Ford to Invest in Electric Cars A Game Changer for the Auto Industry

Featured image for ford to invest in electric cars

Image source: energi.media

Ford is making a massive $50 billion global investment in electric vehicles (EVs) through 2026, signaling a bold shift toward an all-electric future and intensifying competition with Tesla and other EV leaders. This strategic move includes building new EV manufacturing plants and securing battery supply chains, positioning Ford as a major player in the rapidly evolving auto industry. The commitment marks a turning point not just for Ford, but for the entire automotive landscape.

Key Takeaways

- Ford accelerates EV shift: Major investment signals long-term commitment to electric vehicles.

- New models incoming: Expect expanded EV lineup by 2025 with competitive pricing.

- Battery tech focus: Partnerships aim to cut costs and boost range efficiency.

- Job creation ahead: U.S. plants to add thousands of EV-related jobs.

- Charging network growth: Ford to expand access via partnerships with charging providers.

- Legacy automakers adapt: Ford’s move pressures rivals to speed up EV plans.

📑 Table of Contents

- The Future of Driving is Electric: Ford’s Bold Move

- Ford’s Electrification Strategy: More Than Just New Models

- Why Ford’s Investment Matters for the Auto Industry

- The Environmental and Economic Impact of Ford’s EV Shift

- Challenges and Criticisms: What Ford Must Overcome

- What Consumers and Investors Should Know

- Conclusion: A New Era for Ford and the Auto Industry

- Data Table: Ford’s Key EV Projects and Investments

The Future of Driving is Electric: Ford’s Bold Move

In a world increasingly defined by climate change, technological innovation, and shifting consumer expectations, the automotive industry stands at a pivotal crossroads. For over a century, internal combustion engines (ICE) have dominated our roads, but the winds of change are blowing stronger than ever. Enter Ford to invest in electric cars—a strategic pivot that signals not just a new chapter for one of America’s most iconic automakers, but a seismic shift across the entire transportation landscape. With rising global emissions regulations, plummeting battery costs, and a surge in consumer demand for sustainable mobility, Ford’s commitment to electrification isn’t just timely—it’s transformative.

The Blue Oval has long been synonymous with rugged trucks, muscle cars, and American industrial might. From the Model T to the F-150, Ford has shaped the way people move. Now, the company is redefining its legacy by placing a multi-billion-dollar bet on electric vehicles (EVs). This isn’t a half-hearted attempt to keep up with Tesla or a greenwashing PR stunt. It’s a full-scale transformation: retooling factories, launching new EV platforms, and investing heavily in battery technology and charging infrastructure. As Ford to invest in electric cars becomes the new reality, the implications stretch far beyond Ford’s balance sheet. They touch every aspect of the auto industry—from supply chains and job markets to urban planning and environmental policy.

Ford’s Electrification Strategy: More Than Just New Models

Ford’s shift toward electric mobility isn’t about slapping batteries onto existing models. It’s a holistic, long-term strategy built on three pillars: product innovation, manufacturing transformation, and infrastructure development. The company’s goal is clear: to become a leader in the global EV market by 2030, with electric vehicles making up at least 40% of its global sales—and potentially 100% in key markets like Europe.

Visual guide about ford to invest in electric cars

Image source: marketbeat.com

Product Innovation: From F-150 Lightning to E-Transit

Ford’s EV lineup is already gaining traction. The F-150 Lightning, an all-electric version of America’s best-selling vehicle, has shattered expectations. With over 200,000 reservations in its first year, the Lightning proves that electric power isn’t just for eco-conscious city dwellers—it’s for hardworking Americans who need torque, towing capacity, and durability. The vehicle delivers up to 320 miles of range, 580 horsepower, and can power homes during outages using Ford’s Intelligent Backup Power feature.

But Ford isn’t stopping at pickup trucks. The E-Transit van is revolutionizing commercial fleets. With a 126-mile range and 30-minute fast charging, it’s ideal for delivery services, tradespeople, and municipal fleets. Companies like Amazon have already ordered thousands of units, signaling strong B2B demand. Additionally, the Mustang Mach-E, Ford’s first global EV, has won multiple awards for its blend of performance, tech, and style, appealing to SUV buyers who want both sustainability and excitement.

