Ford Motor Company Government Incentives for Electric Cars Explained

Featured image for ford motor company government incentives for electric cars

Image source: image.slidesharecdn.com

Ford Motor Company offers significant government-backed incentives to make its electric vehicles more affordable, including federal tax credits up to $7,500 and additional state-level rebates. These incentives, combined with Ford’s expanding EV lineup like the F-150 Lightning and Mustang Mach-E, are accelerating the shift to sustainable driving—helping buyers save money while reducing emissions.

Key Takeaways

- Maximize savings: Combine federal tax credits up to $7,500 with state rebates for greater discounts.

- Eligibility matters: Check income and vehicle price limits to qualify for federal incentives.

- Dealer incentives: Ford often offers additional discounts on EVs through special financing or cash rebates.

- State-specific perks: Some states provide extra benefits like HOV lane access or charging discounts.

- Act fast: Incentives phase out as Ford hits 200,000 EV sales—timing impacts savings.

📑 Table of Contents

- Ford Motor Company Government Incentives for Electric Cars Explained

- Federal Tax Credits for Ford Electric Vehicles

- State and Local Incentives for Ford EV Buyers

- Ford-Specific Programs and Dealer Incentives

- Commercial and Fleet Incentives for Ford EVs

- How to Maximize Your Savings: A Step-by-Step Guide

- Data Table: Ford EV Incentive Summary (2024)

- Conclusion

Ford Motor Company Government Incentives for Electric Cars Explained

The automotive industry is undergoing a revolutionary transformation, and at the forefront of this shift is Ford Motor Company, one of America’s most iconic automakers. With a bold commitment to electrification, Ford has launched an aggressive plan to transition from traditional internal combustion engines to a future powered by electricity. As part of this mission, Ford is not only investing billions in research, development, and manufacturing but is also strategically leveraging government incentives for electric cars to make its electric vehicles (EVs) more accessible and affordable for consumers across the United States.

For potential EV buyers, understanding the landscape of Ford Motor Company government incentives for electric cars is crucial. These incentives—ranging from federal tax credits to state-specific rebates, utility discounts, and local benefits—can significantly reduce the upfront cost of purchasing a new Ford EV. Whether you’re eyeing the popular Ford Mustang Mach-E, the rugged Ford F-150 Lightning, or the upcoming Ford E-Transit commercial van, knowing how to maximize these incentives can save you thousands of dollars. This comprehensive guide breaks down everything you need to know about the incentives available, how they work, eligibility requirements, and how Ford is uniquely positioned to help customers take full advantage of them.

Federal Tax Credits for Ford Electric Vehicles

Understanding the Federal EV Tax Credit (Section 25D)

The cornerstone of U.S. government support for electric vehicles is the federal EV tax credit, officially known as the Clean Vehicle Credit under Section 25D of the Internal Revenue Code. As of 2024, this credit offers up to $7,500 for qualifying new electric vehicles, including several Ford models. However, the eligibility and amount of the credit are not guaranteed for every Ford EV—they depend on a combination of factors, including battery component sourcing, final assembly location, and manufacturer sales volume.

Visual guide about ford motor company government incentives for electric cars

Image source: i.ytimg.com

For Ford, the eligibility of its EVs has evolved due to changes in the Inflation Reduction Act (IRA) of 2022, which restructured the tax credit to prioritize vehicles assembled in North America and those using batteries with critical minerals and components sourced from the U.S. or free-trade agreement partners. As of early 2024, the following Ford models qualify for the full $7,500 credit:

- Ford F-150 Lightning (certain trims)

- Ford Mustang Mach-E (specific configurations)

- Ford E-Transit (cargo van)

It’s important to note that not all trims or battery configurations qualify. For example, the Mach-E with a larger battery pack may qualify, while certain imported components or non-compliant battery packs might reduce or eliminate the credit. Ford provides a vehicle eligibility checker on its official website, allowing customers to verify credit eligibility based on VIN or trim level.

How to Claim the Federal Tax Credit

The federal tax credit is a non-refundable credit, meaning it can only be applied to your tax liability—it won’t result in a refund if your tax bill is less than the credit amount. For example, if you owe $5,000 in federal income taxes and qualify for a $7,500 credit, you’ll receive a $5,000 reduction and lose the remaining $2,500.

To claim the credit, you must:

- Be the original owner of the vehicle

- Purchase the vehicle for personal use (not resale)

- Have a tax liability in the year of purchase

- File IRS Form 8936 with your tax return

Tip: If you’re leasing a Ford EV, the leasing company (often Ford Credit) claims the tax credit and may pass on savings through lower monthly payments. Always ask your dealer how the credit is being applied in lease agreements.

