Ford Electric Car Incentives Save You Money Today

Featured image for ford electric car incentives

Image source: gigagears.com

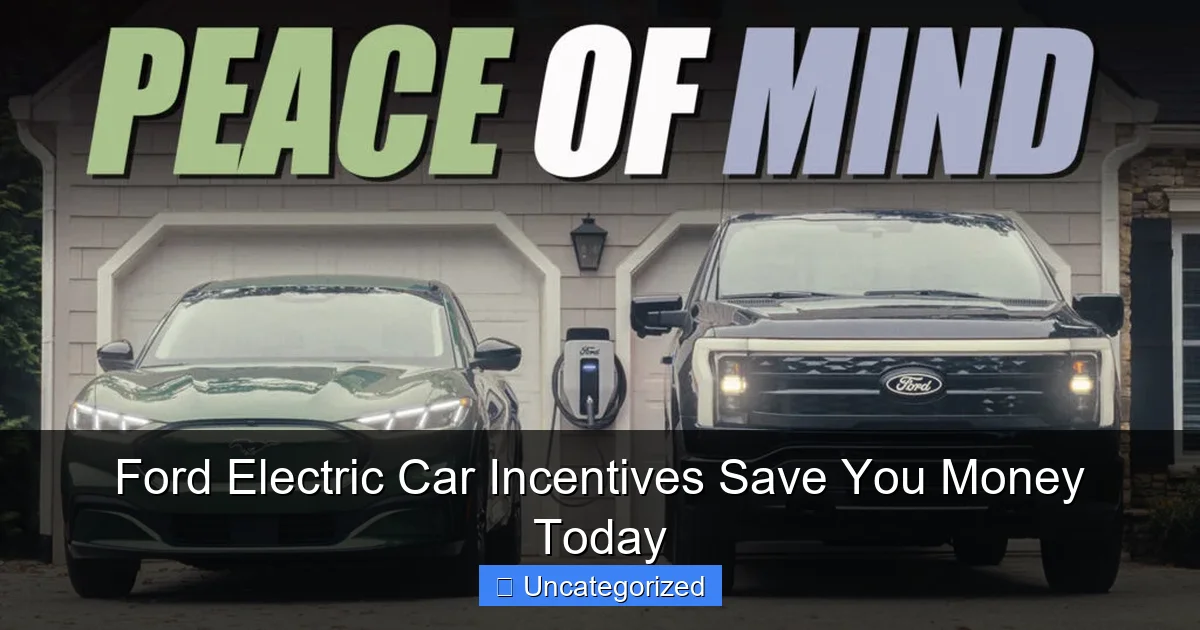

Ford electric car incentives can save you thousands today through federal tax credits, state rebates, and exclusive dealership offers. These limited-time savings make Ford’s EV lineup—like the Mustang Mach-E and F-150 Lightning—more affordable than ever, with potential discounts stacking up to $10,000 or more. Don’t miss out on slashing your upfront costs while driving a cutting-edge electric vehicle.

Key Takeaways

- Federal tax credits: Claim up to $7,500 on eligible Ford EVs.

- State rebates: Check local incentives for extra savings at purchase.

- Dealer discounts: Negotiate added incentives like free charging or maintenance.

- Utility savings: Lower charging rates with time-of-use energy plans.

- Trade-in bonuses: Combine EV incentives with Ford loyalty rewards.

📑 Table of Contents

- Ford Electric Car Incentives Save You Money Today

- Federal Tax Credits: The Biggest Savings Opportunity

- State and Local Incentives: Stack Your Savings

- Ford Manufacturer Incentives: Deals You Can’t Miss

- How to Maximize Your Incentives: A Step-by-Step Guide

- Long-Term Savings: Beyond the Purchase Price

- Data Table: Ford EV Incentives by State (2024)

- Conclusion: Drive Green, Save Big with Ford

Ford Electric Car Incentives Save You Money Today

As the automotive world shifts toward sustainability, electric vehicles (EVs) are no longer a futuristic concept—they’re a present-day reality, and Ford is leading the charge in making EVs more accessible than ever. With a lineup that includes the Ford Mustang Mach-E, F-150 Lightning, and the upcoming E-Transit, Ford is not just building electric vehicles; it’s building a future where driving green is also economically smart. But what truly sets Ford apart is its commitment to affordability, backed by a robust suite of Ford electric car incentives that can save buyers thousands of dollars right now.

