Florida Electric Car Rebate Guide 2024 Save Big on Your EV Purchase

Featured image for florida electric car rebate

Image source: i0.wp.com

Discover how to save thousands with Florida’s 2024 electric car rebate program—now offering up to $2,000 in state incentives for new EV purchases. Combined with federal tax credits of up to $7,500, Floridians can slash their electric vehicle costs significantly. Act fast—eligibility requirements and funding caps mean rebates won’t last forever.

Key Takeaways

- Check eligibility: Verify income and residency for Florida EV rebates.

- Act fast: Rebates are limited and awarded on a first-come basis.

- Combine incentives: Stack state rebates with federal tax credits for bigger savings.

- New models favored: Most rebates apply only to brand-new EVs.

- Document everything: Submit complete paperwork to avoid processing delays.

- Timing matters: Purchase before June 30 to maximize 2024 rebate chances.

📑 Table of Contents

- Why Florida Is the Perfect Place to Buy an Electric Car

- Understanding the Florida Electric Car Rebate Landscape

- Local and Municipal Incentives: Hidden Gems in Your Backyard

- Utility Company Incentives: Power Companies Paying You to Go Green

- Manufacturer and Dealer Incentives: Don’t Forget the Dealership

- Maximizing Your Savings: A Step-by-Step Strategy

- Data Snapshot: Florida EV Incentives at a Glance

- Final Thoughts: Is 2024 the Year to Go Electric in Florida?

Why Florida Is the Perfect Place to Buy an Electric Car

Let’s face it—Florida is a sunshine state in more ways than one. With its warm weather, sprawling highways, and growing eco-conscious population, it’s no surprise that electric vehicles (EVs) are gaining serious traction here. But beyond the palm trees and beach vibes, there’s something even more exciting on the horizon for Floridians: electric car rebates and incentives that can save you hundreds—or even thousands—on your next EV purchase. Whether you’re a first-time EV buyer or upgrading from a gas guzzler, 2024 might just be the best year yet to make the switch.

You’ve probably heard whispers about federal tax credits for EVs, but what about Florida-specific perks? That’s where things get interesting. While Florida doesn’t currently offer a statewide Florida electric car rebate in the traditional sense (like a direct cash-back program), a mix of local incentives, utility company offers, and federal tax credits can still make your EV purchase surprisingly affordable. And with gas prices fluctuating and charging infrastructure expanding across the state, the timing couldn’t be better.

Understanding the Florida Electric Car Rebate Landscape

Before diving into the details, let’s clear up a common misconception: Florida does not have a direct, state-funded electric car rebate program like California or Colorado. But don’t let that discourage you—there’s still plenty of money-saving potential if you know where to look. Think of it as a puzzle: each piece—federal, local, utility-based, and manufacturer incentives—can come together to create significant savings.

Visual guide about florida electric car rebate

Image source: i0.wp.com

Why No Statewide Rebate? A Quick Reality Check

Florida has historically taken a hands-off approach to EV incentives, relying instead on federal programs and private-sector innovation. This isn’t necessarily a bad thing. In fact, it means that Floridians can benefit from a more flexible, decentralized system. For example, while a state rebate might only apply to certain models or income levels, the current mix of incentives often offers broader eligibility and faster processing.

Also, Florida’s low gas tax and lack of emissions testing have traditionally reduced the urgency for aggressive EV incentives. But with climate concerns rising and federal funding pouring in, that’s starting to change. Local governments and utilities are stepping up, and the momentum is building.

Federal Tax Credit: Your Biggest Ally

The biggest player in the game is the federal EV tax credit, which can knock up to $7,500 off your purchase price—but only if you qualify. Here’s how it works:

- Amount: Up to $7,500 for new EVs, $4,000 for used EVs (2023–2032).

- Eligibility: Based on vehicle battery size, final assembly location (must be in North America), and manufacturer sales caps (Tesla and GM have already hit theirs).

- Income limits: $150,000 for single filers, $225,000 for heads of household, $300,000 for joint filers.

- How to claim: File IRS Form 8936 when you do your taxes. You don’t get the money upfront—it’s a credit against your tax liability.

Pro tip: Some dealerships now offer “transferable” credits, meaning they can apply the credit at the point of sale (like a rebate) if they choose to participate. This is a game-changer—ask your dealer if they offer this option.

