Ford Focus Electric Car Tax Credit Guide 2024

Featured image for ford focus electric car tax credit

Image source: insideclimatenews.org

The Ford Focus Electric may qualify for a federal tax credit of up to $7,500 in 2024, depending on battery component and critical mineral sourcing requirements under the Inflation Reduction Act. Eligibility hinges on where the vehicle is assembled and whether it meets new domestic manufacturing criteria, so buyers should verify compliance before claiming the credit.

Key Takeaways

- Check eligibility: Confirm if your Ford Focus Electric qualifies for the 2024 federal tax credit.

- Act fast: Tax credits may phase out once manufacturer sales limits are reached.

- State incentives: Explore additional savings through state-level EV rebates and tax breaks.

- Claim correctly: File IRS Form 8936 to claim the credit when submitting taxes.

- Used models: Verify if pre-owned Focus Electric qualifies for new used-EV credit.

- Dealer discounts: Negotiate tax credit as upfront discount at participating dealerships.

📑 Table of Contents

- The Road to Savings: Understanding the Ford Focus Electric Car Tax Credit in 2024

- What Is the Ford Focus Electric Car Tax Credit?

- Eligibility Requirements for the 2024 Ford Focus Electric Tax Credit

- How to Claim the Ford Focus Electric Tax Credit on Your 2024 Tax Return

- State and Local Incentives to Pair with the Ford Focus Electric Tax Credit

- Ford Focus Electric vs. Other Used EVs: Is the Tax Credit Worth It?

- Conclusion: Maximizing Your Savings with the Ford Focus Electric Tax Credit

The Road to Savings: Understanding the Ford Focus Electric Car Tax Credit in 2024

As the world shifts toward sustainable transportation, electric vehicles (EVs) are no longer a futuristic concept but a practical reality for millions of drivers. Among the pioneers in the affordable EV segment is the Ford Focus Electric, a compact car that delivers eco-friendly performance without breaking the bank. While the initial purchase price of an electric vehicle can be daunting, federal and state incentives are designed to make ownership more accessible. One of the most impactful benefits available to U.S. buyers is the Ford Focus Electric car tax credit, a financial incentive that can significantly reduce the overall cost of going electric.

In 2024, the landscape of EV tax credits has evolved due to new legislation, eligibility rules, and manufacturing requirements. The Ford Focus Electric, though no longer in active production, remains a viable option for budget-conscious consumers seeking used or pre-owned electric vehicles. Understanding how the Ford Focus Electric car tax credit applies—especially in the context of the Inflation Reduction Act (IRA) of 2022 and updated IRS guidelines—is crucial for maximizing savings. Whether you’re buying new, used, or leasing, this guide will walk you through the nuances of qualifying for the credit, calculating your potential savings, and navigating the often-confusing tax code. From eligibility criteria to real-world examples, we’ll help you determine if the Ford Focus Electric can deliver both environmental and economic benefits in 2024.

What Is the Ford Focus Electric Car Tax Credit?

Defining the Federal EV Tax Credit

The Ford Focus Electric car tax credit refers to the federal income tax credit available under the Qualified Plug-in Electric Drive Motor Vehicle Credit, codified in Internal Revenue Code Section 30D. Originally established in 2009, this credit was designed to encourage the adoption of electric vehicles by offering a direct reduction in tax liability. For qualifying EVs, the credit ranges from $2,500 to $7,500, depending on the vehicle’s battery capacity and other factors.

