Ford and Electric Car Manufacturer Battle for EV Supremacy

Featured image for ford and electric car manufacturer

Image source: evearly.news

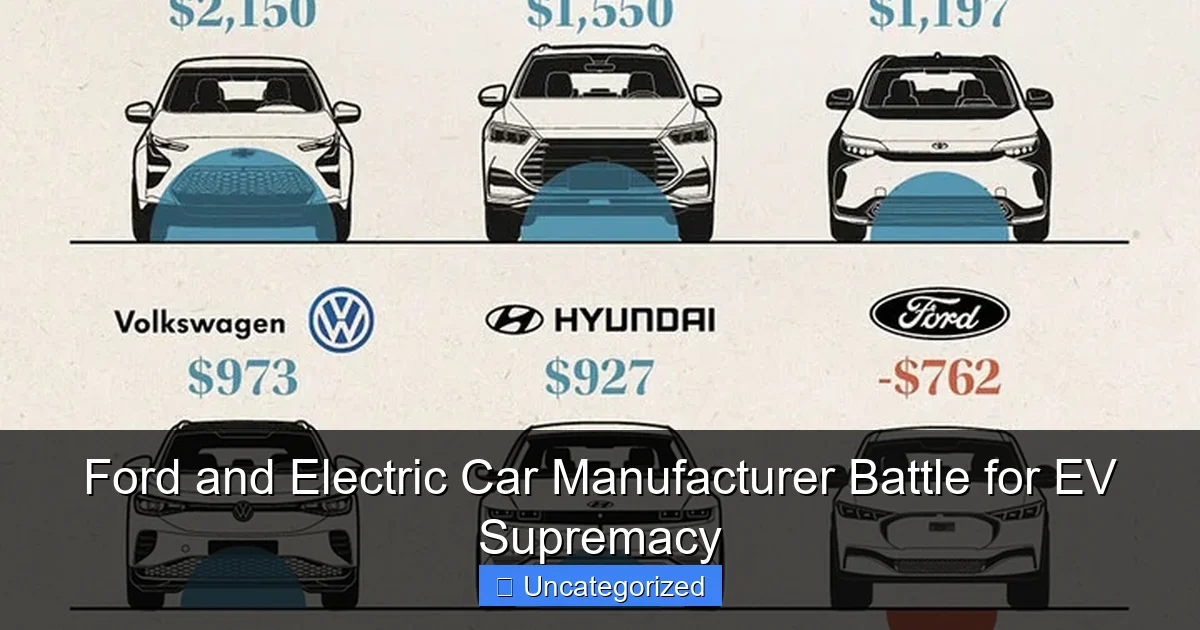

Ford and electric car manufacturer Tesla are locked in an intense battle for EV supremacy, reshaping the future of transportation. With Ford ramping up production of its F-150 Lightning and Mustang Mach-E to challenge Tesla’s dominance, the rivalry is accelerating innovation, cutting prices, and expanding charging networks. This high-stakes competition is driving the entire EV market forward, giving consumers more powerful, affordable, and accessible electric vehicles than ever before.

Key Takeaways

- Ford scales production: Invest in EV factories to meet rising demand.

- Rivian leads innovation: Prioritize R&D for cutting-edge EV technology.

- Charging networks matter: Expand infrastructure to boost consumer confidence.

- Pricing strategies differ: Ford targets affordability; rivals focus on premium.

- Partnerships drive growth: Collaborate with battery makers for supply security.

- Brand loyalty shifts: Legacy automakers must prove EV credibility fast.

📑 Table of Contents

- The Race to Electrify: Ford and Electric Car Manufacturer Battle for EV Supremacy

- Ford’s Electrification Strategy: From F-150 to the Future

- Electric Car Manufacturers: The Disruptors Redefining the Game

- Comparing Battery Tech and Range: The Heart of the EV War

- Sales Models and Consumer Experience: Franchise vs. Direct

- The Future: Autonomous Driving, Software, and Global Expansion

- Conclusion: Who Will Win the EV Supremacy Battle?

The Race to Electrify: Ford and Electric Car Manufacturer Battle for EV Supremacy

The automotive industry is undergoing a seismic shift, with electric vehicles (EVs) at the epicenter of this transformation. Once dominated by internal combustion engines, the market is now witnessing a fierce battle between legacy automakers and agile EV-focused manufacturers. At the heart of this rivalry is Ford, an iconic American brand with over a century of manufacturing prowess, going head-to-head with electric car manufacturers like Tesla, Rivian, and Lucid—companies that were born in the electric era. This showdown isn’t just about technology; it’s about brand legacy, consumer trust, supply chain mastery, and the future of mobility.

