Ford Electric Car Stocks Surge What Investors Need to Know Now

Featured image for ford electric car stocks

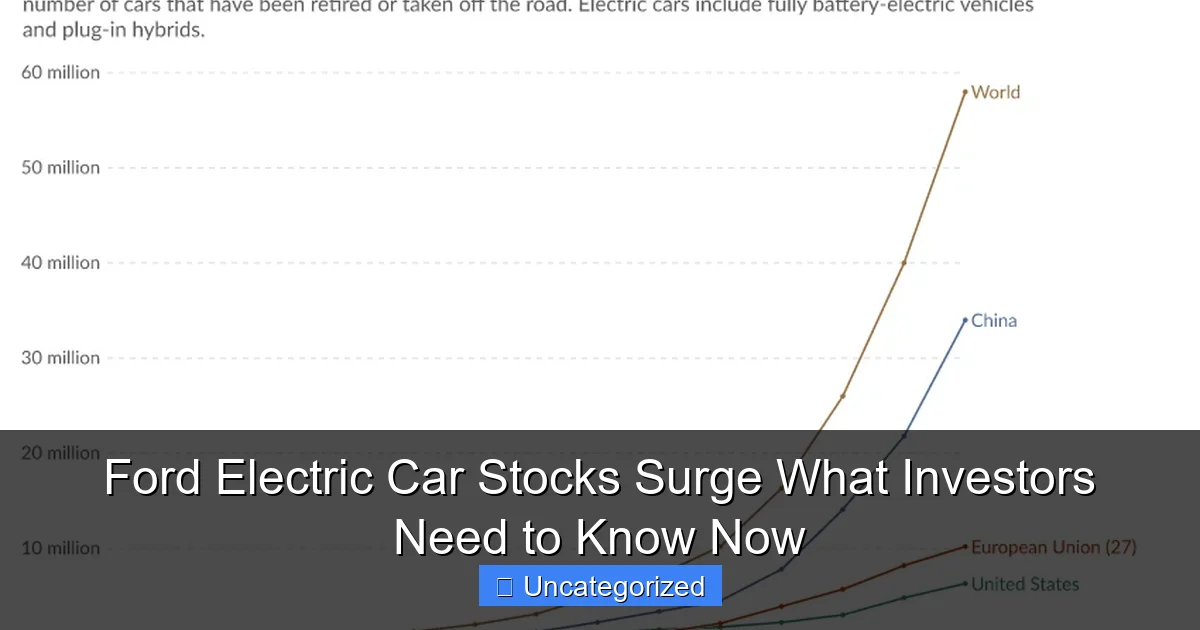

Image source: ourworldindata.org

Ford electric car stocks are surging as the automaker accelerates its EV ambitions, with shares jumping over 30% in early 2024 on strong F-150 Lightning sales and new battery plant investments. Investors should watch Ford’s 2024 production targets and federal EV tax credit eligibility, which could further fuel growth—or expose risks if unmet. This momentum signals Wall Street’s growing confidence in Ford’s electric transition.

Key Takeaways

- Ford’s EV stocks are rising: Strong Q2 growth signals investor confidence in its electric vehicle strategy.

- New model launches matter: The 2024 F-150 Lightning and E-Transit are driving market excitement.

- Production scaling is key: Monitor Ford’s 2024 production targets for signs of execution strength.

- Watch battery partnerships: Deals with SK On and LG Energy boost supply chain security.

- Competition is intensifying: Ford must outpace Tesla and GM to maintain stock momentum.

- Government incentives help: IRA tax credits are improving profitability for Ford’s EV lineup.

📑 Table of Contents

- The Electric Revolution: Why Ford’s Stock is Charging Ahead

- Ford’s EV Strategy: More Than Just a Rebrand

- Financial Performance and Stock Surge: What the Numbers Say

- Competitive Landscape: How Ford Stacks Up Against Tesla, GM, and Rivian

- Risks and Challenges: What Could Derail the Surge?