From federal tax credits to state rebates, manufacturer discounts, and even utility company perks, the financial benefits of going electric with Ford are more compelling than ever. Whether you’re a first-time EV buyer or upgrading from a gas-powered vehicle, understanding these incentives can dramatically reduce your upfront costs and long-term ownership expenses. This guide dives deep into the world of Ford electric car incentives, offering actionable insights, real-world examples, and up-to-date data to help you maximize your savings and drive home in a Ford EV with confidence.

Federal Tax Credits: The Biggest Savings Opportunity

One of the most significant incentives available for Ford electric car buyers is the federal tax credit, a government-backed program designed to accelerate EV adoption. As of 2024, eligible buyers can claim up to $7,500 on the purchase of a new all-electric or plug-in hybrid vehicle—provided the car meets strict battery and manufacturing criteria set by the Inflation Reduction Act (IRA) of 2022.

Visual guide about ford electric car incentives

Image source: carrebate.net

How the Federal Tax Credit Works

The federal EV tax credit is a non-refundable credit, meaning it can reduce your tax liability dollar-for-dollar, but you won’t receive a refund if the credit exceeds what you owe in taxes. For example, if you owe $5,000 in federal taxes and qualify for the full $7,500 credit, you’ll pay $0 in taxes, but you won’t receive the remaining $2,500. However, the credit is transferable starting in 2024, allowing buyers to assign it to the dealership at the time of purchase—effectively lowering the purchase price upfront.

To qualify, the vehicle must:

- Be assembled in North America (Ford’s EVs meet this requirement)

- Have a battery capacity of at least 7 kWh (all Ford EVs do)

- Be purchased new and used primarily in the U.S.

- Meet critical mineral and battery component sourcing requirements (phased in over time)

Which Ford EVs Qualify for the $7,500 Credit?

As of mid-2024, the following Ford electric vehicles are eligible for the full $7,500 federal tax credit:

- Ford Mustang Mach-E (all trims, including GT and Premium)

- Ford F-150 Lightning (all trims, including Pro, XLT, Lariat, and Platinum)

- Ford E-Transit (cargo van, eligible for commercial buyers)

Note: The eligibility depends on the vehicle’s final assembly location and battery sourcing. Ford has confirmed that all current EV models are built in the U.S. (Mach-E in Mexico but qualifies under NAFTA/IRA rules), and battery components are increasingly sourced from North America to meet IRA standards.

Real-World Example: F-150 Lightning Savings

Let’s say you purchase a 2024 Ford F-150 Lightning XLT with a MSRP of $69,995. You qualify for the full $7,500 federal tax credit and choose to transfer it to the dealer. Your effective purchase price drops to $62,495—a savings of over 10%. If you also take advantage of state and local incentives (covered later), your total savings could exceed $10,000. This makes the Lightning not only a powerful, zero-emission pickup but also one of the most cost-effective full-size trucks on the market.

State and Local Incentives: Stack Your Savings

While the federal tax credit is a major win, it’s just the beginning. Many states, counties, and municipalities offer additional rebates, tax exemptions, and grants to encourage EV ownership. These incentives vary widely, so it’s crucial to research what’s available in your area—especially since they can be stacked with federal and manufacturer incentives for maximum savings.

State Rebates: Cash Back on Your Purchase

Over 20 states offer direct rebates for EV purchases. For example:

- California: Clean Vehicle Rebate Project (CVRP) offers up to $7,500 for income-qualified buyers. Even non-qualifying buyers can receive $2,000.

- Colorado: Provides a $5,000 state tax credit for new EVs, with an additional $2,500 for low-income residents.

- New York: Drive Clean Rebate offers $2,000 for new EVs, with no income cap.

- Maryland: Offers a $3,000 excise tax credit on new EVs.

These rebates are often processed through your dealer or via a post-purchase application. In California, for instance, the CVRP is administered by the Center for Sustainable Energy, and rebates are issued as checks or prepaid cards within 90 days of purchase.

Tax Exemptions and Fee Waivers

Many states also reduce or eliminate certain taxes and fees:

- Sales tax exemption: States like Oregon and Vermont waive state sales tax on EVs.

- Registration fee reduction: Texas offers a $100 annual EV registration fee (vs. $50.75 for gas vehicles), but some counties provide additional discounts.

- HOV lane access: In states like Washington and New Jersey, EVs can use high-occupancy vehicle (HOV) lanes, even with a single driver—saving time and fuel costs.

For Ford EV buyers, these benefits can add up to hundreds or even thousands of dollars in annual savings, especially for frequent commuters.

Local and Utility Incentives

Don’t overlook local programs. Many cities and utility companies offer:

- Free or discounted EV charging: For example, Pacific Gas & Electric (PG&E) in California offers a $500 rebate for home EV charger installation.

