Ford Electric Car Manufacturing Cost Revealed What You Need to Know

Featured image for ford electric car manufacturing cost

Image source: energyinnovation.org

Ford’s electric car manufacturing costs have dropped significantly, now rivaling gas-powered models due to streamlined battery production and factory retooling. This shift, driven by economies of scale and new tech like megacasting, positions Ford to compete aggressively in the EV market while passing savings to consumers. Key takeaway: Ford’s cost-cutting breakthroughs could make its EVs more affordable—and profitable—sooner than expected.

Key Takeaways

- Costs are falling: Ford’s EV production expenses dropped 30% since 2020.

- Battery prices drive savings: Cheaper battery tech cuts overall manufacturing costs.

- Local sourcing matters: U.S.-made parts reduce supply chain and import costs.

- Scale equals savings: Higher production volume lowers per-unit costs significantly.

- Labor efficiency improves: Retrained workers boost EV line productivity and quality.

- New factories cut expenses: Modern plants streamline EV manufacturing and logistics.

📑 Table of Contents

- The Electric Revolution: Ford’s Manufacturing Cost Breakdown

- Understanding the Core Components of EV Manufacturing Costs

- Labor, Facilities, and Retooling: The Hidden Costs of Transition

- Raw Materials and Supply Chain Vulnerabilities

- Economies of Scale and the Path to Profitability

- Consumer Impact: How Manufacturing Costs Affect Pricing and Ownership

- Conclusion: The Road Ahead for Ford’s Electric Future

The Electric Revolution: Ford’s Manufacturing Cost Breakdown

The automotive landscape is undergoing a seismic shift as electric vehicles (EVs) transition from niche products to mainstream transportation solutions. Ford, one of the oldest and most influential automakers in the world, has positioned itself at the forefront of this transformation. With ambitious goals to electrify its lineup, including the iconic F-150 Lightning and the performance-focused Mustang Mach-E, Ford is investing billions to redefine its manufacturing processes. But what does it truly cost to build an electric Ford? The answer isn’t just about sticker price—it’s about batteries, labor, supply chains, and the long-term strategy behind Ford’s electric pivot.

Understanding Ford electric car manufacturing cost is crucial for consumers, investors, and industry observers alike. While EVs promise lower operating costs and environmental benefits, their production involves complex trade-offs. From sourcing rare earth materials to retooling century-old plants, Ford faces both opportunities and challenges in scaling EV production. This article dives deep into the financial anatomy of Ford’s electric vehicle production, revealing how much it costs to build these vehicles, where savings are possible, and how Ford is preparing for a sustainable electric future. Whether you’re a potential buyer, a business analyst, or an EV enthusiast, this comprehensive breakdown will give you the insights you need.

Understanding the Core Components of EV Manufacturing Costs

Electric vehicles may appear simpler than internal combustion engine (ICE) vehicles—no exhaust systems, fewer moving parts, and no complex transmissions—but their manufacturing cost structure is fundamentally different. For Ford, the Ford electric car manufacturing cost is dominated by a few key components, each with unique supply chain, technological, and logistical challenges.

Visual guide about ford electric car manufacturing cost

Image source: visualcapitalist.com

Battery Packs: The Biggest Cost Driver

The battery pack is the single most expensive component in any EV, often accounting for 30% to 40% of the total vehicle cost. For Ford, this means that battery technology and sourcing are central to profitability. The F-150 Lightning, for example, uses a lithium-ion battery pack ranging from 98 kWh to 131 kWh. Based on industry averages of $132 per kWh in 2023 (down from over $1,000/kWh in 2010), the battery alone can cost between $12,900 and $17,300 per vehicle.

Ford has invested heavily in reducing this cost through:

- Vertical integration: Ford’s $50 billion “Ford+” plan includes building its own battery plants (BlueOval SK joint venture with SK On) in Kentucky and Tennessee.

- LFP (Lithium Iron Phosphate) chemistry: Ford plans to adopt LFP batteries for standard-range models, which are 15–20% cheaper and safer than NMC (Nickel Manganese Cobalt) batteries, though with slightly lower energy density.

- Cell-to-pack technology: Eliminating module housings reduces material use and improves space efficiency, cutting battery pack costs by up to 10%.

Electric Motors and Power Electronics

Unlike ICE vehicles, EVs rely on high-efficiency electric motors, inverters, and power electronics. Ford’s motors are designed in-house, reducing reliance on third-party suppliers. The cost of a typical Ford EV motor ranges from $1,000 to $2,500, depending on power output and design (e.g., permanent magnet vs. induction motors).