For example, if you buy a 2024 Chevrolet Blazer EV (MSRP $56,715), and the federal credit applies, you could save $7,500. That’s like getting the car for under $49,000 before any other incentives. Not bad for a vehicle that can go 320 miles on a single charge.

Local and Municipal Incentives: Hidden Gems in Your Backyard

While Florida lacks a statewide electric car rebate, many cities and counties are launching their own programs. These are often funded through federal grants (like the Inflation Reduction Act) or local green initiatives. Let’s explore some of the most promising local offers.

City of Miami: EV Charger Rebates

The City of Miami offers a residential EV charger rebate of up to $500 for single-family homes. If you’re installing a Level 2 charger at home, this can cover a big chunk of the cost. The program is open to Miami residents and requires proof of EV registration and a professional installation.

Real-world example: Sarah, a Miami Beach resident, bought a 2024 Hyundai Ioniq 5 and installed a ChargePoint Home Flex charger for $799. With the $500 rebate, her out-of-pocket cost dropped to just $299—plus, she now charges her car overnight for less than $5.

Orlando: Free Public Charging (Yes, Really)

Orlando’s “Green Works” initiative includes free public EV charging at city-owned garages and parks. While not a direct Florida electric car rebate, it’s a massive perk for daily drivers. You can charge for up to 4 hours at a time—perfect for running errands or grabbing lunch downtown.

Orlando also partners with Duke Energy to offer a workplace charging grant for businesses. If your employer installs chargers, they can get up to $5,000 per port. That means more charging options for employees—and potentially free charging for you.

Tampa and St. Petersburg: Utility-Driven Savings

Florida’s largest utility, Duke Energy, offers a “Smart Charging” rebate in the Tampa Bay area. If you sign up for off-peak charging (between 10 p.m. and 6 a.m.), you can get up to $200 back on your charger or $100 in bill credits. This encourages grid stability and saves you money.

St. Petersburg has gone even further with a “Drive Electric” program that includes:

- $1,000 rebate for low- to moderate-income residents who buy a new EV.

- Free Level 2 charger for qualifying applicants.

- Priority parking for EVs at city facilities.

Tip: These local programs often have limited funding and fast deadlines. Check your city’s sustainability or transportation website regularly—new programs pop up fast.

Utility Company Incentives: Power Companies Paying You to Go Green

Here’s a twist: your power company might actually want you to buy an electric car. Why? Because utilities benefit from off-peak charging, which helps balance the grid and reduces strain during peak hours. As a result, many Florida utilities now offer EV-specific rebates and programs.

Florida Power & Light (FPL): The Statewide Leader

FPL, which serves over 12 million Floridians, has one of the most comprehensive EV programs in the state. Their “EVolution” initiative includes:

- Home Charger Rebate: Up to $250 for installing a Level 2 charger.

- Time-of-Use (TOU) Rates: Special electricity plans that charge as little as $0.07/kWh overnight.

- Public Charging Network: Over 500 fast chargers across Florida, many free or low-cost.

For example, if you drive 12,000 miles a year and charge at the TOU rate, your annual electricity cost could be under $300—less than a quarter of what you’d pay for gas.

Real-life story: Mark in Fort Lauderdale switched to FPL’s EV TOU plan and saved over $800 in the first year. He charges his Tesla Model Y every night and barely notices the cost on his bill.

TECO (Tampa Electric) and JEA (Jacksonville): Regional Perks

TECO offers a “Drive Electric” rebate of $200 for new EV purchases, plus a $100 bonus if you enroll in their TOU plan. JEA in Jacksonville has a similar program with a $250 charger rebate and free public charging at city-owned stations.

Important note: These rebates are often stackable with federal and local incentives. That means you could save $7,500 (federal) + $500 (Miami charger) + $250 (FPL) = $8,250 total on a single purchase. That’s like getting a $50,000 EV for $41,750.

Manufacturer and Dealer Incentives: Don’t Forget the Dealership

While government and utility programs are important, don’t overlook what’s happening at the dealership level. Car manufacturers and local dealers are rolling out aggressive promotions to meet federal requirements and boost sales.

Dealer-Level “Point-of-Sale” Federal Credits

Starting in 2024, the IRS allows dealers to apply the federal tax credit at the time of purchase—no waiting until tax season. This is huge. Instead of claiming $7,500 on your taxes, you can get it as a discount right away. But not all dealers participate.

Action step: When shopping for an EV, ask: “Do you offer the federal tax credit as a point-of-sale discount?” If they say no, try another dealer. Some brands (like Hyundai and Kia) are more likely to offer this than others.

