Florida Electric Car Tax Incentive What You Need to Know

Featured image for florida electric car tax incentive

Image source: motorbiscuit.com

Florida does not currently offer a state-level electric car tax incentive, but buyers can still benefit from the federal EV tax credit of up to $7,500 on qualifying vehicles. While state incentives like sales tax exemptions were proposed, they have not passed—yet local perks such as HOV lane access and utility rebates may still apply. Stay ahead by checking federal eligibility and monitoring Florida’s evolving EV policy landscape.

Key Takeaways

- No state tax credit: Florida does not offer a direct EV purchase tax credit.

- Federal credit available: Claim up to $7,500 via the federal EV tax incentive.

- HOV lane access: EV drivers can use carpool lanes regardless of passenger count.

- Charging perks: Some utilities offer rebates for home charger installations.

- Registration discounts: Certain counties provide reduced fees for electric vehicles.

- Future incentives possible: Monitor state legislation for new EV support programs.

📑 Table of Contents

- Why Florida’s Electric Car Tax Incentive Matters

- Understanding the Current Florida Electric Car Tax Incentive Landscape

- Federal Incentives You Can Stack with Florida’s Benefits

- Local Utility and Municipal Incentives in Florida

- Charging Infrastructure and Hidden Savings in Florida

- Future Outlook: What’s Coming for Florida EV Incentives?

- Putting It All Together: How to Maximize Your Savings

Why Florida’s Electric Car Tax Incentive Matters

Imagine this: You’re cruising down I-95 in your brand-new electric SUV, the sun shining, the A/C on blast, and the only sound is the quiet hum of the motor. No gas station stops, no oil changes, and—best of all—no surprise bills at the pump. But here’s the kicker: What if you could save even more money just for driving electric? That’s where the Florida electric car tax incentive comes in. While Florida isn’t known for the most aggressive green policies, the state has quietly rolled out a few key incentives that make going electric more appealing than ever.

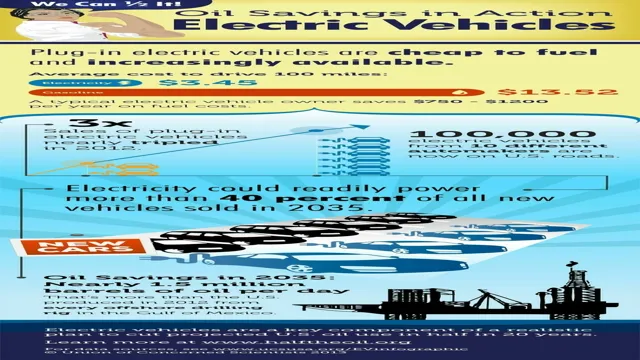

If you’ve been thinking about switching to an electric vehicle (EV), you’re not alone. EV sales in Florida have been rising steadily, with over 100,000 registered EVs in 2023—up nearly 40% from just two years prior. But unlike states like California or New York, Florida doesn’t offer a direct state tax credit for EV purchases. That doesn’t mean you’re out of luck, though. There are still plenty of ways to save—especially when you combine federal incentives, local utility programs, and smart tax strategies. In this guide, we’ll break down everything you need to know about the Florida electric car tax incentive landscape, so you can make an informed decision without getting lost in the fine print.

Understanding the Current Florida Electric Car Tax Incentive Landscape

No Direct State Tax Credit—But Don’t Panic

Let’s get one thing straight: Florida does not currently offer a direct state-level tax credit for purchasing a new or used electric car. That’s a bummer if you were hoping for a $2,000 check from the state like in some other regions. But don’t let that discourage you. The absence of a state tax credit doesn’t mean there are no savings. In fact, Florida’s approach is more about indirect incentives and infrastructure support than upfront cash.

Visual guide about florida electric car tax incentive

Image source: img.money.com

For example, Florida has one of the largest EV charging networks in the Southeast. The state has invested over $85 million in federal funds to expand charging stations along major highways and in urban areas like Miami, Tampa, and Orlando. This makes long-distance travel more feasible and reduces “range anxiety”—a common hesitation for first-time EV buyers. Think of it as the state investing in the ecosystem rather than the individual buyer.

