Ford Stopping Electric Cars What You Need to Know

Featured image for ford stopping electric cars

Image source: shutterstock.com

Ford is not stopping electric cars, but rather shifting focus to prioritize more affordable and practical EV models in response to changing market demand. The automaker is delaying or canceling some high-end electric vehicles to invest in next-generation, cost-efficient platforms and expand hybrid offerings. This strategic pivot aims to balance long-term EV growth with near-term profitability and consumer affordability.

Key Takeaways

- Ford pauses EV production to reassess strategy amid slowing demand.

- Existing models unaffected—current EVs remain on sale and supported.

- Focus shifts to hybrids as Ford balances short-term market realities.

- New EVs delayed—future launches may shift to later dates.

- Investments continue in battery tech and EV infrastructure long-term.

- Monitor updates closely—policy changes could revive paused projects.

📑 Table of Contents

- The Electric Crossroads: Why Ford Is Reevaluating Its EV Strategy

- Why Ford Is Slowing Down Its Electric Car Plans

- Ford’s New Strategy: Hybrids and “Flexible” Electrification

- What Ford’s Pivot Means for Buyers

- Ford’s Long-Term EV Vision: What’s Still Coming?

- How Ford Compares to Other Automakers in the EV Race

- Conclusion: Ford’s Electric Future Is Evolving, Not Ending

The Electric Crossroads: Why Ford Is Reevaluating Its EV Strategy

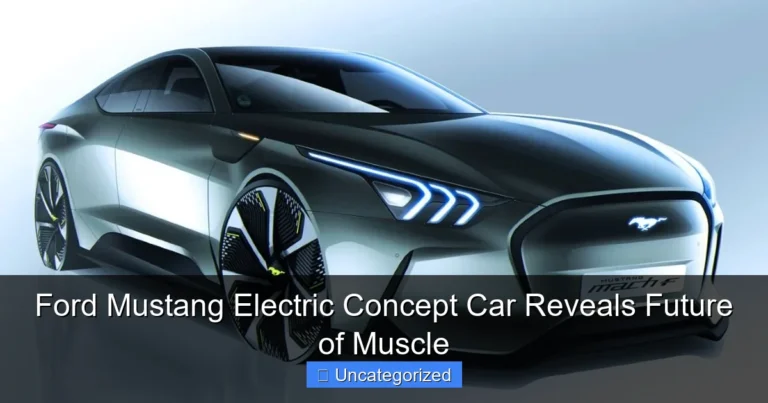

In the past decade, the automotive industry has witnessed a seismic shift toward electrification. Automakers worldwide have pledged billions to transition from internal combustion engines (ICE) to battery-electric vehicles (BEVs), with Ford among the most vocal advocates. The company’s “Ford+” growth plan promised an electric future, including the launch of the Mustang Mach-E, F-150 Lightning, and a $50 billion investment in EVs by 2026. But in late 2023, a surprising pivot emerged: Ford began scaling back its electric car ambitions. This decision sent shockwaves through the industry, leaving consumers, investors, and environmental advocates wondering: What’s really happening?

The reality is more nuanced than a simple retreat. Ford isn’t abandoning electric vehicles (EVs) entirely. Instead, the company is recalibrating its strategy to address market realities, supply chain challenges, and consumer demand. From delaying production timelines to shifting focus toward hybrid technology, Ford’s moves reflect a broader industry trend where automakers are balancing idealism with pragmatism. This blog post dives into the reasons behind Ford’s strategic shift, what it means for buyers, and how the company plans to navigate the evolving EV landscape.

Why Ford Is Slowing Down Its Electric Car Plans

Ford’s decision to pause or delay certain EV projects isn’t a sudden whim—it’s the result of a complex interplay of economic, logistical, and consumer-driven factors. Below are the key reasons behind the company’s strategic pivot.

Visual guide about ford stopping electric cars

Image source: images.jazelc.com

1. Softer-Than-Expected EV Demand

While early adopters embraced Ford’s electric offerings, mainstream buyers have been slower to transition. According to a 2023 J.D. Power report, EV adoption in the U.S. plateaued at 8.6% of total vehicle sales, below projections. Ford’s own data shows the F-150 Lightning and Mustang Mach-E are popular but face stiff competition from Tesla, Hyundai, and legacy automakers. For example:

- The Mach-E’s 2023 U.S. sales (40,771 units) lagged behind the Tesla Model Y (252,000 units).

- F-150 Lightning production was cut by 50% in early 2024 due to inventory buildup.

Tip: If you’re considering an EV, Ford’s slower rollout might mean better deals on existing models as dealers clear inventory.

