Ford Electric Cars Not Selling Whats Behind the Slow Demand

Featured image for ford electric cars not selling

Image source: electrek.co

Ford electric cars are struggling to gain traction in a competitive EV market, with sluggish sales despite aggressive pricing and incentives. High interest rates, limited model variety, and growing consumer preference for Tesla and newer EV entrants have undercut Ford’s momentum, even as legacy automakers race to electrify. Without faster innovation and stronger charging infrastructure support, Ford risks falling further behind in the electric revolution.

Key Takeaways

- High prices: Ford’s EVs cost more than rivals, deterring budget-conscious buyers.

- Charging concerns: Limited fast-charging network undermines long-distance appeal.

- Slow production: Delays in scaling output constrain availability and frustrate demand.

- Brand trust: Legacy automaker’s EV tech lags behind Tesla’s proven reputation.

- Consumer hesitation: Mixed signals on Ford’s EV commitment confuse buyers.

📑 Table of Contents

- Ford Electric Cars Not Selling: What’s Behind the Slow Demand?

- 1. Pricing Strategy and Market Perception

- 2. Competition and Market Saturation

- 3. Charging Infrastructure and Range Anxiety

- 4. Production Challenges and Supply Chain Issues

- 5. Consumer Trust and Brand Positioning

- 6. The Broader Economic and Policy Landscape

- Conclusion: A Roadmap for Recovery

Ford Electric Cars Not Selling: What’s Behind the Slow Demand?

The electric vehicle (EV) revolution has taken the automotive world by storm, with manufacturers racing to electrify their lineups and meet the growing demand for sustainable transportation. Tesla has led the charge, and legacy automakers like General Motors, Volkswagen, and Ford have all made bold commitments to transition away from internal combustion engines. Ford, in particular, has been vocal about its EV ambitions, investing billions in new battery plants, launching high-profile models like the F-150 Lightning and Mustang Mach-E, and setting a goal to sell 2 million EVs annually by 2026. Yet, despite these aggressive moves, Ford electric cars not selling at the pace the company had hoped has become a growing concern. Sales figures, production cuts, and shifting market dynamics suggest that Ford’s EV strategy is facing significant headwinds.

At first glance, the numbers tell a troubling story. In 2023, Ford’s EV sales in the U.S. totaled just over 72,000 units—far below the 100,000+ units sold by Tesla in a single quarter. The Mustang Mach-E, once a promising contender in the midsize SUV segment, saw a 15% year-over-year decline in sales. Even the F-150 Lightning, a vehicle with immense symbolic and practical value as the electric version of America’s best-selling pickup, has seen production slashed by nearly 50% in 2024 due to “slower-than-expected demand.” This disconnect between Ford’s ambitions and consumer uptake raises a critical question: Why are Ford electric cars not selling as expected? Is it a matter of product quality, pricing, infrastructure, or something deeper in the brand’s positioning? This article explores the multifaceted reasons behind the sluggish demand for Ford’s electric vehicles, offering insights for consumers, investors, and industry watchers alike.

1. Pricing Strategy and Market Perception

The High Price Tag Dilemma

One of the most immediate barriers to Ford’s EV adoption is pricing. While Ford initially positioned its EVs as more affordable alternatives to Tesla, recent pricing adjustments have eroded that advantage. The base model of the Mustang Mach-E started at $43,000 in 2021 but now starts at over $48,000, with higher trims exceeding $60,000. The F-150 Lightning, once marketed as a “blue-collar electric truck,” now starts at $54,000 and can easily surpass $80,000 with options. These price points place Ford’s EVs in direct competition with premium brands like BMW, Mercedes-Benz, and even Tesla’s higher-end models—segments where Ford lacks brand equity in the EV space.

Visual guide about ford electric cars not selling

Image source: static.electronicsweekly.com

For comparison, the average transaction price for a new vehicle in the U.S. was around $48,000 in 2023. While that number includes all vehicles, EVs tend to command a premium due to higher battery costs. However, Ford’s pricing strategy has not been matched with a corresponding increase in perceived value. Consumers are asking: Why pay more for a Ford EV when I can get a Tesla with better range, faster charging, and a more established ecosystem?

Perceived Value vs. Reality

Ford’s brand identity has long been rooted in durability, utility, and affordability—values that don’t always translate well in the EV market, where buyers prioritize innovation, tech features, and charging convenience. The Mach-E, for instance, offers solid performance and decent range (up to 314 miles), but its infotainment system, while functional, lacks the polish and seamless integration of Tesla’s UI. The F-150 Lightning’s “frunk” (front trunk) and power export capabilities are innovative, but they don’t compensate for the higher price tag in the eyes of many buyers.