As climate concerns intensify and governments worldwide push for net-zero emissions, automakers are racing to deliver affordable, long-range, and reliable EVs. Ford, with its storied history and vast dealership network, is betting big on electrification through its “Ford+” strategy. Meanwhile, pure-play electric car manufacturers are leveraging cutting-edge battery tech, direct-to-consumer sales models, and software-driven innovation to capture market share. The stakes are high: the winner of this EV supremacy battle will not only dominate sales but also shape the infrastructure, consumer expectations, and regulatory landscape for years to come. This blog post dives deep into the strategies, challenges, and innovations that define the Ford vs. electric car manufacturer rivalry.

Ford’s Electrification Strategy: From F-150 to the Future

Ford’s journey into the electric vehicle space is both ambitious and strategic. Unlike startups that began with EVs, Ford had to pivot from a century of gasoline-powered vehicles. The company’s approach is multifaceted, combining legacy strengths with bold new investments in electrification.

Visual guide about ford and electric car manufacturer

Image source: notebookcheck.net

The Ford+ Plan: A $50 Billion Commitment

At the core of Ford’s EV strategy is the Ford+ plan, a $50 billion investment through 2026 aimed at accelerating electric vehicle development. This includes:

- $30 billion dedicated to EV development, including battery research and manufacturing.

- Establishing BlueOval SK, a joint venture with SK Innovation to build three battery plants in the U.S., creating 129 GWh of annual capacity by 2025.

- Expanding the Ford Ion Park, a global battery R&D center focused on next-gen lithium-ion and solid-state technologies.

This scale of investment reflects Ford’s determination to not just participate in the EV market but to lead it. By vertically integrating battery production, Ford aims to reduce dependency on third-party suppliers and stabilize costs—a critical factor in achieving profitability in the EV space.

Flagship EVs: Mustang Mach-E, F-150 Lightning, and E-Transit

Ford’s EV lineup is built around its most iconic nameplates, ensuring instant brand recognition. The Mustang Mach-E, launched in 2021, is a direct challenge to Tesla’s Model Y. With a starting price of $42,895 (before incentives), up to 314 miles of range, and a performance-focused GT variant, the Mach-E has captured over 25,000 U.S. sales in its first year.

Even more impactful is the F-150 Lightning, an all-electric version of America’s best-selling vehicle. With a starting MSRP of $49,995 and a targeted range of 230–320 miles, the Lightning appeals to both commercial fleets and individual buyers. Ford received over 200,000 reservations within a week of its unveiling, signaling strong demand. The Lightning also features innovative tech like Intelligent Backup Power, which allows the truck to power a home during outages—a feature no electric car manufacturer has matched at scale.

Rounding out the lineup is the E-Transit, Ford’s electric van for commercial customers. With 126 miles of range and a $47,185 starting price, it’s already being used by Amazon, Walmart, and UPS for last-mile delivery, showcasing Ford’s B2B EV strength.

Charging Infrastructure and Software Integration

Ford is investing heavily in charging solutions. Through its FordPass Charging Network, customers gain access to over 19,500 charging stations across North America, including partnerships with Electrify America and ChargePoint. The company also offers a Ford Connected Charge Station for home installation, complete with Wi-Fi and app-based scheduling.

Software is another key differentiator. The Ford Sync infotainment system now integrates EV-specific features like battery preconditioning, route planning with charging stops, and real-time energy usage analytics. Ford is also rolling out over-the-air (OTA) updates, a feature long championed by Tesla but now being adopted by legacy automakers.

Electric Car Manufacturers: The Disruptors Redefining the Game

While Ford leverages its legacy, electric car manufacturers like Tesla, Rivian, and Lucid operate with a clean slate—no baggage of combustion engine infrastructure, no dealership networks to maintain, and a laser focus on innovation. These companies are not just selling cars; they’re selling a vision of the future.

Tesla: The Undisputed Pioneer

Founded in 2003, Tesla remains the benchmark for EV performance, technology, and brand loyalty. The Model 3 and Model Y dominate global EV sales, with the Model Y becoming the world’s best-selling vehicle in 2023 (not just EV). Tesla’s advantages include:

- Gigafactories in Nevada, Shanghai, Berlin, and Texas, enabling massive scale.

- The Supercharger Network, with over 50,000 global chargers offering fast, reliable charging.

- Full Self-Driving (FSD) software, despite regulatory hurdles, which Tesla continues to refine through AI and real-world data.

However, Tesla’s direct-sales model has faced legal challenges in states like Texas and New Mexico, where dealership laws restrict manufacturer-owned stores. This is a key vulnerability Ford doesn’t face, thanks to its 3,000+ franchised dealerships.