Important Changes Under the Inflation Reduction Act

The IRA introduced new sourcing requirements that took effect in 2023 and 2024. Starting April 2023, vehicles must meet two of three criteria to qualify:

- Final assembly in North America

- At least 50% of battery components manufactured in North America

- At least 40% of critical minerals (e.g., lithium, cobalt) extracted or processed in the U.S. or a free-trade partner

Ford has been proactive in adapting to these rules. By investing in battery plants like BlueOval SK in Kentucky and Tennessee, and securing supply chains with U.S.-based mineral processors, Ford ensures its EVs remain compliant. However, customers should always verify the Manufacturer’s Certificate of Conformity (MCC) to confirm eligibility before purchase.

State and Local Incentives for Ford EV Buyers

State-Level EV Rebates and Tax Credits

Beyond the federal tax credit, many U.S. states offer their own electric vehicle incentives, which can be stacked on top of the federal benefit. These vary widely by state and can include:

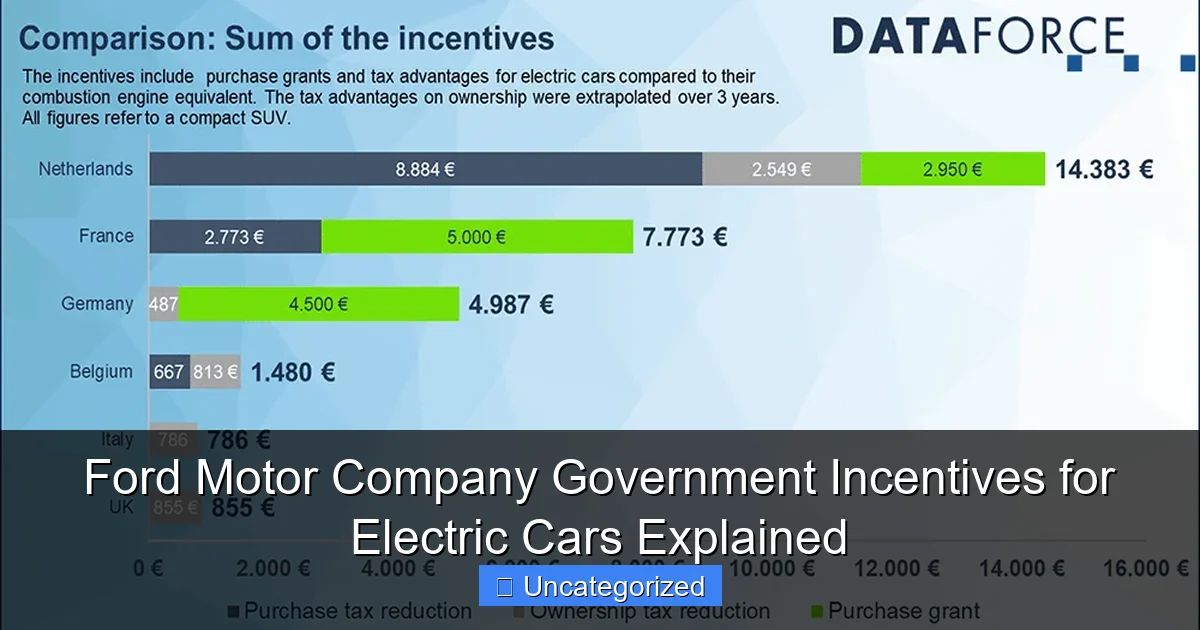

Visual guide about ford motor company government incentives for electric cars

Image source: dataforce.de

- Point-of-sale rebates (applied at the dealership)

- Sales tax exemptions or reductions

- Income-based rebates for low- to moderate-income buyers

- Additional tax credits beyond the federal amount

California leads the pack with its Clean Vehicle Rebate Project (CVRP), offering rebates of up to $7,500 for qualifying EVs, including Ford models. However, the program has a waitlist due to high demand, so early application is critical. Income caps apply: for example, individuals earning over $135,000 (or $200,000 for joint filers) are ineligible for the full rebate.

New York offers the Drive Clean Rebate, providing up to $2,000 at the point of sale for Ford EVs. The program is first-come, first-served and funded by the state’s utility surcharge on electricity bills.

Colorado provides a $5,000 state tax credit for EVs, which can be combined with the federal credit for a total of up to $12,500 in savings. The credit is non-refundable but can be carried forward for up to five years if not fully used.

Local Incentives: Municipal and County Programs

Some cities and counties go even further. For example:

- Denver, CO offers an additional $1,000 rebate for EV purchases, on top of state and federal incentives.

- Seattle, WA provides a free public charging membership for one year with the purchase of a new EV.

- Ann Arbor, MI offers reduced vehicle registration fees for electric vehicles.

