Ford Increases Price of Electric Cars What It Means for Buyers

Featured image for ford increases price of electric cars

Image source: motor.com

Ford has raised prices across its electric vehicle lineup, citing rising battery costs and supply chain challenges, a move that could impact affordability for many buyers. This shift may push some consumers toward competitors or delay EV adoption, though Ford maintains its long-term commitment to electrification and value-driven innovation.

Key Takeaways

- Price hikes impact affordability: Ford’s EV cost surge may deter budget-conscious buyers.

- Evaluate incentives: Check federal/state tax credits to offset higher purchase prices.

- Compare competitors: Rivals may offer better pricing for similar EV features.

- Resale values could rise: Limited supply may boost long-term ownership value.

- Consider used options: Pre-owned Ford EVs offer lower entry points now.

- Watch for promotions: Dealerships might introduce discounts to clear inventory.

📑 Table of Contents

- The Electric Car Market Shifts: Why Ford Is Raising Prices

- Why Is Ford Increasing Electric Car Prices?

- Which Ford Electric Models Are Affected?

- Impact on Buyers: Affordability and Incentives

- How Do Ford’s Prices Compare to Competitors?

- What This Means for the Future of Ford EVs

- Conclusion: Navigating Ford’s EV Price Increases

The Electric Car Market Shifts: Why Ford Is Raising Prices

The electric vehicle (EV) revolution has been one of the most transformative trends in the automotive industry over the past decade. As governments push for carbon neutrality and consumers seek cleaner, more efficient transportation, automakers have raced to expand their EV lineups. Ford, an American legacy automaker with a storied history in innovation, has made significant strides in this space with models like the Mustang Mach-E, F-150 Lightning, and E-Transit. These vehicles have not only won critical acclaim but have also helped Ford capture a growing share of the EV market. However, recent news has sent ripples through the industry: Ford has announced price increases across its electric vehicle lineup. This decision comes at a pivotal moment when inflation, supply chain disruptions, and raw material shortages are reshaping the economic landscape of automotive manufacturing.

For prospective EV buyers, Ford’s price hikes raise critical questions. Are these increases a temporary blip or a sign of a new pricing reality? How will they affect affordability, leasing options, and long-term ownership costs? More importantly, what does this mean for the broader EV market, where competition is intensifying with players like Tesla, Chevrolet, Hyundai, and Rivian? In this comprehensive guide, we’ll explore the reasons behind Ford’s price increases, analyze their impact on different buyer segments, and provide actionable insights to help you make informed decisions. Whether you’re a first-time EV buyer or considering upgrading your current model, understanding the forces driving these changes is essential to navigating the evolving electric vehicle marketplace.

Why Is Ford Increasing Electric Car Prices?

Rising Raw Material and Battery Costs

One of the primary drivers behind Ford’s decision to raise EV prices is the escalating cost of raw materials, particularly those used in lithium-ion battery production. Lithium, cobalt, nickel, and graphite are critical components in EV batteries, and their prices have surged in recent years. According to BloombergNEF, lithium carbonate prices increased by over 400% between 2020 and 2022, while nickel prices spiked by more than 150% in early 2022 due to geopolitical tensions and supply chain bottlenecks. These materials are sourced globally, often from politically unstable regions, making them vulnerable to price volatility.

Visual guide about ford increases price of electric cars

Image source: i.ytimg.com

Ford’s battery supply chain, like most automakers, relies heavily on third-party suppliers such as SK Innovation and Panasonic. As these partners pass on their increased costs, Ford must either absorb the losses or adjust retail prices. In 2023, Ford reported that battery costs accounted for nearly 30% of the total production cost of the F-150 Lightning. With battery technology still evolving and recycling infrastructure underdeveloped, automakers have limited options to reduce these expenses in the short term.

Supply Chain Disruptions and Inflation Pressures

The global supply chain has been under strain since the pandemic, and the EV sector is no exception. Semiconductor shortages, port congestion, and labor disruptions have all contributed to increased manufacturing and logistics costs. Ford has had to reroute shipments, pay premium freight rates, and even halt production temporarily at some facilities due to parts shortages. These inefficiencies add up, forcing the company to pass some of the burden to consumers.

