Florida Electric Car Credit Guide Maximize Your Savings Today

Featured image for florida electric car credit

Image source: c8.alamy.com

Discover how to maximize your savings with the Florida electric car credit, a powerful incentive that can save you thousands on your EV purchase. This guide breaks down eligibility, available state and federal tax credits, and insider tips to ensure you claim every dollar you’re owed. Don’t miss out—act today to drive green and keep more cash in your pocket.

Key Takeaways

- Act now: Florida offers limited-time EV tax credits—apply before deadlines.

- Stack savings: Combine state credits with federal incentives for maximum savings.

- Check eligibility: Income caps and vehicle criteria apply—verify before purchasing.

- New models win: Only 2023+ EVs qualify for full state credit benefits.

- Document everything: Keep receipts and forms for credit claims and audits.

- Local perks count: Some counties add extra rebates—research your area.

📑 Table of Contents

- Why Florida Is the Perfect Place to Go Electric

- Understanding the Federal EV Tax Credit (The Big One)

- Florida-Specific Incentives You Might Be Missing

- How to Maximize Your Savings (Step-by-Step)

- Common Pitfalls and How to Avoid Them

- Future of EV Incentives in Florida (What’s Coming?)

- Final Thoughts: Your Path to Smarter, Cheaper Driving

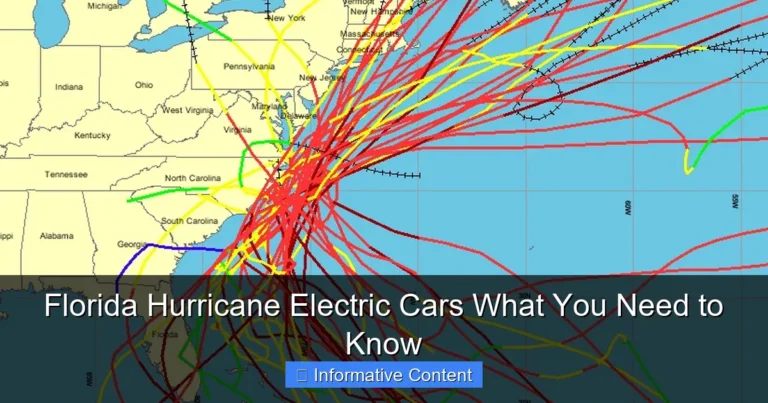

Why Florida Is the Perfect Place to Go Electric

Picture this: You’re cruising down I-95 with the windows down, the sun shining, and not a gas station in sight. Your car hums along quietly, powered entirely by electricity. No more worrying about rising gas prices, oil changes, or smog checks. That’s the dream, right? Well, in Florida, that dream is not only possible—it’s getting more affordable every year thanks to the Florida electric car credit and a growing network of incentives.

Florida might not have a state-level EV tax credit like some other states, but don’t let that fool you. There’s still a treasure trove of savings waiting for you—if you know where to look. From federal tax credits and local utility rebates to HOV lane access and reduced registration fees, the Sunshine State is quietly becoming one of the most electric-friendly places to live. Whether you’re buying your first EV or upgrading to a newer model, understanding how to maximize your savings can make a big difference in your wallet. And that’s exactly what this Florida electric car credit guide is here for.

Understanding the Federal EV Tax Credit (The Big One)

Before we dive into Florida-specific perks, let’s talk about the elephant in the room: the federal electric car tax credit. This is the biggest single incentive available to EV buyers across the U.S., including Florida residents. As of 2024, the credit can be worth up to $7,500 for new electric vehicles and $4,000 for used EVs, depending on several key factors.

Visual guide about florida electric car credit

Image source: shunauto.com

How the Federal Credit Works

The federal EV tax credit is a non-refundable tax credit, which means it reduces the amount of federal income tax you owe. If you don’t owe enough in taxes, you can’t get the full amount back. For example, if your tax bill is only $5,000, you can only claim $5,000 of the $7,500 credit—the rest vanishes. This is important to understand, especially if you’re a low- to middle-income earner.