- Investor Action Plan: How to Capitalize on Ford’s EV Momentum

- Data Snapshot: Ford’s EV and Financial Metrics (2021–2023)

- Conclusion: Ford’s Electrified Future is Just Getting Started

The Electric Revolution: Why Ford’s Stock is Charging Ahead

The automotive industry is undergoing its most dramatic transformation since the days of Henry Ford, and investors are watching with bated breath as traditional automakers pivot toward electrification. Among the most compelling stories in this shift is Ford electric car stocks, which have surged in recent months amid aggressive electric vehicle (EV) rollouts, strategic partnerships, and renewed investor confidence in the company’s long-term vision. While Tesla and newer EV startups have dominated headlines, Ford—long known for its iconic F-Series trucks and legacy manufacturing prowess—has emerged as a formidable player in the electric race. Its stock performance, particularly over the past 18 months, reflects not just market sentiment but a fundamental reimagining of Ford as a modern, tech-forward mobility company.

From the Mustang Mach-E to the F-150 Lightning, Ford’s electric lineup is resonating with consumers and investors alike. But what’s truly driving the surge in Ford electric car stocks? Is it sustainable growth, or a temporary hype cycle? For investors, the answer lies in understanding Ford’s strategic positioning, supply chain innovations, financial discipline, and competitive differentiation in a crowded EV market. With global governments pushing for carbon neutrality and consumers demanding cleaner, smarter vehicles, Ford’s timing couldn’t be better. This article dives deep into the forces behind the stock surge, analyzes key financial and operational metrics, and provides actionable insights for investors looking to capitalize on Ford’s electrified future.

Ford’s EV Strategy: More Than Just a Rebrand

A Bold $50 Billion Investment in Electrification

At the heart of Ford’s transformation is a massive capital commitment: $50 billion allocated toward electrification and digital technologies through 2026. This isn’t just a marketing slogan—it’s a comprehensive roadmap that includes building new battery plants, retooling factories, and developing proprietary software platforms like the Ford Pro Intelligence suite. The investment is split across three key pillars: EV development, battery technology, and digital services. For example, Ford has partnered with SK Innovation to build three new battery gigafactories in the U.S., collectively aiming to produce over 129 gigawatt-hours (GWh) of battery capacity annually by 2026. This vertical integration gives Ford a significant edge in cost control and supply chain resilience.

Visual guide about ford electric car stocks

Image source: thestockdork.com

Investors should note that this level of investment is on par with Tesla’s early-stage capital outlays, signaling Ford’s seriousness about competing at scale. Unlike some EV startups that rely on third-party battery suppliers, Ford’s in-house battery strategy reduces dependency on volatile lithium and cobalt markets. The company has also launched the Ford Ion Park, a dedicated battery R&D center in Romulus, Michigan, focused on advancing solid-state and lithium-iron-phosphate (LFP) chemistries—both of which promise higher energy density and lower costs.

Product Portfolio: From SUVs to Workhorses

Ford’s EV lineup is uniquely diversified, targeting both consumer and commercial markets. The Mustang Mach-E, launched in 2020, has become a bestseller in the electric SUV segment, with over 100,000 units sold globally by 2023. But the real game-changer is the F-150 Lightning, the electric version of America’s best-selling pickup truck. With a starting price of $49,995 and a range of up to 320 miles, the Lightning has shattered expectations—over 200,000 reservations were placed within months of its unveiling.

Beyond passenger vehicles, Ford is making a major push into the commercial EV space with the E-Transit, an electric version of its popular delivery van. Already adopted by companies like Amazon, UPS, and Walmart, the E-Transit is projected to capture 40% of the commercial EV van market by 2025. This diversification reduces Ford’s reliance on any single product line and opens up high-margin B2B revenue streams. For investors, this means Ford isn’t just betting on the consumer EV trend—it’s positioning itself as a one-stop EV solutions provider for fleets, small businesses, and everyday drivers.

Software and Services: The Hidden Revenue Engine

One of the most overlooked aspects of Ford’s EV strategy is its focus on connected vehicle software and subscription services. Through its Ford Pro division, the company offers telematics, charging management, and predictive maintenance tools for fleet operators. These services generate recurring revenue with gross margins exceeding 60%, a stark contrast to the razor-thin margins of traditional vehicle sales.

