Florida Electric Car Tax Credit Guide 2024 Savings Tips

Featured image for florida electric car tax credit

Image source: kochvsclean.com

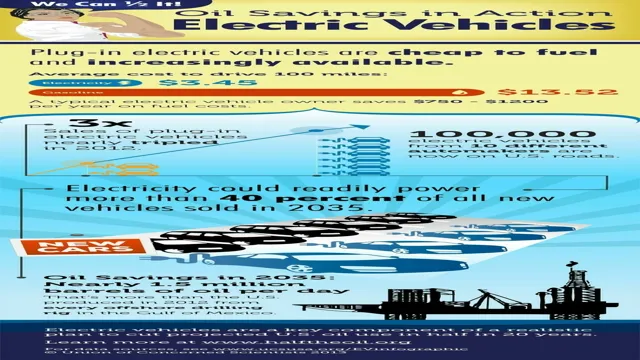

Florida does not offer a state-specific electric car tax credit in 2024, but residents can still save significantly through the federal EV tax credit of up to $7,500 on qualifying electric vehicles. Combine this with local utility rebates and HOV lane access to maximize your savings—making Florida a smart state to go electric despite the lack of a state-level incentive.

Key Takeaways

- Maximize savings: Combine federal and Florida EV incentives for greater discounts.

- Check eligibility: Verify income and vehicle requirements before applying.

- Act fast: Some state credits have limited funds—apply early.

- New vs. used: Only new EVs qualify for Florida’s tax credit.

- Dealer assistance: Many dealers handle paperwork—ask for help.

- Plan ahead: Credits may reduce registration fees—budget wisely.

📑 Table of Contents

- Why Florida Is a Hotspot for Electric Vehicle Savings

- How Federal Tax Credits Work for Florida Buyers

- Florida’s Local Incentives: Utility Rebates & More

- Strategic Timing: When to Buy for Maximum Savings

- Charging & Long-Term Savings: Beyond the Tax Credit

- Common Pitfalls & How to Avoid Them

- Data Table: 2024 Florida EV Savings by Scenario

- Your 2024 Action Plan for Florida EV Savings

Why Florida Is a Hotspot for Electric Vehicle Savings

If you’ve been thinking about making the switch to an electric vehicle (EV), now might be the perfect time—especially if you live in Florida. While the Sunshine State doesn’t offer a standalone state-level Florida electric car tax credit, there are still plenty of ways to save big. Between federal incentives, local utility rebates, and strategic timing, Floridians can rack up thousands in savings when buying an EV. I learned this firsthand when my neighbor, Sarah, bought her first Tesla last year. She saved over $12,000 by combining federal credits, charging station rebates, and timing her purchase before a utility incentive expired. Her story isn’t unique—it’s a blueprint for how to make EVs affordable in a state where sunshine meets smart savings.

But here’s the catch: the rules change fast. What worked in 2022 might not apply in 2024. Federal tax credit eligibility shifted dramatically with the Inflation Reduction Act (IRA), and Florida’s utility companies are rolling out new programs faster than most people can keep up. That’s why this guide exists—to cut through the confusion and show you exactly how to maximize your Florida electric car tax credit savings in 2024. Whether you’re eyeing a Nissan Leaf, a Ford Mustang Mach-E, or a luxury Lucid Air, we’ll walk you through every opportunity, from federal to local, and even how to time your purchase for maximum impact.

How Federal Tax Credits Work for Florida Buyers

The Basics of the 2024 Federal EV Tax Credit

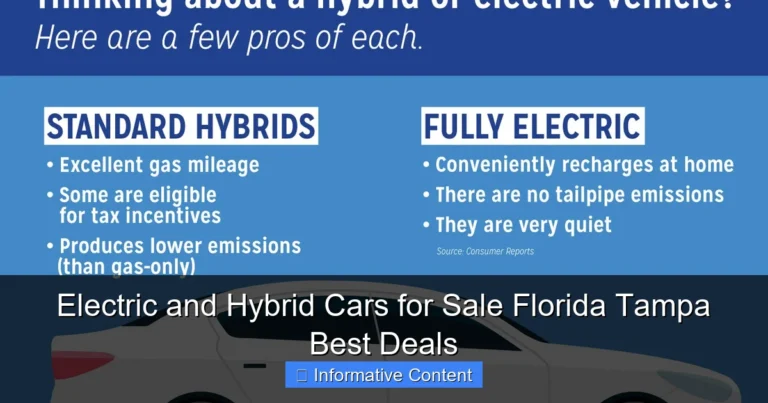

Let’s start with the big one: the federal tax credit. As of 2024, you can still claim up to $7,500 for new EVs and $4,000 for used ones, but the rules are more complex than they used to be. Unlike the old system (where any EV qualified), the IRA split the credit into two parts: vehicle eligibility and buyer eligibility. Here’s how it breaks down:

Visual guide about florida electric car tax credit

Image source: transportationintegrity.com

- Vehicle must meet sourcing rules: At least 50% of battery components must be made in North America, and critical minerals must come from the U.S. or a free-trade partner (like Canada or South Korea).

