Ford Loss on Electric Cars Sparks Industry Debate

Featured image for ford loss on electric cars

Image source: cdn.teslanorth.com

Ford’s $3 billion loss on electric vehicles (EVs) in 2023 has sent shockwaves through the auto industry, raising urgent questions about the financial viability of aggressive EV transitions. The stumble highlights mounting challenges—from slowing demand to production bottlenecks—that threaten legacy automakers’ electrification timelines. As Ford scales back near-term EV investments, the debate intensifies: is this a temporary setback or a sign of deeper structural issues in the EV market?

Key Takeaways

- Ford’s EV losses highlight the financial risks of rapid electrification transitions.

- Cost management is critical as EV production scales to avoid margin erosion.

- Consumer demand for EVs may not match aggressive automaker rollout plans.

- Legacy automakers must balance ICE profitability with EV investments strategically.

- Supply chain stability directly impacts EV profitability and long-term success.

- Industry-wide reassessment of EV timelines and capital allocation is underway.

📑 Table of Contents

- The Electric Crossroads: Ford’s $1.3 Billion Loss and a Shifting Automotive Landscape

- The Anatomy of Ford’s $1.3 Billion EV Loss

- Industry-Wide Implications: A Cautionary Tale for Legacy Automakers

- Strategic Recalibration: Ford’s Pivot to Profitability

- Consumer Impact: What Ford’s Loss Means for Buyers

- Data Snapshot: Ford EV Performance vs. Competitors

- Conclusion: Navigating the Electric Future

The Electric Crossroads: Ford’s $1.3 Billion Loss and a Shifting Automotive Landscape

The automotive industry is undergoing a seismic shift, and at the center of this transformation stands Ford Motor Company—a titan of American manufacturing now grappling with the financial and strategic implications of its electric vehicle (EV) investments. In early 2023, Ford announced a staggering $1.3 billion loss in its electric vehicle division, sending shockwaves through Wall Street, the auto sector, and consumer markets. This figure wasn’t just a quarterly blip; it represented a 30% year-over-year increase in losses, despite a 120% surge in EV deliveries. For a company once synonymous with the internal combustion engine and the American Dream, this moment marks a pivotal crossroads: adapt or risk obsolescence.

Ford’s loss on electric cars has ignited a fierce debate across the industry. Is this a temporary setback in an inevitable transition to sustainable mobility, or a warning sign that the EV revolution is moving faster than legacy automakers can handle? As Ford scales back production, delays new model launches, and reevaluates its $50 billion EV investment plan, questions abound. Why are traditional automakers like Ford struggling despite massive R&D budgets and decades of manufacturing expertise? What does this mean for consumers, investors, and the future of transportation? This article dives deep into Ford’s electric vehicle challenges, dissecting the root causes, industry-wide implications, and the strategic recalibration required to navigate the high-voltage road ahead.

