Florida Electric Car Registration Guide 2024 Update

Featured image for florida electric car registration

Image source: static.vecteezy.com

Registering an electric car in Florida in 2024 is faster and more affordable than ever, thanks to updated state incentives and streamlined DMV processes. EV owners now benefit from reduced registration fees, access to HOV lane decals, and a simplified online application system—making Florida a top state for electric vehicle adoption.

Key Takeaways

- Register online: Use Florida’s FLHSMV portal for faster processing.

- Proof of ownership: Submit title or lease agreement during registration.

- EV fee applies: Pay the $200 annual fee for electric vehicles.

- Skip emissions tests: EVs are exempt from Florida’s vehicle inspections.

- Renew biennially: Registration renewal is required every two years.

- Keep insurance active: Maintain coverage meeting state minimums at all times.

📑 Table of Contents

- Why Registering Your Electric Car in Florida Matters

- How Florida Electric Car Registration Works in 2024

- Tax Credits, Rebates, and Incentives: What You Can Save

- EV Surcharge: What It Is and Why It Exists

- Charging Infrastructure and Registration Perks

- Common Pitfalls and How to Avoid Them

- Final Thoughts: Your EV Journey Starts Here

Why Registering Your Electric Car in Florida Matters

Picture this: You’ve just driven off the lot in your shiny new Tesla Model 3 or maybe a sleek Chevrolet Bolt. The sun’s shining, the AC’s blasting, and you’re feeling like the king (or queen) of the road. But then it hits you—do I need to do anything special to register this thing? After all, it’s not like my old gas guzzler.

You’re not alone. Many new electric car owners in Florida have the same question. And the truth is, while registering an EV in the Sunshine State isn’t *wildly* different from registering a traditional car, there are some important nuances you’ll want to know about. From tax credits to charging station access, getting it right can save you time, money, and a few headaches down the line. So grab a cold drink, and let’s dive into the Florida electric car registration process for 2024—updated and simplified just for you.

How Florida Electric Car Registration Works in 2024

Let’s get one thing straight: Florida doesn’t treat EVs like aliens from another planet. You register your electric car the same way you would any other vehicle—but there are some unique perks and requirements that make the process smoother (and sometimes more confusing) than you might expect.

Visual guide about florida electric car registration

Image source: c8.alamy.com

Step 1: Gather Your Paperwork (It’s Not That Bad)

First things first—before you even think about walking into a DMV office, make sure you have these essentials:

- Proof of ownership: That’s your title or manufacturer’s certificate of origin (MCO) if it’s a new car.

- Bill of sale: This shows the purchase price, which helps calculate your sales tax.

- Valid Florida driver’s license: You need to be a Florida resident to register here.

- Proof of Florida auto insurance: Minimum coverage is required, and yes, your EV needs it too.

- VIN inspection: Usually done at the dealership, but if you’re registering a used EV from out of state, you might need to get this done at a DMV office or with a law enforcement officer.

Pro tip: If you’re buying from a dealership, they’ll often handle most of this for you. But if you’re doing it yourself—say, buying a used Tesla off Facebook Marketplace—be ready to roll up your sleeves.

Step 2: Visit the DMV (Or Skip It Online)

Florida offers both in-person and online options for electric car registration. Here’s the breakdown:

- In-person: Head to your local Florida Department of Highway Safety and Motor Vehicles (FLHSMV) office. Bring all your docs, and expect to spend 30–60 minutes (longer if there’s a line).

- Online: If you’re renewing or registering a new car with no lien, you can often use the MyDMV Portal. Just create an account, upload your documents, and pay the fees electronically.

One thing to note: If your EV has a lien (like a loan), you’ll need to go in person. The lender usually holds the title, so the DMV needs to coordinate directly with them.

And hey—don’t stress about the wait. Bring a book, charge your phone, and maybe even strike up a conversation with another EV owner. You’d be surprised how many people are curious about your car!