2. Supply Chain and Battery Cost Challenges

The EV supply chain is fraught with volatility. Ford faced:

- Battery material shortages: Lithium, nickel, and cobalt prices spiked in 2022–2023, raising production costs.

- Manufacturing bottlenecks: The Rouge Electric Vehicle Center in Michigan struggled with quality control, delaying F-150 Lightning deliveries.

Ford CEO Jim Farley admitted in a 2023 earnings call: “We’re not immune to the headwinds facing the entire EV industry.” The company now plans to diversify battery suppliers and invest in solid-state technology to reduce dependency on volatile materials.

3. Profitability Pressures

EVs are notoriously expensive to produce. Ford’s EV division reported a $4.7 billion pre-tax loss in 2023, compared to a $7.2 billion profit from ICE vehicles. The company’s CFO, John Lawler, stated: “We can’t scale EVs at the pace we wanted without sacrificing profitability.” To address this, Ford is:

- Delaying the launch of its next-generation electric pickup (codenamed “Project T3”) from 2025 to 2026.

- Focusing on profit-first models like the E-Transit van, which targets commercial fleets with higher margins.

Ford’s New Strategy: Hybrids and “Flexible” Electrification

Rather than a full-scale retreat, Ford is adopting a “hybrid-first” approach to bridge the gap between ICE and BEV dominance. This strategy acknowledges that many consumers aren’t ready for full electrification but still want eco-friendly options.

Visual guide about ford stopping electric cars

Image source: electrive.com

1. Expanding Hybrid Lineup

Ford plans to launch four new hybrid models by 2026, including:

- A hybrid version of the next-gen Ford Explorer (2025).

- Hybrid variants of the F-150 and Escape.

Why hybrids? They offer:

- Lower upfront costs (~$5,000–$10,000 cheaper than BEVs).

- No range anxiety: Ideal for rural or cold-climate buyers.

- Faster adoption: J.D. Power predicts hybrids will outsell BEVs in the U.S. through 2030.

Example: The 2024 Ford Maverick Hybrid starts at $25,000, making it one of the most affordable electrified trucks on the market.

2. “Flexible” EV Platforms

Ford’s new “Flexible Electric Vehicle Architecture” (FEVA) will allow the same platform to support BEVs, hybrids, and ICE vehicles. This reduces R&D costs and lets Ford respond to market shifts. Key benefits:

- Cost savings: Shared components cut production expenses by ~20%.

- Faster iteration: Models can be updated without retooling factories.

Tip: Buyers should watch for “FEVA-compatible” badges on future Ford vehicles—they signal adaptability and long-term value.

3. Commercial and Fleet Focus

Ford is doubling down on commercial EVs, where demand is more predictable. The E-Transit van (launched 2022) already dominates the electric cargo van market with 7,500+ units sold in 2023. The company also partners with Amazon and Walmart for last-mile delivery fleets.

What Ford’s Pivot Means for Buyers

Ford’s strategic shift has direct implications for consumers, from pricing to availability. Here’s what you need to know before making a purchase.

1. Current EV Inventory and Deals

With slower production, Ford dealers are sitting on 60+ days of EV inventory (vs. 30 days for ICE vehicles). This means:

- Discounts and incentives: Expect $5,000–$10,000 off Mach-E and Lightning models.

- Lease specials: Ford Credit is offering 0% APR financing on select EVs.

Example: In Q1 2024, Ford advertised a $7,500 lease incentive for the Mach-E GT.

2. Delayed Next-Gen EVs

Ford’s 2025–2026 EV lineup will be smaller than initially promised. Key delays:

- Project T3 pickup: Pushed to 2026 (originally 2025).

- Affordable $25,000 EV: Now slated for 2027 (was 2026).

Tip: If you’re waiting for a budget EV, consider the Chevrolet Equinox EV or Hyundai Kona Electric as alternatives.

3. Hybrid Alternatives

Ford’s hybrid expansion offers a practical middle ground. For example:

- The F-150 Hybrid gets 24 MPG combined (vs. 22 MPG for the gas model).

- Hybrid models qualify for partial federal tax credits (up to $4,000).

Data point: Hybrids cost ~15% less to maintain than BEVs over 5 years (Consumer Reports, 2023).

Ford’s Long-Term EV Vision: What’s Still Coming?

Despite the slowdown, Ford remains committed to electrification. The company’s long-term goals include:

- 90% of U.S. lineup electrified by 2030 (including hybrids).

- Carbon neutrality by 2050 (with interim targets).

1. Next-Generation EVs (2026 and Beyond)

Ford’s delayed but still-planned EVs include:

- Project T3 pickup: A modular, software-defined truck with 300+ miles of range.

- Affordable EV: A $25,000–$30,000 car using LFP (lithium-iron-phosphate) batteries.

