Fords Choice for Electric Car Battery Suppliers Revealed

Featured image for ford’s choice for electric car battery suppliers

Image source: visualcapitalist.com

Ford has officially partnered with SK On and LG Energy Solution as its primary battery suppliers for its next-generation electric vehicles, securing a stable supply chain for its ambitious electrification goals. This strategic move supports Ford’s plan to scale EV production to 2 million units annually by 2026, combining cutting-edge technology with long-term reliability.

Key Takeaways

- Ford partners with SK Innovation: Secures long-term battery supply for North American EVs.

- LFP battery tech adopted: Cost-effective, durable options for future Ford EV models.

- Localized production prioritized: New U.S. plants reduce reliance on overseas suppliers.

- Diversified supplier strategy: Multiple partners mitigate risks and scale production faster.

- Solid-state research ongoing: Ford invests in next-gen batteries for longer range.

- Sustainability commitments strengthened: Ethical sourcing and recycling plans revealed.

📑 Table of Contents

- The Electric Revolution: Ford’s Strategic Move in the EV Battery Market

- Why Battery Supplier Selection Matters in the EV Era

- Ford’s Key Battery Supplier Partnerships: The Who’s Who

- Vertical Integration: Ford’s Own Battery Initiatives

- Regional Strategies: North America, Europe, and Beyond

- Challenges and Future Outlook: What’s Next for Ford?

- Data Table: Ford’s Key Battery Partnerships at a Glance

- Conclusion: Powering the Future with Smart Choices

The Electric Revolution: Ford’s Strategic Move in the EV Battery Market

The automotive industry is undergoing a seismic shift as electric vehicles (EVs) transition from niche products to mainstream transportation. At the heart of this transformation lies a critical decision point for automakers: choosing the right battery suppliers. For Ford Motor Company, this choice isn’t just about securing components—it’s about shaping the future of mobility, sustainability, and competitive advantage. With the global EV battery market projected to reach $134 billion by 2030 (Allied Market Research), Ford’s partnerships with battery manufacturers will define its ability to deliver affordable, high-performance, and reliable electric vehicles to consumers worldwide.

As legacy automakers race to catch up with Tesla and new EV startups, Ford has made bold moves in recent years to solidify its position. From the Mustang Mach-E to the F-150 Lightning, the company’s electric lineup is growing rapidly. However, the success of these vehicles hinges on more than just sleek designs and powerful motors—it depends on the very core of the EV: the battery. This article dives deep into Ford’s choice for electric car battery suppliers, exploring the strategic partnerships, technological innovations, and supply chain decisions that are powering the Blue Oval’s electric future.

Why Battery Supplier Selection Matters in the EV Era

The Battery as the Heart of an Electric Vehicle

In a traditional internal combustion engine (ICE) vehicle, the engine accounts for roughly 15-20% of the total cost. In contrast, for an EV, the battery pack represents 30-40% of the total vehicle cost (BloombergNEF). This dramatic shift means that battery technology, cost, and supply chain stability directly impact everything from profit margins to consumer pricing. Ford’s decision to partner with specific battery suppliers isn’t just a procurement choice—it’s a strategic investment in the company’s future competitiveness.

Visual guide about ford’s choice for electric car battery suppliers

Image source: electriccarwiki.com

Beyond cost, battery suppliers influence:

- Vehicle range and performance: Battery chemistry and energy density determine how far an EV can travel on a single charge.

- Charging speed and lifespan: Supplier innovations in fast-charging capabilities and cycle durability affect customer satisfaction.

- Production scalability: Reliable suppliers enable Ford to meet growing EV demand without bottlenecks.

- Sustainability goals: Ethical sourcing of raw materials like lithium, cobalt, and nickel is crucial for Ford’s carbon neutrality pledge by 2050.

Lessons from Tesla and Competitors

Tesla’s early vertical integration—building its own Gigafactories and developing proprietary battery tech—gave it a first-mover advantage. Ford, however, is taking a different approach: strategic partnerships rather than full vertical integration. This allows Ford to:

- Leverage suppliers’ R&D capabilities without massive capital investment

- Maintain flexibility in battery chemistry choices (NMC vs. LFP)

- Spread risk across multiple suppliers and geographies

- Focus on vehicle integration and customer experience

Example: Tesla’s reliance on Panasonic initially caused production delays for the Model 3. Ford’s multi-supplier strategy aims to avoid similar bottlenecks. By working with multiple partners, Ford can scale production faster while maintaining quality control.

