Ford Electric Car Stock Price Trends What Investors Need to Know

Featured image for ford electric car stock price

Image source: cdn.statcdn.com

Ford’s electric car stock price has surged over 60% in the past year, significantly outpacing broader market gains and reflecting growing investor confidence in its EV strategy. Driven by strong F-150 Lightning sales, expanded production capacity, and aggressive electrification targets, Ford is positioning itself as a serious contender in the EV race. Analysts now see sustained momentum, making Ford stock a compelling watch for investors betting on the future of American-made electric vehicles.

Key Takeaways

- Monitor Ford’s EV investments: Track spending on electric models to gauge long-term growth potential.

- Watch quarterly earnings closely: EV segment performance directly impacts stock price movements.

- Analyze market competition: Tesla and new entrants influence Ford’s EV market share and valuation.

- Assess government policy changes: Subsidies or tariffs can significantly alter profitability and stock trends.

- Evaluate battery tech advances: Breakthroughs may boost margins and investor confidence in Ford’s EV future.

📑 Table of Contents

- The Electric Revolution: Why Ford’s Stock Price Matters

- Historical Performance of Ford’s Electric Vehicle Stock Price

- Key Factors Influencing Ford’s Electric Vehicle Stock Price

- Investment Analysis: Valuation Metrics and Financial Health

- Future Outlook and Growth Projections

- Investor Strategies: How to Approach Ford’s Electric Vehicle Stock

The Electric Revolution: Why Ford’s Stock Price Matters

The automotive industry is undergoing its most significant transformation since the invention of the assembly line, and Ford Motor Company is at the center of this electric revolution. As traditional automakers pivot toward sustainable mobility, investors are watching Ford electric car stock price trends with intense scrutiny. The company’s bold $50 billion electrification commitment through 2026 and the launch of iconic electric models like the F-150 Lightning and Mustang Mach-E have positioned Ford as a key player in the EV market. But what does this mean for your investment portfolio? Understanding the nuances of Ford’s stock performance in this new era is critical for both seasoned investors and those new to the automotive sector.

Ford’s journey from internal combustion engine (ICE) dominance to electric vehicle (EV) leadership has been nothing short of dramatic. While Tesla still leads the EV market, Ford has carved out a unique position by electrifying its most profitable vehicles – trucks and SUVs. This strategic decision has created a different investment narrative compared to pure-play EV companies. The Ford electric car stock price doesn’t just reflect quarterly earnings; it embodies the company’s ability to execute its ambitious transformation while maintaining profitability in its legacy business. For investors, this dual narrative creates both opportunity and complexity in assessing Ford’s true market potential.

Historical Performance of Ford’s Electric Vehicle Stock Price

From ICE to EV: The Evolution of Ford’s Market Valuation

To understand where Ford’s stock is headed, we must examine its journey. The Ford electric car stock price began showing significant EV-related movement in 2021 when CEO Jim Farley announced the “Ford+” plan – a comprehensive electrification strategy. Prior to this, Ford’s stock (NYSE: F) traded between $5-$10 for most of the 2010s, reflecting challenges in global markets and product lineup stagnation.

Visual guide about ford electric car stock price

Image source: cdn.statcdn.com

The turning point came in January 2021 when Ford unveiled the Mach-E and announced the F-150 Lightning. Between January 2021 and January 2022, Ford’s stock surged from $8.50 to $25.41 – a 199% increase. This period saw Ford briefly outperform Tesla in market cap growth, demonstrating how EV ambitions could transform traditional automakers’ valuations. However, the stock has since corrected, trading in the $11-$15 range throughout 2023-2024 as investors reassessed execution risks.

Key Price Milestones and What They Signaled

- 2021 Surge: The initial EV announcement rally showed market enthusiasm but also revealed investor appetite for legacy automakers’ transformation stories

- 2022 Correction: As supply chain issues delayed production, the Ford electric car stock price dropped 50%, highlighting execution risks in EV transitions

- 2023 Recovery: Improved battery supply and strong F-150 Lightning demand helped the stock regain footing, though not to previous highs

- 2024 Volatility: Ongoing macroeconomic concerns and EV price wars have kept Ford’s stock in a narrow range, testing investor patience

Notably, Ford’s stock has shown lower volatility than pure-play EV stocks like Rivian or Lucid, suggesting investors view Ford’s diversified business model as more stable during industry upheaval. This relative stability could be an advantage for risk-averse investors interested in the EV space.