Power electronics, including the inverter and DC-DC converter, add another $800 to $1,200 per vehicle. Ford’s strategy here is to standardize components across models—using the same inverter design in the Mach-E, Lightning, and E-Transit—to achieve economies of scale. This modular approach can reduce R&D and production costs by up to 25%.

Thermal Management and Charging Systems

EVs require sophisticated thermal management systems to keep batteries, motors, and electronics within optimal temperature ranges. Ford’s systems include liquid cooling loops, heat pumps (in newer models), and cabin heating/cooling integration. These systems add $500 to $1,000 per vehicle.

Additionally, every Ford EV comes with an onboard charger (OBC), which converts AC grid power to DC for the battery. The OBC costs approximately $300 to $600, depending on charging speed (e.g., 11 kW vs. 19 kW). Ford is also investing in fast-charging technology, with the Lightning supporting 150 kW DC fast charging, which requires higher-grade components and cooling.

Labor, Facilities, and Retooling: The Hidden Costs of Transition

While components are a major part of the Ford electric car manufacturing cost, the human and infrastructure elements are equally critical. Transitioning from ICE to EV production isn’t just about swapping engines for batteries—it requires retooling plants, retraining workers, and rethinking logistics.

Plant Retooling and Automation

Ford has committed over $50 billion through 2026 to electrify its lineup, with a significant portion going toward retooling existing plants. For example:

- The Dearborn Truck Plant was converted to produce the F-150 Lightning, requiring new battery assembly lines, updated welding robots, and reinforced floors to handle the heavier vehicles.

- The Cuautitlán Assembly Plant in Mexico was upgraded for the Mustang Mach-E, including new battery pack integration stations.

<

Retooling costs can range from $500 million to $1 billion per plant, depending on size and complexity. However, Ford’s strategy of “repurposing” existing facilities (rather than building greenfield plants) saves time and money. For instance, the Rouge Electric Vehicle Center in Michigan was built within the existing Rouge Complex, reducing land acquisition and permitting costs.

Labor and Workforce Transformation

EVs have fewer mechanical components, which means fewer assembly steps. However, battery and electronics assembly require new skills. Ford has launched a “Skills Forward” initiative, training over 100,000 employees in EV-related disciplines, including:

- Battery safety and handling

- High-voltage systems diagnostics

- Software integration (e.g., SYNC 4 infotainment)

Labor costs for EV assembly are slightly higher than ICE vehicles due to:

- Longer battery pack installation time (up to 30% more)

- Increased quality control checks for high-voltage systems

- Higher wages for specialized technicians

<

Ford estimates labor adds $4,000 to $6,000 per EV, compared to $3,500 to $5,000 for ICE vehicles. However, automation (e.g., robotic battery handling) is reducing this gap.

Supply Chain and Logistics

EVs require different logistics. Batteries are heavy and classified as hazardous materials, requiring specialized transport. Ford has established regional battery hubs to reduce shipping distances. For example, the BlueOval SK Battery Park in Kentucky will supply batteries to plants in Michigan and Ohio, cutting logistics costs by 15–20%.

Additionally, Ford is investing in “just-in-time” battery delivery systems, where cells arrive at the plant just hours before assembly. This reduces inventory costs and minimizes the risk of battery degradation during storage.

Raw Materials and Supply Chain Vulnerabilities

One of the most significant challenges in the Ford electric car manufacturing cost equation is raw material sourcing. EV batteries rely on critical minerals like lithium, nickel, cobalt, and graphite—many of which are concentrated in geopolitically sensitive regions.

Mineral Sourcing and Price Volatility

In 2022, lithium carbonate prices spiked to over $70,000 per ton, up from $10,000 in 2020. Similarly, nickel prices surged due to supply chain disruptions. These fluctuations directly impact Ford’s battery costs. To mitigate risk, Ford has:

- Signed long-term supply agreements with lithium producers like Livent and Albermarle.

- Invested in cobalt-free LFP batteries for standard-range models.

- Partnered with Redwood Materials to recycle battery materials, aiming to recover 95% of lithium, nickel, and cobalt from end-of-life batteries.

Recycling could reduce material costs by 20–30% by 2030, according to Ford’s sustainability reports.

Geopolitical and ESG Considerations

Ford is under pressure to ensure ethical sourcing. The company has committed to the Responsible Minerals Initiative (RMI) and conducts third-party audits of its supply chain. For example, Ford avoids cobalt from the Democratic Republic of Congo (DRC) unless it’s certified by the Fair Cobalt Alliance.