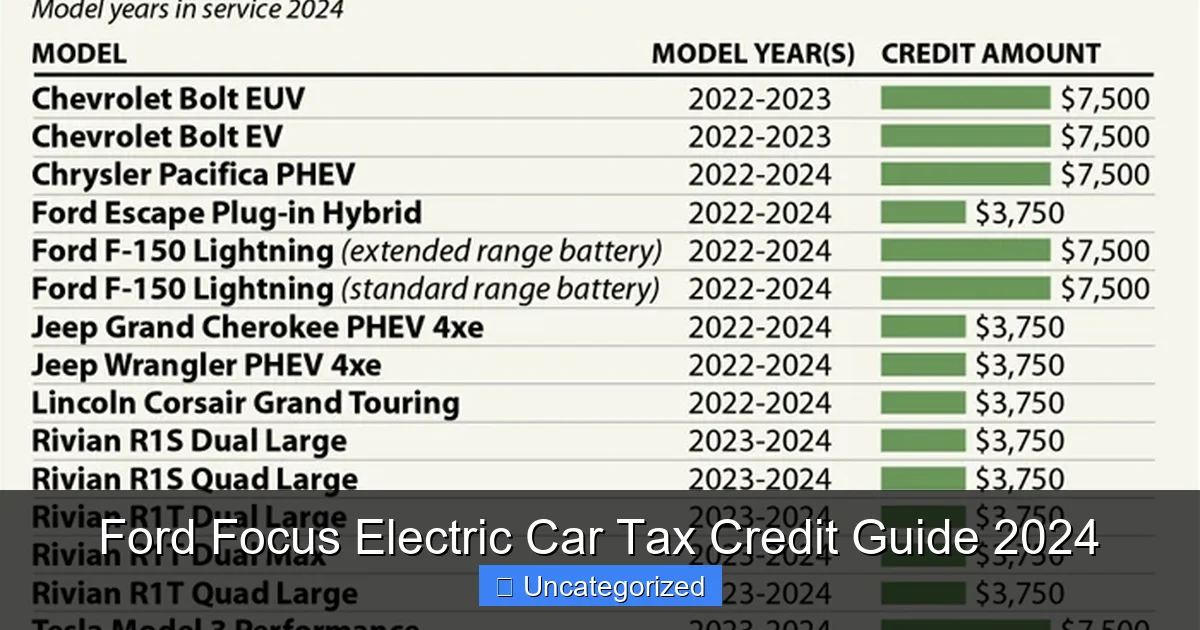

Visual guide about ford focus electric car tax credit

Image source: snd-videos.s3.amazonaws.com

For the Ford Focus Electric, the maximum credit amount was $7,500 when the vehicle was first introduced. This credit applied to new purchases only and was fully refundable, meaning it could reduce your tax bill to zero, with any excess credited back to you. However, due to changes in the law—particularly the Inflation Reduction Act (IRA)—the rules have shifted significantly, especially for vehicles manufactured after January 1, 2023.

How the Credit Works for the Ford Focus Electric

The Ford Focus Electric was produced from 2012 to 2018 and was one of the first mass-market EVs from a major American automaker. It features a 23 kWh lithium-ion battery pack (later increased to 33.5 kWh in 2017), which qualifies it for the full $7,500 federal tax credit under the original rules. However, because production ended in 2018, the Focus Electric is no longer eligible for the new post-IRA tax credit structure that requires vehicles to be assembled in North America and meet critical mineral and battery component sourcing requirements.

That said, the Ford Focus Electric car tax credit is still relevant in two key ways:

- For used vehicle purchases: Under the IRA, buyers of used EVs can now claim a tax credit of up to $4,000 or 30% of the sale price (whichever is lower), provided the vehicle is at least two model years old, priced under $25,000, and purchased from a dealer.

- For legacy credit claims: Buyers who purchased a new Ford Focus Electric between 2012 and 2018 may still be eligible to claim the $7,500 credit if they haven’t already done so, assuming they meet income and other requirements at the time of purchase.

Key Takeaway: Timing Matters

The applicability of the Ford Focus Electric car tax tax credit depends heavily on when the vehicle was purchased. If you bought a new Focus Electric in 2017, you likely qualified for the full $7,500 credit. If you’re buying a used model in 2024, you may qualify for the new used EV credit—but not the original $7,500. It’s essential to understand which version of the credit applies to your situation.

Eligibility Requirements for the 2024 Ford Focus Electric Tax Credit

Federal Requirements for New and Used EV Credits

As of 2024, the IRS has implemented two distinct tax credit programs: one for new clean vehicles (post-IRA) and one for used clean vehicles. Since the Ford Focus Electric is no longer manufactured, only the used EV credit is currently applicable for most buyers.

Visual guide about ford focus electric car tax credit

Image source: images-stag.jazelc.com

To qualify for the used EV tax credit, the following criteria must be met:

- The vehicle must be at least two model years old (e.g., a 2022 model can be purchased in 2024).

- The purchase price must be $25,000 or less.

- The vehicle must be purchased from a licensed dealer (private sales do not qualify).

- The buyer must have federal income tax liability in the year of purchase.

- The buyer must not be claimed as a dependent on someone else’s tax return.

- The credit is limited to one per individual per year.

Vehicle-Specific Qualifications

For the Ford Focus Electric to qualify under the used EV credit, it must meet the IRS definition of a “qualified plug-in electric drive motor vehicle.” This includes:

- Having a battery capacity of at least 7 kilowatt-hours (the Focus Electric exceeds this with 23–33.5 kWh).