- New EVs: Up to $7,500, if the vehicle meets battery and manufacturing requirements.

- Used EVs: Up to $4,000 (or 30% of the sale price, whichever is lower), for vehicles at least 2 years old.

- Leased EVs: The credit goes to the leasing company, not you—but they may pass some savings to you via lower lease payments.

2024 Eligibility Requirements

The rules changed in 2023 and 2024 to encourage domestic manufacturing and battery sourcing. To qualify for the full $7,500, a new EV must meet two main criteria:

- Final assembly must occur in North America.

- Critical minerals and battery components must meet specific sourcing thresholds (e.g., at least 50% of battery components made in North America).

As of mid-2024, only about 15 models fully qualify for the full credit. Some, like the Tesla Model 3 (certain trims), Ford F-150 Lightning, and Chevrolet Bolt, are on the list. Others, like the Nissan Leaf, may only qualify for partial credit or none at all. Always check the official IRS list before buying.

Real-Life Example: Sarah’s Tesla Purchase

Sarah, a teacher in Miami, bought a Tesla Model 3 in April 2024. She paid $42,000 for the car and qualified for the full $7,500 federal credit. Her federal tax bill that year was $12,000, so she reduced it to $4,500—effectively saving $7,500. She didn’t have to wait for a rebate; the credit was applied when she filed her taxes. That’s the power of the federal Florida electric car credit (even though it’s national, it applies here too).

Florida-Specific Incentives You Might Be Missing

While Florida doesn’t offer a direct state tax credit for EVs, it has a suite of other perks that can add up quickly. These are often overlooked, but they’re just as valuable—especially when combined with federal incentives.

HOV Lane Access (Even Without a Passenger)

One of the most popular benefits in Florida is HOV lane access. If you drive an electric vehicle, you can use the High Occupancy Vehicle (HOV) lanes on highways like I-75, I-95, and I-4—even if you’re driving solo. This can save you serious time during rush hour in cities like Miami, Orlando, and Tampa.

To get this perk, you need a Florida EV license plate decal. It’s free and easy to apply for through the Florida Highway Safety and Motor Vehicles (FLHSMV) website. Just show proof of your EV registration, and you’re good to go.

Tip: Some plug-in hybrids (PHEVs) also qualify, but only if they’re on the approved list. Check the FLHSMV site before applying.

Reduced Registration Fees

Florida charges a slightly lower registration fee for EVs compared to gas-powered cars. For a standard 1-year registration, EVs pay about $30 less. It’s not a huge amount, but it’s a nice little bonus every year. For example, a gas car might cost $100 to register, while an EV costs $70. Over five years, that’s $150 saved.

Utility Company Rebates (The Hidden Gems)

Here’s where things get exciting. Many Florida utility companies offer rebates and incentives for EV owners. These aren’t widely advertised, so most people don’t know about them. But if you dig a little, you can find real savings.

- TECO (Tampa Electric): Offers a $250 rebate for new EV purchases and $200 for used EVs. They also have a time-of-use (TOU) rate plan that can cut charging costs by up to 50% if you charge overnight.

- FPL (Florida Power & Light): Provides a free Level 2 home charger (valued at $500) for qualifying customers who purchase a new EV. You just need to install it in your home and agree to participate in a demand-response program.

- Orlando Utilities Commission (OUC): Offers up to $500 in rebates for home charger installation and a special EV rate plan.

Pro tip: Always check your local utility’s website or call their customer service. Some programs have limited funding and may close quickly.

Parking Perks

Several cities in Florida, including Miami Beach, Orlando, and Fort Lauderdale, offer free or discounted parking for EVs at public garages and meters. In Miami Beach, for example, EVs get 2 hours of free metered parking. That’s a $10–$15 savings per visit if you’re shopping or dining downtown.

How to Maximize Your Savings (Step-by-Step)

Now that you know what’s available, let’s talk strategy. The key to getting the most out of the Florida electric car credit ecosystem is combining multiple incentives. Here’s how to do it right.

