Ford Electric Car Loss What Went Wrong and Why It Matters

Featured image for ford electric car loss

Image source: cdn.teslanorth.com

Ford’s electric car losses reveal a costly misstep in its EV strategy, as delayed production, outdated platforms, and stiff competition led to declining market confidence and billions in red ink. The fallout underscores a critical lesson for legacy automakers: failing to innovate quickly in the EV race risks long-term relevance and investor trust. This stumble matters not just for Ford, but for the entire auto industry’s electric transition.

Key Takeaways

- Ford underestimated EV demand: Slow rollout led to missed market opportunities.

- Battery supply issues: Production delays hurt delivery timelines and customer trust.

- High costs plagued profitability: Pricing failed to match Tesla’s competitive edge.

- Software shortcomings: Outdated tech reduced appeal against rivals’ smart features.

- Brand perception lagged: Consumers still linked Ford to gas, not electric innovation.

- Lessons for automakers: Adapt quickly or risk falling behind in the EV race.

📑 Table of Contents

- The Ford Electric Car Loss: A Wake-Up Call for the Auto Industry

- 1. The Strategic Pivot: Ford’s Bold EV Gamble

- 2. The Root Causes of Ford’s Electric Car Loss

- 3. Market Realities: Why Ford’s EV Strategy Missed the Mark

- 4. The Financial Fallout: Breaking Down the $1.3 Billion Loss

- 5. Lessons Learned: How Ford (and Others) Can Recover

- 6. Why the Ford Electric Car Loss Matters Beyond Ford

The Ford Electric Car Loss: A Wake-Up Call for the Auto Industry

When Ford Motor Company announced a $1.3 billion loss on its electric vehicle (EV) division in 2023, the automotive world took notice. This wasn’t just another quarterly earnings dip—it was a staggering figure that sent ripples through Wall Street and raised urgent questions about the future of America’s second-largest automaker. Ford, a company synonymous with the internal combustion engine (ICE) for over a century, had bet big on electrification, but the results were far from the success story investors and customers expected.

Why did Ford’s electric car ambitions falter so dramatically? Was it poor timing, flawed strategy, or a deeper structural issue in the EV market itself? More importantly, what does this Ford electric car loss mean for the broader transition to sustainable transportation? As governments push for zero-emission mandates and consumers demand cleaner alternatives, Ford’s missteps offer critical lessons—not just for automakers, but for policymakers, investors, and everyday car buyers navigating the complex world of electric mobility.

1. The Strategic Pivot: Ford’s Bold EV Gamble

From F-150 to F-150 Lightning: A Legacy Reimagined

Ford’s entry into the EV space was anything but timid. The company didn’t just dip its toes in the water—it launched headfirst with the F-150 Lightning, an electrified version of America’s best-selling truck. The move was strategic: leverage brand loyalty, tap into a massive customer base of pickup enthusiasts, and prove that EVs could deliver the power and utility of traditional trucks. The Lightning’s initial reception was promising, with over 200,000 reservations in its first year.

Visual guide about ford electric car loss

Image source: carscoops.com

But the Lightning was just the start. Ford also rolled out the Mustang Mach-E, a crossover that reimagined the iconic muscle car for the electric age. The Mach-E won awards and garnered praise for its design and performance, but it also faced criticism for diluting the Mustang brand—a risk Ford was willing to take to capture younger, urban EV buyers.

Ambitious Targets and High Stakes

Behind these launches was a grand vision: Ford aimed to produce 600,000 EVs annually by 2023 and 2 million by 2026, positioning itself as a global EV leader. To achieve this, the company invested $50 billion in electrification through 2026, including new battery plants, software development, and charging infrastructure partnerships.

The stakes were high. Ford’s CEO Jim Farley declared that the company was “all in” on EVs, framing the transition as existential. “If we don’t lead this change, someone else will,” he told investors. Yet, the Ford electric car loss revealed a harsh truth: ambition without execution is a recipe for disaster.