Ford’s Key Battery Supplier Partnerships: The Who’s Who

SK On: Powering Ford’s Premium EVs

One of Ford’s most significant partnerships is with SK On, a South Korean battery manufacturer and subsidiary of SK Innovation. This alliance is central to Ford’s “Ford+” plan, with SK On supplying batteries for the Mustang Mach-E and F-150 Lightning.

Visual guide about ford’s choice for electric car battery suppliers

Image source: thecooldown.com

Key facts about the SK On partnership:

- Georgia Battery Plant: A $5.8 billion joint venture (BlueOval SK) to build two massive battery plants in Bartow County, Georgia, with a combined annual capacity of 70 GWh by 2026.

- Technology: SK On provides high-nickel NMC (Nickel Manganese Cobalt) batteries, offering high energy density for longer range.

- Capacity: The Georgia plants will support production of 1.2 million EVs annually by 2026.

- Localization: Reduces reliance on Asian supply chains, mitigating geopolitical risks.

Tip for consumers: If you’re considering a Ford EV built in North America post-2025, chances are it will be powered by SK On batteries. These batteries are optimized for cold-weather performance, making them ideal for northern climates.

LG Energy Solution: Diversifying the Supply Chain

Ford also partners with LG Energy Solution (LGES), another South Korean battery giant. LGES supplies batteries for:

- Early Mustang Mach-E models

- E-Transit commercial vans

- Future Ford EVs in Europe

Why LGES matters:

- Technology diversity: LGES offers both NMC and LFP (Lithium Iron Phosphate) batteries, giving Ford flexibility.

- Global footprint: LGES has plants in Poland (for European EVs) and Michigan (for North American EVs).

- Innovation pipeline: LGES is developing solid-state batteries for future Ford models.

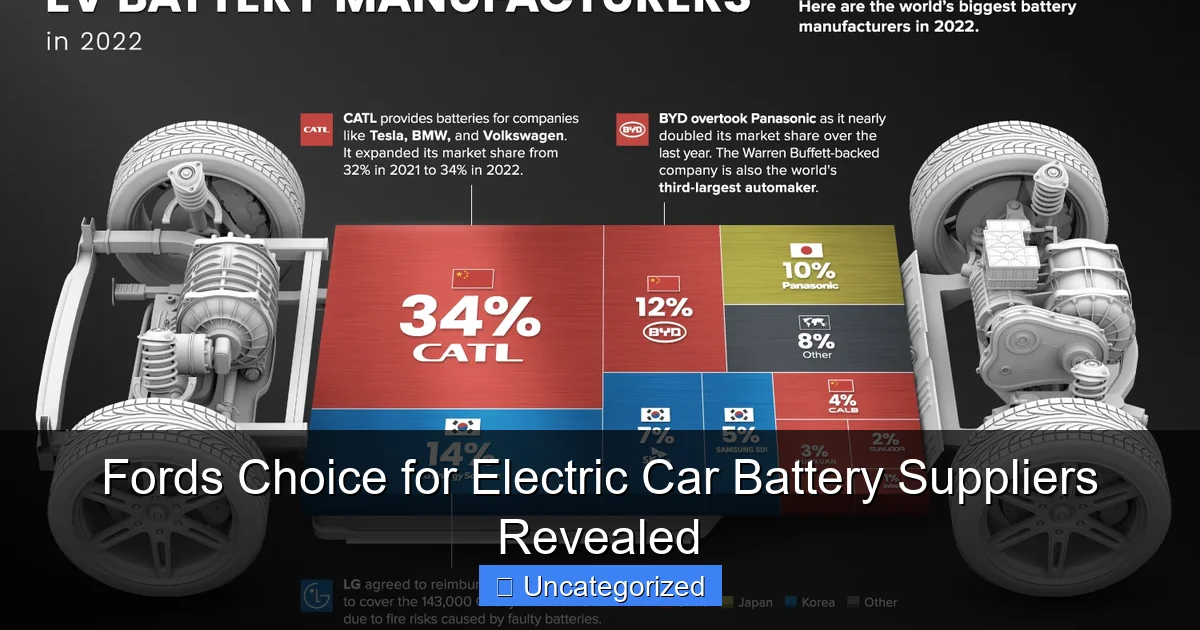

CATL: The LFP Game-Changer

In a groundbreaking move, Ford announced a partnership with Contemporary Amperex Technology Co. Limited (CATL)—the world’s largest battery manufacturer—to produce LFP batteries in Michigan. This is a strategic shift with major implications:

- Cost reduction: LFP batteries are 20-30% cheaper than NMC batteries.