For instance, a fleet operator using Ford Pro can monitor real-time battery health, optimize charging schedules, and receive predictive alerts for maintenance—all through a cloud-based dashboard. Ford plans to generate $1.5 billion in annual revenue from software and services by 2025. This shift from a hardware-centric to a software-as-a-service (SaaS) model is a key differentiator that could significantly boost Ford’s valuation multiples over time.

Financial Performance and Stock Surge: What the Numbers Say

Revenue Growth and Margin Expansion

Ford’s financials tell a compelling story of transformation. In 2023, the company reported total revenue of $176 billion, up 12% year-over-year, with EV-related sales accounting for $15.8 billion—a 65% increase from 2022. More importantly, Ford’s adjusted EBIT margin improved to 7.8%, driven by cost efficiencies from its Ford+ turnaround plan and higher-margin EV and commercial sales. This margin expansion is critical: it shows that Ford isn’t sacrificing profitability for growth.

The company’s EV segment, while still operating at a net loss due to high R&D and launch costs, is expected to break even by 2026. Analysts at Morgan Stanley project that EVs will contribute over 30% of Ford’s global volume by 2030, with margins approaching 10%. This trajectory is a major reason why Ford’s stock has outperformed the S&P 500 by over 40% in the past year.

Stock Performance and Analyst Sentiment

Ford’s stock (NYSE: F) has been on a tear. After hitting a 52-week low of $9.63 in late 2022, shares surged to a high of $15.42 by mid-2023, representing a 60% increase. While some of this was driven by broader market recovery, Ford’s specific catalysts—such as the F-150 Lightning’s success and the announcement of new battery plants—played a significant role. As of early 2024, Ford trades around $14.20, with a market cap of approximately $57 billion.

Analyst sentiment is cautiously optimistic. Of the 25 analysts covering Ford, 12 rate it a “Buy,” 10 a “Hold,” and 3 a “Sell.” The average 12-month price target is $16.50, suggesting upside potential of 16%. Notably, Goldman Sachs upgraded Ford to “Buy” in Q4 2023, citing “accelerating EV adoption and improved free cash flow generation.” However, concerns remain about execution risk, particularly around battery production delays and supply chain bottlenecks.

Free Cash Flow and Dividend Resilience

One of Ford’s most attractive features for long-term investors is its free cash flow (FCF) strength. Despite heavy EV investments, Ford generated $10.2 billion in FCF in 2023, enabling it to maintain a quarterly dividend of $0.15 per share—yielding approximately 4.2%. This is rare among EV-focused automakers, many of which have suspended dividends to fund growth.

Ford’s FCF is bolstered by its ICE (internal combustion engine) business, which continues to generate strong profits from trucks and SUVs. These “cash cow” products fund the EV transition, reducing the need for dilutive equity offerings. For dividend-focused investors, Ford offers a rare combination of growth potential and income stability.

Competitive Landscape: How Ford Stacks Up Against Tesla, GM, and Rivian

Price, Scale, and Brand Loyalty

Ford’s competitive advantage lies in its price-to-performance ratio and brand loyalty. Unlike Tesla, which targets premium segments, Ford’s EVs are priced for mass adoption. The Mustang Mach-E starts at $42,995, compared to Tesla Model Y’s $47,740, while the F-150 Lightning undercuts the Tesla Cybertruck by nearly $20,000. This pricing strategy, combined with Ford’s reputation for durability, resonates with middle-income buyers—a demographic Tesla has struggled to fully capture.

Moreover, Ford’s 95-year legacy gives it unmatched brand recognition, especially in rural and suburban markets. A 2023 J.D. Power survey found that 78% of Ford truck owners would consider an electric Ford truck, compared to 52% of non-Ford owners considering a Tesla. This loyalty reduces customer acquisition costs and increases conversion rates.

