Ford Loses Money on Electric Cars What Went Wrong

Featured image for ford loses money on electric cars

Image source: carscoops.com

Ford is losing billions on its electric vehicle (EV) division, despite heavy investments and ambitious growth targets, as high production costs, supply chain hurdles, and slowing demand undercut profitability. Mistimed launches and internal combustion engine reliance left the automaker struggling to compete with Tesla and Chinese EV makers, forcing costly restructuring and delayed factory plans.

Key Takeaways

- High costs plague production: Ford’s EV manufacturing expenses outpace revenue, eroding profitability.

- Battery supply chain gaps: Inefficient sourcing and scaling hinder cost-effective electric vehicle output.

- Slow tech adoption: Lagging software and charging solutions weaken competitiveness in the EV market.

- Overestimated demand: Aggressive production targets misaligned with current consumer adoption rates.

- Legacy costs drag progress: ICE vehicle commitments divert resources from critical EV innovation.

- Pricing pressure mounts: Discounts and competition slash margins despite rising R&D investments.

📑 Table of Contents

- Ford Loses Money on Electric Cars: What Went Wrong?

- The High Cost of Electrification: Why EVs Are Expensive to Build

- Competition and Market Pressure: Ford vs. Tesla and New Entrants

- Supply Chain Disruptions and Production Challenges

- Strategic Missteps and Organizational Structure

- Financial Performance and Investor Concerns

- Looking Ahead: Can Ford Turn the Corner?

Ford Loses Money on Electric Cars: What Went Wrong?

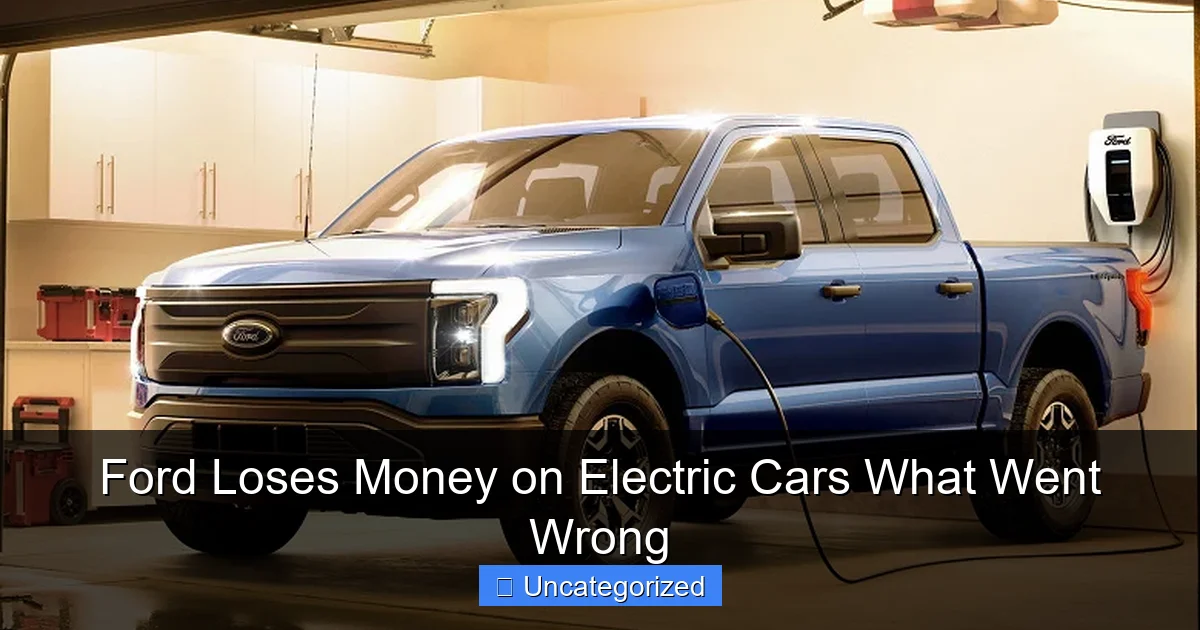

In the rapidly evolving landscape of the automotive industry, the shift toward electric vehicles (EVs) has become a defining trend of the 21st century. Automakers worldwide are investing billions to pivot from internal combustion engines (ICE) to battery-powered alternatives, driven by environmental concerns, regulatory pressures, and consumer demand for cleaner transportation. Among the legacy giants, Ford Motor Company has positioned itself as a key player in this transformation, launching ambitious plans to electrify its fleet, including iconic models like the F-150 Lightning and the Mustang Mach-E. Yet, despite these bold moves, Ford has faced a stark financial reality: Ford loses money on electric cars. The company’s EV division has consistently reported losses, raising eyebrows among investors, analysts, and industry watchers alike.