Moreover, broader inflation trends—driven by energy costs, wage increases, and monetary policy—have raised Ford’s operational expenses. The U.S. Bureau of Labor Statistics reported that automotive manufacturing input costs rose by 12.3% year-over-year in 2023. While Ford has invested in automation and vertical integration, such as its BlueOval SK battery plants in Kentucky and Tennessee, these initiatives take time to yield cost savings. Until then, price adjustments are a necessary measure to maintain profitability.

Increased R&D and Manufacturing Investments

Ford is in the midst of a massive $50 billion electrification initiative aimed at launching 25 new EVs globally by 2030. This includes building new factories, retooling existing plants, and developing next-generation battery technologies like solid-state cells. The company’s BlueOval City complex in Tennessee, set to open in 2025, will produce both the next-generation F-Series EV and batteries, but construction and R&D costs are substantial.

These investments, while critical for long-term competitiveness, require significant upfront capital. By adjusting EV prices, Ford can generate higher margins to reinvest in innovation and scale. For example, the 2024 Mustang Mach-E GT’s price increase from $59,995 to $63,995 reflects not only material costs but also enhancements in performance, software, and charging infrastructure integration.

Which Ford Electric Models Are Affected?

Mustang Mach-E: Premium Pricing for Performance

The Mustang Mach-E has seen multiple price adjustments since its 2021 launch. In 2023, the base Select model increased from $42,895 to $43,895, while the high-performance GT rose from $59,995 to $63,995. The California Route 1 edition, once priced at $52,495, now starts at $55,495. These hikes are tied to upgrades in range (now up to 314 miles), faster DC charging (10–80% in 45 minutes), and new driver-assist features like BlueCruise 1.2.

Visual guide about ford increases price of electric cars

Image source: motor.com

For buyers, the Mach-E’s price increases mean that even mid-tier trims now exceed $50,000. However, Ford has introduced a new “Premium” trim with enhanced interior materials and a larger 15.5-inch touchscreen, justifying the higher cost. Tip: Consider leasing if you prioritize lower monthly payments, as residual values remain strong due to high demand.

F-150 Lightning: From Workhorse to Premium EV

The F-150 Lightning, Ford’s electric pickup, has undergone the most dramatic pricing shifts. Initially launched at $39,974 for the base Pro model, prices have climbed to $49,995 in 2024. The Platinum trim, once $84,974, now starts at $90,995. The Pro model’s increase is partly due to the removal of the $7,500 federal tax credit eligibility (more on that below), but Ford also cites higher battery and chassis costs.

Notably, the Lightning’s “Extended Range” battery now costs an additional $10,000, up from $8,500 in 2022. This option boosts range from 240 to 320 miles, making it a must-have for rural buyers. Practical advice: If you don’t need the extended range, stick with the standard battery to save $10K—the 240-mile range is sufficient for most daily commutes.

E-Transit: Commercial EV Pricing Adjustments

Ford’s electric cargo van, the E-Transit, has also seen price increases, with the base model rising from $47,185 to $51,995 in 2024. The high-roof, extended-wheelbase version now exceeds $60,000. For small businesses, this can be a significant hurdle, especially since the E-Transit qualifies for the Commercial Clean Vehicle Credit (up to $40,000), but only if the final assembly is in North America (which the E-Transit meets).

Tip for business owners: Explore state and local incentives. California’s HVIP program offers up to $15,000 for E-Transit purchases, and New York’s NYTVIP provides $12,000. Combine these with the federal credit to offset the price hike.

Impact on Buyers: Affordability and Incentives

Federal and State Incentives: A Shifting Landscape

One of the most critical factors in EV affordability is the $7,500 federal tax credit under the Inflation Reduction Act (IRA). However, eligibility is now tied to strict requirements: final assembly in North America, battery components sourced from the U.S. or free-trade partners, and income caps for buyers. As of 2024, the F-150 Lightning Pro and E-Transit qualify, but the Mach-E GT does not due to its higher price (MSRP over $80,000).

State incentives add another layer of complexity. For example:

- California: Clean Vehicle Rebate Project (CVRP) offers $2,000–$7,500.

- Colorado: $5,000 tax credit for EVs under $55,000.

- New York: Drive Clean Rebate up to $2,000.

Buyers should use tools like the Alternative Fuels Data Center to calculate total incentives in their state.

