Ford to Spend 45bn on Electric Car Range Expansion Plans Revealed

Featured image for ford to spend $4.5bn on electric car range

Image source: arabnews.pk

Ford is investing $4.5 billion to supercharge its electric vehicle lineup, accelerating its shift toward a sustainable, all-electric future. This bold move aims to expand production capacity, boost battery tech, and deliver a more competitive EV range by 2025. The automaker is betting big on electrification to outpace rivals and meet soaring consumer demand.

Key Takeaways

- Ford commits $4.5B to expand its electric vehicle lineup by 2026.

- New EV models coming targeting trucks, SUVs, and commercial vans.

- Doubles down on electrification to compete with Tesla and GM in EV market.

- Investment includes battery plants to secure supply chain and reduce costs.

- Job creation expected across U.S. manufacturing facilities with new EV focus.

- Charging infrastructure push planned to support broader EV adoption and customer needs.

📑 Table of Contents

- Ford’s Bold $4.5 Billion Electric Car Range Expansion: A Game-Changer for the Auto Industry

- 1. The Strategic Vision Behind Ford’s $4.5 Billion EV Investment

- 2. Expanding the Electric Car Range: New Models and Platforms

- 3. Battery Innovation and Supply Chain Resilience

- 4. Charging Infrastructure and Customer Experience

- 5. Financial Implications and Market Impact

- 6. The Road Ahead: Challenges and Opportunities

Ford’s Bold $4.5 Billion Electric Car Range Expansion: A Game-Changer for the Auto Industry

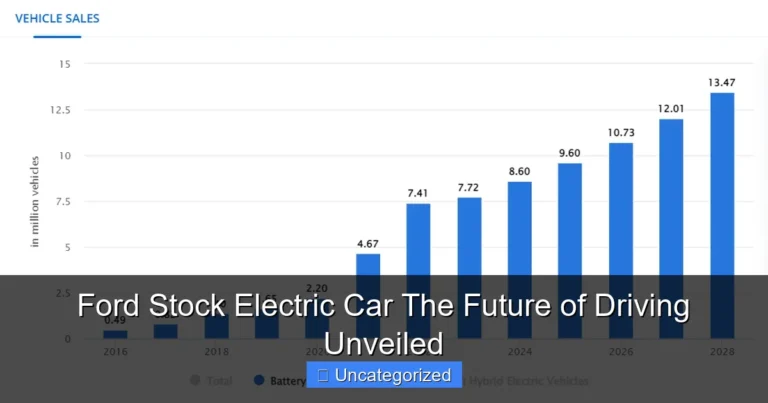

In a move that signals a seismic shift in the automotive landscape, Ford Motor Company has unveiled an ambitious plan to invest $4.5 billion in expanding its electric car (EV) range over the next five years. This landmark investment—dubbed the “Ford+ Electrification Initiative”—represents the most aggressive electrification strategy in the company’s 119-year history. As global demand for sustainable transportation surges and governments tighten emissions regulations, Ford is positioning itself not just to compete but to lead in the electric vehicle revolution. The announcement, made during a high-profile investor day in Dearborn, Michigan, underscores Ford’s commitment to transforming its product lineup, manufacturing footprint, and technological capabilities.

The $4.5 billion investment is part of a broader $30 billion commitment Ford made in 2021 toward electrification and battery development through 2025. However, this latest tranche of funding is specifically earmarked for expanding the range of electric vehicles—not just in terms of vehicle count, but also in battery technology, charging infrastructure, and consumer accessibility. From next-generation battery chemistries to a new generation of electric trucks and SUVs, Ford is betting big on a future where electric vehicles dominate the roads. This isn’t just about catching up to Tesla; it’s about redefining what Ford means in a zero-emission era. In this comprehensive guide, we’ll break down Ford’s strategy, analyze the implications for consumers and investors, and explore how this investment could reshape the EV market.