Tip for consumers: When considering an EV, evaluate not just range and price, but also real-world utility. The F-150 Lightning, for example, doubles as a mobile power station—ideal for camping, emergencies, or job sites.

Manufacturing Transformation: The BlueOval City and SK Innovation Partnership

To support its EV ambitions, Ford is investing $50 billion globally through 2026, with a significant portion going toward manufacturing upgrades. One of the most ambitious projects is BlueOval City in Stanton, Tennessee—a $5.6 billion, 3,600-acre mega-campus set to open in 2025. This facility will produce next-gen electric trucks and batteries, creating over 6,000 new jobs.

Ford has also partnered with South Korean battery giant SK Innovation to form BlueOvel SK, a joint venture building three battery plants in the U.S.—two in Kentucky and one in Tennessee. These plants will have a combined annual capacity of 129 gigawatt-hours (GWh), enough to power over 1.2 million EVs per year. This vertical integration reduces dependency on foreign suppliers and strengthens supply chain resilience.

Example: The Kentucky Battery Park, once operational, will be the largest battery manufacturing complex in the Western Hemisphere, showcasing Ford’s commitment to domestic production and American jobs.

Infrastructure Development: Charging and Grid Integration

EV adoption isn’t just about cars—it’s about charging infrastructure. Ford is addressing this with FordPass Power, a network of over 84,000 public charging stations across North America, including partnerships with Electrify America, ChargePoint, and EVgo. The company’s vehicles come with FordPass Rewards, offering free charging for up to two years on select models.

Additionally, Ford is pioneering vehicle-to-grid (V2G) technology. The F-150 Lightning can feed electricity back into the grid during peak demand, helping stabilize the power system. Ford is piloting this with utilities in California and Texas, positioning EVs as mobile energy assets rather than just consumers.

Why Ford’s Investment Matters for the Auto Industry

When Ford to invest in electric cars, it’s not just a corporate decision—it’s a market signal that electrification is no longer optional. Ford’s scale and influence mean its moves have ripple effects across the entire industry. Competitors, suppliers, and policymakers are all watching closely.

Visual guide about ford to invest in electric cars

Image source: static01.nyt.com

Pressure on Legacy Automakers

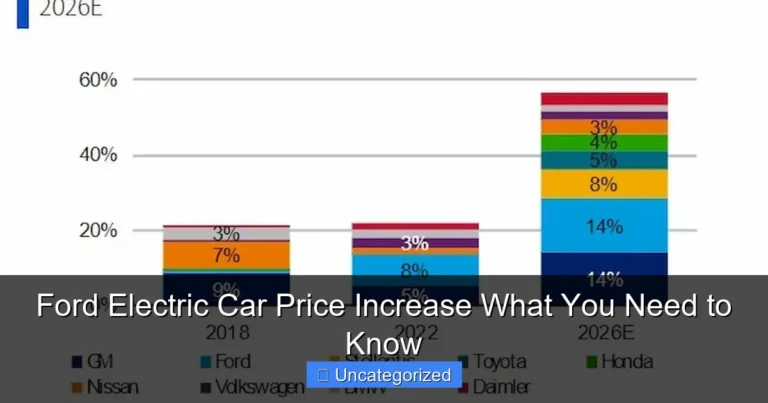

Ford’s aggressive EV push is forcing rivals to accelerate their own plans. General Motors has committed to an all-electric future by 2035, while Stellantis (parent of Jeep, Ram, and Dodge) plans to offer 75 EV models by 2030. Even Toyota, long skeptical of EVs, has ramped up its electrification roadmap.

Why the urgency? Because Ford’s success—especially with the F-150 Lightning—proves that trucks and SUVs can go electric without sacrificing performance or utility. This undermines a key argument used by ICE defenders: that EVs are only suitable for small, urban vehicles.

Supply Chain Realignment

Ford’s investment is reshaping the auto supply chain. Traditional engine and transmission manufacturers are scrambling to pivot to EV components. Meanwhile, demand for lithium, cobalt, nickel, and rare earth metals is surging. Ford is working with mining companies and battery recyclers to secure sustainable supplies.

For example, Ford has signed agreements with:

- Redwood Materials to recycle battery materials

- Livent for lithium hydroxide supply

- SK On for high-nickel batteries

This forward-thinking approach reduces long-term costs and environmental impact.

