Florida Rebates for Electric Cars Save Big on Your Next EV

Featured image for florida rebates for electric cars

Image source: i0.wp.com

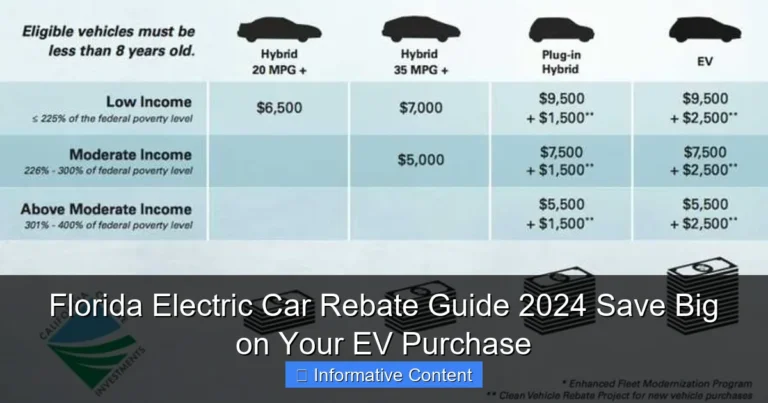

Florida offers generous rebates and incentives for electric car buyers, making it easier than ever to save thousands on your next EV purchase. From state tax credits to local utility rebates, residents can stack multiple programs to maximize savings—especially when combined with federal tax incentives. Don’t miss out on these limited-time opportunities to drive green and spend less.

Key Takeaways

- Check eligibility: Verify income and residency for Florida EV rebates before purchasing.

- Maximize savings: Combine state rebates with federal tax credits for greater discounts.

- Apply promptly: Submit rebate applications within 90 days of purchase to qualify.

- Prioritize new EVs: Only new electric vehicles qualify—used EVs are excluded.

- Review local incentives: Cities like Orlando offer extra rebates—research your area.

📑 Table of Contents

- Why Florida Is the Perfect Place to Go Electric

- Understanding the Current Landscape of Florida EV Incentives

- Federal Tax Credits: The Biggest Bang for Your Buck

- Local Utility Rebates: Hidden Gems in Florida

- Additional Ways to Save: Beyond the Big Rebates

- Real-World Savings: Case Studies from Florida EV Owners

- Tips to Maximize Your EV Savings in Florida

- The Bottom Line: Is Going Electric Worth It in Florida?

Why Florida Is the Perfect Place to Go Electric

Picture this: You’re cruising down I-95 in your new electric vehicle (EV), the sun shining, windows down, and the only sound is the hum of your engine. No gas station stops, no fumes, and best of all—no hefty fuel bills. Sounds like a dream, right? Well, in Florida, that dream is not only possible but also more affordable than you might think, thanks to Florida rebates for electric cars.

As gas prices continue to fluctuate and concerns about climate change grow, more Floridians are making the switch to EVs. The Sunshine State is not just a paradise for retirees and vacationers—it’s becoming a hotspot for sustainable transportation. While Florida doesn’t offer a statewide rebate program like some other states, there are still plenty of ways to save big on your next electric car. From federal incentives to local utility rebates and tax credits, the savings are real—and they’re waiting for you.

Understanding the Current Landscape of Florida EV Incentives

Let’s be honest: navigating rebates and incentives can feel like trying to solve a puzzle with half the pieces missing. But don’t worry—we’ve got you covered. Florida may not have a direct state-level rebate for EVs, but the picture is far from bleak. In fact, it’s quite the opposite.

Visual guide about florida rebates for electric cars

Image source: thumbs.dreamstime.com

No Statewide Rebate? No Problem

Unlike states like California or New York, Florida doesn’t have a direct cash rebate for EV purchases. But that doesn’t mean you’re missing out. Instead, the state takes a different approach—one that relies heavily on federal programs, utility company incentives, and tax benefits. This “stackable” model allows you to combine multiple savings sources, potentially knocking thousands off your purchase price.