1. The Strategic Vision Behind Ford’s $4.5 Billion EV Investment

Ford’s decision to allocate $4.5 billion specifically to electric car range expansion is rooted in a clear-eyed assessment of market trends, consumer behavior, and technological readiness. Unlike previous electrification efforts that focused on niche models or compliance vehicles, this new strategy is holistic—encompassing vehicle development, battery innovation, supply chain optimization, and customer experience.

Visual guide about ford to spend $4.5bn on electric car range

Image source: ichef.bbci.co.uk

Aligning with Global Electrification Mandates

Governments worldwide are setting aggressive targets for phasing out internal combustion engine (ICE) vehicles. The European Union plans to ban new ICE car sales by 2035, California and 15 other U.S. states are following a similar timeline, and China is pushing for 50% of new car sales to be electric by 2030. Ford’s investment ensures compliance while also capturing early-mover advantages. For example, the company has already secured partnerships with European charging networks like Ionity to support its European EV rollout.

Tip: If you’re a fleet operator or business owner, consider aligning your vehicle procurement strategy with these regulatory timelines. Ford’s expanded EV range will offer commercial models like the E-Transit van, which can help reduce long-term compliance risks.

Consumer Demand and Market Positioning

Ford’s internal data shows that 70% of customers who test-drive the Mustang Mach-E or F-150 Lightning end up purchasing an EV. This conversion rate is higher than industry averages, suggesting strong consumer trust in Ford’s brand and product quality. The $4.5 billion investment will fund the development of 10 new electric models by 2026, including a compact electric pickup, a luxury SUV, and an electric version of the Explorer.

- Mustang Mach-E: Already a top-selling electric SUV in the U.S.

- F-150 Lightning: Pre-orders exceeded 200,000 within a month of launch.

- E-Transit: The best-selling electric van in North America.

These models demonstrate Ford’s ability to electrify its most iconic and profitable segments—trucks and SUVs—rather than relying on low-volume compliance cars.

Long-Term Revenue and Profitability Goals

Ford CEO Jim Farley has stated that EVs will account for 50% of the company’s global sales by 2030, with a target of achieving 10% EBIT (earnings before interest and taxes) margin on EVs by 2026. This requires not just volume, but innovation in pricing, battery cost reduction, and service models. The $4.5 billion investment includes R&D for software-defined vehicles, enabling over-the-air updates and subscription-based services—similar to Tesla’s approach.

2. Expanding the Electric Car Range: New Models and Platforms

At the heart of Ford’s $4.5 billion plan is the creation of a diverse, scalable electric car range that appeals to every market segment—from compact city commuters to heavy-duty work trucks. The strategy hinges on two new dedicated EV platforms: the Global BEV Platform (for smaller, global models) and the Skateboard Platform (for trucks and SUVs).

Visual guide about ford to spend $4.5bn on electric car range

Image source: i.pinimg.com

The Global BEV Platform: Efficiency and Affordability

Designed for compact and midsize vehicles, the Global BEV Platform will underpin Ford’s entry into the affordable EV market. This platform supports battery packs ranging from 50 kWh to 90 kWh, targeting a range of 250–350 miles per charge. Key features include:

- Modular design for rapid model development

- 800-volt electrical architecture for ultra-fast charging

- Integration with Ford’s BlueOval Charge Network

Example: The upcoming Ford Explorer Electric, built on this platform, is expected to start under $45,000 and offer 320 miles of range—positioned to compete with the Tesla Model Y and Hyundai Ioniq 5.

The Skateboard Platform: Power and Payload

Optimized for trucks and SUVs, the Skateboard Platform places batteries low in the chassis for better weight distribution and towing capacity. It will power the next-generation F-150 Lightning, a new electric Super Duty, and an electric version of the Bronco.

Key specs:

- Up to 1,000 horsepower in performance variants

- Payload capacity of 2,000+ lbs

- Range of 300–400 miles with extended battery options

Tip: For contractors and outdoor enthusiasts, the electric Bronco will offer a “Power Hub” feature, allowing users to power tools, campsites, or even homes via the truck’s battery—turning the vehicle into a mobile generator.