Step 3: Pay the Fees (Yes, There Are Some)

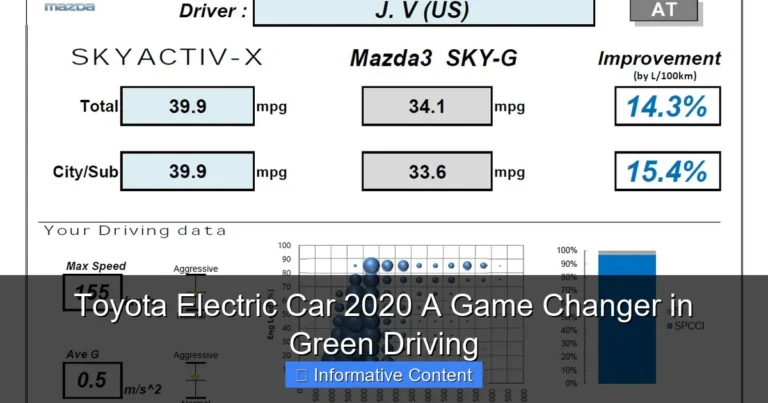

No one likes fees, but they’re part of the deal. Here’s what you’ll typically pay when registering your electric car in Florida:

- Registration fee: Around $225 for a new car (varies slightly by county).

- Sales tax: 6% of the purchase price (or trade-in value, whichever is higher). Some counties add a small surcharge (usually 0.5–1%).

- Title fee: $75.25 (standard for all vehicles).

- Plate fee: $28 (for a standard plate; specialty plates cost more).

- EV surcharge: $134.50 per year (more on this below).

Wait—what’s that last one? The EV surcharge. It’s a newer fee introduced in 2022 to help fund road maintenance, since EVs don’t pay gas taxes. It’s a bit of a bummer, but it’s not outrageous. Think of it as your contribution to keeping I-4 and US-1 in decent shape.

Example: If you buy a $40,000 Tesla in Miami-Dade County, your total first-year cost might look like this:

- Registration: $225

- Sales tax (6.5%): $2,600

- Title: $75.25

- Plate: $28

- EV surcharge: $134.50

- Total: ~$3,062.75

Yikes, right? But remember—you’re saving on gas, maintenance, and (in some cases) federal tax credits. We’ll talk about those next.

Tax Credits, Rebates, and Incentives: What You Can Save

Here’s the good news: Florida may not have as many EV incentives as California, but there are still ways to save big—especially at the federal level and through local programs.

Federal Tax Credit: Up to $7,500

The Inflation Reduction Act (IRA) revamped the federal EV tax credit in 2023, and it’s still in effect for 2024. Here’s how it works:

- You can get a tax credit of up to $7,500 if you buy a new EV that meets certain criteria (battery size, final assembly location, and income limits).

- For used EVs, the credit is up to $4,000 (must be at least 2 years old and cost $25,000 or less).

- Starting in 2024, you can transfer the credit to the dealer at the point of sale—meaning you get the discount upfront instead of waiting for your tax refund.

Example: You buy a new Ford F-150 Lightning for $55,000. It qualifies for the full $7,500 credit. You tell the dealer to apply it, and boom—your effective price drops to $47,500. No waiting, no paperwork.

But here’s the catch: Not every EV qualifies. The IRS maintains a list of eligible vehicles. As of early 2024, models like the Tesla Model 3, Nissan Leaf, and Chevrolet Bolt are on it—but some versions (like high-end trims or certain battery sizes) may not qualify. Always double-check!

Florida-Specific Perks (Yes, There Are a Few)

While Florida doesn’t offer a direct state rebate, there are still some sweet deals:

- HOV lane access: Electric cars with a Florida EV decal can use high-occupancy vehicle (HOV) lanes—even if you’re solo. This is huge in cities like Miami, Orlando, and Tampa during rush hour.

- Free parking: Some cities (like St. Petersburg and Fort Lauderdale) offer free or discounted parking for EVs in public garages and meters.

- Utility incentives: Companies like Florida Power & Light (FPL) and JEA offer rebates for home charging stations. FPL, for example, gives up to $500 back when you install a Level 2 charger.

