In addition, some states also offer their own incentives, such as tax credits or exemptions from emissions tests or high-occupancy vehicle lane access. There are also some tax benefits for businesses who switch to electric vehicles.

The government offers a tax credit for up to 30% of the cost of installing electric vehicle charging stations, for example. This has led to more businesses investing in electric cars and charging stations, which in turn helps to reduce emissions from transportation. It’s worth noting that these federal tax benefits are subject to change and may vary depending on the make and model of the car you purchase.

It’s important to do your research and consult with a tax professional to ensure you’re eligible for these incentives. Switching to an electric car not only benefits the environment, but it can also benefit your wallet. With federal tax benefits and additional incentives from some states, now is a great time to consider making the switch to electric.

Overview of Federal Tax Credits

If you’re in the market for a new car and considering an electric vehicle (EV), you may be eligible for a federal tax benefit. The federal government offers tax credits for the purchase or lease of qualifying EVs, which can help offset the higher initial cost of these vehicles. The amount of the credit varies based on the make and model of the car, as well as the battery capacity.

For example, the credit for a Tesla Model 3 is currently $7,500, while the credit for a Nissan Leaf is $7,500. However, the credit begins to phase out once the manufacturer sells a certain number of EVs, so it’s important to act sooner rather than later. Keep in mind, too, that the tax credit doesn’t actually reduce your tax liability dollar-for-dollar; rather, it reduces the amount of tax you owe.

Nonetheless, it can be a significant benefit for those looking to make the switch to a more sustainable mode of transportation.

What is the federal tax credit for electric cars?

If you’re considering buying an electric car, you may want to take advantage of the federal tax credit available. This credit offers up to $7,500 off your taxes for certain types of electric vehicles. However, it’s crucial to note that not all electric cars qualify for this credit.

Only new, plug-in electric cars with a battery capacity of at least 5 kilowatt-hours are eligible. Additionally, the amount of the credit varies depending on the size of the vehicle’s battery pack. For example, an electric car with a 16-kilowatt-hour battery pack may qualify for a $4,000 credit, while one with a 30-kilowatt-hour pack may be eligible for the full $7,500 credit.

It’s important to keep in mind that the tax credit begins to phase out once a manufacturer has sold 200,000 qualifying electric vehicles. As such, some electric car brands may not be eligible for the tax credit anymore. Overall, if you’re interested in buying an electric car, be sure to do your research to determine whether it qualifies for the federal tax credit.

How does the federal tax credit for electric cars work?

The federal tax credit for electric cars is an incentive designed to encourage more people to switch to electric vehicles. When you buy an electric car, you may be eligible for a tax credit of up to $7,500. However, the amount you can receive depends on the make and model of the car and the battery size.

For example, vehicles with larger batteries may be eligible for higher credits. It’s worth noting that the tax credit is non-refundable, meaning if your tax liability is less than the amount of your credit, you won’t receive the difference in a refund. Additionally, the credit begins to phase out after the manufacturer sells 200,000 electric vehicles, so it’s best to buy an electric car sooner rather than later to take advantage of this benefit.

Overall, the federal tax credit for electric cars is a great way to save money while also reducing your carbon footprint.

Qualifying for Federal Tax Credits

If you’re considering purchasing an electric car, it’s important to know that you may qualify for federal tax credits. These tax credits can be a significant benefit, potentially saving you thousands of dollars on your purchase. To qualify, your electric car must meet certain criteria, such as having a battery capacity of at least 5 kilowatt-hours and being purchased new.

The amount of the tax credit varies depending on the make and model of the vehicle, but it can range from $2,500 to $7,500. Additionally, it’s worth noting that these tax credits are limited and will eventually phase out as more electric vehicles are purchased. So, if you’re interested in taking advantage of this federal tax benefit, it’s important to act soon.

What types of electric cars qualify for the tax credit?

When it comes to qualifying for federal tax credits on electric cars, there are a few things you need to keep in mind. First and foremost, the vehicle must be a plug-in electric car, a plug-in hybrid electric car, or a fuel-cell electric vehicle. This means that traditional hybrid vehicles, which cannot be plugged in, do not qualify for these tax credits.