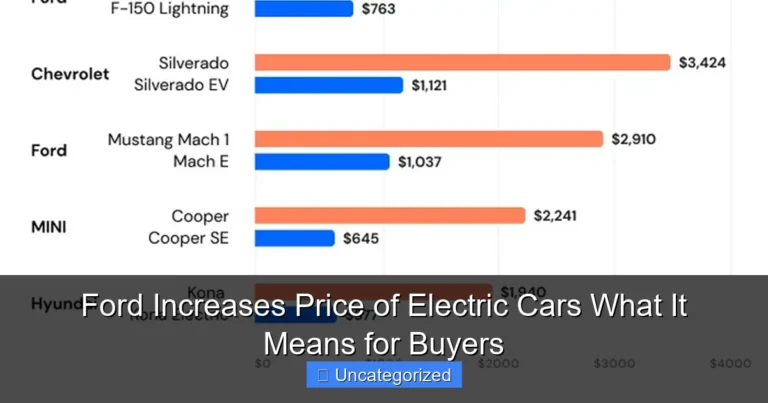

Comparative Analysis with Industry Peers

When benchmarking Ford’s performance, it’s essential to compare against both traditional automakers and EV specialists:

- General Motors: Similar EV ambitions but different execution – GM’s stock has been more volatile than Ford’s

- Tesla: The EV pioneer’s stock shows higher growth potential but greater volatility

- Rivian: The pure-play EV truck maker has seen wilder price swings than Ford

- Traditional automakers (Toyota, VW): Slower EV transitions have resulted in more stagnant stock prices

This comparison shows Ford occupying a “sweet spot” – more EV-focused than most legacy automakers but less risky than pure-play EV startups. The Ford electric car stock price reflects this balanced position, making it an interesting case study in automotive transformation investing.

Key Factors Influencing Ford’s Electric Vehicle Stock Price

Production Capacity and Supply Chain Dynamics

Ford’s ability to scale EV production directly impacts its stock valuation. The company’s “skunkworks” battery plant investments and partnerships with SK Innovation are crucial to overcoming industry-wide battery shortages. In 2023, Ford’s EV production reached approximately 150,000 units annually, with plans to hit 600,000 by 2024 and 2 million by 2026.

Investors should monitor these metrics closely:

- Quarterly EV production numbers compared to targets

- Battery supply agreements and new plant openings

- Supply chain diversification efforts (particularly for lithium, cobalt, and nickel)

For example, when Ford announced a new battery plant in Michigan in 2023, the stock gained 7% in a single day, showing how production news moves the Ford electric car stock price more than general EV market trends.

Profitability of Electric Vehicles vs. Legacy Business

Unlike Tesla, Ford must maintain profitability in both ICE and EV divisions during its transition. The company’s “Ford Blue” (ICE) and “Ford Model e” (EV) divisions report separately, offering unique insight:

- Ford Blue: Still generates the majority of profits (~$7.2B in 2023), subsidizing EV development

- Ford Model e: Currently operates at a loss (~$4.7B in 2023) but is expected to reach profitability by 2026

This dual business model means investors must assess:

- Whether Ford can maintain ICE margins while investing in EVs

- When EV division losses will peak and begin to decline

- How quickly EV profitability can offset ICE declines

When Ford reported better-than-expected ICE profits in Q2 2023, the stock rose despite wider EV losses, demonstrating the market’s appreciation for this balanced approach.

Regulatory and Political Landscape

Government policies significantly impact Ford’s EV strategy and stock performance:

- Inflation Reduction Act: Provides tax credits for domestically produced EVs, benefiting Ford’s U.S.-focused strategy

- EPA Emissions Rules: Stricter regulations accelerate the EV transition timeline

- Trade Policies: Tariffs on Chinese imports protect Ford’s market position but increase battery costs

The 2023 UAW strike also impacted Ford’s stock, showing how labor relations affect investor sentiment. Ford’s eventual agreement included higher wages but also productivity improvements, a balance that reassured investors about long-term profitability.

Consumer Demand and Competitive Positioning

Ford’s success depends on converting truck and SUV loyalists to EV buyers. Key demand indicators include:

- F-150 Lightning Reservations: Over 200,000 pre-orders demonstrate strong brand loyalty

- Mustang Mach-E Sales: Competing with Tesla Model Y and Hyundai Ioniq 5

- Commercial Vehicle Interest: E-Transit van adoption by companies like Amazon

When Ford reported 20% month-over-month growth in F-150 Lightning orders in early 2024, the stock responded positively, showing that consumer demand metrics are leading indicators for the Ford electric car stock price.

