Ford Losses on Electric Cars What Went Wrong

Featured image for ford losses on electric cars

Image source: climatedepot.com

Ford’s electric vehicle losses have surged past $3 billion annually, exposing critical missteps in its EV strategy, including production delays, battery supply chain issues, and underwhelming consumer demand for early models like the Mustang Mach-E and F-150 Lightning. High manufacturing costs and fierce competition from Tesla and legacy automakers have further eroded margins, forcing Ford to scale back ambitious EV targets and rethink its electrification roadmap. The company now faces a pivotal challenge: balancing short-term profitability with long-term EV viability.

Key Takeaways

- High production costs: Ford underestimated EV manufacturing expenses, hurting profitability.

- Battery supply chain gaps: Inconsistent battery sourcing delayed launches and raised costs.

- Slow tech adoption: Lagged behind rivals in software and charging innovations.

- Overestimated demand: Misjudged market readiness for premium-priced electric models.

- Legacy system burdens: ICE-focused factories slowed EV transition and efficiency.

- Brand perception issues: Failed to position EVs as aspirational like Tesla.

📑 Table of Contents

- Ford Losses on Electric Cars: What Went Wrong?

- 1. Overambitious Production Goals and Execution Gaps

- 2. Battery Supply Chain and Raw Material Volatility

- 3. Pricing Missteps and Market Competition

- 4. Software and Technology Lag

- 5. Consumer Trust and Brand Perception

- 6. Strategic Shifts and the Road Ahead

Ford Losses on Electric Cars: What Went Wrong?

When Ford Motor Company announced its ambitious electric vehicle (EV) strategy in 2021, the industry watched with bated breath. The American automaker, with over a century of legacy in gasoline-powered vehicles, was positioning itself as a serious contender in the rapidly expanding EV market. With bold promises of $50 billion in EV investments by 2026 and plans to launch 16 new electric models, Ford seemed poised to challenge Tesla and other EV pioneers. However, by 2023, the narrative had shifted dramatically. Ford reported significant financial losses on its electric vehicle division, with the EV segment alone losing nearly $2 billion in the first half of the year.

The story of Ford’s electric ambitions is not one of failure, but of miscalculations, timing issues, and the harsh realities of transitioning a legacy automaker into a new era of transportation. As the global auto industry races toward electrification, Ford’s struggles offer a cautionary tale for traditional car manufacturers attempting to pivot from internal combustion engines (ICE) to battery-powered vehicles. This article explores the key factors behind Ford’s losses on electric cars, examining everything from production challenges and supply chain disruptions to pricing missteps and market competition. Understanding what went wrong can help not only Ford but also other automakers avoid similar pitfalls in the future.

1. Overambitious Production Goals and Execution Gaps

Unrealistic Timelines and Scaling Challenges

One of the primary contributors to Ford’s losses on electric cars was its aggressive production targets, which outpaced actual manufacturing capabilities. In early 2022, Ford announced plans to produce 600,000 EVs annually by the end of 2023. This included scaling up the Ford F-150 Lightning, Mustang Mach-E, and the E-Transit van. However, by mid-2023, the company had only achieved about 20% of that target, producing roughly 120,000 units.

Visual guide about ford losses on electric cars

Image source: autofinancenews.net

The gap between ambition and reality stemmed from multiple bottlenecks. The F-150 Lightning, for example, faced delays due to battery supply constraints, software integration issues, and a shortage of skilled labor. Ford’s Rouge Electric Vehicle Center in Michigan, which was retrofitted to produce the Lightning, experienced repeated shutdowns due to quality control problems. In one instance, the company recalled over 18,000 units due to battery pack defects—highlighting the challenges of adapting ICE manufacturing lines to EV production.

Retooling Legacy Plants: A Costly Transition

Unlike Tesla, which built its Gigafactories from the ground up with EVs in mind, Ford attempted to retrofit existing facilities. While this approach saved time initially, it introduced inefficiencies. For example, the Kansas City Assembly Plant, which produces the E-Transit, had to be partially shut down for months to install new battery assembly lines and robotic systems. These downtime periods not only delayed deliveries but also increased per-unit manufacturing costs.