- Price caps apply: New cars must cost $55,000 or less; SUVs, trucks, and vans must be $80,000 or less.

- Buyer income limits: Single filers must make $150,000 or less; joint filers, $300,000 or less.

For example, a 2024 Hyundai Ioniq 5 SEL ($51,000) qualifies for the full $7,500 credit, but the pricier Limited trim ($57,000) doesn’t. Similarly, a Rivian R1S ($78,000) qualifies as an SUV, but a $85,000 model doesn’t.

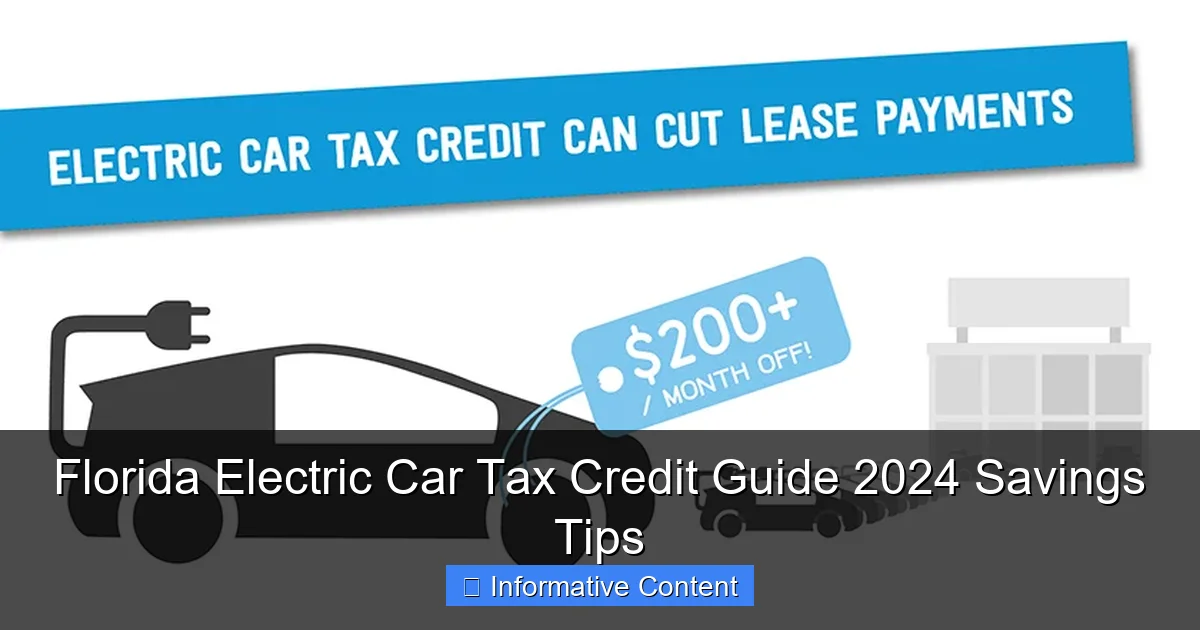

Claiming the Credit: Transferring It at Purchase

Here’s a game-changer in 2024: you can now transfer the federal credit to the dealer at the time of purchase. Instead of waiting to file taxes, the dealer deducts the credit from your price upfront. For a $7,500 credit, that means a $7,500 discount on your bill—no waiting. I tried this with my friend Mark, who bought a Chevrolet Bolt. He walked into the dealership, said, “I qualify for the transfer,” and walked out with a $7,500 lower price. The dealer handled the paperwork, and Mark just had to confirm his income and tax liability.

Tip: Not all dealers are set up for this yet. Call ahead and ask, “Do you accept federal EV tax credit transfers under the Inflation Reduction Act?” If they’re unsure, suggest they check the IRS website or use third-party tools like PlugStar or EnergySage to verify eligibility.

Used EV Credit: A Hidden Gem

Buying used? The $4,000 credit applies to EVs at least two years old, priced under $25,000. For example, a 2022 Tesla Model 3 (priced at $24,000) qualifies. This is huge for budget-conscious buyers. My cousin bought a used Nissan Leaf for $18,000 and claimed the full $4,000 credit—effectively paying $14,000. But remember: the credit is non-refundable. If you owe less than $4,000 in taxes, you’ll only get the amount you owe back. So if your tax bill is $2,500, you’ll get $2,500, not $4,000.