Additionally, the vehicle must be new, not used. There are also specific requirements regarding battery capacity and efficiency that your vehicle must meet in order to qualify. It’s important to do your research and make sure the electric car you are considering meets all of the necessary qualifications in order to receive the tax credit.

But overall, purchasing an electric car can be financially beneficial due to these federal tax credits, as well as long-term cost savings on fuel and maintenance.

What are the income qualifications for the tax credit?

When it comes to federal tax credits, income qualifications play a crucial role in determining eligibility. These tax credits are designed to assist lower-income households in affording health insurance premiums. To qualify for federal tax credits, your household income must fall between 100-400% of the Federal Poverty Level (FPL).

This means that if you’re a single individual making between $12,880 and $51,520 per year, or a family of four earning between $26,500 and $106,000, you may qualify for tax credits. It’s important to note that eligibility for tax credits is also contingent on other factors such as age and residency status. If you’re unsure about your eligibility or have questions about federal tax credits, it’s always best to consult with a tax professional or visit healthcare.

gov for more information. Don’t miss out on this potentially valuable financial assistance- check to see if you qualify for federal tax credits today.

What other criteria must be met to qualify for the tax credit?

If you’re interested in taking advantage of the federal tax credit for energy-efficient improvements to your home, there are a few criteria you must meet. One of the most important is that your upgrades must be made to your primary residence – rental properties or second homes are not eligible. Additionally, the improvements you make must be deemed “qualified energy-efficient improvements” by the IRS.

This includes items such as insulation, energy-efficient windows and doors, and certain heating and cooling systems. You must also make sure that the upgrades meet certain energy efficiency standards, which can vary depending on the specific type of upgrade you’re making. Finally, it’s important to keep in mind that the federal tax credit has a limit – you can only claim up to 10% of the cost of your upgrades, up to a total of $500.

While this may not cover the entire cost of your improvements, it can still provide a significant financial benefit as well as help to lower your energy bills over time. So if you’re looking to make your home more energy-efficient, be sure to explore your options for qualifying for the federal tax credit.

Calculating Federal Tax Credits

If you’re considering purchasing an electric car, you may be wondering about the federal tax benefit offered by the government. The federal government offers tax credits for electric cars that meet certain requirements, which can help offset the higher purchase price of these vehicles. The tax credit amount varies depending on several factors, including the make and model of the car and the buyer’s tax liability.

To calculate your federal tax credit for an electric car, you’ll need to determine the base price of the vehicle, subtract any state or local incentives, and then apply the tax credit percentage based on the vehicle’s battery capacity. It’s important to keep in mind that these tax credits are non-refundable, meaning you can only use them to offset your tax liability for the year. Overall, the federal tax credit can provide a substantial benefit for those looking to invest in an electric car, but it’s important to do your research and consult with a tax professional to ensure you’re taking advantage of all available incentives.

How is the tax credit amount calculated?

When it comes to calculating federal tax credits, there are a number of factors that come into play. The first thing to consider is the type of tax credit you may be eligible for. For example, the Earned Income Tax Credit is calculated based on factors such as your income, marital status, and number of children.

On the other hand, the Child and Dependent Care Credit is calculated based on the amount of money you paid for childcare and your income level. Generally speaking, many tax credits are calculated as a percentage of the eligible expenses or income, and they are subject to certain limitations and income thresholds. It’s important to keep in mind that eligibility for federal tax credits can vary depending on your individual circumstances and financial situation.

That’s why it’s always a good idea to consult with a qualified tax professional or use a reputable tax preparation software to ensure that you’re taking advantage of all the tax credits you’re entitled to.

How does the tax credit affect my tax liability?

When it comes to calculating federal tax credits, it’s important to understand how they impact your tax liability. Tax credits serve as a reduction in your total tax bill, meaning that they directly lower the amount of taxes you owe. For example, if you have a tax liability of $5,000 and you are eligible for a $1,000 tax credit, your final tax bill would be reduced to $4,000.