Manufacturer Rebates and Lease Deals

Even without a Florida electric car rebate, automakers are offering their own deals:

- Hyundai: $7,500 lease incentive on the Ioniq 5 and Ioniq 6 (2024 models).

- Kia: $5,000 cash back on the EV6 (limited-time offer).

- Tesla: $2,000 referral credit + free Supercharging for 3 months.

- Ford: $7,500 lease bonus on the Mustang Mach-E and F-150 Lightning.

Pro tip: Leasing often unlocks more incentives than buying. For example, the federal credit is applied differently on leases, and some states (including Florida) don’t charge sales tax on leased EVs. This can save you thousands.

Case in point: A 36-month lease on a $52,000 Ford F-150 Lightning with $7,500 in lease incentives and no sales tax could cost you just $350/month after a $5,000 down payment. That’s cheaper than many gas-powered trucks.

Maximizing Your Savings: A Step-by-Step Strategy

So, how do you piece all these incentives together to get the biggest bang for your buck? Here’s a practical, step-by-step guide to help you navigate the Florida electric car rebate maze in 2024.

Step 1: Know Your Budget and Needs

Before chasing rebates, decide:

- Do you want to buy or lease?

- How many miles do you drive daily?

- Can you charge at home or work?

- What’s your tax liability? (Important for federal credit.)

For example, if you earn $80,000/year and owe $10,000 in taxes, the $7,500 federal credit could wipe out most of your tax bill. If you earn less, you might not use the full credit—but a lease or point-of-sale discount could still help.

Step 2: Research Local Programs

Visit your city, county, and utility websites. Look for:

- EV purchase rebates

- Charger rebates

- TOU electricity plans

- Public charging access

Create a spreadsheet to track deadlines, eligibility, and application steps. Some programs are first-come, first-served.

Step 3: Compare Deals and Negotiate

Call or visit at least three dealerships. Ask:

- Do you offer the federal tax credit at point of sale?

- Are there any manufacturer rebates or lease bonuses?

- Can you help me apply for local or utility rebates?

Example: A dealership in Orlando might bundle a $2,000 manufacturer rebate with FPL’s $250 charger rebate and help you apply for the city’s free charging program. That’s $2,250 in savings—plus the federal credit.

Step 4: Apply for Incentives (Fast!)

Some rebates require you to apply within 30–90 days of purchase. Don’t wait. Gather:

- Proof of purchase (invoice, title)

- EV registration

- Charger installation receipt

- Utility account number (for TOU plans)

Submit everything online or by mail. Keep copies for your records.

Step 5: Monitor and Maintain

Once you’ve claimed your Florida electric car rebate and other incentives, stay on top of:

- TOU plan enrollment (set your charger to charge at night)

- Public charging access (download apps like PlugShare)

- Future rebates (check websites quarterly)