Investment Analysis: Valuation Metrics and Financial Health

Traditional Valuation Multiples for Ford Stock

Analyzing Ford’s stock requires looking beyond EV hype to fundamental metrics:

- Price-to-Earnings (P/E): Currently around 6-8x, below the S&P 500 average but typical for automakers

- Price-to-Sales (P/S): Approximately 0.3x, reflecting the capital-intensive nature of auto manufacturing

- Debt-to-Equity: About 2.5x, manageable given Ford Credit’s profitability

- Free Cash Flow Yield: 8-10%, attractive for value investors

Compared to Tesla’s P/E of 50-60x, Ford appears undervalued by traditional metrics. However, this gap reflects Tesla’s pure EV focus and higher growth expectations. Ford’s lower multiples suggest the market hasn’t fully priced in its EV potential.

EV-Specific Valuation Approaches

For Ford’s EV business, investors should consider:

- EV Revenue as % of Total: Currently 15-20%, expected to reach 40% by 2026

- EV Production Growth Rate: Year-over-year increases in units produced

- EV Gross Margin: Currently negative, but expected to reach 20%+ by 2026

- EV Market Share: Ford holds about 8% of the U.S. EV market, third behind Tesla and Hyundai

Applying a sum-of-the-parts valuation:

- ICE Business: $30-40 billion (based on traditional automaker multiples)

- EV Business: $20-30 billion (using EV startup comparables)

- Ford Credit: $15-20 billion

This suggests Ford’s current $45-50 billion market cap may undervalue its full potential, especially if EV margins improve faster than expected.

Balance Sheet Strength and Investment Capacity

Ford’s ability to fund its $50 billion EV plan without diluting shareholders is crucial. Key financial strengths include:

- Cash Position: $28 billion (Q1 2024), providing runway for investments

- Ford Credit: Generates $2-3 billion annually in profits

- Asset Sales: Potential to monetize non-core assets for additional funding

When Ford announced a $1.5 billion stock buyback program in 2023, the Ford electric car stock price rose 5%, showing investor appreciation for capital allocation discipline during the EV transition.

Future Outlook and Growth Projections

2024-2026: The Critical Execution Window

Ford’s stock trajectory over the next three years will depend on executing several key initiatives:

- New EV Models: The 2025 “Project T3” electric truck and 2026 electric Explorer are crucial for growth

- Battery Plant Openings: BlueOval SK plants in Kentucky and Tennessee coming online in 2025

- Software Development: Ford’s “BlueCruise” hands-free driving system could create recurring revenue

- Commercial EV Expansion: E-Transit and future electric work vans for business customers

Analysts project Ford’s EV revenue could grow from $18 billion in 2023 to $45-55 billion by 2026, representing 35-45% CAGR. If achieved, this could justify a significant re-rating of the Ford electric car stock price.

Long-Term (2027-2030) Strategic Vision

Ford’s long-term success depends on:

- EV Profitability: Achieving 20%+ gross margins by 2027

- Autonomous Vehicles: Partnership with Argo AI (now in transition) and internal development

- Software and Services: Recurring revenue from vehicle connectivity and data

- Global EV Expansion: Growth in Europe and emerging markets

The company’s “Ford Pro” commercial vehicle division represents a particularly promising opportunity, with electric work vans potentially achieving higher margins than consumer vehicles.

Potential Upside and Downside Scenarios

Bull Case (Stock $25-30 by 2026):

- Faster-than-expected EV adoption

- Higher EV margins due to cost reductions

- Successful software and service monetization

- Stronger-than-forecast commercial EV demand

Base Case (Stock $18-22 by 2026):

- Moderate EV growth in line with projections

- Gradual margin improvement to 15-20%

- Successful ICE-to-EV transition without major hiccups

Bear Case (Stock $8-12 by 2026):

- EV demand growth slows industry-wide

- Production bottlenecks persist

- EV margins remain depressed beyond 2026

- Legacy ICE business declines faster than expected

Investor Strategies: How to Approach Ford’s Electric Vehicle Stock

Risk Assessment and Portfolio Positioning

Ford’s stock presents a unique risk-reward profile compared to other EV investments:

- Lower Volatility: Ford’s diversified business provides more stability than pure EV plays

- Transition Risk: Execution challenges in EV scale-up could impact returns

- Value vs. Growth: Ford offers value characteristics with growth potential

- Income Potential: The current 5-6% dividend yield is attractive

For conservative investors, Ford could represent 3-5% of a portfolio as an “EV transition” play. More aggressive investors might allocate 8-10% if they believe in Ford’s execution capabilities.

