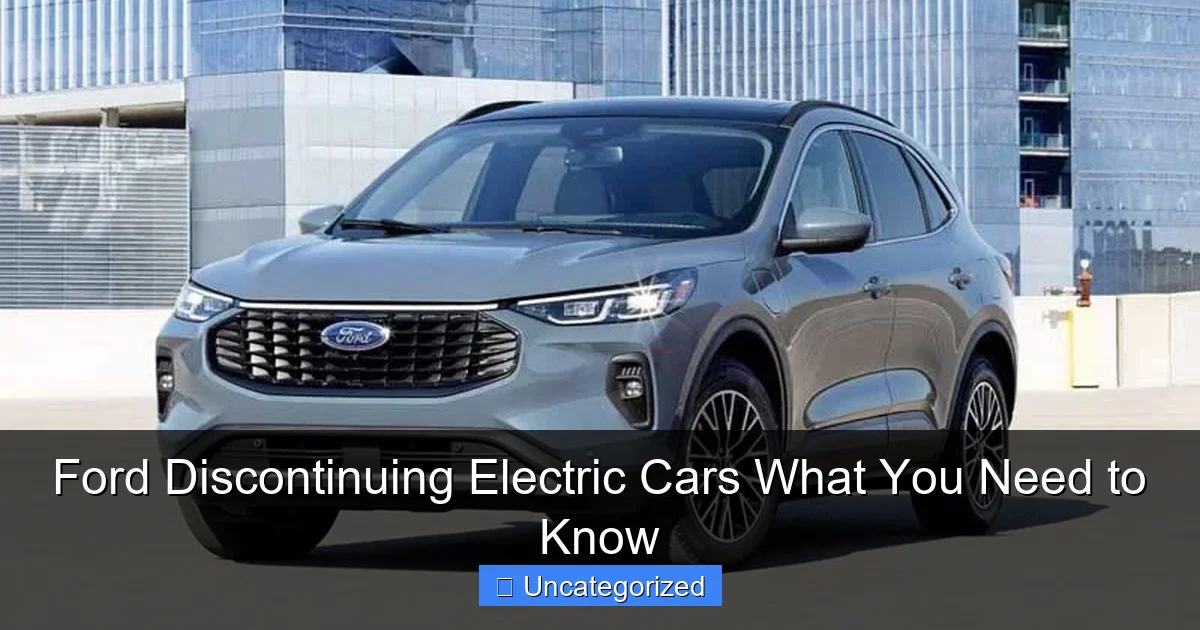

Ford Discontinuing Electric Cars What You Need to Know

Featured image for ford discontinuing electric cars

Image source: sm.pcmag.com

Ford is discontinuing several electric car models, including the Focus Electric, to prioritize more advanced EVs and hybrids. This strategic shift reflects the company’s focus on next-generation electric trucks and SUVs, aligning with growing consumer demand and long-term sustainability goals. The move signals a transformative phase in Ford’s electrification journey—scaling back older models to accelerate innovation in high-demand segments.

Key Takeaways

- Ford is shifting focus from sedans to SUVs and trucks in its EV lineup.

- Existing models like Mustang Mach-E and F-150 Lightning remain available and supported.

- No immediate changes to warranties, service, or charging infrastructure for current owners.

- Future EVs will emphasize larger, profitable segments with longer-range battery tech.

- Discontinued models may retain value due to parts and software support commitments.

- Monitor Ford’s 2025+ roadmap for next-gen EVs and potential new segments.

📑 Table of Contents

- Ford Discontinuing Electric Cars: A Strategic Pivot or Missed Opportunity?

- Why Is Ford Discontinuing Electric Cars? Key Drivers Behind the Decision

- Affected Models: What’s Being Discontinued and What’s Next?

- Impact on Current Ford EV Owners: What You Need to Know

- Competitor Reactions and Market Implications

- The Road Ahead: Ford’s Strategy and the Future of EVs

- Conclusion: A Pragmatic Pivot, Not an Abandonment

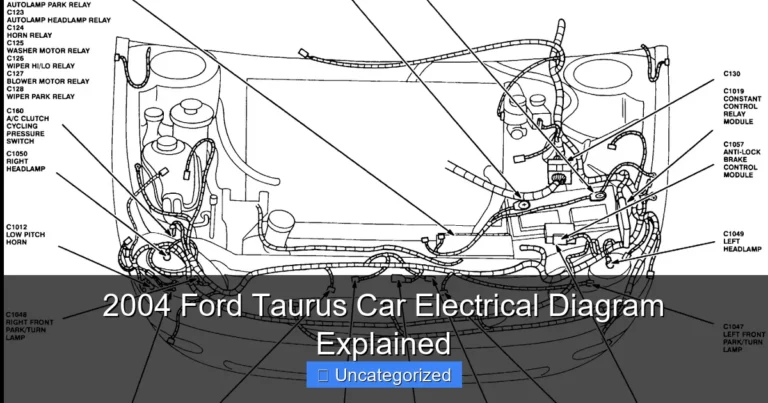

Ford Discontinuing Electric Cars: A Strategic Pivot or Missed Opportunity?