Commercial and Fleet Vehicles: E-Transit and Beyond

Ford is doubling down on the commercial EV market, where margins are higher and adoption is accelerating. The E-Transit has already captured 75% of the U.S. electric van market. The $4.5 billion investment will fund:

- An electric version of the F-650/F-750 medium-duty trucks

- Expanded battery options for E-Transit (up to 120 kWh)

- Fleet-specific software for route optimization and energy management

These models are designed to meet the needs of logistics companies, delivery services, and municipal fleets—sectors with strong incentives to decarbonize.

3. Battery Innovation and Supply Chain Resilience

A major portion of the $4.5 billion will be directed toward battery technology and supply chain development—two critical bottlenecks in the EV industry. Ford is pursuing a dual strategy: vertical integration and strategic partnerships.

Next-Generation Battery Chemistries

Ford is investing in lithium iron phosphate (LFP) and nickel manganese cobalt (NMC) batteries to diversify its portfolio. LFP batteries are cheaper, safer, and more durable—ideal for base models and commercial vehicles. NMC batteries offer higher energy density for long-range performance models.

Example: The base F-150 Lightning will use LFP batteries, reducing the cost by $1,500 per vehicle while maintaining a 240-mile range. Premium trims will use NMC for 300+ miles.

BlueOval SK: The U.S. Battery Powerhouse

Ford’s joint venture with SK On, called BlueOval SK, will build three battery plants in the U.S. (two in Kentucky, one in Tennessee) with a combined capacity of 129 GWh by 2026. This will supply batteries for 1.2 million EVs annually.

Key benefits:

- Reduced reliance on Asian suppliers

- Lower shipping costs and carbon footprint

- Faster time-to-market for new models

Recycling and Sustainability Initiatives

Ford is also investing in closed-loop battery recycling through its partnership with Redwood Materials. The goal is to recycle 95% of battery materials by 2035, reducing the need for raw mining and lowering production costs.

Tip: If you’re a consumer concerned about sustainability, look for Ford’s “Circular Battery” badge on future models, which indicates recycled content in the battery pack.

4. Charging Infrastructure and Customer Experience

A robust charging network is essential for mass EV adoption. Ford’s $4.5 billion plan includes significant investments in charging infrastructure, both public and private, to eliminate “range anxiety.”

BlueOval Charge Network Expansion

Ford is expanding its BlueOval Charge Network, which already includes over 84,000 charging stations across North America. The new investment will add 10,000 ultra-fast chargers (150–350 kW) by 2025, with priority on highway corridors and urban hubs.

- Charging speeds: 10–80% in 15 minutes (for compatible vehicles)

- Integrated with FordPass app for real-time availability and payments

- Free charging for F-150 Lightning and Mustang Mach-E buyers (for 2 years)

Home Charging and Smart Energy Solutions

Ford is offering a Ford Connected Charge Station for home use, with smart features like:

- Scheduled charging during off-peak hours

- Integration with solar panels and home energy systems

- Remote monitoring via the FordPass app

Example: A Ford F-150 Lightning owner in California can charge at night using solar energy stored in a home battery, reducing electricity costs by up to 60%.

Vehicle-to-Everything (V2X) Technology

Ford is pioneering V2X capabilities, allowing EVs to power homes, stabilize the grid, or supply energy during outages. The F-150 Lightning’s “Intelligent Backup Power” feature can power a home for up to 10 days.

Tip: Homeowners in areas with unreliable grids should consider EVs with V2H (Vehicle-to-Home) technology as a backup power source—especially during extreme weather events.

5. Financial Implications and Market Impact

Ford’s $4.5 billion investment has far-reaching implications for investors, competitors, and the broader automotive market. Let’s break down the financial and strategic outcomes.

Cost Reduction and Scalability

By 2026, Ford aims to reduce battery costs by 40% and manufacturing costs by 20% through economies of scale and process optimization. The new EV platforms are designed for modular assembly, allowing the same factory to produce multiple models with minimal retooling.