- Being capable of being charged from an external source and driven at least 40 miles on electricity alone (the Focus Electric has a range of 76–115 miles, depending on the model year).

- Having a gross vehicle weight rating (GVWR) of less than 14,000 pounds (the Focus Electric weighs around 3,600 lbs).

Income Limits for the Used EV Credit

One of the most significant changes under the IRA is the introduction of income caps for both new and used EV credits. For the used EV tax credit in 2024, the following modified adjusted gross income (MAGI) limits apply:

- Single filers: Less than $75,000

- Head of household: Less than $112,500

- Married filing jointly: Less than $150,000

These limits are based on your 2023 or 2024 tax return (whichever is lower). If your income exceeds these thresholds, you are not eligible for the used EV credit—even if the vehicle otherwise qualifies.

Practical Example: Can You Claim the Credit?

Let’s say you’re a single filer with a 2023 MAGI of $72,000. You purchase a 2020 Ford Focus Electric for $22,000 from a certified dealer in April 2024. The vehicle has 45,000 miles and is in good condition. Since:

- It’s 4 model years old (2020 in 2024 → meets 2-year rule)

- Price is under $25,000

- You bought from a dealer

- Your income is under $75,000

You qualify for the used EV credit. The maximum credit is the lesser of $4,000 or 30% of the sale price: 30% of $22,000 = $6,600. So, you can claim $4,000 on your 2024 tax return.

How to Claim the Ford Focus Electric Tax Credit on Your 2024 Tax Return

Step-by-Step Filing Process

Claiming the Ford Focus Electric car tax credit is straightforward if you follow IRS guidelines. Here’s how to do it in 2024:

- Obtain Form 15400 from the dealer: The IRS requires that the selling dealer provides you with Form 15400, Clean Vehicle Credit Transfer Election. This form certifies that the vehicle qualifies for the used EV credit and allows you to claim it.

- File IRS Form 8936 with your tax return: When you file your annual tax return (Form 1040), you must attach Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit. This form calculates your credit amount based on the vehicle details.

- Enter your MAGI and verify eligibility: On Form 8936, you’ll need to report your modified adjusted gross income to ensure you’re under the income cap.

- Submit documentation: While not required to submit with your return, keep a copy of the dealer’s Form 15400, the vehicle’s VIN, purchase contract, and proof of payment for at least three years in case of an IRS audit.

Important: The Credit Is Non-Refundable (With a Twist)

Unlike the original $7,500 credit, the used EV credit is non-refundable, meaning it can reduce your tax liability to zero but won’t generate a refund if your tax owed is less than $4,000. However, if you have a tax liability of $3,000, you can claim the full $3,000—you just won’t get the remaining $1,000 back.

One major change in 2024 is the dealer transfer option. Under the IRA, buyers can elect to have the dealer transfer the credit at the point of sale. This means the dealer reduces the purchase price by up to $4,000, and you claim the credit on your taxes later. This is particularly helpful for buyers with low tax liability, as it provides immediate savings.

Tips for a Smooth Claim

- Ask the dealer early: Not all dealers are familiar with the used EV credit. Confirm they are registered with the IRS and can provide Form 15400 before purchasing.

- Double-check VIN and model year: Ensure the vehicle’s VIN and model year match the IRS database. Use the fueleconomy.gov tax credit lookup tool to verify eligibility.

- File electronically: E-filing with software like TurboTax or H&R Block can help auto-populate Form 8936 and reduce errors.

- Keep records organized: Store digital copies of all documents in a secure cloud folder.

Real-World Example: Claiming the Credit

Sarah, a teacher in Austin, Texas, buys a 2018 Ford Focus Electric for $18,500 in June 2024. She’s a single filer with a 2023 MAGI of $68,000. The dealer provides Form 15400 and offers the credit transfer option. Sarah elects to have the dealer reduce the price by $4,000, paying only $14,500 at the dealership. She then claims the $4,000 credit on her 2024 tax return using Form 8936. Her tax liability is $2,800, so the credit covers her entire bill, and she owes nothing.

State and Local Incentives to Pair with the Ford Focus Electric Tax Credit

Beyond the Federal Credit: State-Level Savings

While the federal Ford Focus Electric car tax credit is the most substantial incentive, many states and local municipalities offer additional rebates, tax exemptions, and benefits. These can be stacked with the federal credit, significantly reducing your total cost of ownership.

Here are some notable state-level incentives in 2024:

- California: The Clean Vehicle Rebate Project (CVRP) offers up to $750 for used EVs. Low-income applicants can receive an additional $2,000. The Ford Focus Electric qualifies.