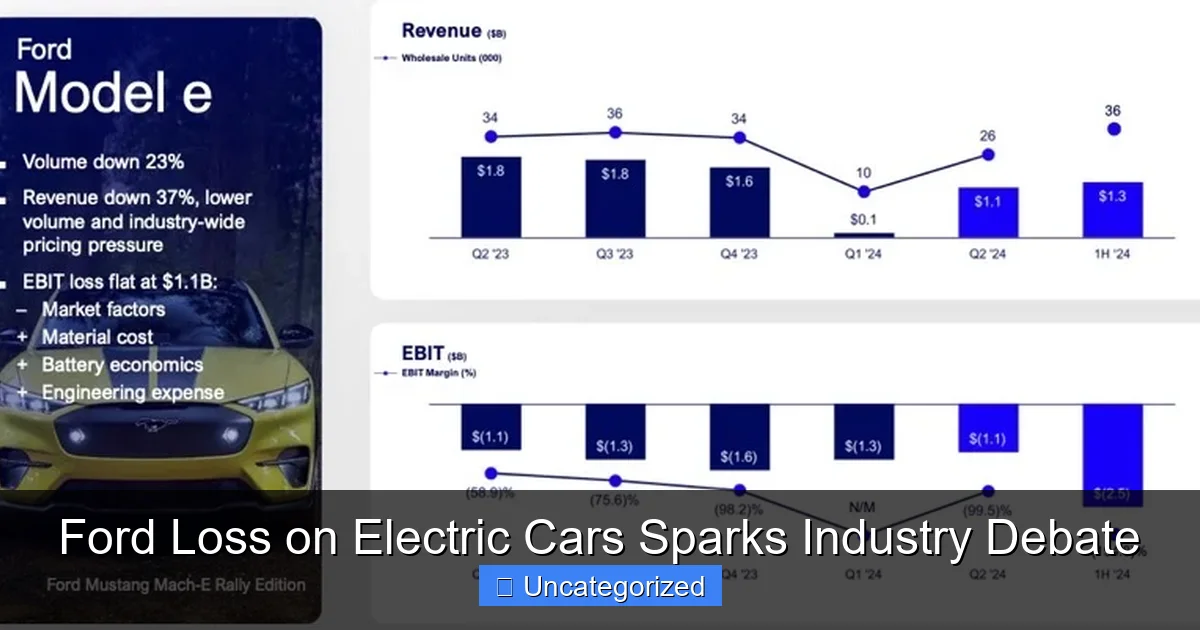

The Anatomy of Ford’s $1.3 Billion EV Loss

Ford’s electric vehicle division, known as Ford Model e, reported a $1.3 billion operating loss in 2023—a figure that stunned analysts and investors alike. To understand the magnitude of this loss, consider this: Ford sold 72,600 EVs in 2023, yet the cost to produce each unit exceeded revenue by nearly $18,000. This gap isn’t just a matter of poor sales; it reflects a complex interplay of production inefficiencies, supply chain bottlenecks, and aggressive pricing pressure.

Visual guide about ford loss on electric cars

Image source: images.carexpert.com.au

Production Costs vs. Pricing Pressure

One of the primary drivers of Ford’s loss is the high cost of EV manufacturing. Unlike Tesla, which has spent over a decade refining battery production and vertical integration, Ford is still in the early stages of scaling its EV operations. The Ford F-150 Lightning, for instance, requires a completely different supply chain than its gas-powered counterpart. Battery cells, sourced from SK Innovation and LG Energy Solution, account for roughly 40% of the vehicle’s total cost. In 2023, Ford’s battery costs averaged $140 per kWh—far above Tesla’s $100 per kWh benchmark.

Compounding the issue is price competition. In response to Tesla’s repeated price cuts (the Model Y dropped from $66,000 in 2022 to $47,000 in 2023), Ford slashed the F-150 Lightning’s MSRP from $60,000 to $49,995. While this boosted sales, it eroded margins. “We’re selling more EVs, but at a loss,” admitted Ford CFO John Lawler. “Until battery costs come down, this is unsustainable.”

Supply Chain and Battery Challenges

Ford’s reliance on third-party battery suppliers has proven to be a double-edged sword. While partnerships with SK Innovation and LG provide short-term capacity, they limit Ford’s control over quality, pricing, and innovation. For example, a 2023 recall of 18,000 F-150 Lightnings due to battery defects cost the company $250 million in repairs and lost revenue.

Additionally, the lithium and cobalt supply chain remains volatile. Geopolitical tensions, mining shortages, and ESG concerns have driven raw material prices upward. In 2023, lithium carbonate prices spiked to $70,000 per ton—up from $10,000 in 2020. Ford’s inability to secure long-term fixed-price contracts has left it vulnerable to these fluctuations.

Software and Technology Gaps

Modern EVs are as much about software as hardware. Tesla’s over-the-air (OTA) updates, advanced driver-assistance systems (ADAS), and user-friendly interfaces set a high bar. Ford’s SYNC infotainment system, while functional, lags behind in responsiveness and feature depth. A 2023 Consumer Reports survey ranked Ford’s EV software 15th out of 20 automakers.

“Legacy automakers underestimated the tech gap,” says auto analyst Jessica Caldwell. “They’re playing catch-up in software development, which requires hiring engineers, building cloud infrastructure, and retraining staff—all costly endeavors.”

Industry-Wide Implications: A Cautionary Tale for Legacy Automakers

Ford’s struggles are not isolated. General Motors, Volkswagen, and Stellantis have all reported declining EV margins in 2023, signaling a broader industry challenge. The Ford loss on electric cars has become a case study in the risks of rapid electrification—particularly for companies built on ICE (internal combustion engine) economies of scale.