Tip: If you’re considering a Ford EV, look for incentives and rebates. The federal tax credit of up to $7,500 (if the vehicle qualifies under the Inflation Reduction Act’s sourcing rules) can significantly reduce the effective price. Additionally, some states offer extra rebates—California, for example, provides up to $2,000. Always check the latest eligibility requirements before purchasing.

2. Competition and Market Saturation

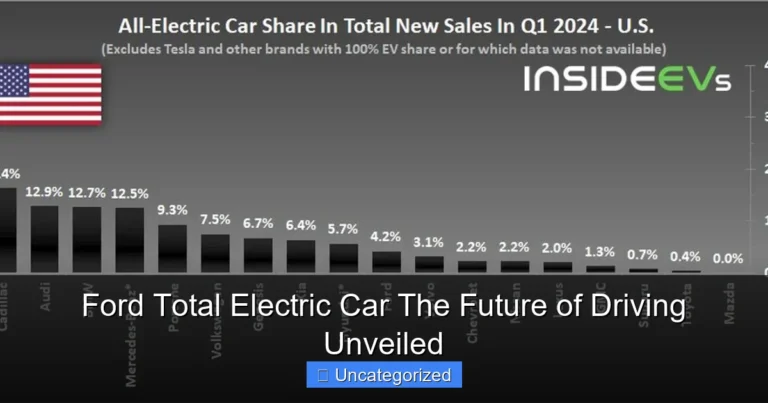

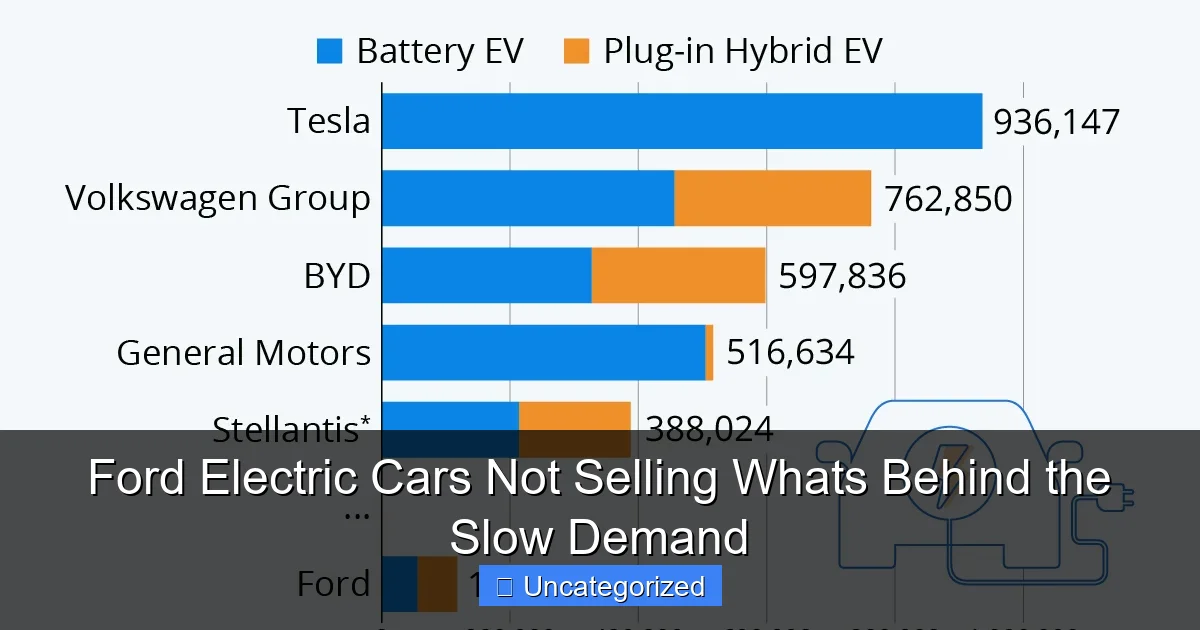

The Rise of Tesla and Legacy Rivals

Ford entered the EV market with a strong lineup, but it did so at a time when competition was intensifying. Tesla continues to dominate the U.S. EV market, with over 55% market share in 2023. Its Model Y alone outsold the Mach-E and Lightning combined. Tesla’s advantages include a vast Supercharger network (over 1,800 stations in the U.S.), over-the-air software updates, and a loyal customer base. Meanwhile, General Motors is pushing hard with the Chevy Blazer EV and Cadillac Lyriq, both of which offer competitive pricing and advanced tech. Hyundai and Kia are also gaining traction with the Ioniq 5 and EV6, which boast ultra-fast charging and striking designs.