Rivian: The Adventure EV Specialist

Rivian, backed by Amazon and Ford (though Ford sold its stake in 2023), targets the adventure and outdoor enthusiast market. The R1T pickup and R1S SUV feature:

- Up to 400 miles of range (with the Max Pack).

- Advanced off-road capabilities like Quad-Motor AWD and Adaptive Air Suspension.

- Unique features like the Gear Tunnel, a storage compartment between the cab and bed.

Rivian’s B2B play is also strong: Amazon has ordered 100,000 electric delivery vans, with 10,000 already in service. However, Rivian faces production challenges, delivering only 57,232 vehicles in 2023 against a target of 65,000.

Lucid: Luxury and Efficiency Redefined

Lucid Motors, led by former Tesla engineer Peter Rawlinson, focuses on ultra-premium EVs. The Lucid Air sedan boasts:

- Up to 516 miles of range (Air Grand Touring), the highest of any production EV.

- 900-volt architecture for ultra-fast charging (0–80% in 21 minutes).

- Luxury interiors with 5K displays and noise-canceling tech.

Lucid’s strategy is to compete on efficiency and refinement, but its high price (starting at $77,400) limits mass-market appeal. The company delivered 6,001 vehicles in 2023, far below Tesla or Ford’s output.

Comparing Battery Tech and Range: The Heart of the EV War

Battery technology is the linchpin of EV performance, affecting range, charging speed, cost, and environmental impact. Here’s how Ford and electric car manufacturers stack up.

Battery Chemistry and Energy Density

Ford primarily uses NMC (Nickel Manganese Cobalt) batteries in the Mach-E and Lightning, offering a balance of energy density and thermal stability. For future models, Ford is transitioning to LFP (Lithium Iron Phosphate) batteries in lower-trim vehicles (e.g., standard-range Lightning) to reduce cobalt use and lower costs. LFP batteries are also safer and longer-lasting, though they offer slightly less range.

Electric car manufacturers are more aggressive:

- Tesla uses NMC in premium models (Model S/X) and LFP in Model 3/Y, with plans for a 4680 battery cell offering 16% more range and 5x energy density.

- Rivian employs NMC with a unique module-less design, reducing weight and increasing efficiency.

- Lucid uses a proprietary 900-volt system with advanced thermal management, enabling ultra-fast charging without degradation.

Real-World Range and Charging Speed

Range anxiety remains a top concern for consumers. Here’s a comparison of EPA-estimated ranges and charging capabilities:

| Vehicle | Manufacturer | Max EPA Range (miles) | Fast Charging (10–80%) | Home Charging (0–100%) |

|---|---|---|---|---|

| F-150 Lightning (Extended Range) | Ford | 320 | 41 min (150 kW) | 10.5 hours (11.5 kW Level 2) |

| Mustang Mach-E (Extended Range) | Ford | 314 | 45 min (150 kW) | 11 hours (11.5 kW Level 2) |

| Model Y Long Range | Tesla | 330 | 25 min (250 kW) | 8 hours (11.5 kW Level 2) |

| R1T (Max Pack) | Rivian | 400 | 30 min (220 kW) | 12 hours (11.5 kW Level 2) |

| Lucid Air Grand Touring | Lucid | 516 | 21 min (300 kW) | 9 hours (19.2 kW Level 2) |

Tip for buyers: Always check real-world range via sources like Consumer Reports or Edmunds, as EPA estimates can vary by 10–15% in cold weather or highway driving.

Sustainability and Recycling

Both Ford and electric car manufacturers are investing in battery recycling. Ford’s Redwood Materials partnership aims to recycle 95% of battery materials by 2030. Tesla recycles over 92% of battery materials at its Nevada facility. Rivian and Lucid are developing closed-loop systems but lack the scale of Ford or Tesla.

Sales Models and Consumer Experience: Franchise vs. Direct

One of the most significant differences between Ford and electric car manufacturers is their sales approach—a factor that directly impacts customer experience, pricing, and market reach.

Ford’s Franchise Network: Strength and Stiffness

Ford’s 3,000+ franchised dealerships provide:

- Immediate access to test drives, service, and financing.

- Local expertise and community trust.

- Trade-in and financing options tailored to regional markets.

However, franchise laws in 48 U.S. states require automakers to sell through independent dealers, limiting Ford’s ability to control pricing and customer experience. This has led to price markups on high-demand EVs like the F-150 Lightning, with some dealers charging $10,000–$20,000 above MSRP. Ford has responded by launching the Ford EV Experience Centers in major cities, offering direct sales and transparent pricing.

Direct-to-Consumer: The Tesla Model

Electric car manufacturers like Tesla, Rivian, and Lucid bypass dealerships entirely, selling directly online or through company-owned stores. Benefits include:

- Fixed pricing with no haggling or markups.