Step 1: Pick the Right Vehicle

Not all EVs are created equal when it comes to incentives. Before buying, ask yourself:

- Does it qualify for the full $7,500 federal credit?

- Is it eligible for HOV lane access?

- Does your utility offer a rebate for this model?

For example, the Chevrolet Bolt is one of the most affordable EVs that still qualifies for the full federal credit (as of mid-2024). It’s also eligible for HOV lanes and often qualifies for utility rebates. That makes it a smart choice for budget-conscious buyers.

Step 2: Time Your Purchase

Utility rebates often run out fast. FPL’s free charger program, for instance, has a limited number of units per year. If you’re eyeing a specific incentive, buy early in the year—don’t wait until December. Also, federal tax credits are claimed when you file your taxes, so buying late in the year (October–December) gives you the shortest wait to claim the credit.

Step 3: Apply for All Available Rebates

Here’s a checklist of what to apply for after buying your EV:

- ✅ Federal tax credit (file with your 1040 using IRS Form 8936)

- ✅ HOV lane decal (apply at flhsmv.gov)

- ✅ Utility rebate (check your provider’s website)

- ✅ Home charger rebate (if applicable)

- ✅ City parking perks (register your EV with the city if required)

Keep copies of all receipts and applications. Some programs require proof of purchase, registration, or charger installation.

Step 4: Switch to a Time-of-Use (TOU) Rate Plan

If your utility offers a TOU plan, switch to it. These plans charge less for electricity between 10 PM and 6 AM—perfect for overnight charging. For example, FPL’s EV rate charges just 5.5 cents per kWh at night, compared to 12 cents during peak hours. That’s a 54% savings!

Most EVs let you schedule charging via their app. Set it to start at 11 PM, and you’ll never pay peak rates again.

Real-Life Example: The Johnson Family’s $12,000 in Savings

The Johnsons in Orlando bought a used Tesla Model Y for $38,000. They qualified for the $4,000 federal used EV credit. Their utility, OUC, gave them a $500 rebate for installing a Level 2 charger. They also got free HOV lane access and saved $100 on registration. Plus, they switched to a TOU plan and cut their annual charging costs by $300. Total savings: $5,900 in direct incentives and $300/year in ongoing savings. That’s a big win.

Common Pitfalls and How to Avoid Them

Even with all these incentives, there are traps that can trip up new EV owners. Let’s talk about the most common ones—and how to dodge them.

Not Checking Federal Credit Eligibility

Some dealers will tell you a car qualifies for the full $7,500 credit, but that’s not always true. The IRS updates the list monthly based on battery sourcing. For example, in early 2024, the Ford Mustang Mach-E lost its credit because it used batteries from China. Buyers who weren’t paying attention missed out.

Solution: Always check the IRS website or use the DOE’s Alternative Fuels Data Center to confirm eligibility.

Missing Utility Rebate Deadlines

Utility rebates often have tight deadlines. FPL’s free charger program, for instance, requires you to apply within 90 days of purchasing your EV. Miss that window, and you’re out of luck.

Solution: Set a calendar reminder to apply within 30 days of buying. Gather all documents (bill of sale, registration, charger receipt) ahead of time.

Overlooking Used EV Incentives

Many people assume used EVs aren’t eligible for incentives. But the $4,000 federal credit for used EVs is a game-changer. Plus, some utilities offer rebates for used EV purchases too.

Example: A 2022 Nissan Leaf with 20,000 miles might sell for $22,000. With the $4,000 credit, your effective cost is $18,000. That’s cheaper than many new gas cars—and you still get all the other perks.

Ignoring Home Charger Costs

A Level 2 home charger costs $500–$800, plus $1,000–$2,000 for installation. But if your utility offers a rebate, you might pay nothing. FPL’s free charger program covers the unit and basic installation. OUC gives you $500 back. Don’t skip this step.

Future of EV Incentives in Florida (What’s Coming?)

The EV landscape in Florida is changing fast. While the state hasn’t announced a direct tax credit yet, there are signs it could happen. In 2023, a bill was introduced to create a $2,500 state rebate for EVs, but it didn’t pass. However, with more Floridians switching to electric, the pressure is building.