Even within its own lineup, Ford faces internal competition. The Ford Escape Plug-in Hybrid and Explorer Hybrid appeal to buyers who want fuel efficiency without the range anxiety of a full EV. For many, these hybrid models offer a “best of both worlds” solution, reducing the urgency to go fully electric.

New Entrants and Niche Players

The EV market is no longer just about big automakers. Startups like Rivian (with its R1T and R1S) and Lucid (Air sedan) are capturing attention with high-performance, luxury EVs. Rivian, in particular, has positioned itself as a direct competitor to the F-150 Lightning, offering a premium electric truck with off-road capabilities. Meanwhile, Chinese automakers like NIO and XPeng are expanding globally, bringing competitive pricing and cutting-edge tech to new markets.

Example: The Rivian R1T starts at $73,000—higher than the base Lightning—but it offers 314 miles of range, a 0-60 mph time of 3.0 seconds, and advanced off-road features. For buyers seeking a premium electric truck, Rivian presents a compelling alternative, even at a higher price point.

3. Charging Infrastructure and Range Anxiety

Limited Access to Fast Charging

One of the biggest hurdles for any EV, including Ford’s, is charging infrastructure. While Ford has partnered with Electrify America and other networks to offer free charging for a limited time, it lacks its own proprietary network like Tesla’s Supercharger system. This forces Ford EV owners to rely on third-party chargers, which can be inconsistent in terms of reliability, availability, and speed.

According to the U.S. Department of Energy, there are over 160,000 public charging ports in the U.S., but only about 12% are fast chargers (DC fast charging). This scarcity becomes a major issue for long-distance travel, where drivers need to recharge quickly. Tesla’s Supercharger network, by contrast, has over 20,000 fast chargers globally, with high reliability and seamless integration into the vehicle’s navigation system.

Range and Real-World Performance

Ford’s EVs offer respectable range figures: the Mach-E can go up to 314 miles on a charge, and the Lightning offers up to 320 miles. However, real-world performance often falls short, especially in cold weather or when towing. For example, Ford estimates the Lightning’s towing range at 10,000 pounds, but independent tests show that towing at capacity can reduce range by up to 50%. This “range anxiety” is a significant deterrent for truck buyers, who often need their vehicles for work and travel.

Tip: If you’re a Ford EV owner, use FordPass Charging Network to find nearby chargers. The app shows real-time availability, pricing, and compatibility. For long trips, plan your route using tools like PlugShare or A Better Routeplanner (ABRP) to avoid running out of charge.

4. Production Challenges and Supply Chain Issues

Battery and Component Shortages

Ford’s EV ambitions have been hampered by supply chain disruptions, particularly in battery production. The company relies on lithium-ion batteries, which require rare earth metals like lithium, nickel, and cobalt. Global shortages and geopolitical tensions have driven up costs and limited availability. In 2023, Ford delayed the launch of its Explorer EV due to battery supply issues, highlighting the vulnerability of its production pipeline.

Additionally, Ford’s decision to source batteries from SK Innovation (a South Korean company) and CATL (a Chinese giant) has raised concerns among some U.S. buyers about supply chain transparency and potential tariffs. While Ford has announced plans to build its own battery plants in Kentucky and Tennessee, these won’t be operational until 2026—too late to address current shortages.

Production Cuts and Layoffs

In early 2024, Ford announced it would cut F-150 Lightning production by nearly 50%, citing “slower-than-expected demand.” The company also laid off 4,000 workers at its Rouge Electric Vehicle Center in Michigan. These moves signal a shift in strategy, from aggressive expansion to cautious scaling. While Ford insists it remains committed to electrification, the production cuts raise questions about whether the company is losing confidence in its EV roadmap.

Example: The F-150 Lightning’s production cut from 150,000 to 70,000 units per year means fewer vehicles available for consumers, which could create a feedback loop: lower availability → lower awareness → lower sales.

5. Consumer Trust and Brand Positioning

Legacy vs. Innovation

Ford has a long history of building reliable, rugged vehicles, but that legacy doesn’t automatically translate to trust in EVs. Many consumers still associate Ford with gas-powered trucks and SUVs, not cutting-edge technology. The Mach-E, despite its Mustang branding, is a crossover—not a true sports car—which has led to criticism from traditional Mustang enthusiasts. Similarly, the Lightning’s “electric truck” identity is a hard sell to buyers who equate trucks with diesel engines and brute strength.

Ford has tried to bridge this gap with marketing campaigns like “Built Ford Tough, Built Electric,” but these efforts have struggled to resonate. In contrast, Tesla has built its brand around innovation and sustainability, creating a cult-like following. Ford, by comparison, lacks a clear EV identity.

