Ford Electric Car Federal Tax Credit Guide 2024

Featured image for ford electric car federal tax credit

Image source: cdn.motor1.com

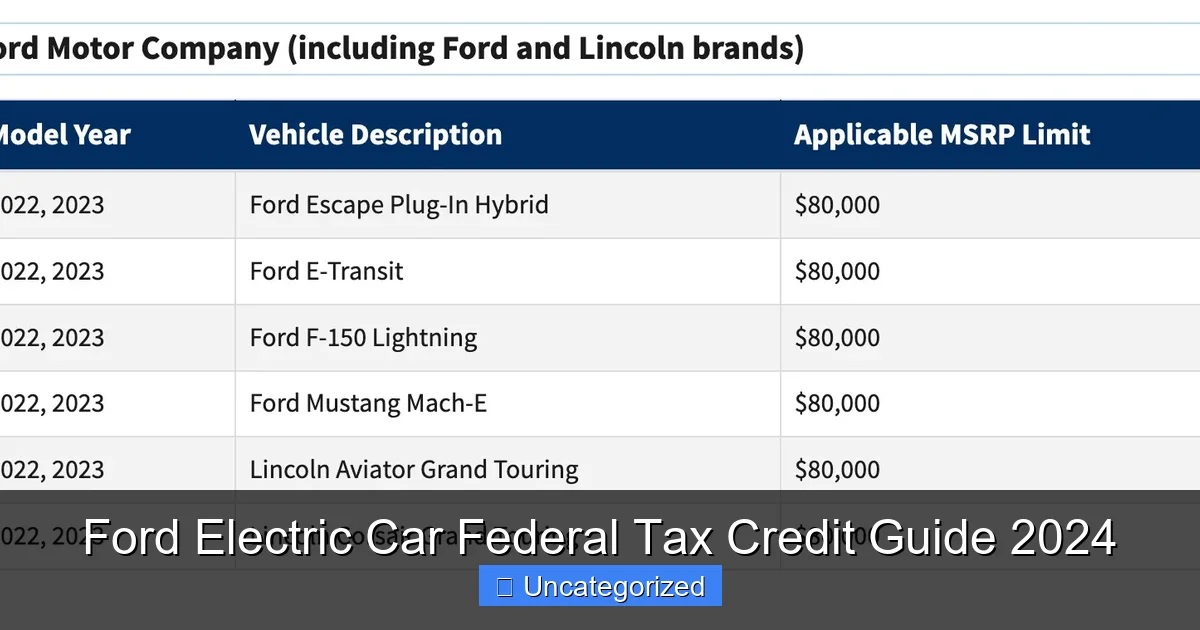

Ford electric car buyers in 2024 may qualify for a federal tax credit of up to $7,500, depending on the model and battery component requirements set by the IRS. Eligible models like the Mustang Mach-E and F-150 Lightning must meet strict sourcing rules to qualify, so check current guidelines before purchasing to maximize your savings.

This is a comprehensive guide about ford electric car federal tax credit.

Key Takeaways

- Check eligibility: Confirm your Ford EV qualifies for the 2024 federal tax credit.

- Maximize savings: Claim up to $7,500 if income and vehicle criteria are met.

- Act fast: Credits may phase out once manufacturer limits are reached.

- Verify battery rules: Only EVs with U.S.-sourced batteries qualify fully.

- File correctly: Use IRS Form 8936 to claim your credit accurately.

- Consider timing: Purchase before December 31, 2024, for full-year eligibility.

Frequently Asked Questions

What is the Ford electric car federal tax credit in 2024?

The Ford electric car federal tax credit is a financial incentive of up to $7,500 for eligible buyers of qualifying Ford electric vehicles (EVs) under the Inflation Reduction Act. The exact amount depends on the vehicle’s battery components and critical mineral sourcing requirements.

Which Ford EVs qualify for the federal tax credit in 2024?

As of 2024, models like the Ford F-150 Lightning, Mustang Mach-E, and E-Transit may qualify for the full or partial federal tax credit. Eligibility hinges on MSRP, battery capacity, and manufacturing compliance with North American sourcing rules.

How do I claim the Ford electric car federal tax credit?

To claim the credit, file IRS Form 8936 with your federal tax return after purchasing a qualifying Ford EV. The dealership may also offer a point-of-sale transfer option, allowing you to assign the credit directly to them at purchase.

Does the Ford EV tax credit phase out based on income?

Yes, the tax credit has income caps: $150,000 for single filers, $225,000 for heads of household, and $300,000 for joint filers. Exceeding these limits disqualifies you from claiming the Ford electric car federal tax credit.

Can I get the tax credit if I lease a Ford electric car?

If you lease, the credit goes to the manufacturer, but dealers may pass savings to you via lower lease payments. However, the lessee cannot claim the Ford federal tax credit directly on their tax return.

Is the Ford EV tax credit a refund or a deduction?

The credit is non-refundable, meaning it reduces your tax liability dollar-for-dollar but won’t result in a refund if it exceeds what you owe. Any unused portion cannot be carried forward to future years.