Florida Rebate for Electric Cars Save Big on Your EV Purchase Today

Featured image for florida rebate for electric cars

Image source: carrebate.net

Florida offers generous rebates of up to $2,000 for electric car purchases, making it the perfect time to save big on your EV. These incentives, combined with federal tax credits, significantly reduce upfront costs and accelerate your switch to clean, cost-effective transportation. Act now—limited funding means rebates are available on a first-come, first-served basis.

Key Takeaways

- Act now: Florida offers limited-time rebates for EV buyers—apply before funds run out.

- Save up to $2,000: Qualify for state rebates on new or used electric cars.

- Check eligibility: Income and vehicle price caps apply—verify before purchasing.

- Combine incentives: Stack state rebates with federal tax credits for maximum savings.

- Charging perks: Some utilities offer rebates on home EV charger installations.

- Hurry deadlines: Rebates are processed first-come, first-served—submit paperwork promptly.

📑 Table of Contents

- Why Florida Is Rolling Out the Green Carpet for EV Buyers

- Understanding the Florida Rebate for Electric Cars: What’s Available?

- How to Qualify for the Florida Rebate for Electric Cars (Step-by-Step)

- Beyond the Rebate: Other Florida EV Perks You Should Know

- Real People, Real Savings: Case Studies from Florida EV Owners

- Maximizing Your Savings: Pro Tips and Pitfalls to Avoid

- Your EV Journey Starts Now—And It’s More Affordable Than Ever

Why Florida Is Rolling Out the Green Carpet for EV Buyers

Picture this: You’re driving down a sun-drenched stretch of I-95 in your brand-new electric vehicle (EV), the AC blasting, the engine whisper-quiet, and your wallet feeling a little heavier than it did a few months ago. That’s not a fantasy—it could be your reality. Thanks to a mix of state and federal incentives, including the Florida rebate for electric cars, going electric in the Sunshine State has never been more affordable. Whether you’re a first-time EV buyer or upgrading from a gas guzzler, Florida is making a strong case for switching to cleaner, more efficient transportation.

But let’s be real—navigating rebates, tax credits, and incentives can feel like reading a foreign language. You’ve probably heard about federal tax credits, maybe even a few local deals, but what about the actual Florida rebate for electric cars? Is it real? How much can you save? And more importantly—how do you actually get it? In this guide, I’m going to walk you through everything you need to know in plain, simple terms. Think of it as your friendly neighbor who just bought an EV, sharing the real scoop on what’s available, what’s worth your time, and how to make the most of every dollar.

Understanding the Florida Rebate for Electric Cars: What’s Available?

Let’s start with the big question: Does Florida have its own state-level rebate for electric cars? The short answer: Not exactly. Unlike California or Colorado, Florida doesn’t currently offer a direct, standalone state rebate program for EV purchases. But don’t let that discourage you—because the real savings come from a powerful combination of federal tax credits, utility company rebates, and local incentives that are very much alive and kicking in the Sunshine State.

Visual guide about florida rebate for electric cars

Image source: carrebate.net

Federal Tax Credit: The Big Kahuna

The most significant financial boost for EV buyers in Florida (and the U.S.) is the federal clean vehicle tax credit, worth up to $7,500. This isn’t a rebate you get at the dealership—it’s a tax credit you claim when you file your federal income taxes. But here’s the good news: if you’re buying a new EV, you can now transfer this credit directly to the dealer at the point of sale (thanks to the Inflation Reduction Act of 2022). That means you can get the $7,500 right off the purchase price, instead of waiting until tax season.

Eligibility requirements include:

- The EV must be new and purchased for personal use

- Your modified adjusted gross income (MAGI) must be under $150,000 (single), $225,000 (head of household), or $300,000 (married filing jointly)

- The vehicle must be assembled in North America

- It must meet battery component and critical mineral requirements (phased in over time)

For example, a 2023 or 2024 Chevrolet Bolt EUV qualifies for the full $7,500 credit. A Tesla Model 3 made in Texas? Yes. A Nissan Leaf built in Tennessee? Also yes. But a Ford Mustang Mach-E made in Mexico? Unfortunately, no—at least not under current rules.

Utility Company Rebates: Hidden Gems in Florida

This is where things get exciting. While the state doesn’t offer a direct rebate, many Florida utility companies do. These are often overlooked but can save you hundreds—sometimes thousands—of dollars. These rebates are designed to encourage EV adoption and reduce strain on the grid during peak hours (like hot summer afternoons when everyone’s blasting the AC).

