Florida Incentives and Tax Credits for Hybrid and Electric Cars Explained

Featured image for florida incentives and tax credits for hybrid and electric cars

Image source: carscoops.com

Florida offers no state income tax and additional incentives for hybrid and electric vehicle buyers, making it one of the most EV-friendly states in the U.S. Residents can benefit from sales tax exemptions on new EV purchases and rebates through local utility programs, significantly reducing upfront costs and boosting long-term savings.

Key Takeaways

- Federal tax credits up to $7,500 may apply to eligible EVs.

- Florida sales tax exemption saves 6% on new EV purchases.

- HOV lane access granted for solo EV drivers with permit.

- Utility rebates available for home charging station installations.

- No state EV fee yet—unlike many other U.S. states.

- Local incentives may include free parking or reduced tolls.

📑 Table of Contents

- Why Florida Is a Great Place for Electric and Hybrid Car Owners

- Federal Tax Credits: The Biggest Bang for Your Buck

- Florida State Incentives: What’s Actually Available?

- Charging Infrastructure and Incentives in Florida

- Long-Term Savings: Beyond Tax Credits and Rebates

- Real-Life Stories: How Floridians Are Saving

- Summary Table: Key Florida Incentives at a Glance

- Final Thoughts: Is It Worth It in Florida?

Why Florida Is a Great Place for Electric and Hybrid Car Owners

Imagine driving down a sunny Florida highway, the breeze in your hair, the engine nearly silent, and the fuel gauge barely moving. That’s the magic of driving a hybrid or electric vehicle (EV) in the Sunshine State. With rising gas prices, growing environmental awareness, and a push toward sustainable living, more Floridians are making the switch. But what really sweetens the deal? Florida incentives and tax credits for hybrid and electric cars. While the state isn’t the most aggressive in offering rebates like California or New York, it still provides meaningful perks that make going green both practical and affordable.

Whether you’re a first-time EV buyer, a budget-conscious commuter, or a tech-savvy eco-warrior, this guide is your go-to resource. We’ll explore everything from state-specific benefits to federal tax credits, charging infrastructure, and real-life examples of how Floridians are saving money. No hype, no fluff—just honest, practical advice to help you decide if an electric or hybrid car is right for you in Florida.

Federal Tax Credits: The Biggest Bang for Your Buck

Let’s start with the elephant in the room: the federal tax credit for electric vehicles. This is the largest financial incentive available to EV buyers, and it’s not exclusive to Florida—any U.S. resident can benefit. But understanding the rules is key, because not every EV qualifies, and the credit amount varies.

Visual guide about florida incentives and tax credits for hybrid and electric cars

Image source: carrebate.net

How the Federal EV Tax Credit Works

The federal government offers a tax credit of up to $7,500 for new qualifying electric vehicles and up to $4,000 for certain used EVs (purchased after 2022). Unlike a rebate, this is a non-refundable tax credit, meaning it reduces the amount of federal income tax you owe. If you owe $5,000 in taxes and claim a $7,500 credit, your tax bill drops to $0, but you won’t get the extra $2,500 back.

To qualify, the vehicle must meet several criteria:

- Be new (for the $7,500 credit) or used (for the $4,000 credit)

- Be purchased for use primarily in the U.S.

- Have a battery capacity of at least 7 kilowatt-hours

- Be assembled in North America

- Have a manufacturer’s suggested retail price (MSRP) under $80,000 for vans, SUVs, and trucks, or under $55,000 for other vehicles

As of 2024, the list of qualifying vehicles includes models like the Tesla Model 3, Ford F-150 Lightning, Chevrolet Bolt EV, and Hyundai Ioniq 5. However, brands like Tesla and General Motors have already hit the sales cap and no longer qualify for the full credit due to the 200,000-vehicle phaseout rule. Always check the fueleconomy.gov website for the latest list.

Used EV Tax Credit: A Hidden Gem

Many people overlook the used EV tax credit, but it’s a game-changer for budget-conscious buyers. If you buy a used EV priced at $25,000 or less, you may qualify for a credit of up to $4,000—or 30% of the sale price, whichever is less. The vehicle must be at least two years old, have a battery capacity of at least 7 kWh, and be purchased from a licensed dealer (private sales don’t qualify).

Example: Sarah from Tampa bought a 2021 Nissan Leaf for $22,000. She received a $4,000 tax credit (30% of $22,000 is $6,600, but the cap is $4,000). She only owed $3,200 in federal taxes that year, so the credit wiped out her entire tax bill and saved her $800 in future taxes.