- Seamless digital buying experience, from configuration to financing.

- Mobile service (e.g., Tesla’s “rangers” who service vehicles at your location).

But this model has downsides: limited physical locations (Tesla has ~250 stores in the U.S.), and no trade-in options for non-Tesla vehicles in some regions. Ford’s hybrid approach—leveraging dealerships while expanding direct sales—may offer the best of both worlds.

Customer Service and Reliability

Ford’s vast service network is a major advantage. A 2023 J.D. Power study found Ford EVs had 20% fewer reported issues than industry average. Tesla, despite its tech edge, ranked below average in reliability, with common complaints about build quality and service wait times.

The Future: Autonomous Driving, Software, and Global Expansion

The EV battle isn’t just about hardware—it’s about software, autonomy, and global reach.

Autonomous Driving: BlueCruise vs. FSD

Ford’s BlueCruise (a Level 2 system) offers hands-free driving on 130,000 miles of mapped highways. It’s reliable but not self-driving. Tesla’s Full Self-Driving (FSD) is more advanced but remains in beta and requires constant driver supervision. Rivian’s Driver+ and Lucid’s DreamDrive Pro are also Level 2, focusing on safety over autonomy.

Tip: Always treat semi-autonomous systems as driver-assist tools—never rely on them fully.

Software and OTA Updates

Ford now delivers OTA updates for features like battery optimization and infotainment improvements. Tesla leads here, with updates adding new games, Autopilot features, and even performance boosts. Rivian and Lucid are catching up, with Rivian adding Camp Mode (climate control for off-grid camping) via OTA.

Global Expansion: China and Europe

Ford is scaling EV production in Europe (Cologne, Germany) and China (Chongqing), but faces stiff competition from local brands like BYD and NIO. Tesla’s Shanghai Gigafactory produces 950,000 vehicles annually, while Rivian and Lucid are focusing on North America for now. Ford’s global footprint and supply chain resilience give it an edge in scaling quickly.

Conclusion: Who Will Win the EV Supremacy Battle?

The race for EV supremacy is far from over, but clear trends are emerging. Ford excels in scale, brand trust, and infrastructure, leveraging its century of manufacturing expertise to deliver reliable, affordable EVs with strong real-world performance. Its F-150 Lightning and E-Transit are reshaping commercial and personal mobility, while BlueOval SK ensures long-term battery independence.

Meanwhile, electric car manufacturers like Tesla, Rivian, and Lucid are pushing the boundaries of technology, software, and design. Tesla’s Supercharger network and FSD ambitions remain unmatched, while Rivian’s adventure focus and Lucid’s luxury efficiency carve unique niches.

Ultimately, the winner won’t be determined by one factor but by a blend of range, cost, software, service, and sustainability. Ford’s hybrid approach—combining legacy strengths with EV innovation—positions it as a formidable contender. But in a market that values disruption, the electric car manufacturers’ agility and tech-first mindset keep them in the lead. For consumers, this battle means more choices, better technology, and a cleaner future. One thing is certain: the road to electrification will be driven by competition, and we’re all along for the ride.

Frequently Asked Questions

What sets Ford apart from other electric car manufacturers in the EV market?

Ford stands out with its legacy of mass production, extensive dealership networks, and iconic models like the F-150 Lightning. Unlike newer electric car manufacturers, Ford combines decades of manufacturing expertise with aggressive electrification goals.

How does Ford’s electric vehicle lineup compare to leading electric car manufacturers?

Ford’s Mustang Mach-E and F-150 Lightning compete directly with Tesla and Rivian, offering competitive range, pricing, and towing capacity. While newer electric car manufacturers focus on tech, Ford emphasizes utility and brand trust.

What challenges does Ford face against pure-play electric car manufacturers?

Ford must balance its legacy ICE production with rapid EV adoption, while newer electric car manufacturers operate with fewer infrastructure constraints. However, Ford’s scale and supply chain give it a cost advantage.

Why is Ford investing so heavily in electric vehicle technology?

To stay competitive, Ford has committed $50 billion to EV development by 2026, aiming to produce 2 million EVs annually. This matches the ambitions of top electric car manufacturers and aligns with global emissions regulations.

Can Ford outperform Tesla in the electric car manufacturer race?

Ford’s truck and SUV focus gives it an edge in North America, but Tesla’s tech and charging network remain strong advantages. Success depends on Ford’s ability to innovate while leveraging its brand loyalty.

What role does Ford’s BlueOval charging network play in the EV battle?

Ford’s BlueOval network, with 84,000+ chargers, rivals Tesla’s Supercharger system, addressing a key concern for EV buyers. This infrastructure helps Ford compete directly with other electric car manufacturers on convenience.