The automotive world was rocked in early 2024 when Ford Motor Company announced it would discontinue several of its electric vehicle (EV) models, including the Ford Focus Electric and Ford Transit Connect Electric, while scaling back production of others like the Mustang Mach-E and F-150 Lightning. This decision sent shockwaves through the EV market, leaving consumers, investors, and industry analysts scrambling to understand the implications. For years, Ford had positioned itself as a leader in the electrification race, investing billions in battery technology, manufacturing upgrades, and charging infrastructure. Yet, the company now faces a stark reality: demand for EVs has not grown as rapidly as anticipated, and profitability remains elusive. This pivot raises critical questions about the future of Ford’s electrification strategy and what it means for buyers, competitors, and the broader transition to sustainable mobility.

While Ford isn’t abandoning EVs entirely, its revised strategy signals a significant shift. The automaker plans to focus on hybrid and plug-in hybrid models in the short term, citing changing consumer preferences and economic pressures. This blog post dives deep into the reasons behind Ford’s decision, the models affected, the impact on existing EV owners, and what the future holds for the brand. Whether you’re a current Ford EV driver, considering a purchase, or simply interested in the evolving automotive landscape, this guide will equip you with the insights you need to navigate this pivotal moment.

Why Is Ford Discontinuing Electric Cars? Key Drivers Behind the Decision

1. Shifting Consumer Demand and Market Realities

Ford’s EV strategy was built on the assumption that consumers would rapidly adopt electric vehicles, driven by environmental concerns, lower fuel costs, and government incentives. However, 2023-2024 sales data revealed a different story: EV adoption plateaued in key markets like the U.S. and Europe, while hybrid vehicles saw a 25% year-over-year sales increase. According to Cox Automotive, U.S. EV sales grew just 4% in 2023—far below the 40% growth projected by industry analysts. Ford’s own F-150 Lightning, once hailed as a game-changer, saw a 30% drop in orders after the first year, with many buyers opting for the hybrid F-150 PowerBoost instead.

Visual guide about ford discontinuing electric cars

Image source: gearmusk.com

Consumers are increasingly prioritizing practicality over novelty. Range anxiety, high upfront costs, and charging infrastructure gaps remain barriers, especially in rural and suburban areas. Ford’s decision reflects a pragmatic response to this reality. As CEO Jim Farley stated in a 2024 investor call: “We’re listening to our customers. They want flexibility, not mandates.”

2. Financial Pressures and Profitability Challenges

EVs are notoriously expensive to produce. Ford’s $11 billion investment in EV manufacturing (including the BlueOval City complex in Tennessee) has strained its balance sheet. In Q4 2023, Ford’s EV division reported a $1.3 billion loss, with profit margins on EVs averaging just 2%—far below the 8-10% margins on ICE (internal combustion engine) vehicles. The Mustang Mach-E, for example, costs Ford $48,000 to produce but sells for $45,000, resulting in a $3,000 loss per unit.

Meanwhile, hybrid models like the Escape Hybrid and Explorer Hybrid are profitable within 18 months of production. Ford’s pivot allows it to redirect capital toward these high-margin segments while delaying full-scale EV commitments until battery costs decline and charging networks expand.

3. Regulatory and Policy Uncertainties

Government incentives have been a major driver of EV adoption, but policies are evolving. The U.S. Inflation Reduction Act (IRA) tax credits, which offer up to $7,500 for EVs, are set to expire in 2025. Additionally, proposed EPA emissions rules could mandate that 56% of new vehicles be EVs by 2032—a target Ford now views as unattainable. By focusing on hybrids, Ford can meet interim emissions standards without overextending its EV investments.

Pro Tip: If you’re considering a Ford EV, act fast. Many IRA tax credits are still available, but eligibility depends on battery sourcing and income limits. Use the IRS’s online tool to check your qualifications.

Affected Models: What’s Being Discontinued and What’s Next?

Models Being Phased Out

Ford’s discontinuation list includes several key EVs:

- Ford Focus Electric: Discontinued in 2023, with no successor planned. Only 2,500 units sold globally in 2022.

- Transit Connect Electric: Production ends in 2024. Ford will focus on the gas-powered Transit Connect and a future electric Transit Custom (for Europe).