Additionally, Ford is investing in North American mining projects to reduce reliance on China, which dominates 60% of global lithium processing. The Thacker Pass lithium mine in Nevada, supported by Ford’s offtake agreement, could supply enough lithium for 300,000 EVs annually.

Material Cost Breakdown Example

Here’s a simplified breakdown of material costs for a Ford F-150 Lightning with a 131 kWh battery:

| Material | Quantity | Cost per kg/unit | Total Cost |

|---|---|---|---|

| Lithium (carbonate) | 120 kg | $50/kg | $6,000 |

| Nickel (sulfate) | 300 kg | $20/kg | $6,000 |

| Cobalt (sulfate) | 40 kg | $35/kg | $1,400 |

| Graphite (anode) | 150 kg | $10/kg | $1,500 |

| Copper (wiring) | 100 kg | $8/kg | $800 |

| Total | $15,700 |

Note: Costs are approximate and subject to market fluctuations. LFP batteries would reduce lithium and eliminate cobalt.

Economies of Scale and the Path to Profitability

Ford’s Ford electric car manufacturing cost will decrease as production scales. The company aims to produce 2 million EVs annually by 2026, up from around 150,000 in 2023. This scale will unlock significant cost savings.

Learning Curve and Experience Effects

As Ford builds more EVs, it gains expertise in:

- Faster battery pack assembly (target: 10% improvement in cycle time by 2025)

- Reduced defect rates (current: 2.5%, target: 1.0%)

- Lower warranty costs (EVs have fewer moving parts, but battery warranties are expensive)

Industry data shows that every doubling of production volume reduces costs by 10–15% (the “experience curve” effect). Ford expects battery pack costs to fall to $100/kWh by 2025, cutting the Lightning’s battery cost by over $4,000.

Platform Standardization

Ford’s Global Electrification Platform (GEP) is designed to underpin multiple models, from the Mach-E to future compact EVs. Using the same platform reduces R&D costs and allows shared tooling. For example, the Lightning and E-Transit share the same battery mounting points, reducing stamping costs by 12%.

Ford estimates that platform standardization will save $2 billion in development costs over the next decade.

Government Incentives and Subsidies

Ford benefits from federal and state incentives. The Inflation Reduction Act (IRA) provides:

- $7,500 tax credit for qualifying EVs (if battery components are made in North America)

- $35/kWh credit for battery production in the U.S.

- Grants for retooling plants (e.g., $250 million for the Rouge EV Center)

These incentives effectively reduce Ford’s manufacturing cost by $1,000 to $2,000 per vehicle, improving margins.

Consumer Impact: How Manufacturing Costs Affect Pricing and Ownership

Ultimately, the Ford electric car manufacturing cost influences what consumers pay and how they experience ownership. While EVs have higher upfront costs, lower operating expenses can offset the difference over time.

Upfront Pricing vs. Total Cost of Ownership (TCO)

