Ford-CEO-Says-Customers-Arent-Ready-Electric-Cars – What It Means for EV Future

Featured image for ford-ceo-says-customers-arent-ready-electric-cars

Image source: static.foxbusiness.com

Ford’s CEO warns that mainstream customers aren’t ready for electric cars, citing affordability and infrastructure concerns as major adoption barriers. This signals a pivotal moment for the EV market, where consumer hesitation could delay industry-wide electrification despite aggressive automaker goals. The statement underscores the urgent need for lower prices, better charging access, and stronger incentives to drive mass-market EV adoption.

Key Takeaways

- Consumer hesitation persists: Many buyers still prefer gas cars over EVs despite automaker efforts.

- Infrastructure gaps matter: Charging access and speed remain top barriers to mass EV adoption.

- Affordability drives decisions: High EV prices deter mainstream customers despite long-term savings.

- Ford adapting strategy: Delaying EV production shows responsiveness to real-world market signals.

- Education is critical: Clearer messaging on EV benefits can shift consumer perceptions faster.

📑 Table of Contents

- The Electric Vehicle Hype Meets Reality: Ford CEO’s Stark Warning

- The CEO’s Statement: Decoding Ford’s Reality Check

- Why Customers Aren’t Ready: The 5 Key Barriers

- Ford’s Response: A Strategic Pivot

- The Bigger Picture: What This Means for the EV Industry

- Data Table: EV Adoption Metrics (2020-2023)

- The Road Ahead: Navigating the EV Transition

The Electric Vehicle Hype Meets Reality: Ford CEO’s Stark Warning

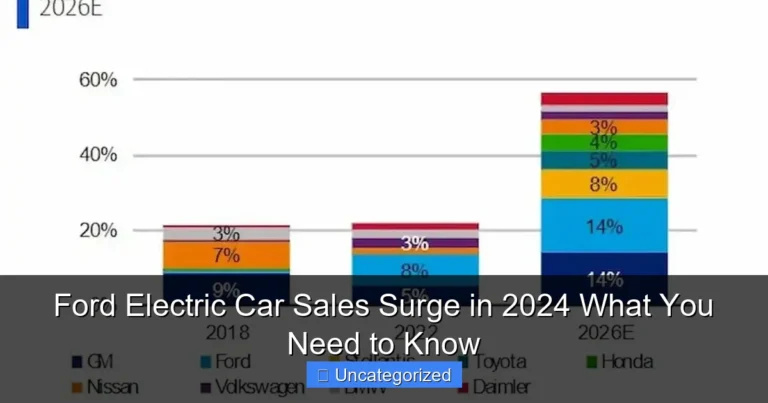

Jim Farley, CEO of Ford Motor Company, sent shockwaves through the automotive industry in late 2023 when he declared: “Customers aren’t ready for electric cars—not yet.” This statement, delivered during an investor call, seemed to contradict the relentless push by governments, manufacturers, and environmental advocates toward an all-electric future. Yet Farley’s candid assessment wasn’t a rejection of EVs; it was a wake-up call. After years of hyping battery-powered vehicles as the inevitable successor to gasoline engines, Ford’s leader acknowledged a painful truth: consumer adoption is lagging behind corporate ambitions. His remarks sparked debates about infrastructure, pricing, and the psychological barriers slowing the EV revolution.

Farley’s comments came amid a pivotal moment in the auto industry. While Tesla, Rivian, and legacy automakers have poured billions into EV development, sales growth has plateaued in key markets like the U.S. and Europe. Ford itself paused production of its F-150 Lightning pickup truck in 2024 due to softening demand. Yet this isn’t just a Ford problem—it’s a microcosm of broader challenges facing the entire sector. The CEO’s warning forces us to ask: What does “not ready” really mean? And more importantly, what does this mean for the future of electric vehicles? This article dissects Farley’s remarks, explores the root causes of consumer hesitation, and examines how automakers, policymakers, and drivers can bridge the gap between EV potential and reality.