It’s important to note that while tax deductions also lower your tax bill, credits provide a dollar-for-dollar reduction, making them even more valuable. Federal tax credits apply to a wide range of expenses, including expenses related to education, energy efficiency, and child care. By taking advantage of these credits, you can significantly lower your tax liability and keep more money in your pocket.

Make sure to work with a tax professional to ensure that you are maximizing your eligible tax credits and minimizing your tax bill.

Claiming Federal Tax Credits

If you’re in the market for an electric car, you’ll be happy to know that there are several federal tax benefits available to you. One such benefit is the federal tax credit, which helps offset the cost of your new electric vehicle. The amount of the credit depends on several factors, including the make and model of your car, as well as the size of its battery.

For example, a Tesla Model 3 with a 75 kWh battery is eligible for a federal tax credit of up to $7,500, while a Chevrolet Bolt with a 66 kWh battery is eligible for up to $3,750. It’s important to note that these tax credits are non-refundable, meaning that if you owe less than the credit amount, you won’t receive the difference as a refund. Additionally, the credit is only available until the manufacturer sells a certain number of qualifying vehicles, so be sure to take advantage of this benefit before it expires.

In conclusion, the federal tax credit is a great way to save money on your electric car purchase and help reduce your carbon footprint.

How do I claim the tax credit on my tax return?

To claim the federal tax credits on your tax return, you will need to fill out Form 896 This form is used to calculate your premium tax credit for the year, as well as reconcile any advance payments of the credit you have received with the actual credit you are eligible for based on your income and family size. To complete the form, you will need to know your total household income for the year, the number of people in your household who are eligible for coverage, and the cost of your health insurance premiums.

Once you have filled out the form, you can attach it to your tax return and submit it to the IRS. If you have any questions or need help with this process, don’t hesitate to reach out to a tax professional who can guide you through the steps and ensure that you receive all the tax credits you are eligible for. Remember that claiming federal tax credits can save you money and make a big difference in your overall tax bill.

What documents do I need to claim the tax credit?

If you’re looking to claim federal tax credits, you need to have the right documentation on hand. First of all, you need to have a valid Social Security number or taxpayer identification number to claim any tax credits. You’ll also need to have your income tax return from the previous year, as well as any relevant receipts or invoices to prove that you’ve made eligible expenses, such as home improvements or energy-efficient purchases.

Additionally, you may be asked to provide proof of eligibility, such as documentation to show that you meet certain income or age requirements. It’s important to keep all of these documents organized and easily accessible, as having the right paperwork can make the difference between getting approved for the tax credit or being denied. So make sure to keep all your documents safe and secure, and don’t hesitate to seek the advice of a tax professional if you have any questions or concerns about claiming federal tax credits.

Conclusion

Electric cars are not just a great way to reduce our carbon footprint and save on gas money, they also come with a federal tax benefit. The federal government recognizes that electric cars contribute to a more sustainable and cleaner future, which is why they offer tax credits as an incentive for individuals to purchase them. So, not only will you be doing your part to help the environment, but you’ll also be rewarded for it! It’s a win-win situation.

So go ahead, invest in an electric car and reap the benefits of both a cleaner planet and a little extra cash in your wallet.”

FAQs

What is the federal tax benefit for electric cars?

The federal tax benefit for electric cars is up to $7,500, depending on the battery capacity of the vehicle.

Is the federal tax benefit for electric cars a rebate or a tax credit?

The federal tax benefit for electric cars is a tax credit, which means it is applied against your federal income tax liability.

Are there any income limits for claiming the federal tax benefit for electric cars?

No, there are no income limits for claiming the federal tax benefit for electric cars. However, the tax credit does begin to phase out after an automaker sells a certain number of electric cars.

Can I claim the federal tax benefit for leasing an electric car?

Yes, if you lease an electric car, you can still claim the federal tax credit. However, the credit goes to the leasing company, which may pass on some or all of the savings to you in the form of lower monthly lease payments.