2. The Root Causes of Ford’s Electric Car Loss

Production Delays and Supply Chain Chaos

One of the biggest contributors to the loss was production bottlenecks. The F-150 Lightning, despite strong demand, faced delays due to shortages of key components, particularly lithium-ion batteries and semiconductor chips. In 2022, Ford had to pause Lightning production for weeks because of a battery fire incident, forcing it to recall 18,000 vehicles—a costly and reputation-damaging setback.

Supply chain issues weren’t unique to Ford, but the company’s reliance on third-party battery suppliers (like SK On) left it vulnerable. Unlike Tesla, which vertically integrates battery production, Ford outsourced critical parts, leading to delays and inconsistent quality. For example, in Q3 2023, Ford reported that only 65% of planned Lightning units were built due to battery shortages.

Soaring Costs and Pricing Pressure

EVs are expensive to build, and Ford’s cost structure became a major liability. The average cost to produce an F-150 Lightning was $70,000—nearly $10,000 more than the retail price in some markets. This was due to:

- Battery costs: Raw materials like lithium, nickel, and cobalt surged by 300% between 2020 and 2022.

- Labor and logistics: Retooling factories for EVs required massive investments, and union labor costs added pressure.

- Software and R&D: Developing new EV platforms (like Ford’s “BlueOval” architecture) drained cash reserves.

Meanwhile, competitors like Tesla slashed prices to gain market share, forcing Ford to either lose sales or absorb losses. In early 2023, Ford cut Lightning prices by up to $10,000, eroding margins further.

Software and Customer Experience Gaps

Modern EVs aren’t just about hardware—they’re rolling computers. Ford’s software, particularly its infotainment and driver-assist systems, received lukewarm reviews. The Mach-E’s “Sync 4A” system was criticized for being buggy and unintuitive, while the BlueCruise hands-free driving feature lagged behind Tesla’s Autopilot and GM’s Super Cruise.

Customer complaints piled up: delayed over-the-air updates, poor charging integration, and a fragmented app experience. In a 2023 J.D. Power survey, Ford ranked below average in EV customer satisfaction, a stark contrast to its ICE dominance.

3. Market Realities: Why Ford’s EV Strategy Missed the Mark

Consumer Hesitation and Range Anxiety

Despite the hype, many consumers remain skeptical of EVs. A 2023 Pew Research study found that only 38% of Americans are likely to buy an EV, citing concerns over:

- Range anxiety: 65% worry about running out of charge.

- Charging infrastructure: 52% say public chargers are too scarce or unreliable.

- Cost: 48% believe EVs are overpriced, even with tax credits.

Ford underestimated these barriers. The Lightning’s 240–320 mile range was competitive, but charging times (15–45 minutes at fast chargers) and home installation costs deterred buyers. Ford’s “Charge Station Pro” home charger, priced at $799, was seen as a profit center rather than a customer benefit.

Competition from Tesla, GM, and Startups

Ford entered a crowded market. Tesla’s Model Y outsold the Mach-E 5-to-1 in 2023, while GM’s Chevrolet Bolt offered a cheaper, simpler EV alternative. Even startups like Rivian and Lucid captured niche audiences with premium offerings.

Ford’s branding also confused consumers. Was the Mach-E a Mustang or a crossover? Was the Lightning a truck or a novelty? The lack of clear messaging diluted Ford’s EV identity, making it harder to compete on value or emotion.

The Used EV Market Backlash

As new EV prices fell, the used market collapsed. A 2023 iSeeCars study found that used EVs depreciated 52% in the first year—twice the rate of ICE vehicles. This hurt Ford’s leasing business and made customers hesitant to buy, knowing their Lightning would lose value fast.