The CEO’s Statement: Decoding Ford’s Reality Check

Farley’s comments were not a sudden revelation but the culmination of months of market data and internal analysis. In 2023, Ford sold just 72,608 electric vehicles in the U.S., a mere 4.2% of its total sales. Meanwhile, Tesla’s Model Y outsold every Ford EV model combined. The disconnect between Ford’s $50 billion EV investment and actual demand forced a strategic reevaluation. Farley’s warning highlighted three critical issues:

Visual guide about ford-ceo-says-customers-arent-ready-electric-cars

Image source: slashgear.com

- Affordability: Even with federal tax credits, EVs remain 20-30% more expensive than comparable gas cars.

- Charging anxiety: 65% of U.S. consumers cite charging access as a top concern (J.D. Power, 2023).

- Consumer psychology: Many buyers still perceive EVs as “compromises” in range, towing, and convenience.

Why Now? The Timing of Farley’s Warning

Farley’s remarks coincided with Ford’s decision to delay $12 billion in EV spending and shift focus to hybrid models. The move reflected a broader industry trend: General Motors and Toyota have similarly scaled back near-term EV targets. The timing underscores a shift from “if” to “when” for EVs. As Farley noted, “We need to meet customers where they are—not where we want them to be.” This pragmatic approach contrasts with Tesla’s all-in strategy but acknowledges that EV adoption requires more than just building cars.

The Data Behind the Statement

Ford’s internal research revealed stark disparities in EV readiness across demographics:

- Urban vs. Rural: 78% of urban residents consider EVs viable, versus 41% in rural areas (Ford Consumer Survey, 2023).

- Age: 55% of buyers under 35 prioritize EVs, compared to 22% over 55.

- Income: Households earning >$150k are 3x more likely to buy EVs than those earning <$75k.

These findings expose a critical truth: EV adoption is not a monolithic process but a segmented journey requiring tailored solutions.

Why Customers Aren’t Ready: The 5 Key Barriers

Farley’s warning reflects systemic challenges that extend far beyond Ford. Here are the five most significant barriers slowing EV adoption:

Visual guide about ford-ceo-says-customers-arent-ready-electric-cars

Image source: perthnow.com.au

1. The Price Gap

The average EV costs $53,469 in the U.S., compared to $48,334 for gas cars (Kelley Blue Book, 2023). Even with a $7,500 federal tax credit, many buyers balk at upfront costs. For example:

- The Ford F-150 Lightning starts at $49,995, while a comparable gas-powered F-150 costs $34,445.

- The Hyundai Ioniq 5 ($41,650) is $10k more than the Hyundai Tucson ($31,550).

Tip: Buyers can reduce costs by:

- Leasing EVs (often with lower monthly payments than purchases).

- Targeting used EVs (prices dropped 30% in 2023 due to oversupply).

- Negotiating state/local incentives (e.g., California’s $2,000 rebate).

2. Charging Infrastructure Gaps

While the U.S. has 180,000 public chargers, 60% are concentrated in 5 states (California, Texas, Florida, New York, Illinois). Rural areas face “charging deserts”—regions with fewer than 1 charger per 100 square miles. For example:

- Montana has 1 public charger per 2,500 residents; New York has 1 per 1,200.

- EV owners in rural areas spend 3x more time finding chargers than urban owners (AAA, 2023).

Tip: Use apps like PlugShare or ChargePoint to map routes with reliable chargers. For home charging:

- Install Level 2 chargers (cost: $500-$2,000; adds 25-40 miles per hour).

- Use workplace charging programs (offered by 40% of Fortune 500 companies).

3. Range Anxiety and Performance Myths

Despite 80% of U.S. drivers traveling <30 miles daily, range anxiety persists. Misconceptions fuel this fear:

- Myth: “EVs can’t handle cold weather.” Reality: Modern EVs lose 20-30% range in extreme cold—but heat pumps (standard on 2024 models) reduce this to 10%.