Leasing vs. Buying: A New Calculation

With higher purchase prices, leasing is becoming an attractive option. Ford’s lease rates have remained relatively stable, with the Mach-E Select available for $429/month (vs. $650/month for a loan at 5% interest). However, lessees may face mileage restrictions (10,000–12,000 miles/year) and wear-and-tear fees.

Key consideration: Leasing allows access to the federal tax credit, which Ford passes on as a lower capitalized cost. For example, a $50,000 Mach-E lease with a $7,500 credit effectively starts at $42,500. But if you plan to keep the car long-term, buying (and claiming the credit yourself) may be cheaper over 5+ years.

Used EV Market: A Silver Lining?

Higher new EV prices are boosting demand for used models. The average price of a used Mach-E dropped 18% in 2023, with 2021–2022 models now priced between $30,000 and $45,000. However, used EVs may lack the latest features (e.g., BlueCruise) and warranty coverage.

Tip: Look for certified pre-owned (CPO) Ford EVs, which come with a 12-month/12,000-mile warranty and a 172-point inspection. Avoid private sales unless you can verify battery health via a third-party scan (e.g., Recurrent).

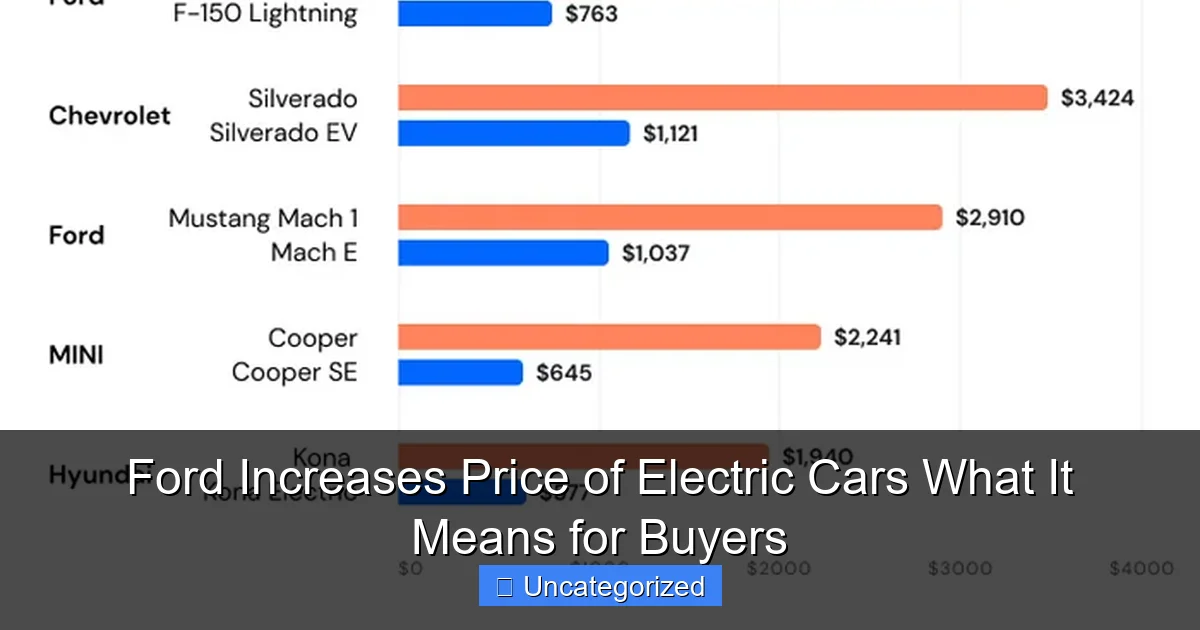

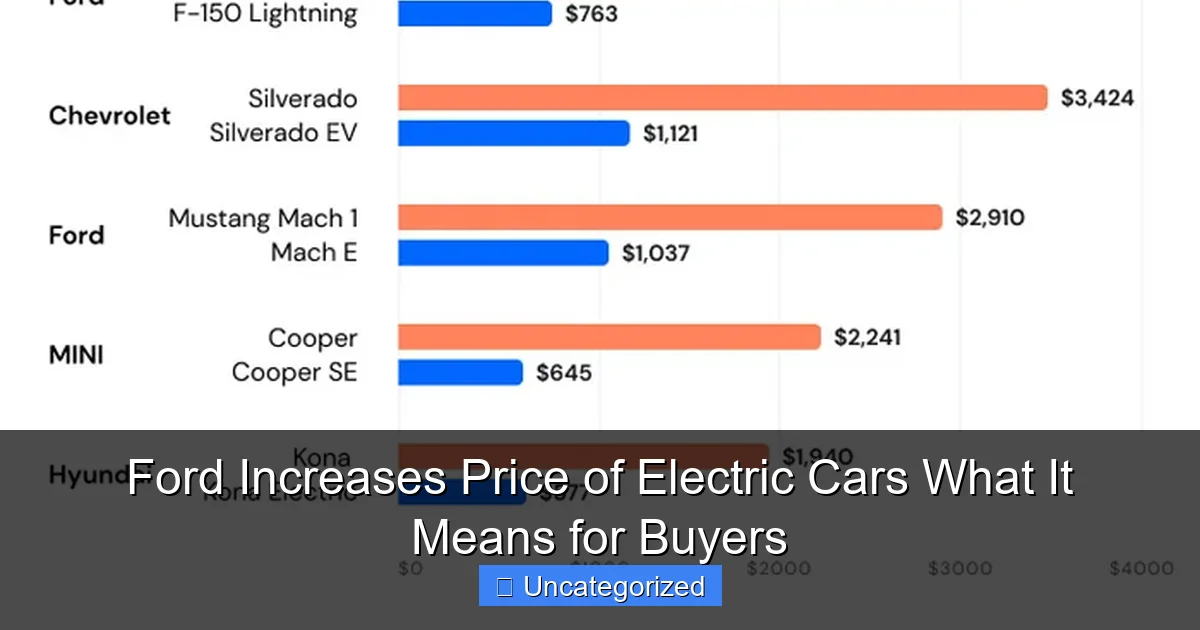

How Do Ford’s Prices Compare to Competitors?

Tesla: The Pricing Benchmark

Tesla has slashed prices multiple times in 2023–2024, with the Model Y starting at $43,990 (after federal credit). The Mach-E Select ($43,895) is now priced similarly, but the Model Y offers longer range (330 miles) and access to Tesla’s Supercharger network. However, Ford’s BlueCruise offers hands-free driving on 130,000+ miles of highways, a feature Tesla’s Autopilot lacks.