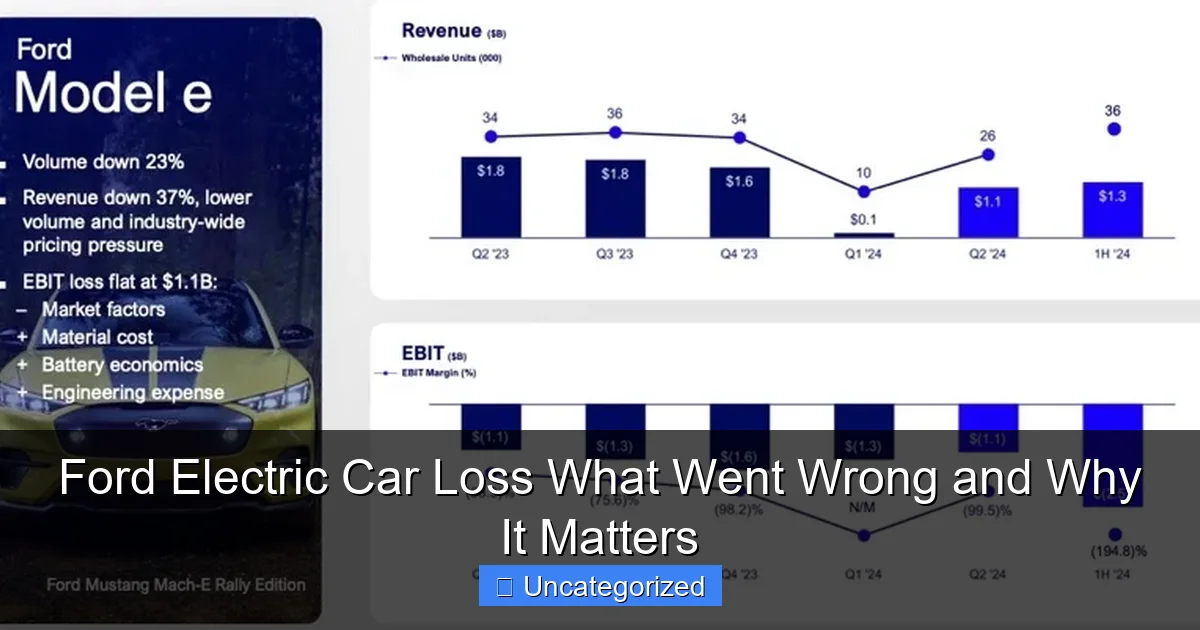

4. The Financial Fallout: Breaking Down the $1.3 Billion Loss

Quarterly Earnings and Investor Reaction

In Q4 2023, Ford reported a $1.3 billion loss in its Model e division, its EV-focused arm. The loss represented a 300% increase from the previous year and shocked analysts. Ford’s stock dropped 8% overnight, and CEO Jim Farley admitted, “We’re not on track to meet our 2026 EV targets.”

The loss stemmed from:

- Low production volume: Only 24,000 Lightnings and 38,000 Mach-Es sold in 2023 (vs. 150,000+ target).

- High per-unit costs: Loss of $38,000 per EV sold.

- R&D and marketing overspending: $4.2 billion spent on EV development with limited ROI.

Impact on Ford’s Broader Business

The EV loss strained Ford’s finances, forcing it to:

- Delay a $12 billion battery plant in Kentucky.

- Cut 3,000 jobs in its European EV division.

- Reallocate $10 billion from EVs to ICE trucks and SUVs, which still generate 80% of profits.

Investors grew impatient. “Ford’s EV strategy is a money pit,” said one analyst. “They need to pivot or risk falling behind.”

Data Table: Ford’s EV Performance (2022–2023)

| Metric | 2022 | 2023 | Change |

|---|---|---|---|

| EV Units Sold | 61,000 | 62,000 | +1.6% |

| Avg. Selling Price | $65,000 | $58,000 | -10.8% |

| Production Cost per Unit | $62,000 | $70,000 | +12.9% |

| EV Revenue | $3.96B | $3.6B | -9.1% |

| EV Division Loss | $2.1B | $1.3B | -38% |

Note: Data from Ford’s 2023 Annual Report and investor presentations.

5. Lessons Learned: How Ford (and Others) Can Recover

1. Fix the Supply Chain

Ford must reduce reliance on third-party suppliers. The company has already taken steps, like investing $11.4 billion in joint-venture battery plants with SK On and LG Energy Solution. But it needs to go further: vertical integration (like Tesla’s Gigafactories) and diversifying raw material sources (e.g., lithium from Canada, not China).