Pro tip: Apply for the EV decal when you register. It’s free, and it takes two minutes. Just ask the DMV clerk for Form HSMV 82040. You’ll get a special sticker to display on your windshield.

Local and Municipal Programs

Keep an eye on your city or county website. Some local governments are starting to offer their own incentives:

- Broward County: Offers a $100 rebate for EV purchases.

- City of Tallahassee: Provides free EV charging at public stations.

- Orlando: Partners with ChargePoint to offer discounted charging rates.

The bottom line? Do your homework. A little research could save you hundreds—or even thousands—over the life of your car.

EV Surcharge: What It Is and Why It Exists

Let’s talk about that $134.50 EV surcharge. It’s the elephant in the room for many new EV owners, and it’s worth understanding—because it’s not going away anytime soon.

Why Florida Charges an EV Surcharge

Here’s the deal: Gas taxes pay for road maintenance and infrastructure. But EVs don’t use gas, so they don’t contribute to that fund. As more people switch to electric, the state needs another way to cover those costs.

Enter the EV surcharge. It’s designed to be roughly equivalent to what a gas-powered car would pay in fuel taxes over a year. For a car averaging 12,000 miles and getting 25 MPG, that’s about $135 in gas taxes (at $3.50/gallon and a 18.4-cent state tax).

So yes—it’s a bit ironic that you’re paying a fee for being eco-friendly. But it’s also fair, in a way. Roads need to be fixed, and someone has to pay for it.

How It’s Calculated and When It’s Due

The surcharge is $134.50 per year, and it’s added to your annual registration fee. You’ll see it listed as “Electric Vehicle Surcharge” on your renewal notice.

- It applies to all EVs, including plug-in hybrids (PHEVs).

- It’s due every year, even if you’re not driving much.

- You can’t avoid it—but you can budget for it.

Example: You renew your registration in 2024. Your base registration fee is $225, plus $134.50 for the EV surcharge. Total due: $359.50.

One small win: If you’re 65 or older, you might qualify for a senior discount on the registration fee (but not the surcharge). Check with your local DMV for details.

Is It Worth It?

Let’s do the math. Say your EV gets 4 miles per kWh and you drive 12,000 miles a year. At $0.12/kWh, your annual electricity cost is about $360. A similar gas car (25 MPG, $3.50/gallon) would cost $1,680 in fuel.

Even with the $134.50 surcharge, you’re still saving over $1,100 per year. So yeah—it’s worth it. Think of the surcharge as a small price for being part of the EV revolution.

Charging Infrastructure and Registration Perks

One of the best parts of driving an EV in Florida? The charging network is growing fast. And your registration status can actually help you access some of it.

Public Charging in Florida: What’s Available

As of 2024, Florida has over 5,000 public charging ports, including:

- Fast chargers along major highways (I-95, I-75, I-4)

- Level 2 chargers at malls, restaurants, and parks

- Destination chargers at hotels and resorts

Many of these are part of networks like ChargePoint, EVgo, and Tesla Superchargers (which are now open to non-Tesla EVs in some locations).

Pro tip: Use apps like PlugShare or ChargeHub to find nearby stations, check availability, and even pay remotely. They’ll also show you if a charger is free or paid.

How Your Registration Helps

Here’s a cool perk: When you register your EV, you can get a free or discounted charging pass from some providers. For example:

- Orlando Utilities Commission (OUC): Gives registered EV owners a $50 credit on their first year of public charging.

- JEA (Jacksonville): Offers a free 6-month trial for its “EV Home” charging plan.

And don’t forget: The HOV lane access from your EV decal can save you time on your daily commute. In rush hour, that’s priceless.

Home Charging: A Must for Convenience

While public charging is great, nothing beats the convenience of a home charging station. Most EVs come with a Level 1 charger (plugs into a regular outlet), but it’s slow—only about 4 miles of range per hour.

A Level 2 charger (240 volts) can fully charge your car overnight and gives you about 25 miles of range per hour. Installation usually costs $500–$1,000, but remember—utilities like FPL offer rebates to help cover it.