- New York: The Drive Clean Rebate provides up to $2,000 for used EVs under $25,000. No income limits.

- Colorado: Offers a $1,500 tax credit for used EVs, plus a $500 rebate for charging equipment installation.

- Massachusetts: The MOR-EV Used program gives a $3,500 rebate for used EVs, with an extra $1,500 for income-qualified buyers.

- Oregon: Provides a $2,500 rebate for used EVs, with no income cap.

Local and Utility-Based Incentives

Many utility companies and city governments offer additional perks:

- Free or reduced-cost public charging: Cities like Seattle and Portland offer free Level 2 charging for EV owners.

- HOV lane access: In states like California and Virginia, EVs with a Clean Air Vehicle (CAV) decal can use carpool lanes, even with a single occupant.

- Reduced registration fees: Some states, including Arizona and Texas, offer lower annual registration fees for EVs.

- Home charging rebates: Utilities like PG&E (California) and Con Edison (New York) offer rebates of up to $500 for installing Level 2 chargers at home.

Stacking Incentives: A Practical Example

Let’s say you buy a 2019 Ford Focus Electric for $20,000 in California in 2024:

- Federal used EV credit: $4,000

- California CVRP rebate: $750

- PG&E home charger rebate: $500

- HOV lane access: Estimated time savings worth $1,200/year

Total first-year savings: $6,250 (not including long-term fuel and maintenance savings). The effective price of the car drops to $13,750.

Tip: Use Online Incentive Calculators

Websites like Plug In America and the U.S. Department of Energy’s Alternative Fuels Data Center offer interactive tools to calculate total incentives based on your location, income, and vehicle model.

Ford Focus Electric vs. Other Used EVs: Is the Tax Credit Worth It?

Comparing the Focus Electric to Competing Used EVs

The Ford Focus Electric is a solid choice for budget-conscious EV buyers, but how does it stack up against other used electric vehicles when factoring in the Ford Focus Electric car tax credit? Let’s compare it to popular alternatives in the $15,000–$25,000 price range.

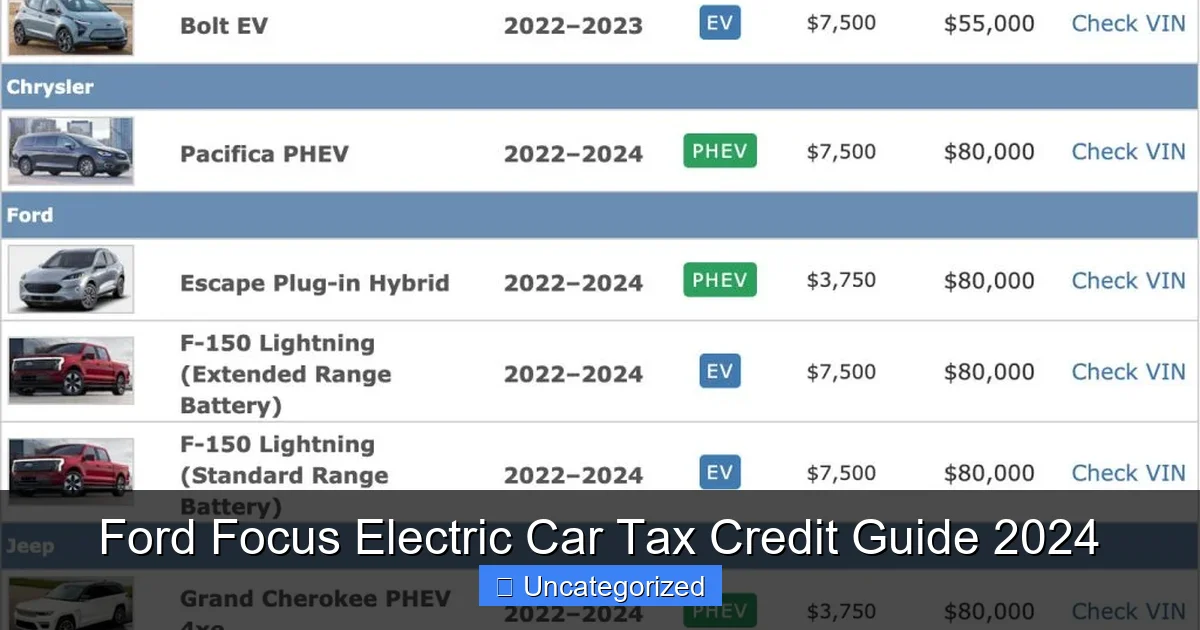

Data Table: Used EVs Eligible for the 2024 Federal Tax Credit

| Vehicle | Model Years | Avg. Used Price (2024) | Range (miles) | Federal Credit | Notes |