Workforce Transformation and Job Creation

Electrification is often framed as a threat to auto workers, but Ford’s strategy emphasizes job retention and retraining. The company is investing $525 million to retrain 18,000 UAW-represented workers for EV and battery production. Programs include:

- EV assembly training at Ford’s Advanced Manufacturing Center

- Certifications in battery safety and diagnostics

- Partnerships with community colleges for technical education

This “just transition” model could become a blueprint for other industries undergoing technological disruption.

The Environmental and Economic Impact of Ford’s EV Shift

Ford to invest in electric cars isn’t just about profits—it’s about planetary responsibility and long-term economic resilience. The environmental and economic benefits of this transformation are profound.

Reducing Carbon Emissions

Transportation accounts for nearly 29% of U.S. greenhouse gas emissions, with light-duty vehicles responsible for the majority. By replacing gas-powered F-150s with the Lightning, Ford estimates each vehicle will save over 100 tons of CO2 over its lifetime. If 10% of F-150 buyers switch to electric, that’s a reduction of 1.5 million tons of CO2 annually—equivalent to taking 320,000 cars off the road.

Moreover, Ford is committed to sourcing 100% renewable energy for all U.S. manufacturing facilities by 2025. This “cradle-to-gate” sustainability approach ensures that EVs are green from production to the road.

Energy Independence and Grid Stability

EVs can enhance national energy security. By reducing reliance on imported oil, countries like the U.S. can strengthen their energy independence. Ford’s V2G technology takes this further: during blackouts, EVs can power homes or critical infrastructure.

Example: During the 2021 Texas freeze, F-150 Lightning owners used their trucks to keep homes warm and refrigerated food safe. This real-world use case demonstrates the dual role of EVs as transportation and emergency power sources.

Economic Growth and Innovation

Ford’s EV investments are creating new economic opportunities. BlueOval City alone will generate $1 billion in annual economic output for West Tennessee. The battery plants will attract suppliers, tech startups, and research institutions to the region.

Nationally, the EV transition could add 1 million new jobs by 2030, according to the U.S. Department of Energy. These include roles in battery manufacturing, software development, charging network operations, and sustainable materials.

Challenges and Criticisms: What Ford Must Overcome

While Ford’s EV ambitions are impressive, the road ahead is fraught with challenges. Critics point to several key hurdles that could slow progress or erode consumer trust.

Battery Supply and Raw Material Ethics

EV batteries require rare earth metals, many of which are mined in politically unstable regions. Cobalt, for instance, is heavily sourced from the Democratic Republic of Congo, where child labor and environmental degradation are concerns.

Ford is addressing this through:

- Partnerships with ethical mining initiatives

- Investment in solid-state batteries that use less cobalt

- Support for closed-loop recycling to recover materials

Still, transparency and traceability remain critical. Ford must ensure its supply chain aligns with ESG (Environmental, Social, Governance) standards.

Charging Infrastructure Gaps

Despite FordPass Power, charging deserts persist—especially in rural areas and multi-family housing. Range anxiety remains a top concern for potential buyers.

Ford is tackling this by:

- Expanding fast-charging networks in underserved regions

- Offering home charging installation support

- Developing battery-swapping pilot programs for fleet vehicles

However, collaboration with governments and utilities is essential for nationwide coverage.

Consumer Education and Price Parity

Many consumers still perceive EVs as expensive and complex. Ford must continue educating buyers on:

- Total cost of ownership (EVs are cheaper to maintain and fuel)

- Incentives (federal tax credits up to $7,500)

- Technology (over-the-air updates, app integration)

Achieving price parity with ICE vehicles—projected by 2025—will be a game-changer.

What Consumers and Investors Should Know

Ford to invest in electric cars has implications for both everyday drivers and financial stakeholders. Here’s what you need to know to make informed decisions.

For Consumers: Is an EV Right for You?

Before buying an EV, consider:

- Daily driving needs: If you drive less than 100 miles per day, even mid-range EVs (200–250 miles) are sufficient.

- Charging access: Do you have a garage or driveway? If not, research public charging options near your home or workplace.

- Home charging setup: A Level 2 charger (240V) costs $500–$2,000 to install but cuts charging time in half.