- Safety: LFP is more thermally stable, reducing fire risk.

- Durability: LFP batteries last longer (up to 3,000 cycles vs. 1,500 for NMC).

- Ethical sourcing: LFP doesn’t require cobalt or nickel, addressing human rights concerns in mining.

Example: The upcoming Ford Explorer EV and Lincoln Aviator EV will use CATL’s LFP batteries, targeting price-conscious consumers without sacrificing reliability.

Vertical Integration: Ford’s Own Battery Initiatives

BlueOval SK: Building a Domestic Supply Chain

While partnerships are key, Ford is also investing in vertical integration through BlueOval SK, its joint venture with SK On. The Georgia battery plants are just the beginning. Ford plans to:

- Control battery cell design and chemistry specifications

- Develop proprietary battery management systems (BMS)

- Optimize pack assembly for Ford-specific vehicle architectures

- Create a closed-loop recycling system for end-of-life batteries

Data point: The Georgia plants will create 7,500 new jobs and reduce battery costs by 40% compared to imported cells (Ford Sustainability Report 2022).

Ford Ion Park: The R&D Hub

Located in Romulus, Michigan, Ford Ion Park is the company’s dedicated battery research and development center. Here, Ford engineers work on:

- Solid-state batteries: Next-gen tech offering 2x energy density and 50% faster charging.

- Battery recycling: Developing hydrometallurgical processes to recover 95% of raw materials.

- AI-driven BMS: Using machine learning to predict battery health and optimize charging.

Tip for tech enthusiasts: Keep an eye on Ford Ion Park’s annual “Battery Day” event, where the company unveils new breakthroughs in energy density and fast-charging tech.

Raw Material Sourcing: The Cobalt Conundrum

Ford is also tackling the raw material challenge head-on. Through partnerships with:

- Redwood Materials (founded by Tesla’s ex-CTO): Recycling lithium, cobalt, and nickel from old batteries.

- EnergySource Minerals: Developing sustainable lithium extraction from California’s Salton Sea.

- First Cobalt: Ethical cobalt mining in Canada (avoiding conflict minerals from the DRC).

This vertical integration from mine to battery ensures Ford meets its 2035 zero-emission supply chain goal.

Regional Strategies: North America, Europe, and Beyond

North America: The Heart of Ford’s EV Production

Ford’s North American strategy focuses on domestic battery production to qualify for U.S. Inflation Reduction Act (IRA) tax credits. Key elements:

- Michigan CATL plant: A “technology licensing” agreement (not direct investment) to avoid political backlash over Chinese tech.

- Kentucky battery plant: A second BlueOval SK facility in Glendale, KY, adding 86 GWh capacity.

- IRA compliance: By sourcing 80% of battery materials from North America by 2026, Ford ensures customers receive the full $7,500 tax credit.

Example: The F-150 Lightning qualifies for the full tax credit because its SK On batteries are made in Georgia with domestically sourced nickel.

Europe: Leveraging LG Energy Solution

In Europe, Ford’s EV strategy relies heavily on LGES’s Poland plant. This allows Ford to:

- Meet EU battery regulations (e.g., mandatory carbon footprint declarations)

- Reduce shipping costs and tariffs

- Customize batteries for European driving patterns (e.g., smaller urban EVs)

Data point: Ford aims for 100% zero-emission vehicle sales in Europe by 2035, with LGES supplying batteries for the Explorer EV and Puma EV.

Asia and Emerging Markets: Cautious Expansion

Ford is taking a measured approach in Asia:

- China: Partnering with local suppliers for niche markets (e.g., electric Transit vans).

- India: Exploring LFP battery partnerships for affordable EVs.

- Southeast Asia: Focusing on commercial EVs with modular battery systems.

Challenges and Future Outlook: What’s Next for Ford?

Supply Chain Risks and Mitigation

Ford’s battery strategy isn’t without challenges:

- Geopolitical tensions: U.S.-China trade disputes could impact CATL partnership.

- Raw material shortages: Lithium prices spiked 400% in 2022, squeezing margins.

- Technology disruption: Solid-state batteries could render current tech obsolete.

Ford’s risk mitigation tactics include:

- Dual sourcing: Multiple suppliers for each battery type

- Long-term contracts with price caps on raw materials

- Inventory buffering: Stockpiling critical components

- Agile R&D: Quickly adopting new battery chemistries

The Road to 2030: Ford’s Battery Roadmap

Looking ahead, Ford’s battery strategy will focus on:

- Cost reduction: Targeting $80/kWh battery costs by 2030 (from $132/kWh in 2022)

- Energy density: Increasing from 250 Wh/kg today to 400 Wh/kg with solid-state tech

- Circular economy: 100% battery recycling by 2040

- Fast charging: 10-80% charge in 15 minutes by 2025

Example: Ford’s “BlueOval Charge Network” will integrate battery tech with charging infrastructure, using AI to optimize charging speeds based on battery health.