- Electric Explorer: A Europe-focused crossover (U.S. debut TBD).

Tip: Follow Ford’s “EV Day” announcements (typically in Q4) for updates on these models.

2. Battery Breakthroughs

Ford’s partnership with SK On and LG Energy Solution aims to:

- Reduce battery costs by 40% by 2026.

- Launch solid-state batteries by 2030 (potentially doubling range).

Example: The 2025 Ford E-Transit will use a new 120 kWh battery, extending range to 180 miles.

3. Software and Charging Infrastructure

Ford is investing in:

- BlueOval Charge Network: 10,000+ fast chargers by 2025 (partnering with Electrify America).

- Ford Pro Telematics: Fleet management tools for commercial EVs.

How Ford Compares to Other Automakers in the EV Race

Ford’s pivot isn’t unique. Most automakers are reevaluating EV plans amid market shifts. Here’s how Ford stacks up:

1. Industry Trends

- GM: Delayed Chevy Silverado EV production; focusing on Ultium platform.

- VW: Cut ID.4 production in the U.S.; shifting focus to Europe.

- Honda: Paused U.S. EV plans; investing in fuel-cell technology.

Data point: Only Tesla, BYD, and Hyundai maintained aggressive EV growth in 2023 (Cox Automotive).

2. Ford’s Competitive Edge

Ford’s strengths in this new landscape include:

- Truck dominance: The F-Series outsells all EVs combined.

- Hybrid expertise: Ford has sold 1.5 million hybrids since 2004.

- Commercial focus: E-Transit and E-Transit Custom lead their segments.

3. Data Table: Ford’s Electrified Vehicle Lineup (2024)

| Model | Type | 2024 U.S. Sales (Projected) | Price Range | Range (EPA) |

|---|---|---|---|---|

| F-150 Lightning | BEV | 20,000 | $50,000–$90,000 | 230–320 miles |

| Mustang Mach-E | BEV | 45,000 | $42,000–$60,000 | 224–314 miles |

| E-Transit | BEV | 10,000 | $50,000–$70,000 | 159 miles |

| F-150 Hybrid | Hybrid | 100,000 | $35,000–$80,000 | 700 miles (combined) |

| Maverick Hybrid | Hybrid | 50,000 | $25,000–$35,000 | 500 miles (combined) |

Conclusion: Ford’s Electric Future Is Evolving, Not Ending

Ford’s decision to slow its electric car rollout isn’t a surrender—it’s a recalibration. The company is responding to real-world challenges with a pragmatic, hybrid-friendly strategy that prioritizes profitability, consumer demand, and long-term sustainability. For buyers, this means:

- Better deals on existing EVs.

- More hybrid choices for those not ready to go fully electric.

- Future-proof platforms like FEVA, ensuring flexibility.

The EV revolution isn’t over; it’s just entering a more nuanced phase. Ford’s pivot highlights a critical truth: The path to electrification will be messy, with automakers balancing innovation, cost, and consumer readiness. As Jim Farley stated: “We’re not slowing down—we’re speeding up in the right direction.” Whether you’re an EV enthusiast, a hybrid pragmatist, or an ICE loyalist, Ford’s evolving strategy ensures there’s a place for you in the company’s electrified future. Keep an eye on 2025–2027 for the next chapter in Ford’s electric story—one that’s shaping up to be more resilient, adaptable, and customer-focused than ever before.

Frequently Asked Questions

Why is Ford stopping electric car production?

Ford is pausing certain electric vehicle (EV) programs to reassess its strategy, focusing on profitability and adapting to slower-than-expected EV market growth. This includes delaying new models and shifting resources toward hybrid and next-gen EV technologies.

Which Ford electric cars are being discontinued?

While specific models haven’t been officially retired yet, Ford is halting production of the Ford Mustang Mach-E and Ford F-150 Lightning at select plants to adjust output. Future EVs like the “Project T3” truck remain in development.

Is Ford abandoning electric cars entirely?

No, Ford isn’t quitting EVs. The company is slowing its rollout to prioritize hybrid vehicles and improve battery tech, aiming to launch more affordable, efficient electric cars by 2025-2026.

How does Ford stopping electric cars affect buyers?

Current EV owners won’t be impacted, as warranties and service remain intact. However, potential buyers may see fewer new Ford electric cars in showrooms until the revised lineup launches.

What’s the reason behind Ford’s electric vehicle delays?

Ford cites high battery costs, supply chain hurdles, and softening consumer demand for EVs as key reasons. The shift allows them to focus on hybrids, which are more profitable in the short term.

Will Ford resume electric car production soon?

Yes, Ford plans to restart EV production with next-gen models by mid-2025, emphasizing lower-cost platforms and faster charging. The pause is strategic, not permanent.