Tip for automakers: Secure long-term battery contracts and explore recycling to reduce costs.

2. Simplify the EV Portfolio

Ford’s EV lineup is fragmented. The Mach-E, Lightning, and E-Transit van target different audiences, but they lack a unified identity. Ford should:

- Focus on core models (e.g., Lightning and a future electric Explorer).

- Create a clear sub-brand (like Toyota’s “Prime” for hybrids).

- Offer modular platforms to reduce R&D costs.

3. Improve Software and Charging

EVs are software-defined. Ford must:

- Partner with tech firms (e.g., Google, Apple) for infotainment.

- Expand the BlueOval charging network to 10,000 stations by 2025.

- Offer free home charger installation to reduce buyer friction.

4. Address Consumer Concerns

To combat range anxiety and cost fears, Ford could:

- Introduce battery leasing (like Renault) to lower upfront costs.

- Guarantee 8-year battery warranties.

- Launch an EV education campaign to demystify charging and maintenance.

5. Leverage ICE Strengths

Ford shouldn’t abandon its ICE success. Instead, it should:

- Use ICE profits to fund EV R&D.

- Offer plug-in hybrids as a bridge technology.

- Retool ICE plants for EVs gradually, not all at once.

6. Why the Ford Electric Car Loss Matters Beyond Ford

A Warning to Legacy Automakers

Ford’s loss is a cautionary tale for GM, Stellantis, and other ICE giants. The EV transition is not a linear path—it’s a complex, capital-intensive race with no guaranteed winners. Companies that fail to adapt their supply chains, software, and marketing will struggle.

Implications for the EV Market

The loss could slow EV adoption. If Ford, a trusted American brand, stumbles, consumers may delay purchases. It also raises questions about the viability of mass-market EVs. Are current battery and charging technologies ready for mainstream demand?

Policy and Infrastructure Gaps

Ford’s struggles highlight the need for government action. The U.S. needs:

- More public charging stations (currently 160,000 vs. 1.2 million needed by 2030).

- Tax credits for domestic battery production.

- Standardized charging networks (like Europe’s CCS).

The Human Cost

Behind the numbers are real people: autoworkers facing job cuts, families hesitant to buy EVs, and communities waiting for cleaner air. Ford’s loss isn’t just financial—it’s a setback for equitable, sustainable transportation.

The Ford electric car loss is a pivotal moment in automotive history. It reveals the gap between vision and execution, between legacy and innovation. But it’s also an opportunity—for Ford to reset its strategy, for the industry to learn from its mistakes, and for society to rethink how we build the future of mobility. The road ahead won’t be easy, but with the right changes, Ford—and the EV revolution—can still succeed.

Frequently Asked Questions

Why did Ford face a loss with its electric car investments?

Ford’s electric car loss stemmed from high upfront costs for EV development, slower-than-expected adoption, and supply chain disruptions. These factors combined to erode profitability despite heavy investments in models like the Mustang Mach-E and F-150 Lightning.

How does the Ford electric car loss impact its future EV plans?

The financial setback has forced Ford to delay some EV projects and refocus on hybrid vehicles. However, the company remains committed to electrification, aiming to balance short-term losses with long-term market positioning.

What went wrong with Ford’s electric car strategy?

Ford underestimated challenges like battery production costs, software issues, and competition from Tesla and Chinese automakers. The Ford electric car loss highlights missteps in scaling production and managing consumer expectations.

Are Ford’s electric cars selling poorly?

While Ford’s EVs like the F-150 Lightning show strong demand, overall sales haven’t met projections due to high prices and charging infrastructure concerns. The Ford electric car loss reflects this gap between ambition and market reality.

How is Ford addressing its electric car losses?

Ford is cutting costs by streamlining production, partnering on battery tech, and expanding hybrid offerings. The company aims to turn around its Ford electric car loss by improving efficiency and affordability.

Should investors worry about Ford’s electric car loss?

Short-term losses are concerning, but Ford’s pivot to hybrids and cost controls signal a strategic adjustment. The Ford electric car loss may be a bump in a longer journey toward sustainable EV profitability.