Think of it like a savings buffet: you don’t have to pick just one. You can grab a plate and pile on the deals. For example, you might qualify for the federal tax credit, a local utility rebate, and even a discount on home charging equipment—all at the same time.

Why Florida’s Approach Makes Sense

Florida’s strategy focuses on long-term sustainability and infrastructure development. Instead of offering a one-time rebate, the state is investing in EV charging networks, public awareness campaigns, and partnerships with utility providers. This ensures that the transition to electric mobility is smooth, accessible, and scalable.

Plus, Florida’s mild climate is ideal for EVs. Unlike colder regions where battery performance can drop in winter, Florida’s warm weather helps maintain battery efficiency year-round. That means you get more range, fewer charging stops, and better overall performance.

Tip: If you’re considering an EV, start by checking your eligibility for federal incentives and then explore local utility programs. You might be surprised by how much you can save—even without a state rebate.

Federal Tax Credits: The Biggest Bang for Your Buck

Let’s talk about the elephant in the room: the federal EV tax credit. This is hands down the most valuable incentive available to Florida drivers—and it could save you up to $7,500.

How the Federal Tax Credit Works

As of 2024, the federal government offers a tax credit of up to $7,500 for new qualifying EVs and $4,000 for used EVs (purchased for $25,000 or less). The key word here is credit—this isn’t a rebate you get at the dealership. Instead, it reduces the amount of income tax you owe when you file your return.

For example, if you owe $10,000 in federal taxes and qualify for the full $7,500 credit, you’ll only pay $2,500. If your tax liability is less than the credit amount, the remainder is not refundable (though there are changes coming in 2024—more on that later).

Qualifying Vehicles and Manufacturer Limits

Not every EV qualifies. The credit applies only to vehicles that meet strict battery sourcing and manufacturing requirements. As of 2024, eligible models include:

- Chevrolet Bolt EV/EUV ($7,500 credit)

- Ford F-150 Lightning ($7,500)

- Tesla Model 3 and Model Y (varies by trim; check IRS list)

- Lucid Air (limited trims)

- Kia EV6 ($7,500)

Important: The credit phases out once a manufacturer sells 200,000 qualifying EVs. Tesla and GM have already passed this threshold, but new rules now allow their vehicles to qualify again under updated sourcing criteria. Always check the IRS website for the latest list.

New 2024 Rule: Point-of-Sale Transfer

Here’s some exciting news: starting in 2024, the federal credit can be transferred at the point of sale. That means instead of waiting until tax season, you can apply the $7,500 credit directly at the dealership—reducing your out-of-pocket cost immediately.

Example: You buy a $45,000 EV. The dealership applies the $7,500 credit, so your loan or payment is based on $37,500. You still claim the credit on your taxes, but the upfront savings make the purchase much more affordable.

Tip: Not all dealerships are set up for this yet, so ask in advance if they participate in the point-of-sale transfer program.

Local Utility Rebates: Hidden Gems in Florida

While the federal credit is the headline act, local utility companies across Florida are offering their own Florida rebates for electric cars. These programs are often overlooked—but they can save you hundreds, sometimes even thousands.

Major Utility Programs to Explore

Here’s a breakdown of some of the most generous utility incentives in the state:

| Utility Provider | Rebate Amount | Eligible Vehicles | Additional Perks |

|---|---|---|---|

| Florida Power & Light (FPL) | Up to $1,000 | New EVs (BEV/PHEV) | Free home charging station (limited time) |

| Tampa Electric (TECO) | $1,000 | New EVs only | Time-of-use (TOU) rate plan for lower charging costs |

| Orlando Utilities Commission (OUC) | $1,500 | New EVs | Free Level 2 charger + installation |

| JEA (Jacksonville) | $1,000 | New EVs | Discounted EV rate plan |

| Gulf Power (now part of FPL) | $1,000 | New EVs | EV education workshops |

Note: Rebates are typically one-time payments, and funds are limited. Some programs run out fast, so apply early. Also, most require you to be a customer of that utility for at least 12 months.