- Public charging credits: Xcel Energy in Minnesota provides $250 in charging credits for new EV buyers.

- Workplace charging grants: Employers in Illinois can receive up to $5,000 for installing EV chargers.

Pro Tip: Visit DriveClean.ca.gov (for California) or the U.S. Department of Energy’s Alternative Fuels Data Center (afdc.energy.gov) to find incentives in your state. Enter your ZIP code for a personalized list.

Ford Manufacturer Incentives: Deals You Can’t Miss

Beyond government incentives, Ford offers its own suite of manufacturer rebates, loyalty bonuses, and financing deals to make EVs more affordable. These incentives are often time-limited, so acting quickly is key.

Ford Electric Vehicle Rebates (2024)

As of Q2 2024, Ford is offering:

- $7,500 cash allowance on the 2024 Mustang Mach-E (all trims)

- $10,000 cash allowance on the 2024 F-150 Lightning (select trims, including Pro and XLT)

- 0% APR financing for up to 72 months on select models

- Loyalty bonus: $1,000 for current Ford owners or lessees

These rebates can be combined with federal and state incentives. For example, a Ford F-150 Lightning XLT buyer in Colorado could receive:

- $10,000 Ford rebate

- $7,500 federal tax credit (transferred to dealer)

- $5,000 Colorado state tax credit

- Total savings: $22,500—reducing the effective price from $69,995 to $47,495

FordPass Rewards and Charging Perks

Ford also rewards EV buyers with FordPass Rewards, a loyalty program that offers:

- 10,000 points ($100 value) for new EV purchases

- Free access to Ford’s BlueOval Charge Network, which includes over 10,000 fast-charging stations across North America

- Discounted rates at partner chargers (e.g., Electrify America, ChargePoint)

Additionally, the Ford Charge Station Pro (a Level 2 home charger) is included with every F-150 Lightning purchase—saving you $1,000 on installation and equipment.

Special Programs for Businesses and Fleets

Commercial buyers can access even greater savings:

- Ford Pro Fleet Incentives: Up to $20,000 in rebates for businesses purchasing multiple EVs (e.g., E-Transit vans)

- Section 179 Tax Deduction: Businesses can deduct up to $1.16 million in EV purchases in 2024, subject to phase-out limits.

- Utility Fleet Programs: Companies like Con Edison in New York offer $2,500–$5,000 per EV for fleet conversions.

How to Maximize Your Incentives: A Step-by-Step Guide

With so many incentives available, navigating the process can feel overwhelming. Follow this step-by-step strategy to ensure you don’t miss out on any savings.

Step 1: Determine Your Eligibility

Before shopping, check:

- Your tax liability (to confirm you can use the federal credit)

- Your state’s rebate program (income caps, application deadlines)

- Your utility’s EV programs (e.g., charger rebates, time-of-use rates)

Use tools like the PlugStar Incentive Finder (plugstar.com) to generate a personalized incentive report.

Step 2: Work with a Knowledgeable Dealer

Not all dealers are up-to-date on EV incentives. Ask:

- “Can you apply the federal tax credit at purchase?”

- “Do you handle state rebate applications?”

- “Are there any Ford manufacturer rebates available this month?”

Choose a Ford EV-certified dealer—they’re trained to guide you through the incentive process and often have direct access to rebate portals.

Step 3: Time Your Purchase

Incentives change frequently. For example:

- Ford’s $10,000 Lightning rebate was introduced in April 2024 and may expire by year-end.

- California’s CVRP funds are limited and distributed on a first-come, first-served basis.

Set up alerts via Ford’s website or EV news sites (e.g., InsideEVs) to stay informed.

Step 4: Document Everything

Keep records of:

- Your purchase contract (showing MSRP and incentives)

- Proof of eligibility (e.g., income verification for state rebates)

- Charger installation receipts (for utility rebates)

These documents are essential for claiming rebates and filing taxes.

Step 5: Combine Incentives Strategically

Always stack incentives where possible. For example:

- Use the Ford rebate and federal credit at purchase.

- Apply for state rebates and utility grants post-purchase.

- Claim the Section 179 deduction at tax time (for business owners).

Long-Term Savings: Beyond the Purchase Price

While upfront incentives are crucial, the real value of Ford EVs lies in their long-term cost savings. Electric vehicles have fewer moving parts, lower maintenance costs, and cheaper fuel than gas-powered cars.