Tips to Maximize Your Federal Credit

- Time your purchase: The credit is claimed in the tax year you buy the car. If you’re close to retirement or expect a lower income, consider buying when you’ll owe more in taxes.

- Check MSRP carefully: Some trims of otherwise qualifying EVs exceed the $55,000 limit. A loaded Model 3 Performance might not qualify, while a base model does.

- Talk to your dealer: Some manufacturers now offer “pass-through” credits at the point of sale. This means you get the $7,500 discount upfront instead of waiting for tax season. Tesla and Ford are among those offering this.

Florida State Incentives: What’s Actually Available?

Here’s where things get a little tricky. Unlike states like California, which offer direct rebates and free charging, Florida doesn’t have a statewide rebate program for EVs. But that doesn’t mean there are no state-level perks. In fact, Florida offers several indirect but valuable incentives that make EV ownership more appealing.

Sales Tax Exemption on Electric Vehicle Charging Equipment

One of the most useful Florida incentives is the exemption from state sales tax on electric vehicle charging equipment and installation services. If you buy a Level 2 home charger (typically $500–$1,000), you won’t pay the 6% Florida sales tax. This can save you $30–$60, and it applies to both residential and commercial installations.

Tip: Keep your receipt and invoice. While most retailers automatically apply the exemption, it’s good to confirm. Some installers may not be aware of the rule, so it helps to mention it upfront.

HOV Lane Access for EVs

Florida allows electric and certain hybrid vehicles to use High Occupancy Vehicle (HOV) lanes, even with only one person in the car. This is a huge perk in cities like Miami, Orlando, and Tampa, where rush hour traffic can be brutal. To qualify, your vehicle must have a special “Clean Fuel” decal from the Florida Department of Highway Safety and Motor Vehicles (FLHSMV).

As of 2024, eligible vehicles include:

- All battery electric vehicles (BEVs)

- Plug-in hybrid electric vehicles (PHEVs) with an EPA-estimated all-electric range of at least 20 miles

- Hydrogen fuel cell vehicles

You can apply for the decal online through the FLHSMV website. It’s free, and it’s valid for five years. Just make sure your vehicle is on the approved list—older hybrids like the Toyota Prius (non-plug-in) don’t qualify.

Utility Company Rebates: Local Savings You Might Miss

While Florida doesn’t offer a state rebate, many local utility companies do. These are often overlooked but can save you hundreds. For example:

- Florida Power & Light (FPL): Offers a $1,000 rebate for installing a Level 2 charger at home. You must enroll in their “Charge Ready” program and use an approved charger and installer.

- Orlando Utilities Commission (OUC): Provides up to $750 for home charger installation and offers discounted electricity rates during off-peak hours (11 p.m.–7 a.m.).

- Tampa Electric (TECO): Offers a $500 rebate for EV charger installation and a special EV rate plan that can cut your electricity bill by 30%.

Real-life example: Carlos in Orlando bought a 2023 Hyundai Kona Electric. He applied for the OUC rebate, got $750 off his charger, and switched to the EV rate plan. His monthly electricity cost for charging dropped from $40 to $28.

Charging Infrastructure and Incentives in Florida

One of the biggest concerns for EV buyers is charging. “Will I run out of juice on I-4?” “Can I charge at work?” “Is it expensive?” Florida has made significant progress in building a reliable charging network, and several incentives support both public and private charging.

Public Charging: Fast, Growing, and Often Free

Florida has over 2,500 public charging stations, with more than 500 fast-charging (DC fast) locations. Major corridors like I-4, I-75, I-95, and I-10 are well-covered. Many are free or low-cost, especially at shopping centers, hotels, and municipal buildings.

- Walmart and Target: Offer free Level 2 charging at many Florida locations.

- EVgo and Electrify America: Provide fast charging at malls, rest areas, and gas stations. Some offer free charging for first-time users or during promotions.

- City programs: Cities like St. Petersburg and Fort Lauderdale offer free public charging at city-owned lots.

Tip: Use apps like PlugShare or ChargePoint to find nearby chargers, check availability, and read user reviews. Always carry a portable Level 1 charger (included with most EVs) as a backup.

Home Charging Incentives: Save on Installation and Electricity

Home charging is the most convenient and cheapest way to power your EV. Florida’s utility rebates (mentioned earlier) help offset the cost of installing a Level 2 charger (240-volt). But there’s more:

- Time-of-Use (TOU) Rates: Many utilities offer special EV rate plans. Charge at night (off-peak), and you’ll pay as little as 6–8 cents per kWh—less than half the daytime rate.