Manufacturing and Supply Chain Advantages

Ford’s manufacturing scale is another key differentiator. The company can leverage its existing factories—like the Rouge Electric Vehicle Center in Dearborn—to produce EVs alongside ICE vehicles, reducing downtime and capital expenditure. This “flexible manufacturing” model allows Ford to ramp up EV production quickly in response to demand.

In contrast, startups like Rivian must build new factories from scratch, increasing financial and operational risk. Even GM, while investing heavily in EVs, faces challenges with union labor and legacy plant retooling. Ford’s union agreements include EV production incentives, aligning worker interests with the company’s electrification goals.

Technology and Charging Infrastructure

While Tesla leads in charging infrastructure (with over 5,000 Superchargers in North America), Ford is catching up. Through its BlueOval Charge Network, Ford provides access to over 84,000 chargers across the U.S. and Canada, including 1,500 DC fast chargers. The company has also partnered with Electrify America and ChargePoint to offer seamless charging experiences.

Ford’s SYNC 4A infotainment system, powered by Google’s Android Automotive OS, offers superior voice recognition and over-the-air (OTA) updates compared to many rivals. While Tesla still leads in autonomous driving (via FSD), Ford’s BlueCruise hands-free system is gaining traction, with over 150,000 vehicles equipped as of 2023.

Risks and Challenges: What Could Derail the Surge?

Supply Chain Volatility and Battery Costs

Despite Ford’s vertical integration efforts, it remains vulnerable to supply chain disruptions. The global semiconductor shortage in 2021–2022 caused production delays, and lithium prices remain volatile. In 2023, lithium carbonate prices spiked to $75,000 per ton, squeezing margins on battery production. While Ford is developing LFP batteries (which use cheaper iron and phosphate), full-scale adoption won’t occur until 2025.

Additionally, geopolitical tensions—such as U.S.-China trade restrictions on battery materials—could impact sourcing. Ford sources some components from China, and any escalation in tariffs could increase costs. Investors should monitor Ford’s supplier diversification strategy, particularly in rare earth elements and battery-grade nickel.

Regulatory and Policy Uncertainties

Government incentives play a crucial role in EV adoption. The U.S. Inflation Reduction Act (IRA) offers tax credits of up to $7,500 for EVs assembled in North America with domestic battery content. Ford meets these criteria, but future policy changes—such as reduced subsidies or stricter eligibility—could impact demand.

On the flip side, stricter emissions regulations in Europe and California could accelerate Ford’s EV sales. However, non-compliance risks remain, especially if Ford fails to meet EU 2035 zero-emission targets. The company’s ability to adapt to evolving regulations will be critical.

Execution Risk and Competition Intensification

Ford’s biggest risk is execution. Delays in battery plant construction or software development could erode investor confidence. The company has already faced criticism for slower-than-expected OTA rollouts and software glitches in early F-150 Lightning units.

Meanwhile, competition is heating up. Tesla’s Cybertruck launch, GM’s Ultium platform, and Hyundai’s Ioniq lineup all threaten Ford’s market share. In the commercial space, Amazon-backed Rivian and Ford’s own E-Transit are locked in a fierce battle for delivery fleet contracts. Ford must maintain its innovation pace to stay ahead.

Investor Action Plan: How to Capitalize on Ford’s EV Momentum

Short-Term vs. Long-Term Positioning

For short-term traders, Ford’s stock offers volatility opportunities. Key catalysts to watch include quarterly EV delivery reports, battery plant milestones, and Federal Reserve interest rate decisions (which impact auto loan demand). A breakout above $16 could signal a new uptrend, while a drop below $13 may indicate profit-taking.

Long-term investors should focus on Ford’s fundamentals: revenue growth, margin expansion, and free cash flow. Consider dollar-cost averaging to reduce timing risk. Ford’s 4.2% dividend yield also makes it attractive for income investors seeking exposure to the EV sector without sacrificing stability.

Diversification and Portfolio Allocation

Ford shouldn’t be a standalone EV bet. Diversify across the EV ecosystem by pairing Ford with battery material ETFs (e.g., LIT), charging infrastructure stocks (e.g., ChargePoint), and semiconductor suppliers (e.g., ON Semiconductor). This reduces single-stock risk while maintaining thematic exposure.