Tip: Use the Database of State Incentives for Renewables & Efficiency (DSIRE) (dsireusa.org) to search for incentives by zip code. Ford also partners with local governments in key EV markets to promote awareness of these programs.

Utility Company Incentives

Many electric utilities offer rebates for EV purchases, home charger installations, or time-of-use (TOU) rate plans. For example:

- Pacific Gas & Electric (PG&E) offers a $500 rebate for purchasing a new EV and a $250 rebate for installing a Level 2 charger.

- Con Edison (NY) provides a $500 rebate for EV purchases and a $1,000 incentive for home charger installation.

- Duke Energy (NC/SC) offers a free Level 2 charger and $500 rebate for qualifying customers.

Ford works with utility partners to promote these programs and often includes utility rebate information in its dealer training materials.

Ford-Specific Programs and Dealer Incentives

Ford Credit and Leasing Benefits

Ford Credit, the automaker’s financing arm, offers special programs to make EVs more affordable. These include:

- Reduced APR financing (as low as 0.9% for qualified buyers)

- Lease specials with lower monthly payments (e.g., $299/month for the Mach-E)

- Bonus Cash programs (e.g., $1,000-$2,500 off select models)

- Military, First Responder, and College Graduate discounts

When leasing, Ford Credit often claims the federal tax credit and passes on the savings through lower lease payments. For example, a $7,500 tax credit might reduce a lease payment by $100–$150 per month over a 36-month term.

Ford BlueOval Charging Network and Home Charger Offers

Ford has partnered with Electrify America to provide free fast charging for new EV buyers. Purchasers of the F-150 Lightning or Mustang Mach-E receive 250 kWh of free charging at Electrify America stations for two years.

Additionally, Ford offers a home charging bundle that includes:

- A Ford Connected Charge Station (Level 2, 240V)

- Professional installation (up to $750 covered by Ford)

- Access to the BlueOval Charge Network (over 100,000 public chargers)

Tip: When purchasing, ask your dealer to include the home charger installation in the deal. Ford covers up to $750, but you may need to pay the difference if costs exceed that amount.

Trade-In and Loyalty Programs

Ford runs periodic EV trade-in bonuses, offering additional incentives for customers trading in a gas-powered vehicle. For example, in 2023, Ford offered a $2,000 trade-in bonus for customers switching from a Ford ICE vehicle to an EV.

Loyalty discounts are also common. If you’ve previously purchased a Ford, you may qualify for $500–$1,000 in additional savings on an EV.

Commercial and Fleet Incentives for Ford EVs

Federal and State Incentives for Businesses

Businesses and fleet operators purchasing Ford EVs—especially the E-Transit van or F-150 Lightning Pro—can access a broader range of incentives. The Alternative Fuel Infrastructure Tax Credit (Section 30C) offers up to $100,000 per site for installing EV charging stations.

Additionally, the Commercial Clean Vehicle Credit (Section 45W) provides up to $40,000 per qualifying commercial EV, with higher limits for heavier vehicles. The E-Transit, for example, qualifies for the full amount if used for business purposes.

States like California and New York also offer fleet rebates through programs like HVIP (Hybrid and Zero-Emission Truck and Bus Voucher Incentive Project), which can provide up to $40,000 per E-Transit van.

Ford Pro Incentive Programs

Ford’s Ford Pro division specializes in commercial EV solutions and offers tailored incentives, including:

- Fleet management software (free for one year)

- Charging infrastructure consulting (included with purchase)

- Bulk purchase discounts for fleets of 10+ vehicles

- Extended warranties for commercial use

Ford Pro also helps businesses navigate government incentives and apply for grants, such as the U.S. Department of Energy’s Clean Cities program.

Case Study: A Delivery Company’s Savings

Consider a small delivery company in California purchasing 10 Ford E-Transit vans:

- Federal Commercial Credit: $40,000 x 10 = $400,000

- HVIP Rebate: $40,000 x 10 = $400,000

- Section 30C Charging Credit: $100,000 (for installing 5 Level 2 chargers)

- Total Incentives: $900,000

This reduces the effective cost of the fleet by over 50%, making the switch to electric not just environmentally responsible but economically smart.

How to Maximize Your Savings: A Step-by-Step Guide

Step 1: Research Incentives in Your Area

Start by visiting DSIRE and entering your zip code. Look for:

- State rebates

- Local utility programs

- County or city incentives

Step 2: Verify Federal Tax Credit Eligibility

Use Ford’s online tool or ask your dealer to confirm whether your desired trim qualifies for the full $7,500 credit. Remember: the credit is based on the vehicle’s configuration at the time of sale, not the model year.

Step 3: Explore Financing and Leasing Options

Compare Ford Credit offers with third-party lenders. Leasing may be more advantageous if you want to pass the tax credit to the lessor and enjoy lower monthly payments.