- Solar + EV Combo: If you have solar panels, charging your EV during the day can make your system even more cost-effective. Some solar providers offer bundled discounts for EV buyers.

Example: Maria in Naples installed solar panels and a Level 2 charger. Her utility gave her a $500 rebate. She now charges her Tesla Model Y using solar power and pays almost nothing for electricity.

Workplace and Apartment Charging

More employers and apartment complexes are adding EV chargers. Some even offer incentives:

- Orlando International Airport: Free charging for employees and travelers.

- Google and Disney: Provide free or discounted charging for staff.

- Florida Apartment Association: Offers grants to help multifamily properties install chargers.

If your workplace or apartment doesn’t have chargers, consider asking. Many property managers are willing to install them, especially with utility incentives available.

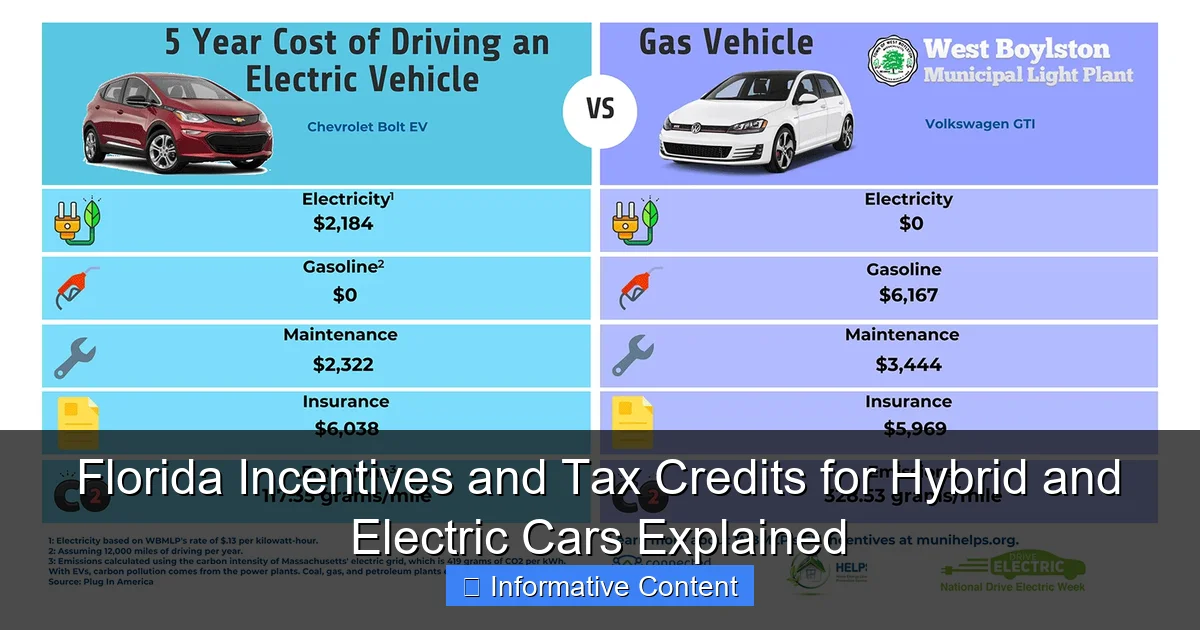

Long-Term Savings: Beyond Tax Credits and Rebates

Tax credits and rebates are great, but the real savings come from long-term ownership costs. EVs and hybrids are often cheaper to maintain, insure, and fuel than gas-powered cars—especially in Florida’s sunny, flat terrain.

Lower Maintenance Costs

Electric cars have fewer moving parts. No oil changes, spark plugs, or exhaust systems. Brake wear is also reduced thanks to regenerative braking. According to Consumer Reports, EV owners spend 50% less on maintenance over the life of the vehicle.

Example: John in Jacksonville owns a 2020 Chevrolet Bolt. He’s driven 40,000 miles and only paid for tire rotations and cabin air filters. No engine repairs, no transmission issues.

Fuel Savings: The Sunshine State Advantage

Florida has some of the lowest electricity rates in the U.S. (around 14 cents/kWh on average). Charging a 60 kWh battery costs about $8.40—equivalent to $1.50 per gallon in a gas car. For a 20,000-mile annual driver, that’s $1,600–$2,000 saved per year compared to gas.

Plus, with free public charging and off-peak rates, savings can be even greater.