Quality and Reliability Concerns

Early adopters of Ford’s EVs have reported quality issues, including software glitches, battery management problems, and build quality inconsistencies. For example, some Lightning owners have experienced sudden loss of power or charging errors. While Ford has addressed many of these issues through software updates, the initial negative experiences have damaged consumer confidence.

Tip: Before buying a Ford EV, check consumer reviews and reliability ratings from sources like Consumer Reports, J.D. Power, and Edmunds. Pay attention to long-term ownership feedback, not just first impressions.

6. The Broader Economic and Policy Landscape

Inflation and Interest Rates

The U.S. economy has faced significant headwinds in recent years, with inflation and high interest rates making big-ticket purchases like EVs less attractive. The average new car loan interest rate exceeded 7% in 2023, and many EV buyers rely on financing. For a $60,000 F-150 Lightning, that means monthly payments of over $1,000—a steep commitment for most households.

Additionally, the cost of electricity has risen in many regions, reducing the long-term savings of EVs. While EVs are still cheaper to operate than gas cars, the gap has narrowed, making the financial case less compelling.

Policy Uncertainty

Government policies play a crucial role in EV adoption. The Inflation Reduction Act (IRA) of 2022 introduced tax credits for EVs, but the eligibility rules are complex and subject to change. For example, the IRA requires that EVs be assembled in North America and use batteries with a certain percentage of critical minerals sourced from the U.S. or free-trade partners. As of 2024, only about half of Ford’s EVs qualify for the full $7,500 credit—down from 100% in 2023. This uncertainty makes it harder for consumers to plan their purchases.

Data Table: Ford EV Tax Credit Eligibility (2024)

| Model | MSRP (Base) | Federal Tax Credit | Qualifies for Full $7,500? |

|---|---|---|---|

| Mustang Mach-E | $48,000 | $3,750 | No (partial credit) |

| F-150 Lightning | $54,000 | $7,500 | Yes (if battery criteria met) |

| E-Transit Van | $52,000 | $7,500 | Yes |

Conclusion: A Roadmap for Recovery

The slow demand for Ford electric cars not selling is not due to a single factor but a confluence of pricing, competition, infrastructure, production, branding, and macroeconomic challenges. Ford’s EVs are technically sound and offer unique value propositions—the Lightning’s power export, the Mach-E’s driving dynamics—but they’re struggling to stand out in a crowded market. To reverse this trend, Ford must take a multi-pronged approach.

First, pricing and incentives need to be more competitive. Ford should consider lowering base prices or offering more generous lease deals to attract buyers. Second, charging infrastructure must be improved. Partnering with more networks or building its own fast-charging stations (like GM’s Ultium Charge 360) could alleviate range anxiety. Third, brand positioning needs refinement. Ford must clearly communicate what makes its EVs different—durability, utility, American-made—and leverage its legacy as a strength, not a liability.

Finally, Ford must address supply chain and production issues to ensure consistent availability. Delays and shortages only reinforce consumer skepticism. With the right strategy, Ford can still become a major player in the EV market. But time is running out. The window of opportunity is closing as rivals gain momentum and consumer expectations evolve. For Ford, the road ahead is steep—but not impassable.

Frequently Asked Questions

Why are Ford electric cars not selling as expected?

Several factors contribute to slow demand, including high prices, limited model variety, and strong competition from Tesla and other EV brands. Buyers also cite concerns about charging infrastructure and battery range as deterrents.

What is holding back demand for Ford electric cars?

The slow adoption stems from a mix of pricing, delayed production timelines, and consumer hesitation around transitioning from gas-powered vehicles. Ford’s early EV models, like the Mustang Mach-E, also faced reliability complaints, impacting buyer confidence.

Are Ford electric cars not selling due to poor marketing?

While Ford has invested in EV advertising, its marketing struggles to match Tesla’s brand appeal or Hyundai/Kia’s aggressive incentives. The messaging often fails to highlight unique features that differentiate Ford’s EVs from rivals.

Is the lack of charging stations affecting Ford electric car sales?

Yes, range anxiety and sparse charging infrastructure remain key barriers. Even though Ford joined Tesla’s Supercharger network, some buyers still perceive non-Tesla charging options as less convenient or reliable.

Why are Ford’s EV sales lagging behind competitors?

Ford’s electric cars face stiff competition from more affordable or feature-rich models by Tesla, Chevrolet, and Hyundai. Supply chain delays and slower production ramps have also limited Ford’s ability to meet demand.

Will Ford’s future electric cars solve the slow sales problem?

Upcoming models like the F-150 Lightning Pro and a new $25K EV aim to address affordability and practicality gaps. Success depends on competitive pricing, improved battery tech, and faster production scaling.