Example: You install a Level 2 charger for $800. FPL gives you a $500 rebate. Your net cost: $300. Over five years, that’s less than $60 per year—and you’ll save thousands on gas.

Common Pitfalls and How to Avoid Them

Even with all the perks, there are a few traps that can trip up new EV owners. Let’s talk about how to avoid them.

1. Missing the EV Decal Deadline

The EV decal (for HOV lanes) is free, but you have to request it during registration. If you forget, you’ll need to go back to the DMV or mail in a form. Save yourself the hassle—ask for it upfront.

2. Underestimating the Surcharge

The $134.50 surcharge isn’t optional, and it’s not always clearly explained. Budget for it when you’re comparing EVs. It’s not a dealbreaker, but it’s part of the total cost.

3. Assuming All Charging Stations Are Free

Many public chargers are free, but some—especially fast chargers—charge by the minute or by kWh. Always check the rate before plugging in. Apps like PlugShare usually show pricing info.

4. Not Checking Tax Credit Eligibility

Just because a car is electric doesn’t mean it qualifies for the $7,500 federal credit. Check the IRS list before you buy. And remember: The credit is non-refundable, so if you don’t owe that much in taxes, you won’t get the full amount.

5. Skipping the VIN Inspection (If Needed)

If you’re registering a used EV from out of state, you might need a VIN inspection. Don’t skip it—it’s required by law, and it only takes a few minutes.

Data Table: Florida EV Registration Costs (2024)

| Fee | Amount | Notes |

|---|---|---|

| Registration | $225 | Varies slightly by county |

| Sales Tax | 6% + local surcharge (0.5–1%) | Based on purchase price |

| Title | $75.25 | One-time fee |

| Plate | $28 | Standard plate |

| EV Surcharge | $134.50/year | Annual fee |

Final Thoughts: Your EV Journey Starts Here

Look, registering your electric car in Florida isn’t rocket science. But it’s not *quite* the same as registering a gas car either. From the EV surcharge to the HOV lane decal, there are little details that make all the difference.

The good news? Once you’re set up, life gets a whole lot easier. No more gas station runs. Lower maintenance costs. And the quiet hum of an electric motor—seriously, it’s addictive.

So whether you’re a first-time EV owner or upgrading to a newer model, take the time to understand the Florida electric car registration process. Do your research, ask questions, and don’t be afraid to lean on your dealer or DMV for help. After all, you’re not just buying a car—you’re joining a movement.

And hey, when you’re zipping past traffic in the HOV lane, charging up at a free station, or saving $1,000 a year on fuel, you’ll know it was all worth it. Welcome to the future of driving—Florida style.

Frequently Asked Questions

How do I register an electric car in Florida for the first time?

To register an electric car in Florida, visit your local DMV office with proof of ownership, a valid ID, proof of insurance, and payment for fees. Unlike gas-powered vehicles, EVs are exempt from emissions testing but still require standard registration steps.

Is there a special Florida electric car registration fee?

Yes, Florida charges a $225 additional fee for electric vehicles during registration, known as the “EV surcharge,” to offset lost gas tax revenue. This fee applies to all EVs, regardless of model or battery range.

Do I need emissions testing for my electric car in Florida?

No, Florida law exempts electric cars from emissions testing since they produce zero tailpipe emissions. This is one advantage of Florida electric car registration compared to traditional vehicles.

Can I renew my electric car registration online in Florida?

Yes, you can renew your EV registration online via the Florida Highway Safety and Motor Vehicles (FLHSMV) portal. Ensure your insurance is up-to-date and pay the annual renewal fee plus the $225 EV surcharge.

What documents are needed to transfer an out-of-state electric car to Florida?

Bring your out-of-state title, bill of sale, valid ID, proof of Florida insurance, and a completed Application for Certificate of Title (HSMV 82040). The same $225 EV surcharge applies during transfer.

Are there tax incentives for registering an electric car in Florida?

While Florida doesn’t offer state tax credits for EV purchases, you may qualify for federal tax incentives (up to $7,500). Check IRS guidelines and ensure your EV meets eligibility requirements.