Insurance and Registration

EV insurance can be slightly higher due to battery replacement costs, but it’s not a dealbreaker. Shop around—companies like GEICO and Progressive offer EV discounts. Also, Florida doesn’t charge extra registration fees for EVs, unlike some states (e.g., Georgia charges $200 annually).

Real-Life Stories: How Floridians Are Saving

Let’s bring this to life with real examples from people across Florida who’ve made the switch.

The Commuter: Miami to Fort Lauderdale

Ana drives 45 miles round-trip daily. She bought a 2023 Toyota Prius Prime (a plug-in hybrid) for $32,000. She qualified for the $4,500 federal tax credit (PHEVs under 20 miles all-electric range get partial credit). Her utility, FPL, gave her a $1,000 rebate for her home charger. She now saves $180/month on gas and uses HOV lanes to shave 20 minutes off her commute.

The Retiree: Naples, FL

Bob and Linda, both 68, downsized to a Tesla Model 3. They bought it used for $30,000 and claimed the $4,000 used EV tax credit. They installed solar panels and charge for free. Their annual fuel and maintenance savings? Over $3,000.

The Family: Orlando Suburbs

The Patel family has two kids and drives 15,000 miles a year. They leased a Kia Niro EV. The lease included a $7,500 federal credit (passed through by the dealer). They got $750 from OUC for their charger and charge at night at 7 cents/kWh. Their total “fuel” cost: under $300/year.

Summary Table: Key Florida Incentives at a Glance

| Incentive | Amount | Eligibility | How to Claim |

|---|---|---|---|

| Federal New EV Tax Credit | Up to $7,500 | New EVs under $55K MSRP, assembled in North America | File IRS Form 8936 |

| Federal Used EV Tax Credit | Up to $4,000 | Used EVs ≥2 years old, ≤$25K, from dealer | File IRS Form 8936 |

| FL Sales Tax Exemption (Charging Equipment) | 6% savings | All EV charging equipment and installation | Ask retailer to apply exemption |

| HOV Lane Access | Free | BEVs, PHEVs with ≥20 mi electric range | Apply for Clean Fuel decal at FLHSMV |

| FPL Charge Ready Rebate | $1,000 | FPL customers, approved charger/installer | Apply via FPL website |

| OUC EV Charger Rebate | Up to $750 | OUC customers, Level 2 charger | Submit application online |

Final Thoughts: Is It Worth It in Florida?

So, are Florida incentives and tax credits for hybrid and electric cars enough to make the switch? The answer is a resounding “yes”—if you do your homework. While Florida doesn’t offer a flashy rebate program, the combination of federal tax credits, utility rebates, HOV lane access, and long-term savings makes EV ownership smart and affordable.

The key is to layer the incentives. Claim the federal credit, apply for utility rebates, use free public charging, and charge during off-peak hours. Add in lower maintenance and fuel costs, and you could save thousands over the life of your vehicle.

And remember: Florida’s charging network is growing fast. With solar power, smart rate plans, and community support, the future is electric—and it’s already here. Whether you’re driving a Tesla, a Prius, or a Kia EV6, the Sunshine State is ready to power your journey.

So, next time you see a silent EV gliding down I-75, don’t just admire it. Think about the savings, the convenience, and the cleaner air. That could be you—saving money, time, and the planet, one mile at a time.

Frequently Asked Questions

What Florida incentives and tax credits are available for hybrid and electric cars?

Florida offers several incentives, including sales tax exemptions on new EV purchases and reduced registration fees for hybrid and electric vehicles. Some local utilities also provide rebates for home charging equipment.

Are there federal tax credits for electric cars in Florida?

Yes, Florida residents qualify for the federal EV tax credit (up to $7,500 for new EVs and $4,000 for used EVs), which can be combined with state-level incentives. Check the IRS guidelines to confirm eligibility.

Does Florida offer charging station rebates for EV owners?

While Florida doesn’t have a statewide program, many local utilities (like FPL and TECO) provide rebates for installing Level 2 chargers at homes or businesses. Incentives vary by provider.

Is there a HOV lane access incentive for electric vehicles in Florida?

Yes, Florida allows hybrid and electric car owners to apply for a decal to use HOV lanes, even with a single occupant. This perk aims to encourage EV adoption.

Do Florida incentives for hybrid and electric cars apply to leased vehicles?

Sales tax exemptions apply to leased EVs, but other incentives (like utility rebates) may require ownership. Check with your leasing company and local programs for specifics.

Are there property tax benefits for EV charging stations in Florida?

Florida offers a property tax exemption for the added value of EV charging infrastructure in commercial buildings. Residential properties may qualify for local incentives.