Visual guide about ford loss on electric cars

Image source: carsguide-res.cloudinary.com

The ICE-to-EV Transition Dilemma

Legacy automakers face a classic “innovator’s dilemma.” Their core business—selling gas-powered trucks, SUVs, and sedans—generates the cash flow needed to fund EV development. In 2023, Ford’s ICE division earned $10.2 billion, subsidizing the Model e’s losses. But as EV adoption grows, this model becomes unsustainable. “You can’t fund the future with the past forever,” warns industry expert Sam Abuelsamid.

Consider this: Ford’s F-150 pickup is America’s best-selling vehicle, with a 25% profit margin. The F-150 Lightning, however, operates at a 15% loss. If EV adoption reaches 50% by 2030 (as projected by the IEA), Ford risks cannibalizing its most profitable product line.

Competition from Tesla and Chinese Automakers

Ford isn’t just competing with domestic rivals—it’s battling Tesla and Chinese EV giants like BYD and NIO. Tesla’s gigacasting and 4680 battery cells have reduced production costs by 50% since 2020. BYD, meanwhile, controls its entire supply chain—from lithium mining to battery recycling—giving it a 20% cost advantage over Western rivals.

“Chinese automakers are winning on price and speed,” says BloombergNEF analyst Colin McKerracher. “They launch new EVs in 12-18 months; legacy brands take 3-5 years.”

Regulatory and Market Pressures

Government mandates are accelerating the EV transition. The U.S. Inflation Reduction Act (IRA) ties $7,500 tax credits to North American battery sourcing and final assembly. Ford’s Kentucky-built F-150 Lightning qualifies, but its Mexico-produced Mach-E does not—a $7,500 price disadvantage in a tight market. Similarly, the EU’s 2035 ICE ban forces automakers to pivot quickly or face fines.

Consumers, meanwhile, are demanding affordability. A 2023 J.D. Power study found that 62% of U.S. car buyers won’t pay more than $35,000 for an EV. Ford’s cheapest EV, the E-Transit van, starts at $47,000—out of reach for most.

Strategic Recalibration: Ford’s Pivot to Profitability

In response to its losses, Ford has launched a sweeping strategic overhaul. The company’s new mantra: “EVs first, ICE second.” Key initiatives include cost-cutting, platform consolidation, and a renewed focus on software and customer experience.

Cost Reduction and Vertical Integration

Ford is investing $30 billion in vertical integration by 2026. This includes:

- Building four new battery plants (BlueOval SK joint venture with SK Innovation).

- Developing in-house battery tech (Ford Ion Park).

- Acquiring lithium mining rights in Argentina and Canada.

“We’re bringing battery production in-house to cut costs by 20%,” says CEO Jim Farley. The goal: achieve $100 per kWh battery costs by 2025.

Platform Consolidation: From 10 to 3 EV Architectures

Ford is reducing its EV platforms from 10 to 3—a move expected to save $2 billion annually. The new architectures include:

- TE1: For full-size trucks and SUVs (F-150 Lightning, upcoming Explorer EV).

- TE2: For midsize vehicles (Mustang Mach-E refresh).

- TE3: For affordable compact EVs (launching 2025).

This “one-size-fits-most” approach streamlines production and reduces R&D costs.

Software and Services: The New Profit Frontier

Ford is betting big on software. Its new Ford Pro division offers EV fleet management, charging solutions, and predictive maintenance—services with 50%+ gross margins. The company plans to generate $1 billion in software revenue by 2025.

Additionally, Ford is rolling out OTA updates for all 2024 EVs, including battery optimization, navigation improvements, and new driver-assist features.

Consumer Impact: What Ford’s Loss Means for Buyers

Ford’s financial woes have direct consequences for consumers—both positive and negative.

Lower Prices, But Limited Availability

To clear inventory, Ford is offering aggressive discounts. In Q1 2024, the F-150 Lightning saw $7,500 rebates (stacked with federal tax credits), dropping its effective price to $42,495. Similarly, the Mach-E received $5,000 cash incentives.