Step 4: Bundle Home Charger Installation

Ask your dealer to include the Ford Connected Charge Station and installation in your purchase. Submit receipts to your utility for additional rebates.

Step 5: Apply for Rebates Promptly

Many state and utility rebates are first-come, first-served. Submit applications within days of purchase to avoid missing out.

Step 6: Keep Records

Save all documents: sales contract, MCC, rebate applications, charger installation invoices, and utility bills. These are essential for tax filing and future audits.

Pro Tip: Use Ford’s Incentive Calculator

Ford offers an online incentive estimator on its website. Enter your location, vehicle choice, and income to get a personalized estimate of total savings.

Data Table: Ford EV Incentive Summary (2024)

| Vehicle | Federal Credit | State Rebate (Example: CA) | Utility Rebate (Example: PG&E) | Ford Home Charger Coverage | Free Public Charging | Total Potential Savings |

|---|---|---|---|---|---|---|

| F-150 Lightning (Pro) | $7,500 | $7,500 | $500 | Up to $750 | 250 kWh (2 years) | $16,250+ |

| Mustang Mach-E (Premium) | $7,500 | $7,500 | $500 | Up to $750 | 250 kWh (2 years) | $16,250+ |

| E-Transit (Cargo Van) | $7,500 (personal) / $40,000 (commercial) | $40,000 (HVIP) | $500 | Up to $750 | 250 kWh (2 years) | $48,750+ (commercial) |

| Ford Escape Plug-in Hybrid | $0 (not eligible) | $1,500 (CA) | $250 | N/A | None | $1,750 |

Note: Total savings are estimates and vary by location, income, and eligibility. Always confirm with local authorities and Ford dealers.

Conclusion

The shift toward electric vehicles is no longer a niche trend—it’s a national priority, and Ford Motor Company is leading the charge with a robust lineup of EVs and a strategic approach to leveraging government incentives for electric cars. From the $7,500 federal tax credit to state rebates, utility discounts, and Ford-specific programs, the financial benefits of going electric with Ford are substantial and often underappreciated.

What sets Ford apart is its holistic approach: it doesn’t just sell EVs—it helps customers navigate the entire ecosystem of incentives, charging infrastructure, and financing. Whether you’re an individual buyer looking to save on a Mustang Mach-E or a business owner upgrading your fleet with E-Transit vans, Ford provides the tools, partnerships, and support to maximize your savings.

As government policies continue to evolve—especially with the IRA’s emphasis on domestic manufacturing and clean supply chains—Ford’s investments in U.S.-based battery plants and North American assembly ensure its EVs remain eligible for the most generous incentives. This forward-thinking strategy not only benefits consumers but also strengthens America’s clean energy future.

Ultimately, the message is clear: buying a Ford EV is not just a smart environmental choice—it’s a financially savvy one. By understanding and leveraging the full spectrum of available incentives, you can drive away in a cutting-edge electric vehicle while keeping thousands of dollars in your pocket. The road to electrification is paved with opportunity, and with Ford and government incentives on your side, the journey has never been more rewarding.

Frequently Asked Questions

What government incentives are available for Ford electric car buyers?

Buyers of eligible Ford electric vehicles (EVs), like the Mustang Mach-E and F-150 Lightning, may qualify for federal tax credits up to $7,500 under the Inflation Reduction Act. State and local incentives, such as rebates or HOV lane access, may also apply depending on your location.

How do Ford Motor Company government incentives work for leased EVs?

For leased Ford EVs, the leasing company typically claims the federal tax credit, but the savings are often passed to you through lower monthly payments. Confirm with your dealer or leasing provider to understand how Ford Motor Company government incentives are applied to your lease.

Can I combine Ford’s discounts with government incentives?

Yes, Ford’s manufacturer discounts (e.g., retail bonus cash) are usually stackable with federal, state, or local government incentives. However, some programs may have restrictions, so check with your dealer and tax advisor for full eligibility.

Are Ford electric car incentives available in all states?

Federal tax credits apply nationwide, but state-level Ford Motor Company government incentives vary. For example, California offers additional rebates through the Clean Vehicle Rebate Project (CVRP), while other states may provide tax exemptions or charging perks.

Do I need to buy a new Ford EV to get the tax credit?

Yes, federal incentives currently apply only to new, eligible Ford EVs purchased through authorized dealers. Used EVs have a separate tax credit program (up to $4,000), but it’s not tied directly to Ford’s new vehicle promotions.

How do I claim government incentives for a Ford electric car?

Federal tax credits are claimed when you file your annual tax return using IRS Form 8936. For state/local incentives, you may need to submit a separate application or provide proof of purchase—your Ford dealer can guide you through the process.