- Cost per E-Transit van: ~$68,000 (2022) vs. projected $52,000

- F-150 Lightning production cost: ~$75,000 (vs. $55,000 target)

- Labor hours per EV: 30% higher than ICE counterparts

These inflated costs directly eroded Ford’s profit margins, especially when combined with pricing pressures from competitors. Ford’s inability to scale efficiently meant it was losing money on every EV sold—a situation that became unsustainable as interest rates rose and consumer demand plateaued.

2. Battery Supply Chain and Raw Material Volatility

Dependence on Third-Party Battery Suppliers

Ford’s reliance on external battery suppliers—primarily SK Innovation and LG Energy Solution—created a critical vulnerability. Unlike Tesla, which has invested heavily in in-house battery production (e.g., 4680 cells), Ford outsourced battery pack assembly. This dependency led to:

Visual guide about ford losses on electric cars

Image source: absolutenews.com

- Production halts during supplier quality audits

- Delays due to shipping bottlenecks (e.g., 2022 port congestion in South Korea)

- Inconsistent battery performance, affecting vehicle range and reliability

For instance, in Q4 2022, Ford halted F-150 Lightning production for over a month after SK Innovation flagged potential thermal runaway risks in certain battery modules. The recall and replacement process cost Ford an estimated $150 million in lost revenue and warranty expenses.

Raw Material Price Spikes and Inflation

The global surge in lithium, nickel, and cobalt prices between 2021 and 2023 significantly impacted Ford’s EV economics. Lithium carbonate prices, for example, increased from $7,000 per ton in 2020 to over $80,000 in 2022—a 1,000% jump. These raw materials constitute up to 40% of an EV battery’s cost.

Ford’s inability to secure long-term supply contracts at fixed prices left it exposed to market volatility. While competitors like GM locked in deals with mining companies (e.g., GM’s partnership with Livent), Ford’s procurement strategy remained reactive. This lack of foresight forced the company to absorb higher input costs, further widening the gap between production expenses and retail prices.

Tip: Diversify Supply Chains and Invest in Vertical Integration

To mitigate future risks, automakers should consider:

- Establishing joint ventures with mining companies (e.g., Ford’s 2023 deal with Nemaska Lithium)

- Building in-house battery gigafactories (Ford plans BlueOval SK in Kentucky by 2025)

- Using AI-driven supply chain forecasting tools to anticipate price trends

3. Pricing Missteps and Market Competition

Initial Overpricing and Subsequent Discounts

Ford launched the Mustang Mach-E in 2020 with a starting price of $42,895. While competitive at the time, the price failed to account for rapid advancements by rivals. By 2022, Tesla had slashed Model Y prices to $46,990 (after incentives), while Hyundai’s Ioniq 5 started at $41,450. Ford responded by offering up to $10,000 in discounts and lease incentives, but this eroded brand value and margins.

The F-150 Lightning, initially priced at $39,974, saw a 40% price hike by 2023 due to inflation, reaching $55,974. However, Tesla’s Cybertruck announcement and Rivian’s price cuts undercut Ford’s value proposition. As a result, F-150 Lightning sales dropped by 15% in Q2 2023 compared to the previous quarter.

Competition from Legacy and New EV Brands

Ford underestimated the speed at which competitors would enter the EV space. Key rivals included:

- Tesla: Dominating with vertical integration, over-the-air updates, and a cult-like customer base

- Rivian: Targeting the same premium truck/SUV segment with better range and tech

- GM: Offering Ultium-based vehicles (e.g., Cadillac Lyriq) at competitive price points

- Chinese OEMs (BYD, NIO): Flooding markets with affordable, high-quality EVs

Ford’s brand identity, once synonymous with rugged trucks and American muscle, struggled to translate into the EV era. While the Mustang Mach-E leveraged the iconic Mustang name, it was criticized for diluting the brand’s performance heritage. The F-150 Lightning, though praised for utility, faced skepticism from traditional truck buyers who questioned its towing capacity and off-road capabilities.

Tip: Align Pricing with Total Cost of Ownership (TCO)

To compete effectively, Ford should emphasize TCO advantages—such as lower fuel and maintenance costs—through marketing. For example, a $5,000 higher sticker price could be offset by $15,000 in lifetime savings, making the vehicle more attractive to cost-conscious buyers.