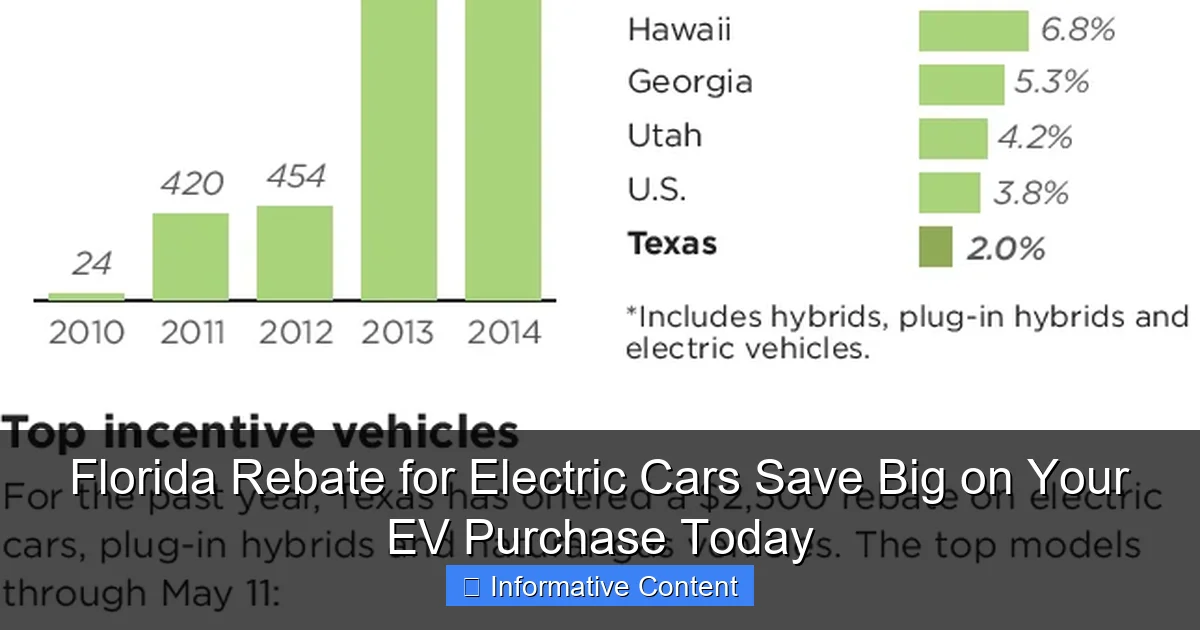

Here are a few standout programs:

- FPL (Florida Power & Light): Offers a $1,000 rebate for new EV purchases or leases through the “Drive Electric” program. You must be an FPL customer and apply within 90 days of purchase.

- TECO (Tampa Electric): Provides a $1,500 rebate for residential customers who buy or lease a new EV. They also offer a $500 rebate for home EV charger installations.

- JEA (Jacksonville): Offers a $1,000 rebate for new EVs and a $500 rebate for used EVs (2020 or newer).

- Orlando Utilities Commission (OUC): Gives a $1,000 rebate for new EVs and a $250 rebate for used EVs.

Pro tip: These rebates are often stackable with the federal tax credit. So if you buy a $40,000 EV in Tampa, you could get $7,500 (federal) + $1,500 (TECO) = $9,000 in total savings. That’s like paying $31,000 for a car that originally cost $40,000. Not bad, right?

Local Incentives: Check Your City or County

Some Florida cities and counties offer their own sweeteners. For example:

- City of Tallahassee: Offers a $500 rebate for EV purchases and a $300 rebate for EV charger installations.

- Broward County: While not a cash rebate, they’ve expanded EV charging infrastructure and offer free public charging at select locations.

- City of Miami: Has a “Green Mobility” initiative that includes reduced parking fees for EVs in certain zones.

The key here is to check with your local government and utility provider. These programs change often, and new ones pop up all the time. A quick Google search like “EV rebate [your city] Florida” can uncover hidden opportunities.

How to Qualify for the Florida Rebate for Electric Cars (Step-by-Step)

Now that you know what’s out there, let’s talk about how to actually get these rebates. It’s not always as simple as walking into a dealership and saying, “I want the discount.” You’ll need to do a little legwork—but trust me, it’s worth it.

Step 1: Confirm Federal Tax Credit Eligibility

Before you even step foot in a dealership, check if your dream EV qualifies for the federal credit. The U.S. Department of Energy maintains a list of eligible vehicles. Look for the “Final Assembly Location” and battery requirements. Also, verify your income eligibility. If you’re close to the limit, consider adjusting your W-4 withholdings or making a retirement contribution to lower your MAGI.

For example, if you’re a single filer earning $155,000, you’re technically over the limit. But if you contribute $5,000 to a traditional IRA before year-end, your taxable income drops to $150,000—and now you qualify. Smart money move.