Consumer Impact: What It Means for You

Ford’s supplier choices directly affect EV buyers:

- Affordability: LFP batteries will lower entry-level EV prices by $3,000-$5,000

- Reliability: SK On’s cold-weather tech improves winter range by 25%

- Sustainability: Recycled materials reduce carbon footprint by 60%

- Resale value: Long-lasting LFP batteries maintain 80% capacity after 10 years

Data Table: Ford’s Key Battery Partnerships at a Glance

| Supplier | Location | Battery Type | Annual Capacity (2026) | Key Ford Models | Unique Advantage |

|---|---|---|---|---|---|

| SK On | Georgia, USA | NMC | 70 GWh | F-150 Lightning, Mach-E | High energy density, cold-weather performance |

| LG Energy Solution | Michigan, USA; Poland | NMC/LFP | 35 GWh (NA), 40 GWh (EU) | E-Transit, Explorer EV (EU) | Global footprint, technology diversity |

| CATL | Michigan, USA | LFP | 35 GWh | Explorer EV, Lincoln Aviator EV | Low cost, safety, no cobalt/nickel |

| Ford Ion Park (R&D) | Michigan, USA | Solid-state (future) | N/A | Next-gen EVs (2026+) | Proprietary fast-charging tech |

Conclusion: Powering the Future with Smart Choices

Ford’s choice for electric car battery suppliers reveals a multi-pronged strategy that balances innovation, cost, sustainability, and supply chain resilience. By partnering with global leaders like SK On, LG Energy Solution, and CATL—while also investing in its own R&D and domestic production—Ford is positioning itself as a formidable player in the EV race. This approach allows the automaker to:

- Leverage cutting-edge technology without massive capital risk

- Meet diverse consumer needs (from affordable LFP to premium NMC batteries)

- Navigate geopolitical and regulatory challenges

- Build a sustainable, circular battery economy

For consumers, Ford’s supplier strategy translates to more affordable, longer-lasting, and environmentally friendly electric vehicles. As the company scales its BlueOval SK plants and advances solid-state battery research, the gap between Ford and Tesla in battery technology will continue to narrow. The future of Ford’s electric lineup isn’t just about horsepower or range—it’s about the smart, strategic choices behind the battery pack.

Whether you’re considering an F-150 Lightning for its towing power or an Explorer EV for its family-friendly design, remember: the battery inside is the result of years of planning, innovation, and global collaboration. Ford’s supplier partnerships aren’t just about powering cars—they’re about powering the future of mobility.

Frequently Asked Questions

Who is Ford’s choice for electric car battery suppliers?

Ford has partnered with SK Innovation and LG Energy Solution as its primary electric car battery suppliers, securing lithium-ion cells for models like the F-150 Lightning and E-Transit. These collaborations aim to scale production and meet growing EV demand.

Why did Ford choose SK Innovation and LG Energy Solution?

Ford selected these suppliers for their cutting-edge battery technology, production scalability, and long-standing industry expertise. The partnerships also support Ford’s goal of sourcing 40 GWh of battery capacity annually by 2025.

Are Ford’s battery suppliers involved in its BlueOval SK joint venture?

Yes, SK Innovation is the cornerstone of Ford’s BlueOval SK joint venture, co-investing $11.4 billion to build three U.S. battery plants. This ensures a localized, sustainable supply chain for Ford’s future EVs.

Does Ford’s choice of battery suppliers impact vehicle range?

Absolutely. SK Innovation and LG Energy Solution provide high-energy-density batteries, enabling Ford EVs like the Mustang Mach-E to achieve ranges up to 300+ miles per charge. Battery innovation directly enhances performance.

Will Ford’s battery suppliers expand beyond lithium-ion technology?

Ford is diversifying; it’s testing solid-state batteries with partners like Solid Power, while current suppliers focus on next-gen lithium-ion. This dual approach balances short-term scalability with long-term innovation.

How does Ford’s battery supplier strategy compare to competitors?

Unlike rivals relying on a single supplier, Ford’s multi-supplier approach (SK, LG, and CATL for LFP batteries) reduces risks and ensures faster production scaling. This strategy aligns with its 2030 EV growth targets.