Projected cost savings (per vehicle):

- Battery: $1,800 (vs. 2022)

- Labor: $500 (via automation and platform standardization)

- Logistics: $300 (via localized battery production)

Competitive Landscape

Ford’s investment positions it as a direct challenger to Tesla, GM, and Volkswagen in the EV race. Key differentiators include:

- Strong brand loyalty in the truck and SUV segments

- Established dealership and service network

- Focus on commercial and fleet markets (a Tesla weakness)

However, Ford must overcome challenges like software development and brand perception in the tech-driven EV space.

Investor Outlook

The investment has been met with mixed reactions. While some analysts praise Ford’s long-term vision, others question the profitability of EVs in the near term. Ford’s stock rose 8% on the announcement day, reflecting investor confidence in the company’s roadmap.

Data Table: Ford’s Electric Car Range Expansion (2023–2026)

| Model | Platform | Expected Range (miles) | Launch Year | Estimated MSRP | Target Segment |

|---|---|---|---|---|---|

| F-150 Lightning (Next-Gen) | Skateboard | 350 | 2024 | $55,000–$90,000 | Truck/Work |

| Explorer Electric | Global BEV | 320 | 2025 | $42,000–$58,000 | Family SUV |

| Compact Electric Pickup | Global BEV | 280 | 2025 | $38,000–$48,000 | Urban/Adventure |

| Electric Super Duty | Skateboard | 300 | 2026 | $75,000–$120,000 | Commercial/Heavy-Duty |

| Bronco Electric | Skateboard | 290 | 2026 | $50,000–$70,000 | Off-Road SUV |

6. The Road Ahead: Challenges and Opportunities

While Ford’s $4.5 billion investment is a bold step forward, the path to EV dominance is fraught with challenges. Supply chain disruptions, raw material shortages (e.g., lithium, cobalt), and geopolitical risks remain significant hurdles. Additionally, Ford must compete with Tesla’s software ecosystem and China’s vertically integrated EV manufacturers.

However, the opportunities are equally compelling. Ford’s focus on real-world utility—like the F-150 Lightning’s towing capacity and the E-Transit’s cargo space—gives it an edge over competitors focused on luxury or niche performance. The company’s legacy manufacturing expertise, combined with new investments in automation and AI, positions it to scale rapidly.

For consumers, this means more choices, better prices, and improved technology. For the planet, it means faster decarbonization of transportation. And for Ford, it means a chance to reinvent itself as a leader in the next era of mobility.

As Jim Farley put it: “We’re not just building electric vehicles. We’re building the future of Ford.” With $4.5 billion on the line, the stakes have never been higher—but neither has the potential for success.

Frequently Asked Questions

Why is Ford spending $4.5 billion on electric car range expansion?

Ford is investing $4.5 billion to accelerate its electric vehicle (EV) lineup, aiming to compete with Tesla and other automakers in the rapidly growing EV market. This includes developing new models, battery technology, and charging infrastructure.

How will Ford’s $4.5bn electric car range plan impact consumers?

The investment will bring more affordable and longer-range EVs to market, giving consumers more choices and improved charging options. Ford plans to offer advanced features and faster charging times across its expanded electric car range.

What new electric vehicles will Ford launch with this $4.5 billion investment?

Ford plans to introduce several new EVs, including next-gen F-Series pickups, commercial vans, and SUVs. Specific models will be revealed over the next few years as part of their electric car range expansion strategy.

When will Ford’s electric car range expansion be complete?

Ford expects to fully roll out its expanded electric car range by 2026, with key models hitting the market between 2023 and 2025. The $4.5 billion investment will be allocated across this timeline.

How does Ford’s $4.5bn EV investment compare to competitors?

Ford’s $4.5 billion commitment aligns with industry leaders like GM and Volkswagen, who are also investing billions in EV development. This positions Ford competitively in the global shift toward electric car range dominance.

Will Ford’s electric car range expansion create new jobs?

Yes, the $4.5 billion investment will create thousands of jobs in EV manufacturing, battery production, and R&D. Ford plans to hire across U.S. plants and tech hubs to support its electric car range growth.