The narrative of Ford’s electric journey is not one of failure, but of growing pains in a high-stakes, high-cost transition. While Ford’s commitment to electrification is clear—aiming for 50% of global sales to be electric by 2030—the road to profitability has been bumpy. Supply chain disruptions, soaring battery costs, aggressive competition, and internal strategic missteps have all contributed to the financial shortfall. This article dives deep into the reasons behind Ford loses money on electric cars, exploring the technological, economic, and operational challenges that have undermined profitability. By analyzing Ford’s missteps and lessons learned, we aim to provide a comprehensive understanding of what went wrong—and what the future might hold for Ford and the broader EV market.

The High Cost of Electrification: Why EVs Are Expensive to Build

Battery Costs and Raw Material Volatility

One of the primary reasons Ford loses money on electric cars is the exorbitant cost of EV batteries, which can account for 30% to 40% of a vehicle’s total production cost. Lithium, nickel, cobalt, and manganese—key components of lithium-ion batteries—have seen extreme price fluctuations in recent years. For example, lithium carbonate prices surged by over 400% between 2020 and 2022, driven by supply constraints and soaring demand. Ford, like other automakers, has had to absorb these costs or pass them on to consumers, squeezing margins.

Visual guide about ford loses money on electric cars

Image source: phonemantra.com

To mitigate this, Ford has invested in vertical integration. In 2021, it partnered with SK Innovation to form BlueOval SK, a joint venture to build three battery plants in the U.S. with a total capacity of 129 GWh by 2025. However, these facilities are still ramping up, and Ford remains dependent on external suppliers for many components. Until full-scale production is achieved, the company cannot achieve the economies of scale needed to reduce per-unit battery costs.

Manufacturing Retooling and Capital Expenditure

Transitioning from ICE to EV production requires massive capital investment. Ford has committed over $50 billion through 2026 to electrify its lineup, including retooling existing factories and building new ones. For instance, the Rouge Electric Vehicle Center in Michigan, where the F-150 Lightning is built, underwent a $700 million renovation. While such investments are necessary for long-term competitiveness, they create short-term financial strain.

Moreover, EV-specific manufacturing processes—such as battery pack assembly, electric motor integration, and thermal management systems—are more complex and labor-intensive than traditional engine production. This increases labor costs and requires retraining of workforce, further impacting profitability. Ford’s Q4 2022 earnings report revealed that the Model e (EV) division posted a $3 billion loss, underscoring the financial burden of these upfront investments.

Low Production Volumes and Economies of Scale

Despite strong initial demand for EVs like the F-150 Lightning, Ford has struggled to ramp up production to levels that would allow for cost optimization. In 2022, Ford produced just 27,000 F-150 Lightnings—far below the 150,000-unit capacity of the Rouge plant. Low production volumes mean fixed costs (e.g., factory overhead, R&D) are spread over fewer units, increasing the cost per vehicle.

To improve scale, Ford has set a target of producing 600,000 EVs globally by the end of 2023 and 2 million by 2026. However, achieving these numbers requires not only factory capacity but also reliable battery supply, skilled labor, and efficient logistics—all of which remain bottlenecks.

Competition and Market Pressure: Ford vs. Tesla and New Entrants

Tesla’s First-Mover Advantage and Cost Leadership

Perhaps the most formidable challenge facing Ford is Tesla, which has established itself as the dominant player in the EV market. Tesla’s early entry allowed it to perfect battery technology, scale production, and achieve significant cost advantages. For example, Tesla’s 4680 battery cells are designed to reduce material costs and improve energy density, giving it a 10-15% cost edge over competitors.

Visual guide about ford loses money on electric cars

Image source: mr.cdn.ignitecdn.com

Additionally, Tesla’s direct-to-consumer sales model eliminates dealer markups, allowing it to maintain lower prices and higher margins. In 2023, Tesla slashed prices on the Model Y by up to 20%, triggering a price war. Ford was forced to respond by cutting F-150 Lightning prices by $10,000, further eroding already thin margins. This illustrates a key point: Ford loses money on electric cars not just due to production costs, but also because it cannot compete on price without sacrificing profitability.

New EV Startups and Legacy Rivals

Beyond Tesla, Ford faces competition from a wave of new EV startups like Rivian, Lucid, and Polestar, as well as legacy automakers like GM, Volkswagen, and Hyundai. These companies are aggressively investing in EVs, often with government subsidies and lower cost structures. For instance, Rivian’s R1T pickup, while priced higher than the F-150 Lightning, benefits from being built on a dedicated EV platform, reducing complexity and enabling better performance.