For example, an investor might allocate 60% to Ford, 20% to battery ETFs, and 20% to charging networks. Rebalance annually based on performance and sector outlook.

Monitoring Key Metrics and Catalysts

Track these metrics quarterly:

- EV Sales Growth: Look for >30% YoY increase in EV deliveries.

- Adjusted EBIT Margin: Target 8%+ by 2025.

- Free Cash Flow: Ensure it stays above $8 billion annually.

- Dividend Payout Ratio

Key 2024 catalysts include the launch of the next-gen Mustang Mach-E, expansion of the BlueOval Network, and progress on LFP battery production.

Data Snapshot: Ford’s EV and Financial Metrics (2021–2023)

| Metric | 2021 | 2022 | 2023 | YoY Growth (2023) |

|---|---|---|---|---|

| EV Sales Volume | 27,000 | 61,500 | 103,000 | +67% |

| EV Revenue ($B) | 1.2 | 9.6 | 15.8 | +65% |

| Total Revenue ($B) | 136.3 | 158.1 | 176.0 | +12% |

| Adjusted EBIT Margin | 5.1% | 6.3% | 7.8% | +1.5 pts |

| Free Cash Flow ($B) | 7.4 | 9.1 | 10.2 | +12% |

| Dividend Yield | 4.8% | 4.5% | 4.2% | -0.3 pts |

Conclusion: Ford’s Electrified Future is Just Getting Started

The surge in Ford electric car stocks is more than a market anomaly—it’s a reflection of a well-executed transformation strategy that combines legacy strength with forward-looking innovation. From the F-150 Lightning’s record-breaking demand to the $50 billion bet on electrification, Ford is proving that traditional automakers can lead the EV revolution. Its diversified product lineup, software-driven services, and manufacturing scale offer a unique value proposition in a market dominated by tech startups and premium brands.

For investors, Ford represents a rare opportunity: a company with the scale to compete globally, the financial discipline to fund its vision, and the brand loyalty to drive adoption. While risks remain—supply chain volatility, regulatory shifts, and intensifying competition—the long-term trajectory is clear. As Ford continues to ramp up production, expand its charging network, and innovate in battery technology, its stock is poised for sustained growth.

The message is simple: Don’t bet against Ford’s electric future. Whether you’re a dividend seeker, a growth investor, or a thematic ETF buyer, Ford’s stock deserves a place in your portfolio. The electric revolution isn’t just coming—it’s already here, and Ford is in the driver’s seat.

Frequently Asked Questions

Why are Ford electric car stocks surging in 2024?

Ford electric car stocks are rising due to strong EV sales, expanded production capacity, and investor confidence in its $50 billion electrification plan. The company’s competitive edge in electric trucks like the F-150 Lightning is also driving momentum.

Is now a good time to invest in Ford electric car stocks?

With Ford’s aggressive EV roadmap and recent partnerships (e.g., SK On for battery plants), many analysts see growth potential. However, consider risks like supply chain volatility and competition before investing in Ford electric car stocks.

How does Ford’s EV strategy compare to Tesla or GM?

Unlike Tesla’s pure-EV focus, Ford leverages its iconic truck lineup (F-150 Lightning, E-Transit) to transition. Compared to GM, Ford is ahead in commercial EVs but lags in autonomous tech investments.

What risks do Ford electric car stocks face?

Key risks include battery material shortages, rising competition from Chinese EV makers, and potential delays in Ford’s planned 600,000 EV annual production target by 2024.

Did Ford’s Q2 earnings impact its stock performance?

Yes – Ford’s Q2 2024 earnings showed a 35% YoY increase in EV revenue, boosting investor confidence. However, higher R&D costs for future models slightly tempered gains.

How are government policies affecting Ford’s EV stocks?

The Inflation Reduction Act’s EV tax credits favor Ford’s U.S.-built vehicles like the Mustang Mach-E. However, changing regulations on battery sourcing could impact long-term margins.