Sales Tax Exemption for EVs (Yes, Really!)

Here’s a bright spot: Florida offers a 6% sales tax exemption on the purchase of new electric vehicles. That’s right—you don’t pay the usual 6% state sales tax on the vehicle price. This isn’t a tax credit you claim later; it’s applied at the point of sale. For a $50,000 EV, that’s an instant $3,000 savings. And yes, it applies to both battery electric vehicles (BEVs) and plug-in hybrids (PHEVs).

Example: Sarah from Jacksonville bought a Tesla Model Y for $52,000. At a 6% sales tax rate, she would have paid $3,120 in tax. Thanks to the exemption, she paid $0. That’s money she could put toward home charging equipment or a weekend getaway in the Keys.

Pro tip: This exemption only applies to new vehicles. Used EVs are still subject to sales tax unless you qualify under other programs (more on that later).

How This Compares to Other States

Compared to states with robust EV incentives—like California’s Clean Vehicle Rebate Project (CVRP) or Colorado’s $5,000 state tax credit—Florida’s offerings might seem modest. But when you factor in the federal incentives (which we’ll cover next), the total savings can still be substantial. And let’s be real: Florida’s year-round sunshine and lower cost of living make EV ownership even more practical. Less winter battery drain, lower electricity rates, and no state income tax? That’s a win-win.

Federal Incentives You Can Stack with Florida’s Benefits

The Federal Clean Vehicle Tax Credit (Up to $7,500)

Here’s where things get exciting. The federal government offers a tax credit of up to $7,500 for qualifying new electric vehicles under the Inflation Reduction Act (IRA). This isn’t a rebate or cash back—it’s a dollar-for-dollar reduction in your federal income tax bill. If you owe $10,000 in taxes and your EV qualifies for the full $7,500 credit, your tax bill drops to $2,500.

But—and this is a big “but”—not every EV qualifies. The credit has strict rules about:

- Vehicle price limits: $55,000 for cars, $80,000 for SUVs, trucks, and vans.

- Battery component sourcing: At least 50% of battery components must be made or assembled in North America (rising to 100% by 2029).

- Critical mineral sourcing: 40% of critical minerals (like lithium, cobalt) must come from the U.S. or a free-trade partner (increasing over time).

- Buyer income limits: $150,000 for single filers, $225,000 for heads of household, $300,000 for joint filers.

<

<

Example: Mark and Lisa (married, filing jointly) earn $280,000. They buy a 2024 Ford F-150 Lightning priced at $78,000. The truck meets battery and sourcing requirements. Since their income is under the $300k cap, they can claim the full $7,500 credit.

Used EV Tax Credit (Up to $4,000)

Good news for budget-conscious buyers: The IRA also created a used EV tax credit of up to $4,000. This applies to pre-owned electric vehicles that are at least two years old and priced at $25,000 or less. The buyer must have an income below $75,000 (single), $112,500 (head of household), or $150,000 (joint).

This is a game-changer for Floridians looking to go electric without breaking the bank. Used EVs like the Nissan Leaf or older Tesla models can now be even more affordable. Plus, you still get the 6% sales tax exemption on the new vehicle if you buy a used EV from a dealership that applies the exemption to qualifying used models (check with the dealer—some do).

How to Claim the Federal Credit

Claiming the federal EV tax credit is straightforward but requires attention to detail:

- Your dealer must provide IRS Form 15400 (“Clean Vehicle Credit”) at the time of purchase.

- You’ll file this form with your annual tax return (Form 1040).

- If your tax liability is less than the credit amount, you won’t get a refund for the difference. (The credit is non-refundable.)

- Starting in 2024, you may be able to assign the credit to your dealer at purchase, effectively lowering your out-of-pocket cost. This is called the “dealer transfer” option and is rolling out gradually.

Tip: Talk to your tax preparer early. They can help you confirm eligibility and ensure you don’t miss out.