Step 2: Apply for Utility Rebates (Before or After Purchase)

Most utility rebates require you to apply within 30 to 90 days of your purchase. Here’s how to do it:

- Visit your utility’s website (e.g., FPL.com, TECOenergy.com)

- Navigate to the “EV Rebate” or “Drive Electric” section

- Fill out the online form with your vehicle info, purchase date, and proof of ownership (like your sales contract or lease agreement)

- Upload required documents (usually a copy of your registration and utility bill)

- Wait 4–8 weeks for a check or direct deposit

One thing to note: Some utilities require you to install a Level 2 home charger to qualify. Others offer a separate rebate for the charger. So if you’re planning to charge at home, consider buying a 240-volt charger (like a ChargePoint Home Flex or Tesla Wall Connector). It’ll speed up charging and might save you another $500.

Step 3: Stack Incentives for Maximum Savings

This is where the magic happens. The Florida rebate for electric cars isn’t just one thing—it’s a combination of federal, utility, and local perks. Here’s a real-world example:

- You buy a 2024 Hyundai Ioniq 5 in Orlando for $48,000

- You qualify for the full $7,500 federal tax credit (transferable at purchase)

- OUC gives you a $1,000 rebate

- You install a home charger and get an additional $250 rebate from OUC

- Total savings: $8,750

- Effective price: $39,250

That’s a 18% discount—and you didn’t even have to haggle with the salesperson.

Step 4: Don’t Forget Used EVs

Yes, you can get rebates on used electric cars too! The federal tax credit for used EVs is $4,000, but it only applies to cars that cost $25,000 or less and are at least two model years old. Plus, some utilities (like JEA) offer their own used EV rebates. So if you’re on a budget, a 2020 Tesla Model 3 or a 2021 Chevrolet Bolt could be a great deal.

Beyond the Rebate: Other Florida EV Perks You Should Know

Rebates are great, but Florida offers other benefits that make EV ownership even sweeter. These aren’t cash in your pocket, but they add up in convenience, savings, and peace of mind.

HOV Lane Access (Yes, Really!)

In many parts of Florida, EVs can use High Occupancy Vehicle (HOV) lanes—even with just one person in the car. That’s a huge time-saver during rush hour. To qualify, you’ll need to apply for a special “Clean Air Vehicle” decal from the Florida Department of Highway Safety and Motor Vehicles (FLHSMV). It’s free, takes 10 minutes online, and lasts for five years.

Pro tip: This perk is especially valuable in South Florida (Miami-Dade, Broward, Palm Beach), where I-95 and I-75 can turn into parking lots at 8 a.m. Driving solo in the HOV lane can cut your commute by 20–30 minutes. Over a year, that’s like gaining back an entire workweek.

Reduced or Free Public Charging

While Florida doesn’t have a statewide free charging program, many cities and malls offer free Level 2 charging. For example:

- Miami’s Brickell City Centre has free EV charging

- Fort Lauderdale’s beach parking lots offer free charging for EVs

- Disney World and Universal Studios have free charging for guests

Even better, apps like PlugShare and ChargeHub let you filter for “free” stations. I’ve charged my EV for free at Publix, Whole Foods, and even a few car dealerships. It’s not much per session, but over time, it adds up.

Lower Registration Fees

Florida charges a higher registration fee for EVs—$225 instead of $100 for gas cars. Wait, that doesn’t sound like a perk! But here’s the twist: many people don’t realize this fee goes directly into the state’s transportation fund, which is used to build EV charging infrastructure and maintain roads. So while it’s a cost, it’s also an investment in a better EV ecosystem for everyone.

And hey, you’re still saving money on fuel and maintenance. The average EV driver in Florida saves about $600 per year on gas and $300 on maintenance (no oil changes, fewer brake jobs). So even with the higher registration, you’re still ahead.

Real People, Real Savings: Case Studies from Florida EV Owners

Let’s hear from real Floridians who’ve taken advantage of the Florida rebate for electric cars. These stories show how different people—with different budgets and needs—saved big by combining incentives.

Case Study 1: The Budget-Conscious Family (Tampa)

“We bought a used 2020 Chevrolet Bolt for $18,000. It was under the $25,000 limit, so we got the $4,000 federal used EV credit. TECO gave us $1,500 for the car and another $500 for installing a home charger. Total savings: $6,000. Now we’re paying $12,000 for a car that gets 259 miles per charge. We drive to Disney a lot, and we charge for free at their lots. It’s been a game-changer.” — Sarah M., mother of two

Case Study 2: The Commuter (Orlando)

“I drive 60 miles a day for work. I bought a 2023 Kia EV6 for $45,000. The federal credit knocked off $7,500, and OUC gave me $1,000. I also got the HOV lane decal, so my commute is now 20 minutes shorter. I charge at home with solar panels, so my electricity cost is basically zero. I’m saving about $1,200 a year on fuel alone.” — James L., IT consultant

Case Study 3: The Retiree (Miami)

“I wanted a small, easy-to-park EV for errands. I bought a new Mini Cooper SE for $32,000. It didn’t qualify for the full federal credit because of battery sourcing, but I still got $3,750. FPL gave me $1,000. And I charge for free at the mall. For a retired person on a fixed income, this was a smart move.” — Linda P., retiree

These stories show that whether you’re buying new or used, big or small, there’s a path to savings. The key is to do your homework and apply for every incentive you qualify for.