4. Software and Technology Lag

Outdated Infotainment and Connectivity

One of Ford’s most glaring weaknesses in EVs is its software ecosystem. While Tesla offers seamless over-the-air (OTA) updates, advanced driver assistance systems (ADAS), and a minimalist interface, Ford’s SYNC 4 system lags in responsiveness and feature depth. Common complaints include:

- Slow boot times (up to 30 seconds)

- Glitchy voice recognition

- Lack of third-party app integration (e.g., Spotify, YouTube)

In a 2023 Consumer Reports survey, Ford’s EV software scored 3.8/10, compared to Tesla’s 8.5/10 and Rivian’s 7.9/10. This software deficit undermines the premium experience expected in EVs and reduces customer loyalty.

ADAS and Autonomy: Playing Catch-Up

Ford’s BlueCruise hands-free driving system, launched in 2022, covers only 130,000 miles of highways—far behind Tesla’s Full Self-Driving (FSD) beta, which operates on city streets. Moreover, BlueCruise requires a subscription ($600/year), while Tesla includes basic Autopilot for free. This pricing model alienates tech-savvy buyers who expect advanced features as standard.

Ford’s partnership with Argo AI (a self-driving startup) collapsed in 2022, costing the company $2.7 billion in write-downs. The failure to develop in-house autonomy technology left Ford dependent on third-party solutions, delaying its roadmap and increasing R&D costs.

Tip: Invest in Software Talent and OTA Capabilities

Automakers must treat software as a core competency, not an afterthought. Ford should:

- Hire top-tier software engineers (e.g., from Silicon Valley)

- Develop a unified software platform across all EVs (similar to VW’s MEB)

- Launch OTA updates to fix bugs and add features post-purchase

5. Consumer Trust and Brand Perception

Recall After Recall: Quality Control Issues

Between 2021 and 2023, Ford issued over 15 recalls for its EVs, affecting more than 300,000 vehicles. Notable issues included:

- Battery pack fires (F-150 Lightning)

- Faulty door latches (Mustang Mach-E)

- Software glitches causing sudden shutdowns (E-Transit)

These recalls damaged consumer confidence, with J.D. Power reporting a 25% drop in Ford’s EV satisfaction scores during this period. In contrast, Tesla, despite its own recalls, maintained a “we fix it fast” reputation through OTA updates.

Marketing Misalignment with EV Buyers

Ford’s marketing still leans heavily on traditional truck messaging—towing, payload, and ruggedness—while EV buyers prioritize range, charging speed, and tech. A 2023 survey by Deloitte found that 68% of EV intenders rank “fast charging” as a top factor, yet Ford’s ads rarely highlight the F-150 Lightning’s 150 kW DC fast charging (slower than Tesla’s 250 kW).

Additionally, Ford’s “Built for America” campaign resonates with ICE buyers but fails to address the sustainability concerns of environmentally conscious EV shoppers. Competitors like Rivian emphasize carbon neutrality and off-grid adventures, creating a more compelling narrative.

Tip: Rebuild Trust Through Transparency and Community

To regain trust, Ford should:

- Publish real-world performance data (e.g., cold-weather range tests)

- Create EV owner communities for peer-to-peer support

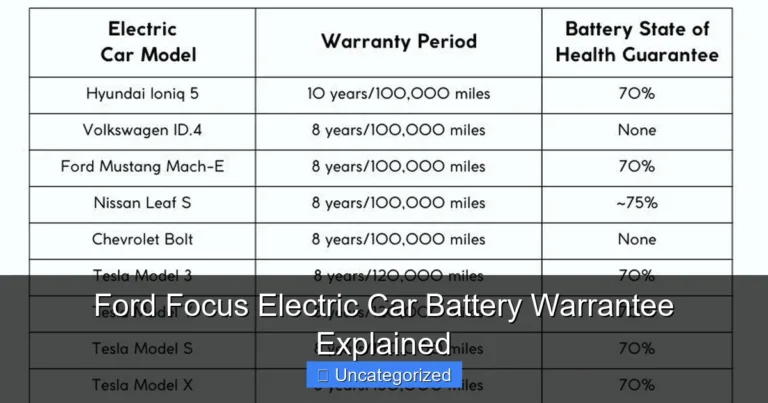

- Offer extended warranties (e.g., 8 years/100,000 miles) to alleviate battery concerns