How to Apply and What You Need

Applying is usually straightforward. Most utilities require:

- Proof of EV purchase (invoice or VIN)

- Copy of your utility bill

- Completed rebate form (available online)

- Photos of the vehicle and charging setup (for charger rebates)

Processing takes 4–8 weeks. Some utilities mail a check; others apply the amount as a credit on your bill.

Tip: If you’re buying from a dealership, ask if they handle the rebate application for you. Some do—saving you time and hassle.

Bonus: Charging Incentives and TOU Rates

Beyond vehicle rebates, many utilities offer free or discounted Level 2 chargers and special time-of-use (TOU) rate plans. These plans let you charge your EV at off-peak hours (like late night), when electricity is cheaper.

For example, TECO’s TOU plan can cut your charging cost by up to 50%. If you charge 20 kWh per day, that’s about $0.10/kWh off-peak vs. $0.20/kWh standard—saving you $365 per year.

Pro tip: Pair a TOU plan with a smart charger (like ChargePoint or JuiceBox), and you can schedule charging to run automatically during low-cost hours.

Additional Ways to Save: Beyond the Big Rebates

Think the savings stop at tax credits and utility rebates? Think again. There are several other ways to reduce your EV cost—some of which are unique to Florida.

HOA and Municipal Incentives

Some Florida cities and homeowners’ associations (HOAs) offer their own incentives. For example:

- City of Orlando: $500 rebate for EV purchases (in addition to OUC’s $1,500)

- Broward County: Free EV parking at county facilities

- Miami-Dade: Expedited permitting for home charger installation

Check your city or county website for local programs. Even small perks—like free parking or reduced registration fees—can add up over time.

Used EV Savings and Leasing Options

Buying a used EV can be a smart financial move. Not only are prices lower, but you may still qualify for the federal used EV tax credit ($4,000 for vehicles under $25,000). Plus, some utilities offer rebates for used EV purchases too—though less common.

Leasing is another option. Many automakers offer lease deals that include the federal credit as a “capitalized cost reduction,” lowering your monthly payment. For example, a $45,000 EV with a $7,500 credit might have a lease price based on $37,500—saving you $150–$200 per month.

Tip: Always compare lease vs. buy. Use an online calculator to see which option saves you more in the long run.

Insurance and Registration Discounts

Some insurers offer EV-specific discounts for safety features, lower accident rates, and eco-friendly driving. Companies like Geico, Progressive, and State Farm have programs that can save you 5–15% on premiums.

Also, Florida offers a one-time $200 tax credit for EV registration. This is small but still helpful—especially if you’re stacking other incentives.

Bonus: EVs are exempt from Florida’s emissions testing requirement, saving you time and stress every year.

Real-World Savings: Case Studies from Florida EV Owners

Enough with the theory—let’s look at real people saving real money with Florida rebates for electric cars.

Case Study 1: Maria in Miami (FPL Customer)

Maria bought a new Kia EV6 for $48,000. She qualified for:

- $7,500 federal tax credit (applied at dealership)

- $1,000 FPL rebate (check in mail)

- Free Level 2 charger from FPL

- TOU rate plan (saves $400/year)

Total savings: $8,500 upfront + $400/year in energy costs. Her effective purchase price: $39,500.

“I was nervous about the cost,” Maria says. “But with all the rebates, it felt like I was getting a luxury car at a compact car price.”

Case Study 2: James in Orlando (OUC Customer)

James leased a Tesla Model 3. His savings:

- $7,500 federal credit (applied to lease)

- $1,500 OUC rebate

- Free charger + installation ($1,200 value)

- City of Orlando $500 rebate

Total savings: $10,700 in first year. Monthly lease payment: $320 (vs. $470 without incentives).

“I drive 60 miles a day,” James says. “Now I spend $20 a month on electricity instead of $150 on gas. It’s a game-changer.”