Local Utility and Municipal Incentives in Florida

Utility Rebates: Free Money from Your Electric Company

Here’s a secret many people miss: Your local electric utility might offer rebates or discounts for EV owners. These programs vary by region but can add hundreds—or even thousands—of dollars in savings. Let’s look at a few key examples:

- Florida Power & Light (FPL): Offers a $1,000 rebate for installing a Level 2 home charger. You can also get a $200 rebate for purchasing a qualifying EV (new or used) and enrolling in a time-of-use rate plan.

- Orlando Utilities Commission (OUC): Provides a $750 rebate for home charger installation and a $150 annual credit for EV owners who charge during off-peak hours (overnight).

- Tampa Electric (TECO): Offers a $500 rebate for EV purchases and a $1,000 discount on home charger installations through approved vendors.

<

Example: Maria in Miami bought a Hyundai Ioniq 5 and applied for FPL’s $1,000 charger rebate. She also enrolled in the time-of-use plan, which cut her electricity bill by 15%. Total savings: $1,200 in the first year.

HOA and Apartment Charging Incentives

If you live in a condo or apartment, charging can be tricky. But Florida law is on your side. The Florida Energy and Climate Protection Act (FS 163.04) states that HOAs and landlords cannot unreasonably restrict EV charging installations. Many utilities also offer programs to help multi-family buildings install shared charging stations.

For example, FPL’s “Charge at Home” program partners with property managers to install Level 2 chargers in parking garages. Tenants can use them for a small monthly fee—sometimes as low as $20. Some complexes even offer free charging for the first year as a resident perk.

County and City Programs

A few Florida cities are stepping up with local incentives:

- Broward County: Offers a $500 rebate for EV purchases and free EV charging at county-owned facilities.

- City of St. Petersburg: Provides free parking for EVs in downtown garages during weekends.

- Pinellas County: Runs a “Green Fleet” program that offers grants for businesses to switch to electric delivery vehicles.

Pro tip: Check your city or county’s website for an “EV incentives” or “sustainability” page. These programs are often under-promoted but can make a big difference.

Charging Infrastructure and Hidden Savings in Florida

Public Charging: More Than You Think

Florida has over 1,500 public charging stations—more than any other Southeastern state. The Florida Department of Transportation (FDOT) is using federal funds to add 1,000 more by 2026, focusing on I-75, I-4, and I-95 corridors. Many of these are fast-charging (DCFC) stations, which can recharge an EV to 80% in 30 minutes.

Popular networks like Electrify America, EVgo, and ChargePoint have a strong presence in Florida. Some offer free charging for the first year with an EV purchase. For example, Tesla owners get free Supercharging on certain Model 3 and Model Y trims—perfect for road trips to the Everglades or the Gulf Coast.

Home Charging: The Real Money-Saver

The biggest savings come from charging at home. In Florida, the average residential electricity rate is around $0.14 per kWh. For a 300-mile-range EV with a 75 kWh battery, that’s about $10.50 to fully charge. Compare that to $50+ for gas at $3.50 per gallon.

And remember: Many utilities offer time-of-use (TOU) rates. If you charge between 10 p.m. and 6 a.m., your rate might drop to $0.08 per kWh. That cuts your charging cost to just $6.00. Over a year, that’s a $180 savings.

Example: David charges his Rivian R1T every night at 11 p.m. on TECO’s off-peak rate. He saves about $15 per month—$180 annually—compared to daytime charging.

Free Charging Perks

Many businesses in Florida offer free EV charging as a customer perk. You’ll find chargers at:

- Walmart, Target, and Costco parking lots

- Shopping malls (like The Mall at Millenia in Orlando)

- Restaurants and hotels (especially in tourist areas)

- Some dealerships (e.g., Tesla Superchargers near dealerships)

While not a tax incentive, free charging adds up. If you top off your battery while grocery shopping or grabbing lunch, you’re effectively getting paid to run errands.

Future Outlook: What’s Coming for Florida EV Incentives?

Potential State-Level Changes

Florida lawmakers have introduced several bills to expand EV incentives, though none have passed yet. In 2023, HB 1057 proposed a $2,000 state tax credit for new EVs and a $500 credit for home charger installations. While it didn’t make it to the governor’s desk, it shows growing interest in EV support.