|---|---|---|---|---|---|

| Ford Focus Electric | 2012–2018 | $15,000–$22,000 | 76–115 | Up to $4,000 | Strong reliability; limited cargo space |

| Nissan Leaf (24 kWh) | 2013–2017 | $12,000–$18,000 | 84 | Up to $4,000 | Lower price; older battery tech |

| Chevy Bolt EV | 2017–2023 | $18,000–$25,000 | 238 | Up to $4,000 | Best range; battery recall resolved |

| Kia Soul EV | 2015–2019 | $14,000–$20,000 | 111 | Up to $4,000 | Spacious interior; good tech |

| Tesla Model 3 (Standard Range) | 2017–2019 | $22,000–$28,000 | 220 | Up to $4,000 (if under $25k) | Higher price; best tech and charging |

Which Used EV Offers the Best Value?

While the Ford Focus Electric doesn’t have the longest range or most advanced tech, it offers excellent value when you factor in the $4,000 tax credit and low purchase price. For buyers prioritizing:

- Affordability: The Focus Electric and early Nissan Leafs win.

- Range: The Chevy Bolt EV is the clear leader.

- Reliability and safety: The Focus Electric scores well in IIHS crash tests and has a strong service network.

- Tech and charging: Tesla Model 3 leads, but often exceeds the $25,000 price cap.

For urban commuters with a daily drive under 50 miles, the Focus Electric’s 76–115-mile range is more than sufficient. Combined with the Ford Focus Electric car tax credit, it’s one of the most cost-effective EVs on the used market.

Conclusion: Maximizing Your Savings with the Ford Focus Electric Tax Credit

The Ford Focus Electric car tax credit remains a powerful tool for reducing the cost of electric vehicle ownership in 2024—even though the model is no longer in production. By understanding the shift from the original $7,500 credit to the new $4,000 used EV credit, buyers can make informed decisions that maximize their savings. Whether you’re drawn to the Focus Electric for its affordability, reliability, or environmental benefits, the federal tax credit makes it a compelling option in the used EV market.

To get the most out of your purchase, remember to:

- Verify eligibility based on income, vehicle age, and price.

- Work with a dealer who can provide IRS Form 15400.

- Explore state and local incentives to stack additional savings.

- Consider the long-term benefits of lower fuel and maintenance costs.

- Use online tools to compare the Focus Electric with other used EVs.

While newer EVs offer longer range and faster charging, the Ford Focus Electric proves that going electric doesn’t have to mean going broke. With the Ford Focus Electric car tax credit and a strategic approach to incentives, you can drive a clean, efficient vehicle for thousands less than the sticker price. In 2024, the road to sustainable transportation is more affordable than ever—and the Ford Focus Electric is still a smart stop along the way.

Frequently Asked Questions

What is the Ford Focus electric car tax credit amount in 2024?

As of 2024, the federal tax credit for the Ford Focus Electric is up to $7,500, depending on battery capacity and IRS eligibility rules. Confirm with your tax advisor, as phase-out rules may apply based on manufacturer sales caps.

Can I claim the Ford Focus electric car tax credit if I lease the vehicle?

No, the tax credit typically goes to the leasing company, not the lessee. However, some dealers may pass on the savings through reduced lease payments—ask your Ford dealer for details.

Does the Ford Focus Electric qualify for state-level tax credits or incentives?

Yes, in addition to the federal Ford Focus electric car tax credit, many states offer extra rebates or incentives. Check your local DMV or energy office for programs like California’s Clean Vehicle Rebate Project (CVRP).

How do I claim the Ford Focus Electric tax credit on my tax return?

Use IRS Form 8936 (Qualified Plug-in Electric Drive Motor Vehicle Credit) when filing your federal taxes. Keep your vehicle purchase agreement and the IRS certification from Ford as proof of eligibility.

Is the Ford Focus Electric tax credit refundable or non-refundable?

The credit is non-refundable, meaning it can reduce your tax bill to zero but won’t result in a refund. Any unused portion may be carried forward to future tax years in some cases.

Are there income limits to qualify for the Ford Focus electric car tax credit?

Yes, as of 2024, the federal tax credit has income phase-out thresholds. Single filers with MAGI over $150,000 (or $300,000 for joint filers) may see reduced or no credit—consult a tax professional for specifics.