Tip for buyers: Monitor Ford’s “EV Deals” page for limited-time offers. However, production cuts mean longer wait times—up to 6 months for custom orders.

Charging Infrastructure: A Bright Spot

Ford’s partnership with Tesla to adopt the NACS charging standard in 2025 will grant Ford EV owners access to 12,000+ Superchargers—a major convenience boost. Ford also plans to install 10,000 public chargers by 2026.

Pro tip: Use the FordPass app to locate free charging stations (available for first 2 years).

Resale Value Concerns

High depreciation is a risk. A 2023 iSeeCars study found Ford EVs lose 35% of their value in 3 years—vs. 25% for Tesla. “Buyers should consider leasing or certified pre-owned models,” advises auto finance expert Melinda Ziegler.

Data Snapshot: Ford EV Performance vs. Competitors

The table below compares Ford’s 2023 EV performance with key rivals:

| Metric | Ford | Tesla | BYD | GM |

|---|---|---|---|---|

| EV Sales (2023) | 72,600 | 1.8 million | 910,000 | 75,000 |

| Operating Margin | -15% | 12% | 8% | -10% |

| Battery Cost (per kWh) | $140 | $100 | $120 | $135 |

| Time to Market (New EV) | 36 months | 18 months | 12 months | 30 months |

| Software Updates | Quarterly | Monthly | Bi-monthly | Quarterly |

Source: Company reports, BloombergNEF, J.D. Power (2024)

Conclusion: Navigating the Electric Future

Ford’s $1.3 billion loss on electric cars is more than a financial headline—it’s a wake-up call for the entire automotive industry. The transition to EVs is not a linear upgrade but a fundamental reinvention of manufacturing, technology, and business models. For Ford, the path forward requires bold decisions: doubling down on vertical integration, accelerating software development, and rethinking pricing strategies.

Yet, amid the losses, there are signs of hope. Ford’s strategic pivot—embracing battery autonomy, platform efficiency, and software monetization—mirrors the playbook that made Tesla a market leader. The F-150 Lightning remains the best-selling electric truck in the U.S., and Ford Pro’s fleet services are gaining traction. “The EV race isn’t about who leads today,” says CEO Jim Farley, “but who sustains momentum.”

For consumers, Ford’s challenges translate to short-term opportunities (lower prices, improved infrastructure) and long-term risks (resale value, model discontinuation). The key is to buy with eyes wide open: prioritize reliability, charging access, and total cost of ownership. Meanwhile, the broader lesson is clear—legacy automakers must evolve or perish. As the industry debates Ford’s fate, one truth emerges: the electric future is inevitable, but the road to profitability is paved with innovation, agility, and relentless execution.

Frequently Asked Questions

Why is Ford losing money on electric cars?

Ford’s loss on electric cars stems from high upfront costs for EV development, supply chain challenges, and slower-than-expected consumer adoption. The company has invested billions in EV production, but pricing pressures and competition have squeezed profit margins.

How much has Ford lost on electric vehicles so far?

Ford reported over $4.7 billion in losses for its EV division (Model e) between 2021 and 2023, with a $1.3 billion operating loss in Q1 2024 alone. These figures reflect the steep costs of scaling EV production and technology investments.

Is Ford’s loss on electric cars a sign of bigger industry problems?

Yes, Ford’s struggles mirror broader challenges in the EV market, including rising material costs, charging infrastructure gaps, and demand fluctuations. Automakers like GM and Rivian face similar pressures, sparking debates about the viability of current EV timelines.

Will Ford’s electric car losses affect future models?

Ford has delayed some EV projects (like a $12B production pause in 2023) to reassess costs, but it remains committed to electrification. The company plans to balance its lineup with hybrid models to offset loss on electric cars while refining its long-term EV strategy.

What steps is Ford taking to reduce EV losses?

Ford is cutting battery costs, streamlining supply chains, and focusing on higher-margin commercial EVs (like the E-Transit van). It also plans to shift to smaller, more affordable EVs to attract a wider audience and improve profitability.

Are Ford’s electric cars still worth buying despite the financial losses?

Absolutely. Models like the Mustang Mach-E and F-150 Lightning offer strong performance and incentives, even if Ford isn’t yet profitable on them. The losses reflect industry-wide growing pains, not product quality.