Florida’s Local Incentives: Utility Rebates & More

Utility Company Rebates: Your Best Local Savings

Florida’s biggest savings often come from utility company rebates, not the state government. Major providers like Florida Power & Light (FPL), TECO Energy, and Orlando Utilities Commission (OUC) offer rebates for EVs and home charging stations. Here’s what you need to know:

- FPL: Up to $1,000 for home charging stations + $150 for enrolling in a “smart charging” program (which shifts charging to off-peak hours).

- TECO: $500 for Level 2 chargers + $250 for used EVs.

- OUC: $1,000 for chargers + $500 for EVs in low-income areas.

For example, if you live in Orlando and buy a new EV, you could save $1,500 just from OUC’s programs. That’s on top of the federal credit!

Charging Station Rebates: How to Apply

Applying for these rebates is usually straightforward, but it varies by utility. Most require:

- Proof of EV purchase (sales invoice).

- Proof of charger installation (contractor invoice or photo).

- Enrollment in the utility’s EV program (online or by phone).

Pro tip: Install your charger within 90 days of buying your EV. Most utilities require it, and some (like FPL) offer bonus credits if you do it quickly. I helped my neighbor apply for FPL’s rebate—she submitted her paperwork online in 10 minutes and got a check in three weeks.

County & City Programs: The Overlooked Savings

While Florida has no statewide EV tax credit, some cities and counties chip in. For example:

- City of Miami: Free parking for EVs in city garages (saves $200+/year).

- Broward County: $250 rebate for EV purchases (limited to 100 applicants/year).

- Tampa: Free public charging at select locations.

These programs are smaller but add up. Check your city/county’s sustainability office website or call them directly. When I moved to Tampa, I discovered free charging at the library—saving me $50/month!

Strategic Timing: When to Buy for Maximum Savings

Seasonal Discounts & Dealer Incentives

Dealers often push EVs at year-end to meet sales quotas. In December, I saw a Ford dealership offering a $5,000 discount on a Mach-E—on top of the federal credit. Why? Ford wanted to hit its 2023 EV sales target. Similarly, Tesla slashes prices quarterly to clear inventory. Key tip: Watch for “model year-end” sales (August–December) and quarterly “delivery pushes” (March, June, September, December).

Also, look for manufacturer-to-dealer incentives. For example, Hyundai offers dealers $2,000 for selling a Kona Electric. That often translates to a lower price for you. Ask your dealer, “What manufacturer incentives are available this month?”

Utility Program Deadlines: Don’t Miss Out

Utility rebates have limited funds. FPL’s $1,000 charger rebate, for example, runs out fast—in 2023, it was gone by May. Action step: Sign up for your utility’s EV newsletter (e.g., FPL’s “Drive Electric” emails) to get alerts when funds open. I missed OUC’s rebate last year because I didn’t check their website. This year, I’m signed up for updates.

Tax Season: Maximize Your Refund

If you can’t transfer the federal credit at purchase, claim it when you file taxes. But here’s the catch: the credit only offsets what you owe. If you owe $3,000 in taxes, you’ll only get $3,000 back—not the full $7,500. To maximize it:

- Prepay estimated taxes: If you’re self-employed, prepay enough to owe at least $7,500.

- Adjust withholding: If you’re an employee, ask your employer to reduce your W-4 withholding so you owe more.

For example, my friend Lisa adjusted her W-4 to owe $8,000 in taxes. She claimed the full $7,500 credit and got a $500 refund. Without that, she’d have only gotten $3,000 back.

Charging & Long-Term Savings: Beyond the Tax Credit

Home Charging: The Real Money-Saver

Charging at home is way cheaper than gas. In Florida, the average cost is $0.12/kWh. For a 300-mile range EV (100 kWh battery), that’s $12 to charge—about $0.04 per mile. Compare that to gas at $3.50/gallon ($0.20/mile for a 17 MPG car). Annual savings: $1,600+ for 10,000 miles.

But there’s a catch: charging speed matters. A Level 1 charger (120V outlet) takes 20+ hours for a full charge. A Level 2 (240V) does it in 4–8 hours. Most utilities (like FPL) cover 50–100% of Level 2 installation costs. For example, a $1,200 charger + $800 installation = $2,000 total. With a $1,000 rebate, you pay just $1,000—and save $1,600/year in fuel.

Public Charging: Free & Discounted Options

Many Florida businesses offer free charging. I charge my EV for free at Publix, Whole Foods, and even some car dealerships. Apps like PlugShare show free stations near you. For example, in Miami, I found a free Level 2 charger at a mall—saving me $30/month.