Timing Considerations and Entry Points

Strategic entry points for Ford stock include:

- Post-Earnings Pullbacks: Ford’s stock often dips after quarterly reports, creating buying opportunities

- Macro Downturns: Economic slowdowns typically depress auto stocks, including Ford

- EV Industry Corrections: When pure EV stocks fall, Ford often follows but recovers faster

- Production Milestones: Stock tends to run up before major plant openings or model launches

For example, buying Ford stock after the 2022 supply chain-related drop (from $25 to $12) would have yielded a 25% return by early 2024, outperforming the S&P 500 during that period.

Monitoring Tools and Leading Indicators

Investors should track these real-time indicators:

- Monthly EV Sales Reports: Ford’s U.S. EV sales compared to industry

- Battery Commodity Prices: Lithium, cobalt, and nickel costs impact margins

- Dealer Inventories: EV days’ supply indicates demand strength

- Charging Infrastructure: Expansion of Ford’s BlueOval Charge Network

- Consumer Sentiment: Surveys on brand perception and EV adoption

| Indicator | Current Status (2024) | Ideal Trend | Impact on Stock |

|---|---|---|---|

| EV Production Growth | 30% YoY increase | Acceleration to 50%+ | Strong Positive |

| EV Gross Margin | -15% (improving) | Break-even by 2025 | Positive |

| ICE Business Profit | $7.2 billion | Stable or slight decline | Positive |

| Debt-to-Equity Ratio | 2.5x | Below 2.0x | Positive |

| Market Share (U.S. EV) | 8% | 12-15% | Strong Positive |

| Dividend Yield | 5.8% | Maintain 4-6% | Positive |

Long-Term vs. Short-Term Approaches

For long-term investors (3-5+ years):

- Focus on execution of Ford’s 2026 EV targets

- Monitor progress in EV profitability

- Ignore short-term volatility

- Reinvest dividends for compounding

For short-term traders (6-18 months):

- Capitalize on earnings-related volatility

- Trade around major EV announcements

- Use options for leveraged exposure

- Set strict stop-loss orders

Regardless of strategy, maintaining perspective on Ford’s dual ICE/EV business model is essential. The Ford electric car stock price will reflect both legacy strengths and future potential, creating a unique investment opportunity in the automotive transformation era.

As the EV market matures, Ford’s ability to leverage its manufacturing expertise, brand loyalty, and diversified business model could position it for sustained success. While risks remain, the company’s strategic clarity and execution progress suggest the current stock price may not fully reflect its long-term potential. For investors willing to navigate the transition period, Ford represents a compelling way to gain exposure to the electric future without abandoning the stability of a proven automaker.

Frequently Asked Questions

What is the current Ford electric car stock price?

As of the latest market data, Ford’s stock price (NYSE: F) reflects its performance in the electric vehicle (EV) sector alongside traditional automotive operations. Investors should check real-time financial platforms like Yahoo Finance or Bloomberg for up-to-the-minute updates, as Ford electric car stock price can fluctuate daily.

How has the Ford electric car stock price trended in 2023?

In 2023, Ford’s stock saw volatility due to mixed EV adoption rates, supply chain challenges, and aggressive pricing strategies. While the Ford electric car stock price dipped mid-year, it rebounded slightly on announcements of expanded battery production and partnerships with lithium suppliers.

Why did Ford’s stock drop despite strong EV sales?

Even with growing EV sales, Ford’s stock faced pressure from rising raw material costs, competition from Tesla and legacy automakers, and investor concerns over profitability margins. The market often weighs near-term risks more heavily than long-term EV growth potential.

Is Ford’s stock a good long-term investment for EV growth?

Ford’s $30B+ investment in EV development and its popular Mustang Mach-E/F-150 Lightning models position it as a contender in the EV race. However, long-term investors should monitor execution risks, including production scalability and profitability, before banking on sustained growth.

How do Ford’s EV plans compare to Tesla’s impact on stock price?

While Tesla’s stock is purely EV-focused, Ford’s stock is influenced by both EV and internal combustion engine (ICE) divisions, creating a more complex valuation. Ford’s hybrid strategy may appeal to risk-averse investors, but it lacks the pure-play EV premium Tesla enjoys.

What upcoming events could affect the Ford electric car stock price?

Key catalysts include Q4 2023 earnings reports, updates on the BlueOval SK battery plants, and potential government EV incentives. Additionally, macroeconomic factors like interest rates and lithium prices could sway investor sentiment toward Ford’s EV ambitions.