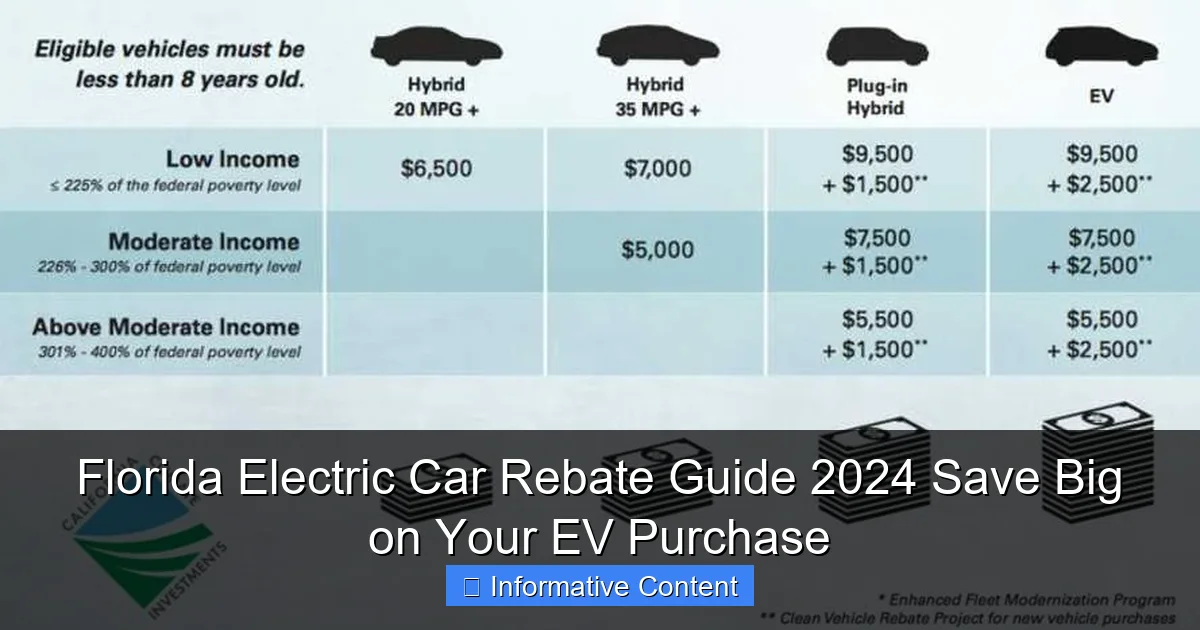

Data Snapshot: Florida EV Incentives at a Glance

Here’s a quick reference table to help you compare the top Florida electric car rebate and incentive programs in 2024. All values are maximum available per household unless noted.

| Program | Type | Amount | Eligibility | Deadline/Notes |

|---|---|---|---|---|

| Federal Tax Credit | Purchase | $7,500 (new), $4,000 (used) | Income limits, NA assembly | File IRS Form 8936 |

| FPL Charger Rebate | Charger | $250 | FPL customers | Apply within 90 days |

| Miami Charger Rebate | Charger | $500 | Miami residents | Limited funds |

| St. Pete EV Rebate | Purchase | $1,000 + free charger | Low-income residents | Apply online |

| TECO Drive Electric | Purchase | $200 + $100 TOU bonus | TECO customers | Enroll in TOU plan |

| Hyundai Lease Incentive | Lease | $7,500 | New Ioniq 5/6 leases | 2024 models only |

| Orlando Public Charging | Charging | Free (4 hrs max) | All EV drivers | City garages & parks |

Final Thoughts: Is 2024 the Year to Go Electric in Florida?

Absolutely. While Florida doesn’t have a traditional Florida electric car rebate, the combination of federal, local, utility, and manufacturer incentives makes this one of the best times in history to buy an EV in the Sunshine State. You’re not just saving money—you’re investing in cleaner air, lower fuel costs, and a more sustainable future.

Think about it: with gas prices hovering around $3.50/gallon, an EV could save you $1,500 a year in fuel alone. Add in the $7,500 federal credit, $500 charger rebate, and free public charging, and you’re looking at total savings of $10,000+ over three years. That’s not pocket change.

And here’s the best part: Florida’s EV infrastructure is only getting better. New fast chargers are popping up on I-75, I-95, and I-4. More cities are adding incentives. And with federal funding pouring in, we could see a true statewide Florida electric car rebate sooner than you think.

So, what are you waiting for? Start researching today. Visit your city’s website, call your utility, and test drive that EV you’ve been eyeing. The road to savings—and a greener Florida—starts now.

Frequently Asked Questions

What is the Florida electric car rebate program in 2024?

The Florida electric car rebate program offers financial incentives to residents who purchase or lease new electric vehicles (EVs). These rebates aim to reduce upfront costs and encourage sustainable transportation across the state.

How much can I save with the Florida EV rebate?

Rebate amounts vary depending on the vehicle type and battery capacity, but eligible buyers can receive up to $2,000 through state and local incentives. Additional savings may be available through federal tax credits.

Who qualifies for the Florida electric car rebate?

To qualify, you must be a Florida resident, purchase or lease a new EV from an authorized dealer, and register the vehicle in the state. Income limits and vehicle eligibility requirements may apply.

Are used electric cars eligible for the Florida EV rebate?

No, the current Florida electric car rebate program only applies to new EV purchases or leases. Used EVs are not eligible, but buyers can explore federal tax credits for pre-owned electric vehicles.

How do I apply for the Florida electric car rebate?

After purchasing an eligible EV, submit your application online through the Florida Department of Environmental Protection or a participating dealership. Required documents include proof of purchase, residency, and vehicle registration.

Does the Florida EV rebate apply to plug-in hybrids?

Yes, some plug-in hybrid vehicles (PHEVs) qualify for the Florida electric car rebate if they meet specific battery capacity and emissions standards. Check the official program guidelines to confirm eligibility.