Meanwhile, GM’s Ultium platform allows for modular battery designs across multiple models, improving economies of scale. Ford’s approach, while innovative, has been slower to scale. The Mustang Mach-E, for example, is based on a modified ICE platform, which limits design flexibility and increases engineering costs.

Practical Tip: To compete, Ford must accelerate platform standardization and consider partnerships or joint ventures to share R&D and production costs, similar to its BlueOval SK model.

Brand Perception and Consumer Trust

While Ford enjoys strong brand loyalty among truck buyers, its image in the EV space is still developing. Tesla and Rivian are often seen as “tech-forward” and innovative, while Ford is perceived as a “traditional” automaker playing catch-up. This affects consumer willingness to pay premium prices for Ford EVs.

To address this, Ford has launched marketing campaigns highlighting the F-150 Lightning’s towing capacity, off-road performance, and FordPass app integration. However, building trust in EV reliability and software requires time and consistent performance—something Ford must prove over the long term.

Supply Chain Disruptions and Production Challenges

Global Semiconductor Shortage

One of the most significant external shocks affecting Ford’s EV production has been the global semiconductor shortage, which began in 2020 and continues to impact the auto industry. EVs require more chips than ICE vehicles due to advanced infotainment systems, driver-assistance features, and battery management systems. A single EV can use over 1,000 semiconductors.

Ford has been forced to halt or slow production of the F-150 Lightning multiple times due to chip shortages. In 2022, the company lost an estimated 30,000 units of EV production, costing tens of millions in potential revenue. This not only impacts sales but also delays cost recovery from fixed investments.

Practical Tip: Ford is now diversifying its semiconductor suppliers and investing in chip design partnerships to reduce dependency on a few key vendors. This long-term strategy could improve supply chain resilience.

Battery Supply and Geopolitical Risks

Beyond chips, Ford faces challenges in securing a stable battery supply. Most of the world’s lithium is mined in Australia, Chile, and China, while battery production is heavily concentrated in Asia. Geopolitical tensions, trade policies, and environmental regulations in these regions can disrupt supply.

To mitigate risk, Ford is investing in North American battery production through BlueOval SK and exploring alternative chemistries like lithium iron phosphate (LFP) batteries, which use less cobalt and are more stable. LFP batteries are already used in the base model F-150 Lightning, reducing material costs and supply chain exposure.

Logistics and Workforce Constraints

Even with components available, Ford has faced logistical bottlenecks. For example, in early 2023, a shortage of rail cars delayed the delivery of battery packs from SK Innovation’s Georgia plant to Ford’s Michigan facilities. Additionally, EV production requires specialized skills, and Ford has had to train thousands of workers in battery assembly and high-voltage safety.

The company has launched apprenticeship programs and partnered with community colleges to build a skilled EV workforce. However, training takes time, and labor shortages in key regions have slowed production ramp-up.

Strategic Missteps and Organizational Structure

Delayed EV Platform Development

One of Ford’s critical missteps was the delayed development of a dedicated EV platform. While Tesla built its vehicles from the ground up as EVs, Ford initially modified existing ICE platforms for EVs. The Mustang Mach-E, for instance, shares underpinnings with the ICE Escape, limiting design optimization and increasing costs.

It wasn’t until 2022 that Ford unveiled the GE2 (Global Electric 2) platform, a dedicated EV architecture designed for high-volume production. However, vehicles based on GE2 won’t launch until 2025, putting Ford behind competitors who already have multiple EV platforms in production.

Organizational Silos and Decision-Making

Internally, Ford has struggled with organizational silos between its ICE and EV divisions. The Model e (EV) division was only fully separated in 2022, allowing it to operate with greater autonomy. Before that, EV projects were often deprioritized in favor of profitable ICE trucks and SUVs.

This lack of focus delayed critical decisions, such as battery sourcing and software development. For example, Ford’s SYNC infotainment system has been criticized for lagging behind Tesla’s and Rivian’s user interfaces, affecting customer satisfaction.

Practical Tip: Ford’s decision to split Model e into a standalone unit was a step in the right direction. Continued investment in agile, cross-functional teams will be essential for innovation.

Software and Over-the-Air (OTA) Updates

Modern EVs are as much software-driven as they are hardware-driven. Tesla’s success is partly due to its ability to deliver OTA updates that improve performance, add features, and fix bugs remotely. Ford has been slow to adopt this model.

While the F-150 Lightning supports OTA updates, the rollout has been inconsistent, and the software ecosystem lacks the polish of competitors. Ford is now investing in a new software division, Ford Digital, to close the gap. However, catching up will require significant investment and time.