Case Study 3: Linda in Jacksonville (JEA Customer)

Linda bought a used Chevrolet Bolt for $22,000. She received:

- $4,000 federal used EV credit

- $1,000 JEA rebate

- Discounted EV rate plan

Total savings: $5,000. Her effective cost: $17,000.

“I thought EVs were out of my budget,” Linda says. “But the used market and rebates made it totally doable.”

Takeaway: No matter your budget or location in Florida, there’s a path to savings. The key is stacking incentives and doing your research.

Tips to Maximize Your EV Savings in Florida

You’re ready to go electric—but how do you make sure you get every dollar of savings available? Here are our top tips.

1. Start with the IRS and Your Utility

Visit IRS.gov to confirm your vehicle qualifies for the federal credit. Then, visit your utility’s website and search for “EV rebate.” Most have dedicated pages with forms and FAQs.

2. Ask the Dealership

Many dealerships now have “EV specialists” who know all the incentives. Ask: “Can you help me apply for the federal point-of-sale credit and any local rebates?” A good dealer will handle the paperwork for you.

3. Time Your Purchase

Utility rebates often run out mid-year. Buy early in the year (January–March) to secure funding. Also, automakers sometimes offer extra incentives at year-end to clear inventory.

4. Consider a Smart Charger

A $500–$800 smart charger can save you hundreds over time by enabling off-peak charging and remote monitoring. Some utilities offer rebates for these too—so ask!

5. Stay Informed

Sign up for newsletters from your utility, the Florida Electric Vehicle Initiative, and EV forums. New programs pop up all the time—like Miami’s recent $1 million EV rebate fund.

6. Don’t Forget the Long-Term Savings

Even without rebates, EVs are cheaper to own. No oil changes, fewer brake jobs (regenerative braking), and lower fuel costs mean you’ll save $6,000–$10,000 over 5 years compared to a gas car.

Final tip: Keep all your paperwork—especially proof of purchase and rebate applications. You’ll need it for taxes and future resale.

The Bottom Line: Is Going Electric Worth It in Florida?

Absolutely. While Florida may not have a flashy state rebate program, the combination of federal tax credits, local utility rebates, and long-term savings makes buying an EV one of the smartest financial decisions you can make.

From Miami to Pensacola, Floridians are discovering that going electric isn’t just good for the planet—it’s great for their wallets. Whether you’re buying new, used, or leasing, there’s a rebate or incentive with your name on it.

So the next time you’re stuck in I-4 traffic, watching your gas gauge drop, imagine pulling into a charging station—knowing you’re saving money, helping the environment, and enjoying a quieter, smoother ride. That’s the power of Florida rebates for electric cars.

Don’t wait. The sun is shining, the roads are open, and your next EV is closer than you think.

Frequently Asked Questions

Are there Florida rebates for electric cars in 2024?

Yes, Florida offers several incentives for electric vehicle (EV) buyers, including sales tax exemptions and local utility rebates. While there is no statewide cash rebate, programs like the Florida EV Charger Rebate help offset charging infrastructure costs.

How much can I save with Florida rebates for electric cars?

Savings vary by program, but you can save up to $1,000 on Level 2 chargers through utility rebates and avoid 6% sales tax on EV purchases. Additional savings may apply through federal tax credits, which stack with Florida incentives.

Does Florida offer free charging for electric cars?

Some Florida utilities, like FPL and TECO, provide free public charging at select stations for limited durations. Private charging is not free, but utility rebates can reduce home charger installation costs.

Can I get a tax credit for buying an EV in Florida?

Florida does not have a state income tax, but you can claim the federal EV tax credit (up to $7,500). Florida also waives sales tax on EV purchases, saving thousands upfront.

Which Florida cities offer extra EV rebates?

Cities like Orlando, Tampa, and Miami offer local incentives, such as discounted parking or utility rebates for home chargers. Check with your municipal utility for specific programs.

Are used electric cars eligible for Florida rebates?

Most Florida rebates focus on new EVs, but the federal tax credit includes used EVs (up to $4,000). Some utilities may extend charger rebates to used EV owners—verify eligibility before purchasing.