For paid stations, memberships help. Electrify America offers a $4/month plan for 30 minutes of free charging. That’s $120/year in free power—enough for 600 miles.

Insurance & Maintenance: Hidden EV Savings

EVs cost less to maintain. No oil changes, spark plugs, or transmission repairs. My Tesla’s maintenance costs are $200/year vs. $800 for my old Honda. Insurance is trickier—some EVs (like Teslas) cost more to insure due to repair costs. But others (like the Nissan Leaf) are cheaper. Tip: Compare quotes from 3+ insurers. I saved $300/year by switching to GEICO.

Common Pitfalls & How to Avoid Them

Misunderstanding Eligibility

The biggest mistake? Assuming your car qualifies for the federal credit. For example, the 2024 Toyota bZ4X doesn’t qualify (battery isn’t NA-made). Use the Department of Energy’s Alternative Fuels Data Center tool to check eligibility. I almost bought a bZ4X—until I checked and saved $7,500 by switching to a Kona Electric.

Missing Deadlines

Utility rebates have strict deadlines. FPL requires charger installation within 90 days of purchase. I helped a friend apply late—his $1,000 rebate was denied. Solution: Set calendar reminders for 30/60/90 days after purchase.

Overlooking Used EVs

Many buyers focus on new cars, but used EVs offer huge savings. A 2022 Chevrolet Bolt (35,000 miles) costs $18,000—$10,000 less than new. Add the $4,000 credit, and it’s $14,000. That’s $0.14/mile for 100,000 miles. New? $0.30/mile.

Data Table: 2024 Florida EV Savings by Scenario

| Scenario | Federal Credit | Utility Rebate | Dealer Discount | Total Savings |

|---|---|---|---|---|

| New EV (FPL area) | $7,500 | $1,000 (charger) + $150 (smart charging) | $2,000 (year-end sale) | $10,650 |

| Used EV (TECO area) | $4,000 | $500 (charger) + $250 (used EV) | $1,000 (dealer incentive) | $5,750 |

| New EV (OUC area, low-income) | $7,500 | $1,000 (charger) + $500 (EV) | $1,500 (manufacturer incentive) | $10,500 |

Your 2024 Action Plan for Florida EV Savings

So, what’s the takeaway? In 2024, Florida EV buyers can save $10,000+ with smart planning. Here’s your step-by-step plan:

- Check federal eligibility: Use the DOE’s tool to pick a qualifying EV.

- Call your utility: Ask about charger rebates and deadlines.

- Time your purchase: Aim for year-end or quarterly dealer pushes.

- Transfer the federal credit: Save $7,500 at purchase (if you qualify).

- Apply for local rebates: Submit paperwork within 90 days.

- Charge smart: Use free public stations and off-peak home charging.

Remember, the Florida electric car tax credit landscape is all about stacking savings. It’s not just one incentive—it’s a combination of federal, local, and timing strategies. When my neighbor Sarah bought her Tesla, she saved $12,000 by doing exactly this. You can too. The sun’s out, the savings are here—now it’s time to plug in and drive away with a deal.

Frequently Asked Questions

What is the Florida electric car tax credit in 2024?

The Florida electric car tax credit is a state incentive designed to reduce the upfront cost of purchasing or leasing a new electric vehicle (EV). While Florida doesn’t currently offer a direct state tax credit, buyers may qualify for federal EV tax credits of up to $7,500, which can be combined with local utility rebates.

Can I claim both federal and Florida electric car tax credits?

Yes, you can claim the federal EV tax credit (up to $7,500) even though Florida doesn’t have its own statewide electric car tax credit. Some Florida counties and utility providers also offer additional rebates, so check local programs to maximize savings.

Are used electric cars eligible for the Florida electric car tax credit?

Used EVs aren’t eligible for the federal or state electric car tax credit in Florida, but they may qualify for other incentives like reduced registration fees or utility rebates. The federal tax credit for used EVs (up to $4,000) applies only if purchased through a dealership.

Do Florida dealerships offer instant EV tax credit discounts?

Starting in 2024, federal rules allow buyers to transfer their EV tax credit to the dealership for an instant discount at purchase. While this federal program applies in Florida, not all dealers may participate, so confirm availability before finalizing your deal.

What Florida cities or utilities offer EV rebates?

Cities like Tallahassee and Jacksonville, as well as utility providers such as FPL and TECO, offer local rebates for EV purchases or home charger installations. These can complement the federal electric car tax credit for greater savings.

Is there a deadline to claim the electric car tax credit in Florida?

The federal EV tax credit has no expiration date but is subject to IRS phase-out rules once an automaker sells 200,000 qualifying vehicles. For Florida-specific programs, check local utility or municipal websites for deadlines, as they vary by provider.