Lower Maintenance Costs

EVs eliminate:

- Oil changes ($50–$100 every 5,000–7,500 miles)

- Transmission fluid changes ($150–$300)

- Exhaust system repairs ($500–$1,000)

According to Consumer Reports, EV owners save an average of $6,000–$10,000 in maintenance over 200,000 miles compared to gas vehicles.

Cheaper “Fuel”

Electricity is significantly cheaper than gasoline. At the U.S. average rate of $0.15/kWh, charging a Ford Mustang Mach-E (70 kWh battery) costs about $10.50 for a full charge—equivalent to driving 250 miles. That’s roughly $0.04 per mile, vs. $0.12–$0.15 for a gas car at $3.50/gallon.

With time-of-use (TOU) rates from your utility, you can charge overnight at even lower rates (e.g., $0.08/kWh in California), reducing costs further.

Higher Resale Value

Ford EVs are holding their value well. The F-150 Lightning, for example, has a 5-year depreciation rate of 35%—better than many gas-powered trucks (45–50%). This means you’ll recoup more of your investment when you sell or trade in.

Environmental and Health Benefits

Beyond money, EVs reduce:

- Carbon emissions (a Mach-E emits 0 grams/mile vs. 404 grams/mile for a gas Mustang)

- Air pollution (improving local air quality)

- Noise pollution (quieter streets and neighborhoods)

For eco-conscious drivers, these benefits are priceless.

Data Table: Ford EV Incentives by State (2024)

| State | Rebate/Incentive | Eligibility | Max Savings |

|---|---|---|---|

| California | Clean Vehicle Rebate Project (CVRP) | Income-qualified or general rebate | $7,500 |

| Colorado | State Tax Credit | All buyers | $5,000 |

| New York | Drive Clean Rebate | All buyers | $2,000 |

| Maryland | Excise Tax Credit | All buyers | $3,000 |

| Oregon | Sales Tax Exemption | All buyers | 6.5% of purchase price |

| Texas | HOV Lane Access | All EVs | Time savings (no cash value) |

| National | Federal Tax Credit | All eligible EVs | $7,500 |

| National | Ford Manufacturer Rebate | All buyers (limited-time) | Up to $10,000 |

Note: Incentives subject to change. Always verify with official sources before purchasing.

Conclusion: Drive Green, Save Big with Ford

The shift to electric vehicles isn’t just about reducing emissions—it’s about smart financial decisions. With Ford electric car incentives, you can save thousands of dollars at purchase, enjoy lower operating costs, and benefit from long-term value retention. From the $7,500 federal tax credit to state rebates, Ford manufacturer deals, and utility perks, the opportunities to save are unprecedented.

Whether you’re eyeing the sporty Mustang Mach-E, the rugged F-150 Lightning, or the versatile E-Transit, now is the time to act. Incentives are evolving, and some are time-sensitive. By combining government, manufacturer, and local programs, you could reduce your EV’s effective price by 20–30% or more. Plus, with Ford’s expanding charging network, cutting-edge tech, and American-made quality, you’re not just saving money—you’re investing in a better driving future.

So don’t wait. Research your incentives, visit a Ford EV-certified dealer, and drive home in a Ford electric car today. The road to savings starts now.

Frequently Asked Questions

What Ford electric car incentives are available right now?

Ford offers several incentives on electric vehicles, including federal tax credits up to $7,500, state-specific rebates, and special financing rates. Check Ford’s website or your local dealer for current Ford electric car incentives in your area.

Can I combine Ford electric car incentives with other discounts?

Yes, in many cases you can stack manufacturer incentives, like lease bonuses or loyalty rewards, with federal/state EV incentives. For example, some states allow combining the $7,500 federal tax credit with local rebates for even greater savings.

Do Ford electric car incentives apply to used EVs?

Federal tax credits for used EVs (up to $4,000) may apply to eligible certified pre-owned Ford electric cars. However, most manufacturer-specific incentives focus on new models, so verify details with a Ford dealer.

How long will Ford’s current EV incentives last?

Ford frequently updates its incentive programs, with many promotions valid through specific dates (e.g., end-of-quarter deals). Always check Ford’s official incentive page or ask a dealer about expiration timelines.

Are Ford electric car incentives available in all states?

Federal tax credits apply nationwide, but state/local incentives (e.g., CA’s Clean Vehicle Rebate) vary by location. Some Ford electric car incentives, like bonus cash, may also differ by region.

Does Ford offer incentives for EV charging equipment?

Yes! Ford often includes perks like free home charger installation or public charging credits with new EV purchases. For instance, the Ford Charge Station Pro may be partially covered under select incentive programs.