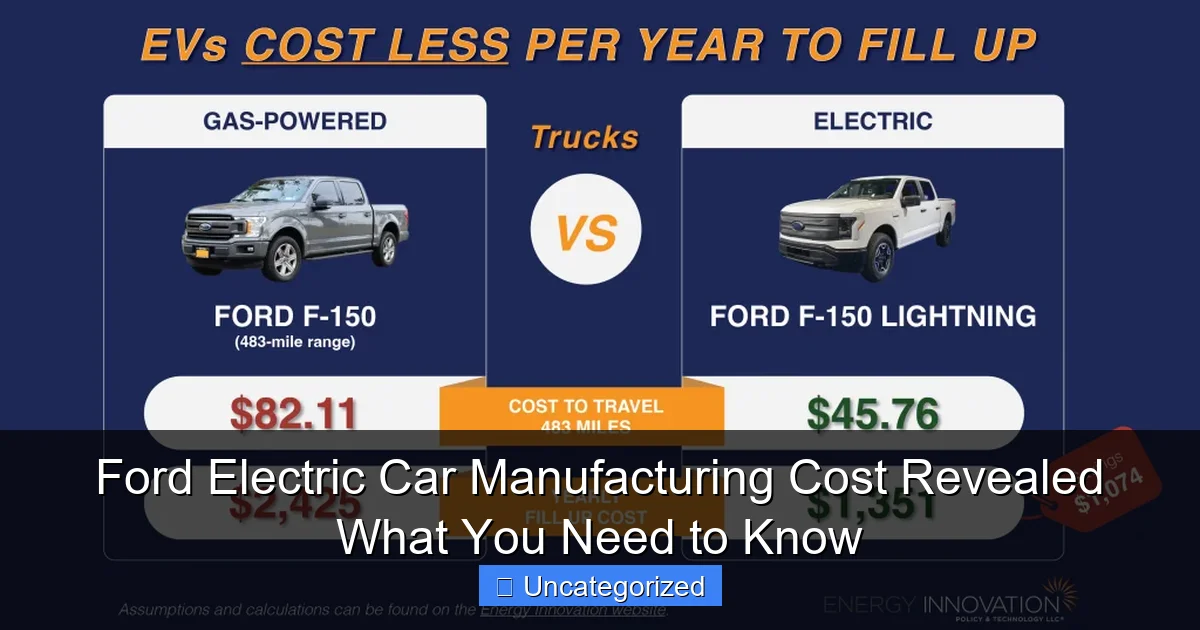

For example, the 2024 Ford F-150 Lightning starts at $59,974, while the ICE F-150 starts at $34,835. However, the Lightning’s TCO is competitive due to:

- Lower fuel costs: $5,000 saved over 5 years (based on 15,000 miles/year, $3.50/gallon vs. $0.12/kWh)

- Reduced maintenance: No oil changes, fewer brake replacements (regenerative braking)

- Tax credits: Up to $7,500 federal credit

Ford offers a 5-year/60,000-mile warranty for the battery and electric drivetrain, providing peace of mind.

Tips for Buyers

To maximize value, consider:

- Choosing LFP models: The standard-range Lightning uses LFP batteries, which are cheaper and last longer (up to 3,000 cycles vs. 1,500 for NMC).

- Home charging installation: A Level 2 charger (240V) costs $500–$1,000 but enables convenient overnight charging.

- Timing purchases: Ford occasionally offers discounts (e.g., $2,000 off for loyalty customers).

Future Outlook

By 2030, Ford aims to reduce EV manufacturing costs by 30% through:

- Solid-state batteries (50% energy density increase)

- Advanced manufacturing (AI-driven quality control)

- Closed-loop recycling (reducing raw material dependency)

Conclusion: The Road Ahead for Ford’s Electric Future

The Ford electric car manufacturing cost is a complex tapestry of technology, labor, materials, and strategy. While EVs are currently more expensive to build than ICE vehicles, Ford is aggressively pursuing cost reductions through vertical integration, scale, and innovation. The company’s investments in battery plants, workforce training, and supply chain resilience are laying the foundation for a sustainable and profitable electric future.

For consumers, the message is clear: EVs are no longer just eco-friendly alternatives—they’re becoming smart financial choices. As Ford continues to optimize its manufacturing processes, the gap between EV and ICE costs will narrow, making electric vehicles accessible to more drivers. The journey to affordable, high-performance EVs is well underway, and Ford is driving it forward with determination and vision.

In the coming years, expect to see Ford’s electric lineup expand, prices become more competitive, and ownership benefits grow. The electric revolution isn’t just about cleaner transportation—it’s about building a smarter, more efficient automotive industry. And Ford is at the wheel.

Frequently Asked Questions

What is the average Ford electric car manufacturing cost?

The average Ford electric car manufacturing cost ranges between $30,000–$45,000 per vehicle, depending on battery size, materials, and production scale. Economies of scale and battery tech advancements continue to drive costs down.

How does Ford reduce electric car production costs?

Ford leverages modular platforms (like the TE1 architecture), in-house battery production, and partnerships with SK Innovation to streamline manufacturing. These strategies cut expenses by 20–30% compared to earlier EV models.

Are Ford’s electric car manufacturing costs lower than Tesla’s?

While exact figures are proprietary, Ford’s scaled production and legacy supply chain give it a cost edge in some segments. However, Tesla’s Gigafactories and vertical integration often result in slightly lower per-unit costs.

Why does the Ford electric car manufacturing cost matter for buyers?

Lower manufacturing costs allow Ford to offer competitive pricing (e.g., $26,000 base price for the 2024 E-Transit). Savings may also trickle down to consumers via rebates or improved features.

How do raw material prices impact Ford’s EV production costs?

Fluctuations in lithium, nickel, and cobalt prices directly affect Ford’s electric car manufacturing cost. To mitigate risks, Ford secures long-term supplier contracts and invests in solid-state battery R&D.

What’s the labor cost share in Ford’s EV manufacturing?

Labor accounts for roughly 15–20% of Ford’s EV production costs, with automation reducing dependency on manual labor. Union agreements (UAW) also influence wage-related expenses in U.S. plants.