- Myth: “EVs can’t tow.” Reality: The F-150 Lightning tows 10,000 lbs—comparable to gas trucks.

Tip: Use EPA range ratings (not manufacturer claims). For example:

- Ford Mustang Mach-E: EPA 247-314 miles (vs. 314-320 miles advertised).

- Tesla Model 3: EPA 272-333 miles (vs. 272-358 miles advertised).

4. Lack of Trust in New Technology

Only 35% of consumers trust automakers to deliver reliable EVs (Edelman Trust Barometer, 2023). High-profile issues like:

- GM’s Bolt battery fires (2021-2023).

- Ford’s F-150 Lightning software glitches (2023).

- Tesla’s Autopilot crashes (NHTSA investigations).

…have eroded confidence. Tip: Research reliability ratings (e.g., Consumer Reports, J.D. Power) and opt for models with proven track records.

5. The “Chicken-and-Egg” Problem

Consumers won’t buy EVs until infrastructure improves, but infrastructure won’t expand until demand rises. This cycle stifles progress. For example:

- Only 12% of U.S. gas stations have fast chargers.

- EV adoption is 50% lower in states without charging incentives (e.g., Alabama vs. Vermont).

Ford’s Response: A Strategic Pivot

Farley’s warning triggered a radical shift in Ford’s EV strategy—one that prioritizes customer readiness over aggressive timelines. Key moves include:

1. Embracing Hybrids as a “Bridge”

Ford plans to triple hybrid production by 2026, targeting 40% of U.S. sales. The strategy addresses:

- Affordability: Hybrids cost $5,000-$10,000 less than EVs.

- Convenience: No charging required; 500+ mile range.

- Market demand: Hybrid sales grew 25% in 2023 (S&P Global).

Models like the Maverick Hybrid ($23,920) and Escape Hybrid ($30,995) offer entry points for hesitant buyers.

2. Reimagining Charging Partnerships

Ford is investing $1.2 billion in charging infrastructure, including:

- BlueOval Charge Network: 10,000 fast chargers by 2025 (partnering with ChargePoint and EVgo).

- FordPass Rewards: Free charging at select stations for EV buyers.

- Dealer Charging Hubs: 2,000 dealerships will add chargers by 2024.

For example, Ford’s “Plug & Charge” feature lets drivers pay via app—no membership cards or credit cards needed.

3. Price Adjustments and Incentives

Ford slashed prices on key models:

- Mustang Mach-E: $3,000-$10,000 cuts (2023-2024).

- F-150 Lightning: $5,500 reduction (2024).

The company also offers:

- Free home charger installation ($1,310 value).

- $1,000 “Charge Confidence” bonus for rural buyers.

4. Education and Test Drive Programs

Ford’s “EV Experience” initiative includes:

- Free 24-hour test drives (addressing range anxiety).

- Virtual reality tours of EV charging (available at dealerships).

- “Ask an EV Expert” hotline (staffed by Ford engineers).

The Bigger Picture: What This Means for the EV Industry

Farley’s warning isn’t unique to Ford—it’s a harbinger of broader industry shifts. Here’s how other players are responding:

1. Automakers: From “EV-Only” to “EV-First”

Legacy automakers are scaling back all-electric targets:

- GM: Delayed 2024 EV production targets by 6 months.

- Mercedes: Pushed back “EV-only” goal from 2025 to 2030.

- Toyota: Increased hybrid production by 50% in 2024.

Meanwhile, Tesla is slashing prices globally to maintain growth.

2. Governments: Accelerating Infrastructure

The U.S. Bipartisan Infrastructure Law allocates $7.5 billion for EV chargers. States are adding incentives:

- California: $2,000 rebate for low-income buyers.

- New York: $2,000 tax credit for used EVs.