Maximizing Your Savings: Pro Tips and Pitfalls to Avoid

Now that you’re armed with info, let’s make sure you don’t leave money on the table—or make costly mistakes.

Tip 1: Apply Early and Often

Utility rebates often have limited funding and are awarded on a first-come, first-served basis. Apply as soon as you get your registration or lease agreement. Don’t wait until you’ve driven 5,000 miles. I know someone who missed out on a $1,000 rebate because they applied 95 days after purchase (the deadline was 90 days). Heartbreaking.

Tip 2: Keep All Your Paperwork

You’ll need:

- Sales contract or lease agreement

- Vehicle registration

- Utility bill (to prove residency)

- Proof of home charger installation (if applicable)

Scan everything and save it in a folder named “EV Rebates 2024.” You’ll thank yourself later.

Tip 3: Watch for Expiration Dates

Some rebates are only available for certain model years. For example, FPL’s $1,000 rebate applies only to EVs purchased between January 1, 2023, and December 31, 2024. After that, it might change. Always check the current terms.

Common Pitfall: Assuming You’re Ineligible

Many people skip the federal credit because they think “I make too much.” But remember: the income limits are based on your tax return, not your salary. If you’re close, talk to a tax pro about strategies to lower your MAGI. It could be worth $7,500.

Data Table: Florida EV Incentives at a Glance

| Incentive | Provider | Amount | Deadline | Notes |

|---|---|---|---|---|

| Federal Tax Credit (New) | IRS | Up to $7,500 | None (phasing out by 2032) | Transferable at purchase |

| Federal Tax Credit (Used) | IRS | Up to $4,000 | None | $25,000 price cap, 2+ years old |

| FPL Drive Electric Rebate | Florida Power & Light | $1,000 | 90 days after purchase | Must be FPL customer |

| TECO EV Rebate | Tampa Electric | $1,500 | 90 days after purchase | Includes $500 for home charger |

| JEA EV Rebate | Jacksonville Energy Authority | $1,000 (new), $500 (used) | 60 days after purchase | 2020 or newer for used EVs |

| HOV Lane Decal | FLHSMV | Free | None | Renew every 5 years |

Your EV Journey Starts Now—And It’s More Affordable Than Ever

So, is the Florida rebate for electric cars a myth? Not at all. It’s not a single program, but a powerful ecosystem of federal, utility, and local incentives that can save you thousands. Whether you’re buying new or used, big or small, there’s a way to make it work—especially if you’re willing to do a little research and apply early.

I’ll be honest: the process isn’t always smooth. Some websites are clunky. Some deadlines are tight. And yes, you’ll have to dig through a few forms. But think about it: if you save $8,000 on a $40,000 car, that’s like getting a free vacation. And once you’re in the driver’s seat, you’ll enjoy quieter rides, lower fuel costs, and the satisfaction of doing your part for the planet.

So what are you waiting for? Visit your utility’s website, check the federal EV list, and start dreaming about your next ride. The road to savings is paved with incentives—and it’s wide open in Florida. Drive on.

Frequently Asked Questions

What is the Florida rebate for electric cars?

The Florida rebate for electric cars is a state incentive program designed to reduce the upfront cost of purchasing or leasing qualifying new electric vehicles (EVs). It offers a partial refund or point-of-sale discount, helping drivers save thousands on eligible models.

How much can I save with the Florida EV rebate?

Rebate amounts vary by program but typically range from $1,000 to $2,500 for qualifying EVs, depending on battery size and income eligibility. Check the latest Florida rebate for electric cars guidelines to see current offers.

Which electric cars qualify for the Florida rebate?

Most new battery-electric vehicles (BEVs) and plug-in hybrids (PHEVs) with a minimum battery capacity (e.g., 4 kWh) qualify for the Florida rebate for electric cars. Vehicles must be purchased or leased through approved dealerships and meet state requirements.

Do I need to apply for the rebate, or is it automatic?

Depending on the program, the rebate may be applied instantly at the dealership (point-of-sale) or require a post-purchase application. Confirm with your dealer or the Florida Department of Environmental Protection to ensure you receive your EV savings.

Are there income limits for the Florida electric car rebate?

Yes, some Florida EV incentives have income caps—typically for individuals or households earning under $150,000 annually. Higher-income applicants may still qualify for partial rebates under certain programs.

Is the Florida EV rebate available for used electric cars?

As of now, most state rebates focus on new EV purchases, but limited programs may support used EVs. Always verify the latest Florida rebate for electric cars rules, as policies can update annually.