Chevrolet: The Budget Alternative

The Chevrolet Blazer EV starts at $48,800, while the Bolt EUV (discontinued in 2023) was $27,495. Ford’s Mach-E Premium ($50,995) competes with the Blazer EV RS ($54,995), but the Bolt’s low price made it a favorite for budget-conscious buyers. Tip: Wait for the 2024 Chevrolet Equinox EV ($30,000 target) if affordability is key.

Hyundai and Kia: Value Packed

Hyundai’s IONIQ 5 ($41,450) and Kia’s EV6 ($42,600) offer 300+ mile ranges and ultra-fast charging (10–80% in 18 minutes). Ford’s Mach-E GT ($63,995) is more expensive but has a sportier design and better towing capacity (3,500 lbs vs. 2,300 lbs). For families, the Kia EV9 ($54,900) offers three rows at a lower price than the Rivian R1S ($78,000).

| Model | Starting Price (2024) | Range (EPA) | Federal Tax Credit Eligible? | Key Advantage |

|---|---|---|---|---|

| Ford Mustang Mach-E Select | $43,895 | 250 miles | Yes | BlueCruise hands-free driving |

| Ford F-150 Lightning Pro | $49,995 | 240 miles | Yes | Pro Power Onboard (9.6 kW) |

| Tesla Model Y RWD | $43,990 (after credit) | 330 miles | Yes | Supercharger network access |

| Hyundai IONIQ 5 SE | $41,450 | 303 miles | Yes | 800V fast charging |

| Chevrolet Blazer EV 2LT | $48,800 | 279 miles | Yes | GM’s Ultium battery platform |

What This Means for the Future of Ford EVs

Long-Term Strategy: Scale and Innovation

Ford’s price increases are not a sign of weakness but part of a calculated strategy to fund its EV transition. By 2026, the company aims to produce 2 million EVs annually, leveraging economies of scale to reduce costs. The upcoming “Project T3” (Truck, Tech, Trust) electric pickup, set for 2025, will use a new modular platform designed to cut production costs by 30%.