- Resale value: EVs from reputable brands like Ford are holding value well, especially as demand grows.

Tip: Use tools like Ford’s EV Range Calculator to estimate real-world range based on your driving habits.

For Investors: Ford’s Financial Outlook

Ford’s stock (NYSE: F) has been volatile due to the high costs of electrification. However, long-term prospects are strong. Key metrics to watch:

- EV sales growth: Track quarterly EV deliveries and market share

- Battery margins: As production scales, costs will drop, improving profitability

- Government incentives: The Inflation Reduction Act offers tax credits for U.S.-made EVs, boosting Ford’s competitiveness

- Debt levels: Ford has $15 billion in cash reserves, providing flexibility during the transition

Analysts at Morgan Stanley and JPMorgan have upgraded Ford’s outlook, citing its “execution momentum” in EVs.

The Road Ahead: 2025 and Beyond

By 2025, Ford plans to:

- Launch 15 new EV models globally

- Achieve 2 million annual EV production capacity

- Introduce next-gen solid-state batteries with 50% more energy density

- Expand V2G partnerships with utilities and smart grid providers

The company’s “Ford+” plan aims to integrate EVs with digital services, subscription models, and mobility solutions—positioning Ford as a tech company as much as an automaker.

Conclusion: A New Era for Ford and the Auto Industry

Ford to invest in electric cars is more than a business decision—it’s a cultural and industrial revolution. By reimagining its core products, retooling its factories, and leading the charge on sustainable mobility, Ford is proving that legacy automakers can innovate at scale. The F-150 Lightning isn’t just a truck; it’s a symbol of American resilience and ingenuity in the face of climate change.

This transformation benefits everyone: consumers gain access to high-performance, low-emission vehicles; workers find new, high-tech careers; and the planet breathes a little easier. While challenges remain—from supply chain ethics to charging infrastructure—Ford’s proactive approach sets a powerful example for the industry.

As the world accelerates toward a zero-emission future, Ford’s investment in electric cars isn’t just a game-changer. It’s a blueprint for the next century of transportation. Whether you’re a driver, investor, or policymaker, one thing is clear: the electric revolution is here, and Ford is driving it forward.

Data Table: Ford’s Key EV Projects and Investments

| Project | Location | Investment | Capacity | Expected Launch |

|---|---|---|---|---|

| BlueOval City | Stanton, TN | $5.6 billion | 500,000 EVs/year | 2025 |

| Kentucky Battery Park | Glendale, KY | $5.8 billion | 86 GWh/year | 2025 |

| BlueOval SK Tennessee | Memphis, TN | $4.3 billion | 43 GWh/year | 2025 |

| FordPass Power Network | North America | $1.2 billion | 84,000+ chargers | Ongoing |

| Solid-State Battery R&D | Michigan | $2.1 billion | Next-gen cells | 2027 |

Frequently Asked Questions

Why is Ford investing in electric cars now?

Ford is investing in electric cars to meet rising consumer demand for sustainable vehicles and to comply with stricter global emissions regulations. This strategic shift positions Ford as a serious competitor in the rapidly growing EV market.

How much is Ford investing in electric cars?

Ford has committed over $50 billion toward electric car development and production through 2026, including new battery plants and EV manufacturing facilities. This investment underscores their long-term commitment to electrification.

What electric car models will Ford release?

Ford plans to launch multiple new electric vehicles, including the F-150 Lightning, Mustang Mach-E variants, and upcoming all-electric SUVs and commercial vans. These models aim to cover key market segments from performance to utility.

How will Ford’s electric car investment impact the auto industry?

Ford to invest in electric cars sends a strong signal to competitors, accelerating industry-wide electrification and pushing rivals to speed up their own EV plans. This could lead to faster innovation and more affordable options for consumers.

Are Ford’s electric cars profitable yet?

While Ford’s EV division is still scaling, early models like the Mustang Mach-E are gaining market share. The company expects its electric car segment to become profitable as production ramps up and battery costs decline.

Where will Ford build its electric cars and batteries?

Ford is constructing EV and battery plants in the U.S., including BlueOval City in Tennessee and a battery plant in Kentucky. These facilities aim to streamline production and reduce supply chain costs for their electric cars.