Financial Performance and Investor Concerns

Ford’s financial disclosures reveal the stark reality behind Ford loses money on electric cars. In 2022, the Model e division reported an operating loss of $3 billion on $2.5 billion in revenue—a margin of -120%. In contrast, the Ford Blue (ICE) division posted a $7.2 billion profit. This stark contrast has raised concerns among investors about the viability of Ford’s EV strategy.

Data Table: Ford EV Financial Performance (2021–2023)

| Year | EV Revenue ($B) | EV Operating Profit/Loss ($B) | EV Units Sold | Key Models |

|---|---|---|---|---|

| 2021 | 1.2 | -2.1 | 22,000 | Mustang Mach-E, E-Transit |

| 2022 | 2.5 | -3.0 | 61,000 | F-150 Lightning, Mach-E |

| 2023 (Est.) | 5.0 | -4.0 | 150,000 | F-150 Lightning, Mach-E, E-Transit |

Note: Data based on Ford earnings reports and analyst estimates. 2023 figures are projected.

The data shows a clear trend: as EV sales grow, losses are also increasing. This is typical during the early stages of a new product line, but the scale of losses is concerning. Ford projects that Model e will become profitable by 2026, assuming production reaches 2 million units and battery costs decline by 30%.

Investor Sentiment and Stock Performance

Ford’s stock has underperformed relative to Tesla and other EV-focused automakers. In 2023, Ford’s share price dropped over 20%, while Tesla’s rose 100%. Investors are skeptical about Ford’s ability to achieve profitability in EVs without sacrificing ICE profits.

To reassure investors, Ford has emphasized that ICE profits will fund the EV transition. The company plans to reinvest $10 billion in Model e from Ford Blue’s earnings through 2026. However, this model is unsustainable if EV losses continue to grow.

Looking Ahead: Can Ford Turn the Corner?

The story of Ford loses money on electric cars is not a verdict of failure, but a reflection of the immense challenges inherent in transforming a century-old automaker for the electric age. Ford’s struggles are not unique—GM, Volkswagen, and others have also reported EV losses. However, Ford’s path forward requires a combination of strategic discipline, operational efficiency, and long-term vision.

Key opportunities for improvement include:

- Accelerating battery cost reduction through vertical integration and LFP adoption.

- Scaling production rapidly to achieve economies of scale and reduce fixed costs.

- Enhancing software capabilities to match Tesla’s OTA and user experience.

- Improving supply chain resilience through diversification and regional sourcing.

- Strengthening brand positioning to justify premium EV pricing.

Ford’s leadership, under CEO Jim Farley, has acknowledged the challenges and is implementing corrective measures. The separation of Model e, the launch of GE2, and partnerships with tech companies like Google and Qualcomm signal a renewed commitment to innovation. While the road to profitability is steep, Ford’s legacy of resilience and engineering excellence offers hope.

In conclusion, Ford’s current losses in the EV sector are a painful but necessary phase of transformation. The company is betting its future on electrification, and while the journey has been costly, the destination—a sustainable, profitable EV business—is within reach. For consumers, investors, and the planet, the hope is that Ford’s missteps will serve as a roadmap for a smoother, more successful transition in the years ahead. The lesson is clear: electrification is not just about building electric cars—it’s about reimagining every aspect of the automotive business.

Frequently Asked Questions

Why is Ford losing money on electric cars?

Ford is losing money on electric cars due to high production costs, supply chain disruptions, and aggressive pricing strategies to stay competitive. The company also invested heavily in EV technology before achieving economies of scale, squeezing margins.

How much has Ford lost on electric vehicles?

Ford’s Model e division reported a $3.1 billion pre-tax loss in 2023, with EV losses expected to rise to $4.5 billion in 2024. These figures reflect ongoing challenges in scaling production while maintaining profitability.

What went wrong with Ford’s electric car strategy?

Ford underestimated battery costs, faced manufacturing delays, and struggled with software development for its EVs. Additionally, price wars with Tesla and slower-than-expected consumer adoption have hurt its electric car profitability.

Can Ford turn around its electric vehicle business?

Ford is cutting costs, delaying $12 billion in EV spending, and focusing on hybrid models to bridge the gap. Success depends on lowering battery expenses and launching more affordable, high-volume EVs by 2025.

Are Ford’s electric cars selling poorly?

While Ford’s Mustang Mach-E and F-150 Lightning have seen decent demand, sales haven’t met projections. Supply chain issues, production bottlenecks, and rising interest rates have dampened electric car purchases.

How does Ford’s EV loss compare to competitors?

Unlike Tesla, which profits from EVs, Ford’s losses mirror industry-wide struggles. GM and Rivian also face similar challenges, but Ford’s aggressive EV push has led to steeper short-term losses.