Expanding Charging Infrastructure

The federal government is investing $70 million in Florida to build EV charging stations along highways and in underserved areas. This means faster charging, fewer range anxiety issues, and more convenience. By 2026, you’ll see chargers every 50 miles on major interstates.

Potential for a State Rebate

With neighboring states like Georgia offering $5,000 rebates, Florida may feel the need to compete. Watch the 2025 legislative session—there’s a good chance a state Florida electric car credit could emerge.

More Utility Programs on the Horizon

FPL and TECO are both testing “smart charging” programs that reward you for charging during off-peak hours. Think of it like a loyalty program—charge at night, earn points, get discounts. These could launch in 2025.

Data Table: Florida EV Incentives at a Glance

| Incentive | Amount | Who Qualifies? | How to Apply | Deadline |

|---|---|---|---|---|

| Federal New EV Credit | Up to $7,500 | All U.S. taxpayers | File IRS Form 8936 | When you file taxes |

| Federal Used EV Credit | Up to $4,000 | All U.S. taxpayers | File IRS Form 8936 | When you file taxes |

| HOV Lane Decal | Free access | EV owners | Apply at flhsmv.gov | None |

| FPL Free Charger | $500 value | FPL customers | Apply on FPL website | 90 days after purchase |

| TECO EV Rebate | $250 (new), $200 (used) | TECO customers | Submit online form | 6 months after purchase |

| OUC Charger Rebate | $500 | OUC customers | Apply via email | 1 year after install |

| Registration Fee Reduction | $30/year | All EV owners | Automatic | None |

Final Thoughts: Your Path to Smarter, Cheaper Driving

Going electric in Florida isn’t just good for the environment—it’s one of the smartest financial moves you can make. The Florida electric car credit landscape, while not as flashy as some states, is full of real, tangible savings. From the federal tax credit to free HOV access, utility rebates, and parking perks, there’s no shortage of ways to cut costs.

But here’s the thing: you have to be proactive. Incentives don’t come to you—you have to seek them out. Check eligibility, apply on time, and combine every benefit you can. That’s how you go from “this is expensive” to “this is a steal.”

And remember, the future looks even brighter. With more charging stations, potential state rebates, and smarter utility programs on the horizon, Florida is positioning itself as an EV leader. So if you’ve been on the fence about making the switch, now’s the time. Your wallet—and the planet—will thank you.

So go ahead. Take that test drive. Apply for the HOV decal. Call your utility. File that tax form. Every step brings you closer to a cleaner, quieter, and more affordable way to drive. Welcome to the electric future—it’s already here in the Sunshine State.

Frequently Asked Questions

What is the Florida electric car credit and who qualifies?

The Florida electric car credit is a state incentive offering tax rebates or credits for purchasing or leasing new electric vehicles (EVs). To qualify, you must be a Florida resident, purchase an eligible EV, and meet income or vehicle price cap requirements set by the program.

How much can I save with the Florida electric car credit?

The credit amount varies by program but typically ranges from $1,000 to $2,500 for qualifying EVs. Savings may stack with federal tax credits, helping you maximize total incentives when buying an electric car in Florida.

Can I combine the Florida electric car credit with other incentives?

Yes, you can often combine the Florida electric car credit with federal tax credits (up to $7,500) and local utility rebates. Check with your dealer or the Florida Department of Revenue to confirm eligible stacking options.

Are used electric cars eligible for the Florida electric car credit?

Currently, most Florida EV incentives apply only to new vehicle purchases or leases. However, federal tax credits now include used EVs—check if state programs update eligibility to include pre-owned electric models.

How do I apply for the Florida EV tax credit?

You typically claim the credit when filing your Florida state tax return using Form DR-405. Your dealership may also assist with documentation—save all purchase and lease records to verify eligibility.

Does the Florida electric car credit cover charging equipment?

While the main credit applies to EVs, some local utilities and municipalities offer separate rebates for home charging stations. Visit the Florida Energy Office website to explore additional EV charger incentives.