With Florida’s population booming and climate concerns rising, we could see more action in the next few years. Advocacy groups like Southern Alliance for Clean Energy are pushing for a statewide EV rebate program similar to California’s. Keep an eye on the 2025 legislative session—it might be a turning point.

Federal Incentive Updates

The federal tax credit rules are evolving. Starting in 2024, the credit can be transferred to the dealer at purchase, meaning you’ll see the savings upfront instead of waiting for tax season. This could make EVs more accessible to lower-income buyers.

Also, the battery sourcing rules are tightening. By 2027, most EVs will need 80% of battery components and 80% of critical minerals from North America or trade partners. This could limit the number of qualifying vehicles but also encourage domestic manufacturing.

Charging Access for All

Florida is part of the federal NEVI (National Electric Vehicle Infrastructure) program, which aims to build a coast-to-coast charging network. Florida’s share of the $5 billion fund is $198 million—enough to install chargers every 50 miles along interstates. This will make EV ownership even more practical for rural and low-income communities.

Putting It All Together: How to Maximize Your Savings

So, how much can you really save with the Florida electric car tax incentive and related programs? Let’s do the math with a real-world example:

| Incentive | Amount | Notes |

|---|---|---|

| Federal Tax Credit (new EV) | $7,500 | For qualifying EVs under $55k (car) or $80k (SUV/truck) |

| Florida Sales Tax Exemption | $3,000 | 6% on a $50,000 EV |

| FPL Charger Rebate | $1,000 | For Level 2 home charger installation |

| OUC Off-Peak Credit | $150/year | Annual credit for time-of-use plan |

| Free Public Charging (estimated) | $300/year | Based on 10 free top-ups per year |

| Total First-Year Savings | $11,950 | Plus ongoing electricity and maintenance savings |

That’s nearly $12,000 in first-year savings—enough to cover a year of car payments or a dream vacation. And remember, EVs have lower maintenance costs (no oil changes, fewer moving parts) and often higher resale value.

Final tips:

- Check energy.gov for the latest incentive updates.

- Ask your dealer about federal credit eligibility before you buy.

- Apply for utility rebates within 90 days of purchase—don’t miss the deadline!

- Consider a used EV if you’re on a tight budget. The $4,000 federal credit helps.

Switching to an electric car in Florida isn’t just about saving money—it’s about joining a cleaner, quieter, and more sustainable future. With the right mix of incentives, you can go electric with confidence. The road ahead is bright (and electric).

Frequently Asked Questions

What is the Florida electric car tax incentive?

The Florida electric car tax incentive refers to state-level benefits, such as sales tax exemptions on EV purchases and reduced registration fees, designed to encourage adoption of electric vehicles. While Florida doesn’t offer direct rebates, these incentives can significantly lower upfront costs.

Who qualifies for the Florida EV tax incentive?

Any individual or business purchasing or leasing a new electric vehicle in Florida qualifies for the state’s sales tax exemption and reduced registration fees. The vehicle must be classified as a zero-emission EV and registered in Florida to receive the benefits.

Does Florida offer a tax credit for electric car charging stations?

As of now, Florida does not provide a state tax credit for residential or commercial EV charging station installations. However, federal tax credits (up to 30% of installation costs) may still apply, so check current federal guidelines.

How does the Florida electric car tax incentive compare to federal incentives?

Florida’s incentive focuses on sales tax exemptions and registration discounts, while federal incentives offer a tax credit of up to $7,500 for qualifying EVs. Both can be combined to maximize savings on your electric vehicle purchase.

Are used electric cars eligible for the Florida tax incentive?

No, Florida’s sales tax exemption and reduced registration fees apply only to new electric vehicles. Used EVs are not currently eligible for state-level incentives, though federal tax credits may still apply under certain conditions.

Is there a deadline to claim the Florida electric car tax incentive?

Florida’s EV incentives, including the sales tax exemption, are ongoing with no announced expiration date. However, policies may change, so it’s wise to verify current rules with the Florida Department of Highway Safety and Motor Vehicles.