- Texas: $2,500 grant for rural charging stations.

3. Tech Companies: Solving Charging Gaps

Companies like ChargePoint and Electrify America are deploying:

- Ultra-fast chargers: 350 kW stations (10-80% in 15 minutes).

- Bidirectional charging: EVs powering homes (Ford’s “Intelligent Backup Power”).

- AI routing: Apps that optimize charging stops (e.g., ABetterRoutePlanner).

4. The Rise of “EV-Adjacent” Solutions

Startups are addressing adoption barriers:

- SparkCharge: Mobile charging units for stranded EVs.

- Recurrent: Used EV battery health reports.

- EVgo: “Charging as a Service” for apartment complexes.

Data Table: EV Adoption Metrics (2020-2023)

| Metric | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| U.S. EV Sales (units) | 320,000 | 470,000 | 800,000 | 1,200,000 |

| EV Market Share (%) | 2.2% | 4.2% | 5.8% | 7.6% |

| Avg. EV Price ($) | 55,600 | 53,800 | 53,400 | 53,469 |

| Public Chargers (U.S.) | 100,000 | 130,000 | 160,000 | 180,000 |

| Charger-to-Vehicle Ratio | 1:10 | 1:8 | 1:6 | 1:5 |

The Road Ahead: Navigating the EV Transition

Farley’s warning is less about the death of EVs and more about the death of a one-size-fits-all approach to electrification. The future of EVs won’t be a sudden flip—it will be a gradual evolution shaped by three key trends:

- Hybrid Dominance (2024-2030): As Ford’s pivot shows, hybrids will serve as a critical bridge for mainstream adoption.

- Infrastructure as a Catalyst: Federal and state investments will turn charging deserts into networks, reducing range anxiety.

- Price Parity (2025-2027): Falling battery costs (projected to hit $80/kWh by 2026) will make EVs competitive with gas cars.

For consumers, the message is clear: You don’t need to rush into EVs today. Instead, leverage the growing hybrid options, advocate for better charging in your community, and use tools like tax credits to reduce costs. For automakers and policymakers, the lesson is equally clear: Listen to customers. The EV revolution will only succeed when it’s driven by real-world needs, not just corporate or political agendas.

Farley’s candid assessment might seem like a step back, but it’s actually a step forward. By acknowledging the gap between ambition and reality, Ford and the broader industry can build a more sustainable, inclusive path to electrification—one that doesn’t leave customers behind. The road to an all-electric future is long, but with pragmatism and innovation, it’s one we’ll travel together.

Frequently Asked Questions

Why did the Ford CEO say customers aren’t ready for electric cars?

Ford CEO Jim Farley highlighted concerns about charging infrastructure, vehicle cost, and consumer hesitation as key barriers. He emphasized that while Ford is investing in EVs, widespread adoption requires addressing these pain points first.

Is the Ford CEO against electric vehicles?

No, the Ford CEO isn’t opposed to EVs—he stressed the company’s commitment to electrification but acknowledged real-world challenges. His comments reflect a strategic pause to align production with actual electric car demand.

How does Ford plan to address customer hesitancy about electric cars?

Ford is focusing on improving charging networks, lowering battery costs, and offering hybrid transition models. The company aims to build trust by solving practical issues like range anxiety and affordability.

What does this mean for the future of Ford’s EV lineup?

Ford may slow its EV rollout to match consumer readiness, prioritizing hybrids and cost-effective models. This approach could delay some electric launches but ensure long-term market success.

Are other automakers facing similar challenges with electric car adoption?

Yes, many automakers report softening EV demand due to high prices and charging limitations. The Ford CEO’s electric car comments mirror industry-wide trends of recalibrating expectations.

Will Ford’s stance impact government EV mandates?

Ford’s feedback may encourage policymakers to extend deadlines or expand incentives for charging infrastructure. The company’s real-world data could help shape more achievable electrification timelines.