6. Strategic Shifts and the Road Ahead

Ford’s New EV Strategy: Slower, Smarter, and More Profitable

In late 2023, Ford CEO Jim Farley admitted the company had “moved too fast” and announced a strategic pivot. Key changes include:

- Delaying $12 billion in EV spending to focus on hybrid vehicles

- Reducing annual EV production target to 300,000 by 2024

- Launching a new low-cost EV platform by 2025 (targeting $25,000 vehicles)

This shift acknowledges that the EV market is not growing as quickly as expected. With U.S. EV adoption plateauing at 8% in 2023, Ford is betting on hybrids as a bridge technology.

Investing in Charging Infrastructure and Partnerships

Ford has partnered with Tesla to adopt the NACS (North American Charging Standard) by 2025, giving Ford EV owners access to Tesla’s Supercharger network. It has also invested in charging startups like ChargePoint and is piloting mobile charging units for fleet customers.

Additionally, Ford is exploring vehicle-to-grid (V2G) technology, allowing EVs to power homes during outages—a feature already available on the F-150 Lightning.

Data Table: Ford’s EV Performance (2021–2023)

| Year | EV Models | Units Sold | Revenue ($B) | Operating Loss ($B) | Key Challenges |

|---|---|---|---|---|---|

| 2021 | Mustang Mach-E, E-Transit | 27,000 | 1.2 | -0.8 | Production delays, low margins |

| 2022 | +F-150 Lightning | 61,500 | 3.5 | -1.5 | Battery recalls, inflation |

| 2023 (H1) | All models | 58,200 | 4.1 | -2.0 | Software issues, price cuts |

Tip: Balance Innovation with Pragmatism

Ford’s lesson is clear: electrification is a marathon, not a sprint. Automakers must balance innovation with financial discipline, ensuring each EV launch is profitable before scaling. Ford’s new strategy—focusing on hybrids, charging partnerships, and affordable EVs—may finally put the company on a sustainable path.

Ford’s losses on electric cars were not due to a single failure, but a confluence of strategic overreach, supply chain fragility, and brand misalignment. Yet, these setbacks offer invaluable lessons. As the auto industry continues its electric transition, Ford’s experience underscores the importance of realistic timelines, software excellence, and customer-centric innovation. The road to profitability in EVs is steep, but with a more measured approach, Ford may yet turn its losses into a legacy of resilience and adaptation.

Frequently Asked Questions

Why is Ford losing money on electric cars?

Ford’s losses on electric cars stem from high production costs, supply chain disruptions, and slower-than-expected consumer adoption. The company has invested billions in EV development, but margins remain tight due to battery expenses and aggressive pricing competition.

What went wrong with Ford’s electric vehicle strategy?

Ford underestimated challenges like battery supply constraints and manufacturing complexities, leading to delays in key models like the F-150 Lightning. Additionally, rapid price cuts by rivals forced Ford to slash prices, further eroding profitability.

How much has Ford lost on electric cars so far?

Ford reported over $4.7 billion in losses from its EV division (Model e) in 2023 alone, with losses expected to continue into 2024. The company’s losses on electric cars are part of a broader industry struggle to balance scale and profitability.

Is Ford still committed to electric vehicles despite the losses?

Yes, Ford remains committed to EVs, aiming for 2 million annual EV production by 2026. However, it has slowed some investments to prioritize hybrid models and improve near-term financial performance.

How does Ford plan to reduce its electric car losses?

Ford is focusing on cost-cutting measures, including simplifying EV designs, localizing battery production, and leveraging partnerships like SK On for cheaper batteries. The company also plans to scale production to improve margins.

Are Ford’s electric car losses worse than other automakers?

While Ford’s losses on electric cars are significant, they mirror industry-wide challenges faced by GM and Volkswagen. However, Ford’s losses are more pronounced due to its aggressive early bets on high-volume models like the Mustang Mach-E.