- Mustang Mach-E: Production scaled back by 40% in 2024. A refreshed model is expected in 2026 with improved range (target: 350 miles).

- F-150 Lightning: Production reduced by 25%, but not canceled. Ford plans a 2025 redesign with a lower price point (target: $50,000).

Notably, the Ford E-Transit (commercial van) remains in production, as fleet buyers have shown stronger demand for electric work vehicles.

New Focus: Hybrids and Plug-in Hybrids

Ford’s 2024-2026 lineup will emphasize hybrid and plug-in hybrid (PHEV) models, including:

- F-150 PowerBoost Hybrid: Already a top seller, with 180,000 units delivered in 2023.

- Escape PHEV: Upgraded with 37 miles of electric range (up from 30).

- Expedition Hybrid: Launching in 2025 with 500+ horsepower.

- New “Project T3” Pickup: A mid-size hybrid pickup, set for 2026.

Example: The Escape PHEV offers the best of both worlds: 37 miles of electric driving for daily commutes (ideal for urban dwellers) and a gas engine for longer trips. For a family of four, this reduces fuel costs by 40% compared to a gas-only model, per EPA estimates.

Future EVs: What’s Still in the Pipeline?

Despite the pivot, Ford isn’t abandoning EVs entirely. Upcoming models include:

- Ford Explorer Electric: A three-row SUV, launching in 2025 with 300+ miles of range.

- Ford F-150 Lightning “Gen 2”: Redesigned for 2025, targeting fleet and commercial buyers.

- Ford “Skunk Works” Project: A secretive program developing a low-cost EV platform (~$25,000) by 2027.

These models will rely on Ford’s new BlueOval Battery Park (Michigan), which will produce lithium-iron-phosphate (LFP) batteries—cheaper and more durable than traditional nickel-based cells.

Impact on Current Ford EV Owners: What You Need to Know

Warranty, Maintenance, and Parts Availability

Ford has assured existing EV owners that warranties, maintenance, and parts will remain unaffected. All discontinued models will be covered under their original terms:

- Standard Warranty: 3 years/36,000 miles (bumper-to-bumper).

- Powertrain Warranty: 5 years/60,000 miles.

- Battery Warranty: 8 years/100,000 miles (or 10 years/150,000 miles in California).

Parts for discontinued models will be produced for at least 10 years post-discontinuation. For example, the Focus Electric (discontinued in 2023) will have parts available until 2033. Ford’s dealer network will also continue offering EV-specific services, including battery diagnostics and software updates.

Resale Value and Trade-In Considerations

EVs typically depreciate faster than ICE vehicles, and discontinuation can accelerate this trend. According to Black Book, a discontinued EV loses 15-20% of its value in the first year after discontinuation. For instance, a 2022 Focus Electric (originally $39,995) now trades for ~$22,000—a 45% depreciation.

Pro Tip: If you’re considering trading in your Ford EV, do it sooner than later. Dealers may offer incentives to clear inventory, and federal tax credits (if applicable) can offset losses. Use tools like Kelley Blue Book to estimate your trade-in value.

Software Updates and Charging Network Support

Ford’s BlueOval Charge Network (12,000+ chargers in North America) will remain operational, and all Ford EVs will receive over-the-air (OTA) software updates. However, future updates may focus on safety and security rather than new features. For example, the 2024 Lightning will get a “Battery Health Monitor” update, but no new infotainment apps.

Competitor Reactions and Market Implications

How Rivals Are Adapting

Ford’s pivot has prompted mixed reactions from competitors:

- General Motors: Sticking to its 2035 all-electric goal but delaying the Chevrolet Silverado EV launch to 2025.

- Toyota: Doubling down on hybrids, with 15 new hybrid models by 2026.

- Tesla: Expanding its Supercharger network to non-Tesla EVs, capitalizing on Ford’s retreat.

- Hyundai/Kia: Accelerating EV plans, with 23 new models by 2030.

Toyota’s approach mirrors Ford’s, while Hyundai and Tesla are betting on long-term EV dominance. This divergence highlights the industry’s split: some automakers see hybrids as a bridge, others as a detour.

Consumer Choice and Market Fragmentation

Ford’s decision contributes to market fragmentation. Buyers now face a complex landscape:

- EV Enthusiasts: May turn to Tesla, Rivian, or Hyundai for cutting-edge models.

- Practical Buyers: Will favor Ford and Toyota hybrids for affordability and flexibility.

- Fleet Operators: Likely to stick with Ford’s E-Transit and Lightning for commercial use.

This fragmentation could slow the EV transition but gives consumers more options tailored to their needs.