Additionally, Ford is investing in battery recycling and solid-state battery R&D to reduce reliance on expensive raw materials. Partnerships with Redwood Materials and SK On aim to create a closed-loop supply chain, potentially lowering battery costs by 2030.

Market Positioning: Premium vs. Mainstream

Ford is repositioning its EVs as premium offerings. The Mach-E GT and Lightning Platinum emphasize luxury and performance, while the base models target mainstream buyers. This two-tier strategy mirrors Tesla’s approach (Model 3 vs. Model S) and could help Ford maintain margins as competition grows.

However, risks remain. If Tesla or Hyundai introduces a $30,000–$35,000 EV with 300+ mile range, Ford may lose price-sensitive buyers. The company’s success hinges on balancing innovation with affordability.

Consumer Expectations and Brand Loyalty

Ford’s brand loyalty—especially among truck and Mustang owners—gives it an edge. The F-150 Lightning has over 200,000 reservations, and the Mach-E has won multiple “Car of the Year” awards. But rising prices could alienate budget-conscious buyers. To retain them, Ford may need to:

- Expand lease programs with flexible terms.

- Introduce a lower-cost EV (e.g., a compact SUV under $35,000).

- Offer loyalty discounts for existing Ford owners.

Conclusion: Navigating Ford’s EV Price Increases

Ford’s decision to increase electric car prices reflects the complex realities of modern automotive manufacturing. While higher costs for raw materials, supply chain disruptions, and massive R&D investments are undeniable, these factors are not unique to Ford. The entire EV industry is grappling with similar challenges, and Ford’s proactive approach—raising prices to fund innovation—positions it for long-term success. For buyers, the key is to adapt your strategy rather than abandon your EV dreams.

Start by evaluating your budget and needs. If you’re a daily commuter, a base Mach-E or Lightning Pro may suffice, especially with federal and state incentives. For long-distance drivers, prioritize range and fast-charging capability—consider the Mach-E California Route 1 or Hyundai IONIQ 5. Business owners should explore the E-Transit’s tax credits and fleet discounts. And if upfront costs are a barrier, leasing or buying a used EV can provide a cost-effective entry point.

Finally, stay informed. EV pricing, incentives, and technology evolve rapidly. Use tools like PlugShare for charging station maps, Recurrent for battery health reports, and FordPass for real-time vehicle data. Remember: the transition to electric mobility is a marathon, not a sprint. By understanding the forces shaping Ford’s pricing and making smart, data-driven decisions, you can enjoy the benefits of EV ownership without breaking the bank. The road ahead is electric—and with the right approach, it’s also affordable.

Frequently Asked Questions

Why did Ford increase the price of electric cars?

Ford cites rising battery material costs, supply chain challenges, and increased demand as key reasons for the price hike. These factors have impacted production expenses across the EV market. The Ford electric car price increase reflects adjustments to maintain profitability and meet evolving manufacturing demands.

Which Ford electric models are affected by the price increase?

Models like the Mustang Mach-E and F-150 Lightning have seen recent price adjustments. Trim levels and configurations may vary in their increase amounts. Buyers should check Ford’s official website for model-specific pricing updates.

How does Ford’s electric car price increase compare to competitors?

Ford’s pricing adjustments align with industry trends, as automakers like Tesla and GM have also raised EV prices in recent years. The Ford electric car price increase is competitive, with added value from features like extended battery warranties and charging incentives.

Will the price increase affect existing reservations or orders?

Typically, price changes apply only to new orders placed after the announcement. Buyers with existing reservations or deposits are usually grandfathered in at the original price. Contact Ford directly to confirm order status and pricing guarantees.

Are there any incentives to offset Ford’s higher EV prices?

Yes, buyers may qualify for federal tax credits (up to $7,500) and state-level EV incentives, depending on location. Ford also offers loyalty bonuses and charging network partnerships to enhance value. These can help counterbalance the Ford electric car price increase.

Does the price hike include upgrades or new features?

Some trims include minor tech or comfort upgrades, but the primary driver is cost management, not feature additions. Ford emphasizes that core performance and range specifications remain unchanged. Buyers should review trim details to assess value relative to the higher price.