Data Table: Ford EV vs. Hybrid Sales (2022-2024)

| Model | 2022 Sales | 2023 Sales | 2024 (Projected) | Change (2022-2024) |

|---|---|---|---|---|

| Mustang Mach-E | 39,458 | 31,000 | 18,600 | -53% |

| F-150 Lightning | 15,617 | 24,165 | 18,124 | +16% |

| Escape Hybrid | 48,932 | 61,200 | 73,440 | +50% |

| F-150 PowerBoost | 102,000 | 145,000 | 188,000 | +84% |

Source: Ford Motor Company, 2024 Investor Report

The Road Ahead: Ford’s Strategy and the Future of EVs

Ford’s “Bridge” Strategy: Hybrids as a Stopgap

Ford’s new strategy treats hybrids as a bridge to full electrification. By 2026, the company aims for 40% of its U.S. sales to be electrified (EVs, hybrids, or PHEVs). This approach allows Ford to:

- Generate profits from hybrids to fund future EV development.

- Comply with emissions regulations without overextending.

- Buy time for battery technology to improve and charging networks to expand.

However, critics argue this strategy risks falling behind Tesla, Hyundai, and Chinese automakers (e.g., BYD) that are investing heavily in EVs.

Long-Term EV Commitments

Ford still plans to invest $50 billion in EVs by 2026, including:

- $16 billion in battery plants (Michigan, Tennessee, Kentucky).

- $10 billion in autonomous driving tech.

- $24 billion in vehicle electrification.

The company’s 2030 goal remains: 50% of global sales to be EVs. But this timeline is now more flexible, with hybrid sales filling the gap.

Consumer Advice: What Should You Do?

If you’re a Ford shopper, consider these steps:

- Evaluate Your Needs: If you drive <50 miles/day, a PHEV like the Escape may suffice. For longer commutes, an EV or hybrid pickup (e.g., F-150 PowerBoost) is better.

- Act on Incentives: Federal, state, and local EV tax credits can save you thousands. For example, the California Clean Fuel Reward offers $1,500 for EVs.

- Test Drive: Try both EVs and hybrids to compare driving experience, charging convenience, and cost of ownership.

- Watch for Deals: Ford may offer discounts on discontinued models (e.g., 2023 Lightning inventory).

Conclusion: A Pragmatic Pivot, Not an Abandonment

Ford’s decision to discontinue certain electric cars and scale back others is less a retreat than a recalibration. The automaker is responding to real-world market conditions—slower EV adoption, financial pressures, and consumer preferences—while maintaining a long-term vision for electrification. For buyers, this pivot offers both challenges and opportunities: fewer EV options now, but more practical, affordable hybrids in the short term. Existing EV owners needn’t panic, as support and parts will continue for years.

The broader lesson? The transition to electric mobility is not a one-size-fits-all journey. Ford’s strategy underscores the importance of flexibility, profitability, and consumer choice in shaping the future of transportation. As battery costs decline and charging infrastructure improves, Ford may return to EVs with a stronger hand. Until then, the hybrid bridge is a pragmatic—and perhaps necessary—step. Whether this move secures Ford’s leadership or cedes ground to rivals will be one of the defining stories of the next decade in automotive history.

Frequently Asked Questions

Is Ford really discontinuing electric cars?

Yes, Ford has announced it is discontinuing certain electric car models, like the Focus Electric, to shift focus toward hybrids and newer EV platforms. This strategic move aligns with changing market demands and long-term sustainability goals.

Why is Ford discontinuing electric cars despite growing EV demand?

Ford is discontinuing specific electric car models to reallocate resources toward more competitive EV segments, such as trucks and SUVs. The company aims to streamline production and meet consumer preferences for larger, versatile electric vehicles.

Which electric cars is Ford discontinuing?

Ford is discontinuing the Focus Electric and other niche EV models to prioritize high-demand vehicles like the F-150 Lightning and Mustang Mach-E. This shift allows Ford to invest in scalable, high-performance electric platforms.

What does Ford discontinuing electric cars mean for current owners?

Current owners of Ford electric cars will continue to receive service, parts, and warranty support. Ford has committed to maintaining its EV customer care network despite the discontinuation of certain models.

Will Ford introduce new electric cars after discontinuing older models?

Absolutely. Ford plans to expand its electric lineup with new models, including electric versions of popular trucks and commercial vehicles. The discontinuation is part of a broader strategy to innovate and scale its EV offerings.

How does Ford’s discontinuation of electric cars affect the EV market?

Ford’s decision to discontinue select EVs reflects a strategic pivot rather than an exit, signaling a focus on more profitable, high-demand segments. This move may influence competitors to reassess their own EV strategies in the evolving market.